BTC is still in a volatile market atmosphere. The negative news of Japan's interest rate hike did not cause a drop in the entire market; rather, the ordinary single-day trend yesterday saw a drop of over 2.5%. Currently, the market is a test for both institutions and retail investors. If you pay close attention, you will notice that the current short-term exchanges are all dominated by machine orders, with a significant emotional reversal.

ETH just broke above 3000, then quickly fell back below 3000. The market currently feels quite strange, and it needs some time to brew. There’s no need to rush to catch the bottom in the short term; wait for the market to reach a suitable point before making a move for a low entry.

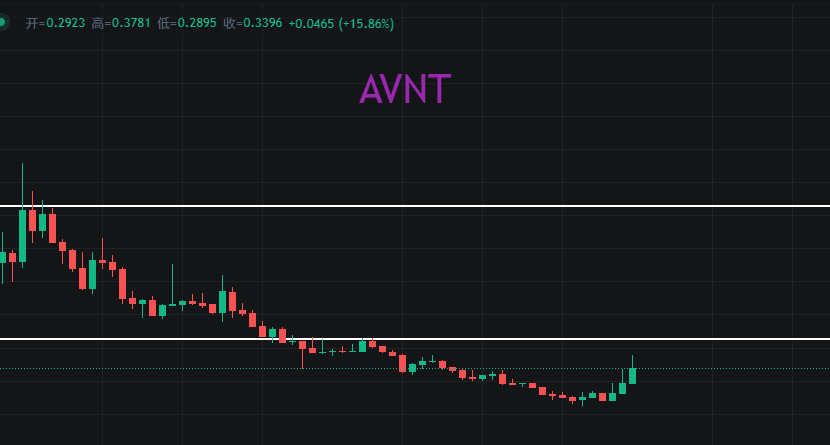

ANVT's recent performance has been quite impressive, with trading volume just below 4 million a few days ago, and now it has started to reach 40 million. It is still a few intervals away from a one-sided reversal market, so it can be worth paying attention to in the future.

Pepe has already been considered extremely oversold, and the price is close to the lower shadow of the last waterfall. Making a purchase at this position will not result in a loss; instead, it could lead to a market movement of around 1-3 times. The biggest failure for a person is to exhaust their resources in a boring market, as the market will eventually rise to a higher position. It only takes three days for the rise, yet they happen to falter before these three days arrive.