Life is like chess, chess is like life. Those at a higher level should aim high, prioritizing strategy to gain opportunities, not fixating on minor gains or losses. Those at a lower level often get entangled in a few moves, judging success or failure based on immediate gains or losses. It may seem like they are fighting for every inch, but in reality, they lose both position and territory. Therefore, a good strategist protects their unassailable ground and attacks the vulnerable enemy.

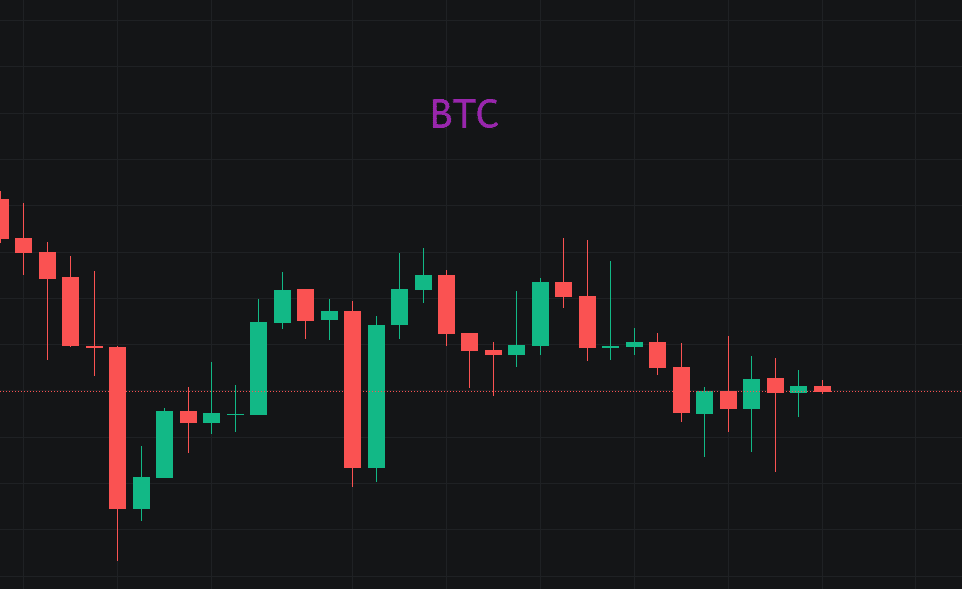

BTC has severe long-short divergence within the fluctuating range. This position is likely to see a one-way market after nearly doubling the time. I just saw a fan leave a message saying it's not a good time to bottom out, indicating a good understanding of the market. Many people are too fixated on the bottom, which in Zen terms can be referred to as attachment.

Recently, I've encountered issues with ETH. It seems like a relentless battle for every inch, but in reality, it has led to losing everything. In the end, I could only be led by it; being able to eat a little is already quite good. Shorting is much harder than going long; in the short term, you can't take control of the profit wall, and later on, it becomes unmanageable. Holding on just feels meaningless.

The trend of DOGE has hit a new low again, and there has been no sign of recovery. It isn't making any moves, and the meme market isn't getting any better. There are both positive and negative views on memes; some aspects seem to have no value and will surely be eliminated by the market, while the positive view is that low-priced stocks will always be in trend.

I've always wanted to tell everyone, but a cold delayed me for a few days. I wanted to share in the afternoon, but after the fever I now have a temperature of 35.5. Every day like this, maybe tomorrow!