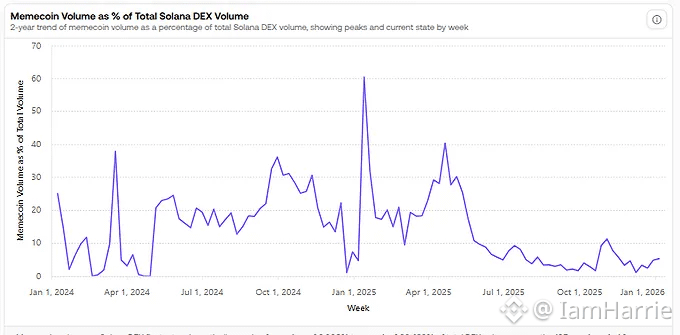

The flow of liquidity and revenue into the chain and meme tokens is largely tied to one activity: speculation. And it’s likely to persist for a while, because people will always want to speculate on trends, events, and even the news.

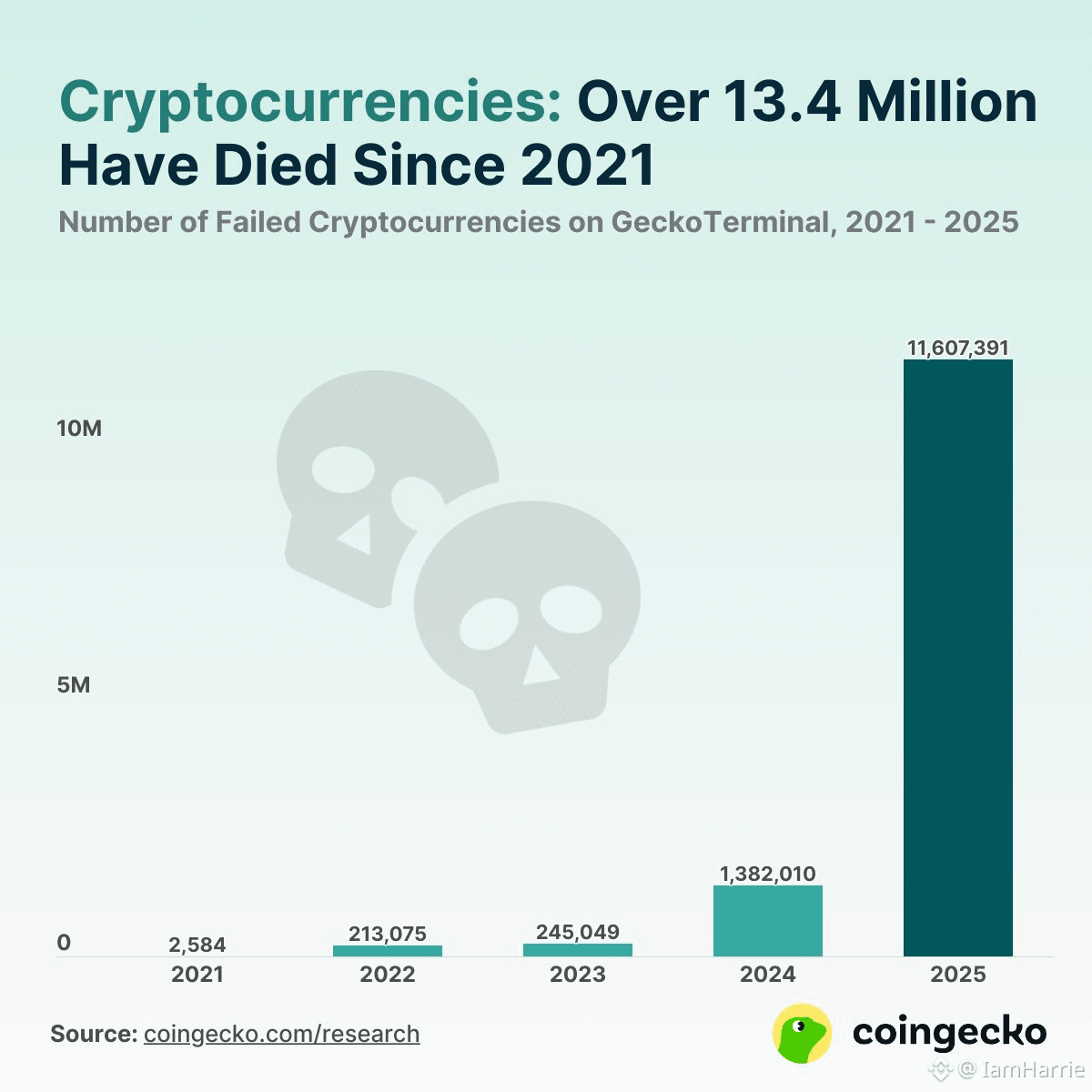

I did a little digging and found that the memecoin market is experiencing a gradual decline. Conservative estimates place trader losses from rug pulls in 2025 at around $8 billion, with most losses occurring when liquidity was removed after launch, making the tokens impossible to sell. Remarkably, 93% of these rug pulls were executed in under one hour.

The risk with speculation is that wrong choices are paid for with one’s portfolio, and consistent wrong choices can burn traders, leading them to pause or seek more stable and sustainable sources of liquidity inflow.

The next question would be, what happens to the token launchpads?

What’s happening with Launchpads?

Initially, what drew people into memecoins was the fact that you could see a promising token on Dexscreener, check its tokenomics, join the project’s Telegram group, and see the stats on holders and the developers themselves before buying in.

It was a good way to explore potential wins.

Today, there is a lot of Insider activity, sniper bots, and other automated strategies that make it easier to get rekt.

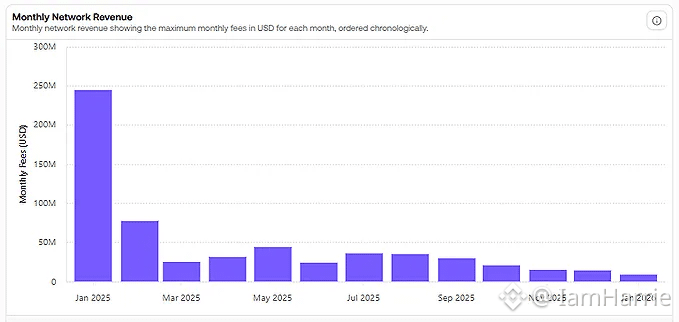

This has, in a way affected launchpad activity over the past year. Pumpfun, for instance, has seen fewer graduations and fewer active users daily, which also affects their revenue.

Occasionally, there are spikes in activity, but they are brief and rarely go beyond a certain timespan.

User Sentiment in Memecoins

User participation has also declined. Fewer wallets are actively engaging with new launches, and repeat participation has dropped as many users step away after negative experiences.

And by negative, I mean after getting used as the liquidity exit.

Although people continue to speculate on trends, news, and cultural moments (a whole market was built on that economy; prediction markets), the willingness to take early risks has diminished, so a growing number of users are moving towards more sustainable DEX activities.

It is way harder to find the next 10x or 1000x launch due to insider factors, early coordinated buyers, and automated bots that extract value almost immediately after launch.

To build on this, only a small number of memecoins currently maintain a market capitalization above $1 billion.

Most new tokens struggle to retain liquidity beyond the initial launch phase, and since capital does not remain on-chain long enough, user activity tanks or declines.

What’s next for Degenerates?

I’ll be as candid as possible. Memecoins, as a form of expression and speculation, are unlikely to disappear, as cultural interest continues to exist and new launches tied to events or public figures still draw attention.

However, these moments tend to be short-lived and do not develop into sustained market cycles or narratives.

For the market to stabilize, better structures with protection mechanisms are required.

Without these safeguards becoming common practice, speculative markets will still struggle to maintain trust.

Meaningful changes needs to happen, otherwise, memecoin activity across major launchpads is likely to remain under pressure and continue to decline.