1) Executive summary

Silo is a decentralized lending project that uses isolated lending markets to minimize risk contagion between assets. Each market pairs a unique collateral asset with a bridge asset, allowing users to supply and borrow without exposure to risks from other listed tokens. The project operates across multiple chains including Sonic, Avalanche, Arbitrum One, Ethereum, Base, and OP Mainnet.

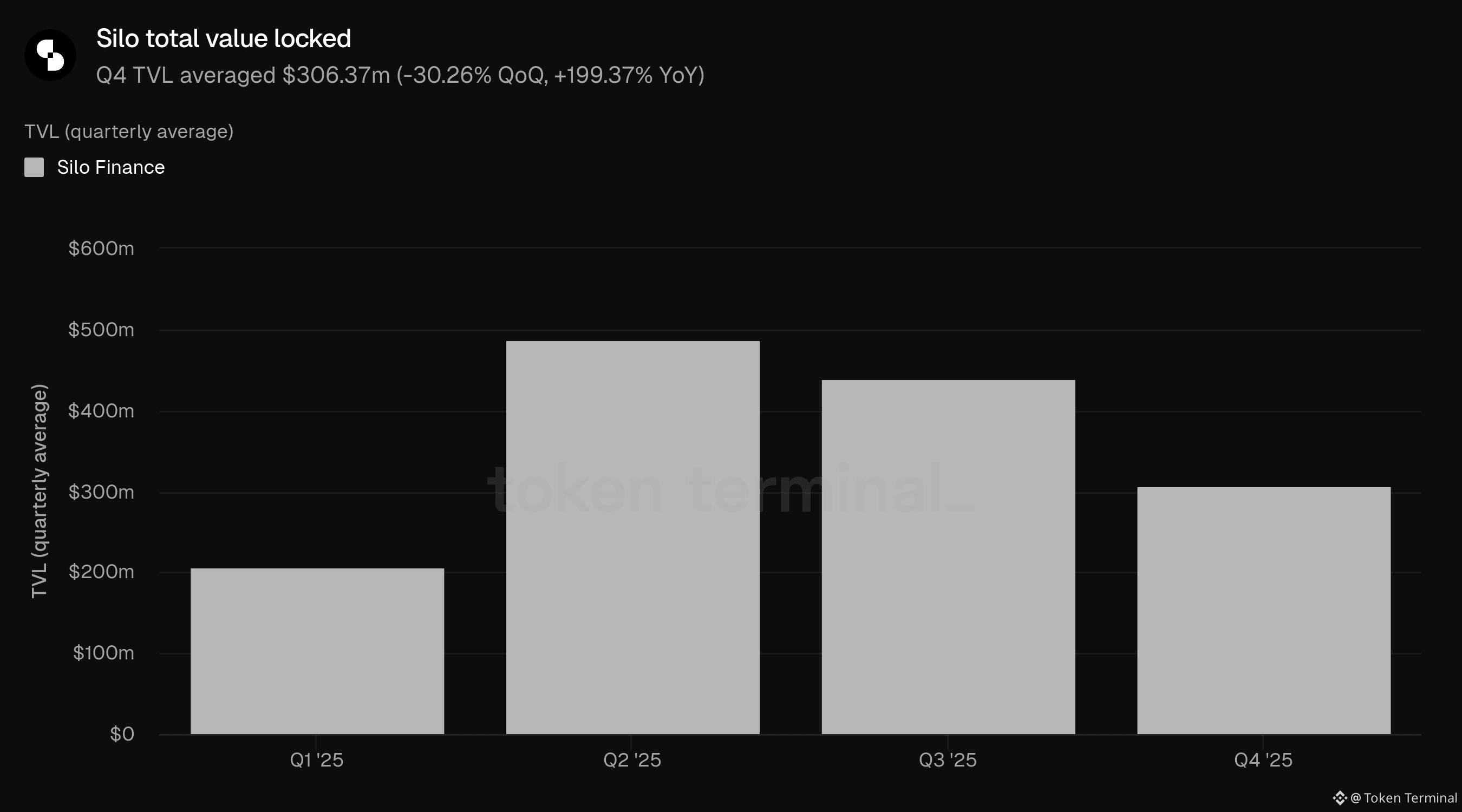

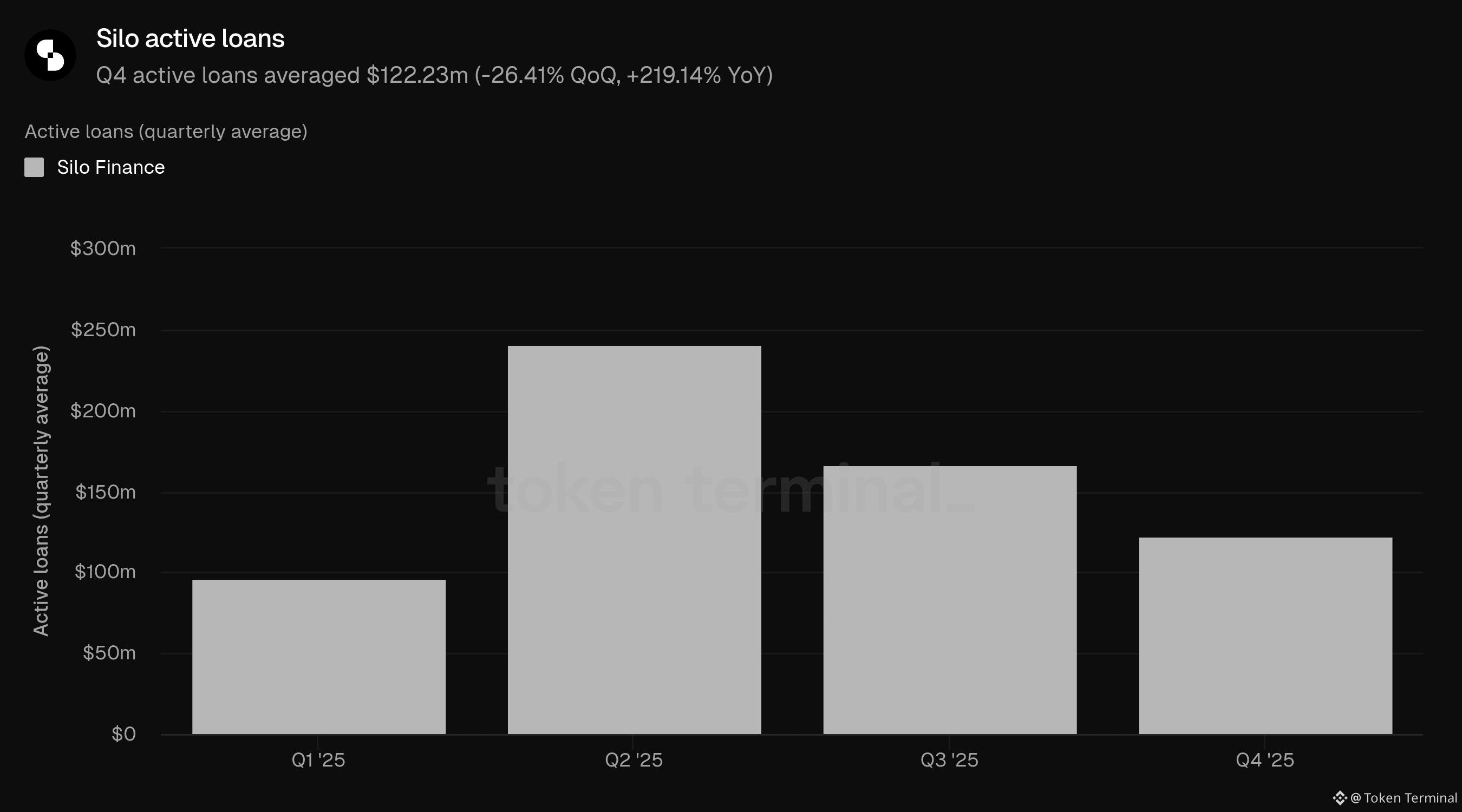

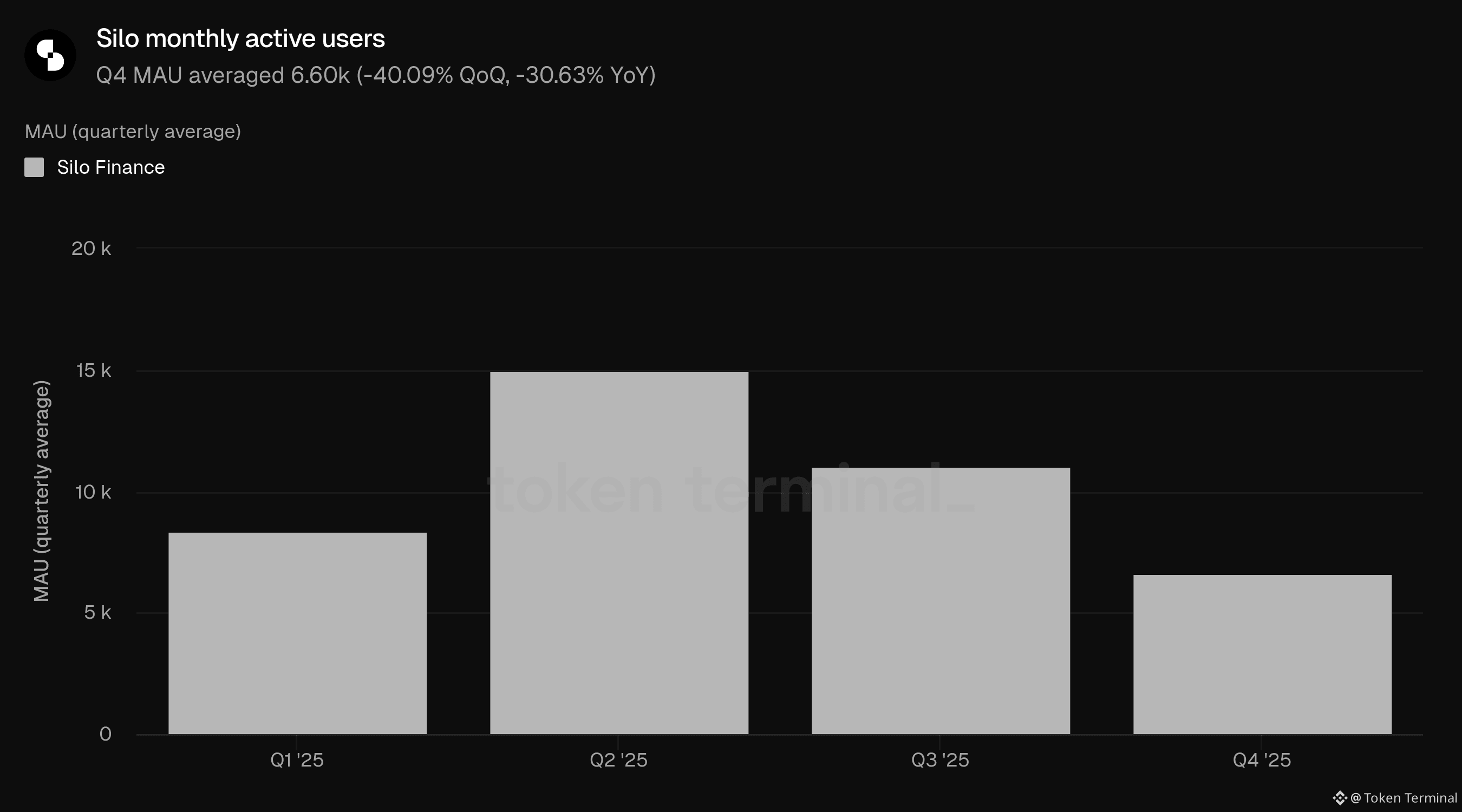

In Q4 2025, Silo's key metrics declined from Q3 levels, with TVL, active loans, and MAU all falling while fees and revenue grew to their highest quarterly totals of 2025. However, the year-over-year picture shows substantial growth across the project's core metrics: TVL tripled, active loans more than tripled, and fees grew over 5x. MAU declined on both a quarterly and annual basis, though the project generated significantly more value per user compared to Q4 2024.

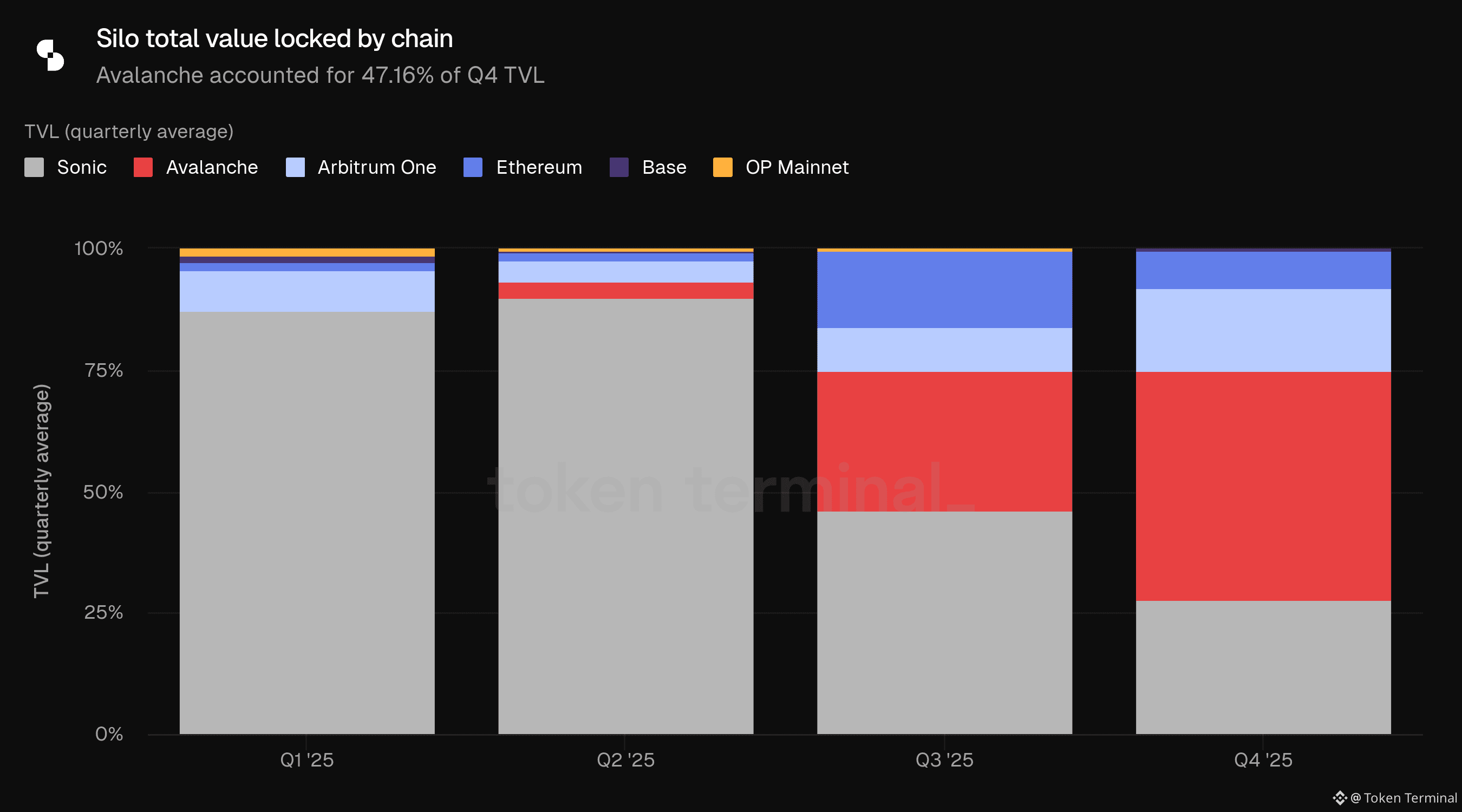

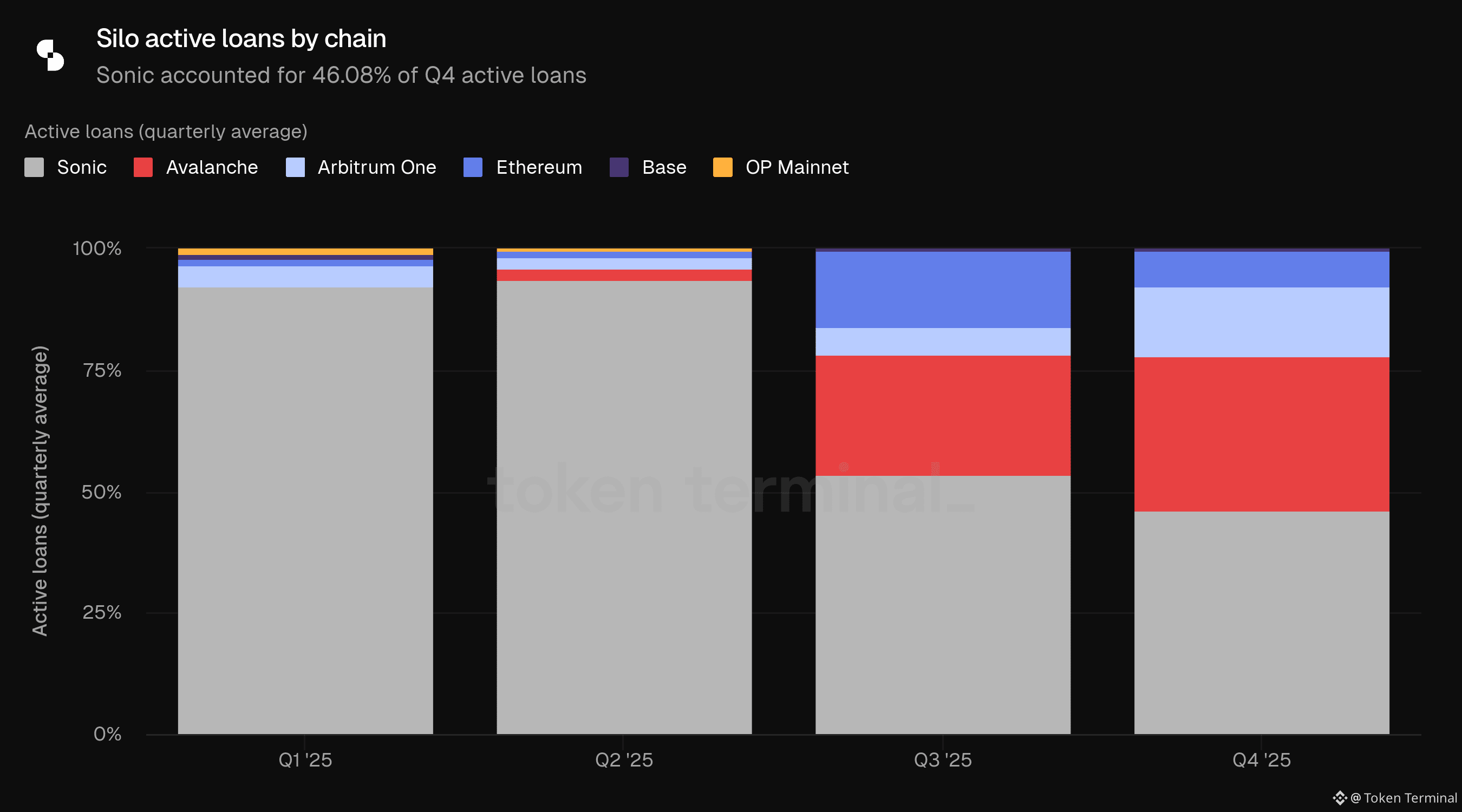

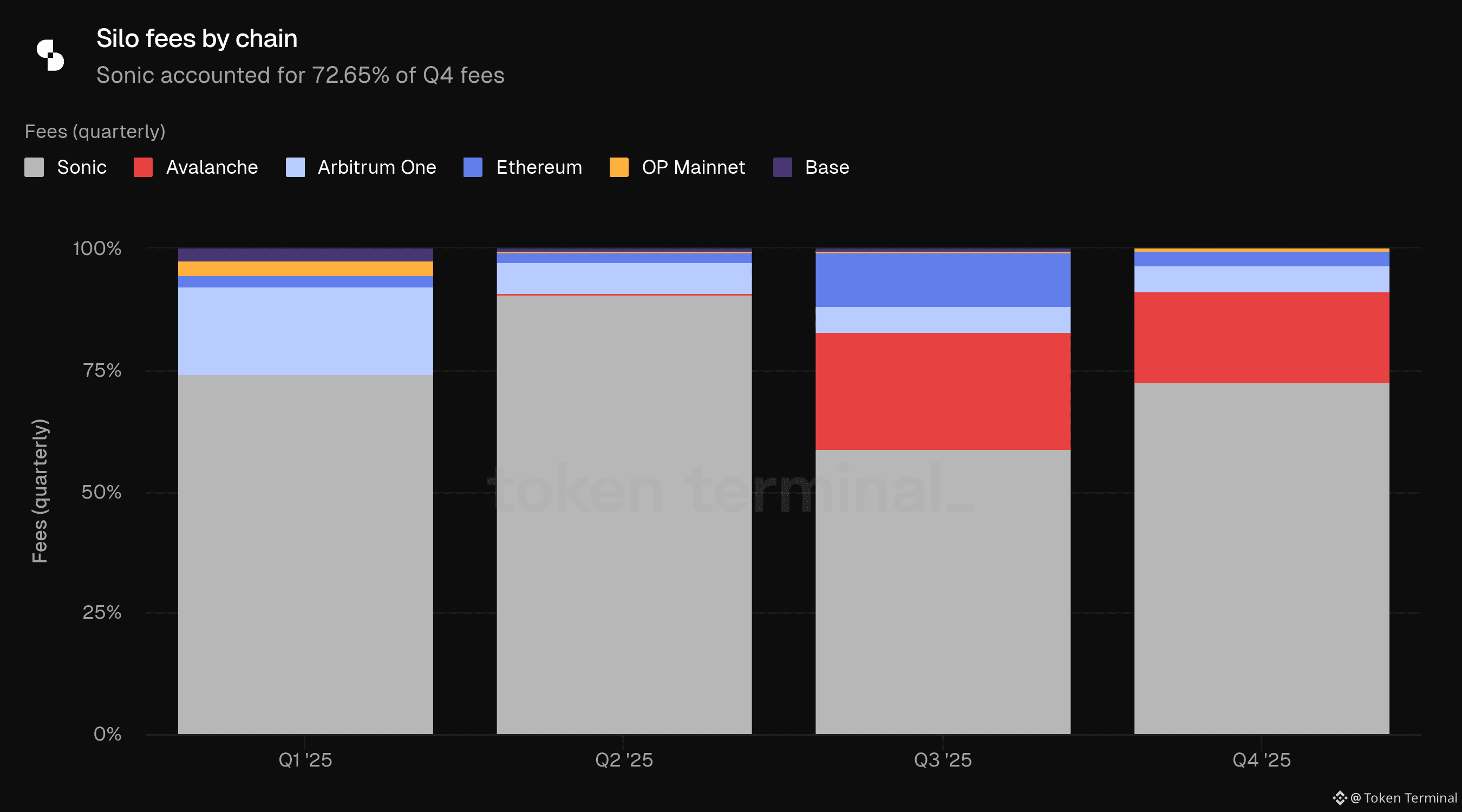

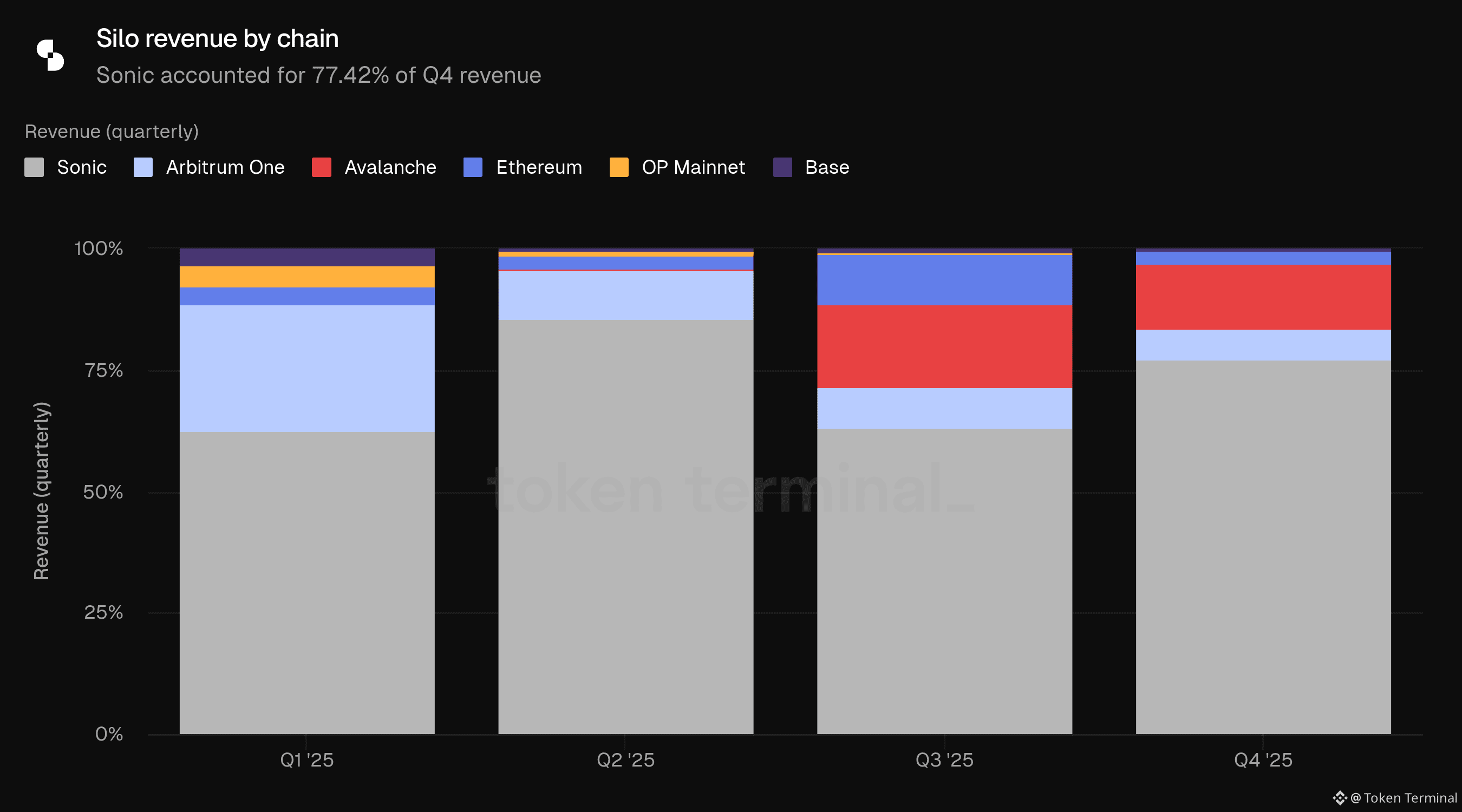

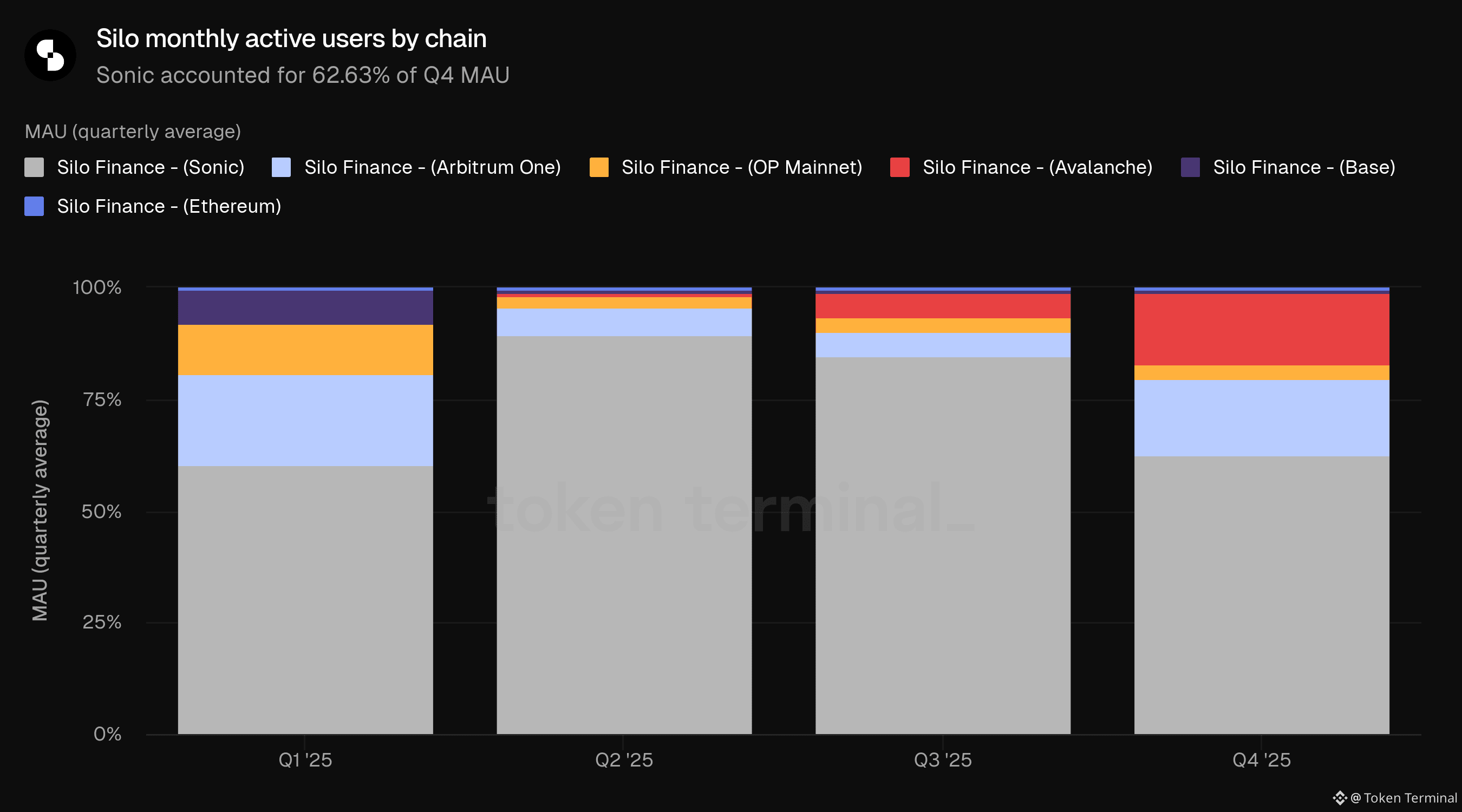

The chain distribution shifted notably, with Avalanche overtaking Sonic for TVL leadership while Sonic maintained its dominance in fees and revenue, generating over 70% of fees despite holding less than 30% of TVL. User activity diversified across chains, with Arbitrum One and Avalanche both gaining share.

🔑 Key metrics (Q4 2025)

Total value locked: $306.37m (-30.26% QoQ, +199.37% YoY)

Active loans: $122.23m (-26.41% QoQ, +219.14% YoY)

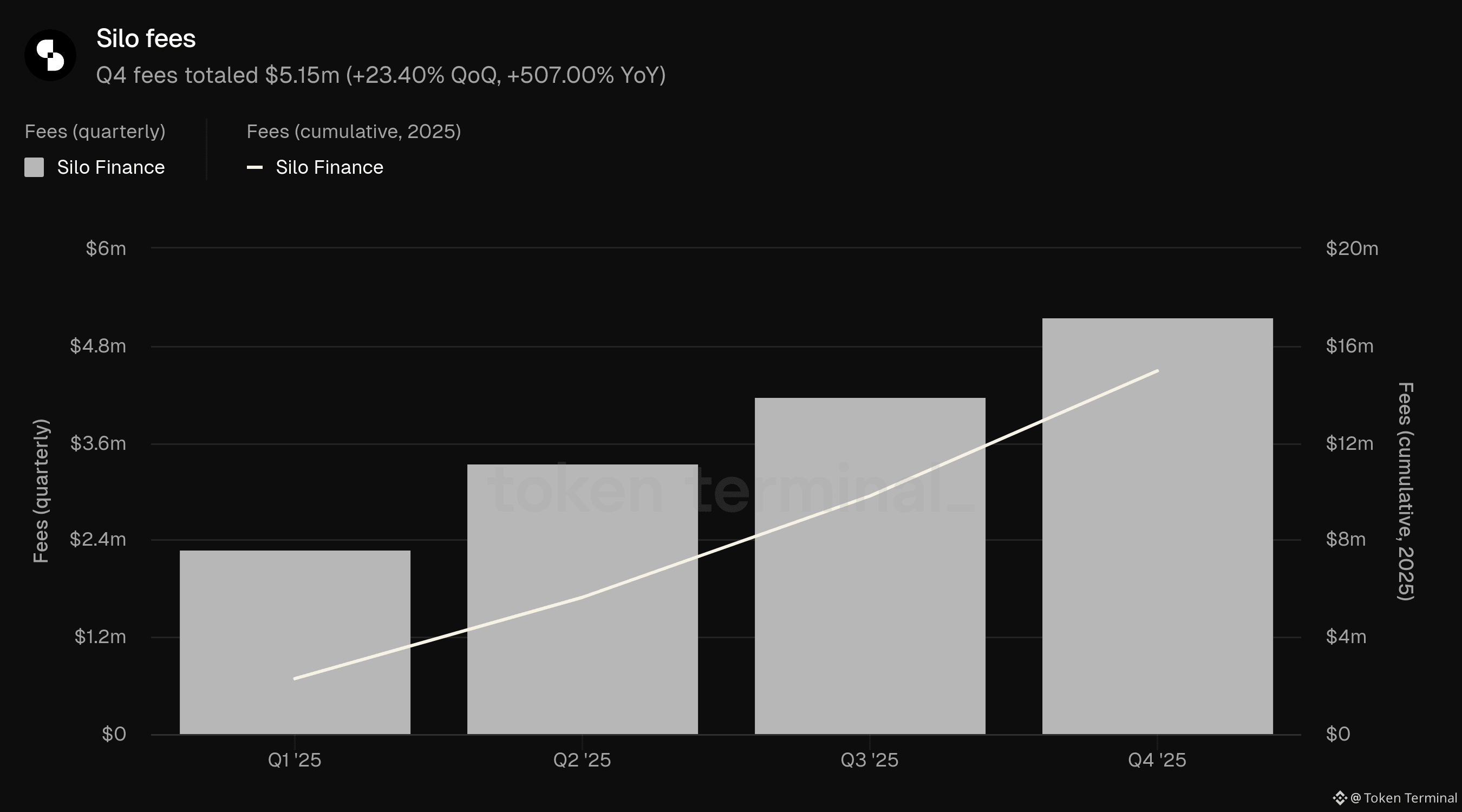

Fees: $5.15m (+23.40% QoQ, +507.00% YoY)

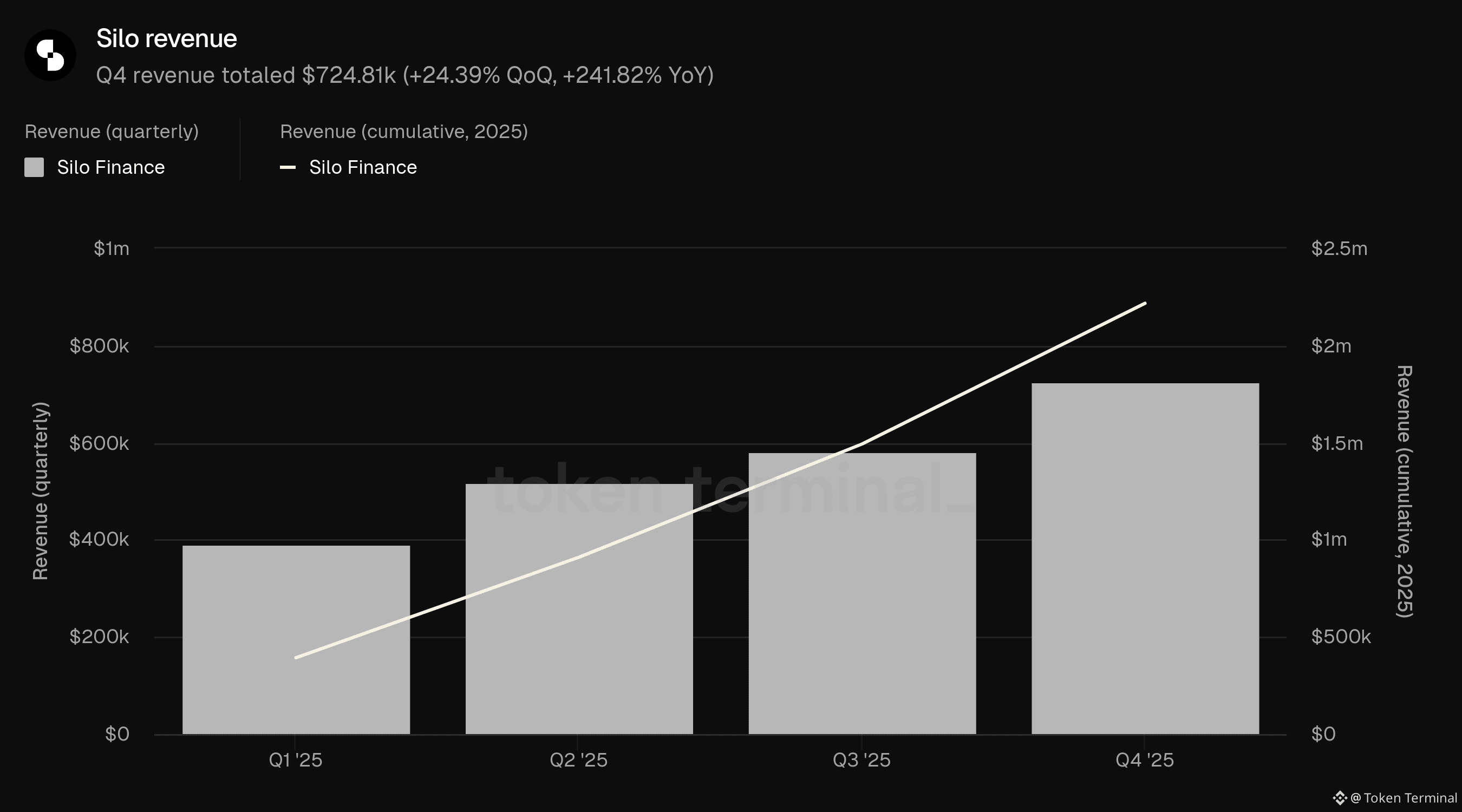

Revenue: $724.81k (+24.39% QoQ, +241.82% YoY)

Monthly active users: 6.60k (-40.09% QoQ, -30.63% YoY)

👥 Silo team commentary

"Q4 was a transitional quarter for Silo, marked by a combination of external market headwinds, isolated protocol incidents, and meaningful progress toward the next generation of the protocol.

During the quarter, several immutable lending markets were impacted by incidents involving Stream Finance and Stable Labs. While these markets remain isolated by design, lenders in the affected markets have not yet been able to withdraw funds. In response, Silo’s analytics surfaces wrote off the impacted markets to ensure that reported protocol metrics accurately reflect healthy, withdrawable liquidity and provide clean, transparent data to the DeFi community.

At the same time, the team made significant progress toward finalizing Silo v3 (expected in March 2026), a new money market architecture designed to remove reliance on instant liquidity and materially improve lender safety and capital efficiency. This work sets the foundation for Silo’s next phase of growth in 2026."

2) Total value locked

Total value locked (TVL) measures the total USD value of collateral deposited and outstanding loans on Silo. Q4 TVL averaged $306.37m, down 30.26% from Q3's $439.32m but triple Q4 2024's $102.35m. The chain distribution shifted considerably: Avalanche overtook Sonic as the largest deployment, growing from 28.81% to 47.16% of TVL, while Sonic's share fell from 46.00% to 27.70%. Arbitrum One also gained ground, nearly doubling its share to 17.07%. Ethereum's portion declined from 15.47% to 7.74%.

👥 Silo team commentary

"The QoQ decline in TVL was driven by a combination of broader market conditions and project-specific factors related to the Stream Finance and Stable Labs incidents. While the impacted markets were isolated and did not affect the broader protocol, they contributed to short-term TVL contraction and were subsequently written off from analytics to reflect only healthy, accessible liquidity.

On a YoY basis, TVL growth remains strong, reflecting sustained demand for isolated lending markets and Silo’s expansion across multiple chains.

The increase in Avalanche’s TVL share reflects organic demand driven by asset availability and borrower activity, rather than a deliberate reallocation of strategic focus. Similarly, Arbitrum One’s growing share highlights increasing usage of Silo’s isolated market design by more sophisticated users deploying capital across ecosystems.

Going forward, Silo’s approach to chain allocation remains opportunistic and demand-driven, with an emphasis on Silo v3 deployments that demonstrate sustainable borrowing activity rather than headline TVL alone."

3) Active loans

Active loans measures the total USD value of outstanding borrows across Silo lending markets. Q4 active loans averaged $122.23m, down 26.41% from Q3's $166.10m but more than triple Q4 2024's $38.30m. Sonic remained the largest chain for borrowing at 46.08%, despite falling to second place for TVL, suggesting higher utilization on that deployment. Avalanche grew its share from 24.86% to 31.99%, while Arbitrum One nearly tripled from 5.56% to 14.34%. Ethereum's share continued to decline, falling from 15.69% to 7.29%.

👥 Silo team commentary

"The QoQ decline in active loans mirrors the broader market slowdown and the impact of isolated market incidents during the quarter. However, the strong YoY growth in borrowing activity highlights continued adoption of Silo’s lending model and growing borrower confidence across supported chains.

Sonic’s high share of active loans relative to TVL reflects higher utilization rates driven by borrower-heavy market structures and more active leverage strategies. This dynamic has historically translated into stronger fee and revenue generation per unit of capital.

Arbitrum One’s growth in active loans is primarily driven by a chain-wide incentives campaign."

4) Fees

Fees measure the total USD value of interest paid by borrowers across Silo lending markets. Q4 fees totaled $5.15m, up 23.40% from Q3's $4.18m and over 5x Q4 2024's $848.38k. This was the highest quarterly total of 2025. Sonic's dominance intensified, accounting for 72.65% of fees despite holding only 27.70% of TVL and 46.08% of active loans, indicating significantly higher interest rates or more active borrowing turnover on that chain. Avalanche's share fell from 23.96% to 18.68%, while Ethereum dropped sharply from 11.08% to 3.26%.

👥 Silo team commentary

"The strong YoY growth in fees is a direct result of increased borrowing activity, higher utilization rates, and Silo’s isolated market architecture, which concentrates risk and pricing at the market level rather than across the entire protocol.

Sonic’s outsized contribution to fees relative to TVL reflects its higher capital velocity and borrower demand. The decline in Ethereum’s fee share is not a concern and reflects a deliberate focus on capital deployments where borrowing activity and utilization are stronger."

5) Revenue

Revenue measures the total USD value of fees retained by Silo. Q4 revenue totaled $724.81k, up 24.39% from Q3's $582.70k and more than triple Q4 2024's $212.10k, marking the best quarter of the year. Sonic's share of revenue grew to 77.42%, even higher than its 72.65% share of fees, suggesting favorable revenue retention dynamics on that chain. Avalanche contributed 13.28%, down from 17.17% in Q3. Ethereum's share fell sharply from 10.30% to 2.80%, mirroring the decline seen across other metrics.

👥 Silo team commentary

"Silo’s business model is based on capturing a portion of interest generated by borrowers across isolated lending markets, aligning protocol revenue directly with economic activity rather than raw TVL.

Revenue growth in Q4 and over the past year was driven by higher utilization, increased borrowing demand, and improved market composition, particularly on Sonic and Avalanche. These dynamics allowed revenue to reach a new quarterly high despite broader market volatility.

While Sonic currently represents a significant share of protocol revenue, Silo views this concentration as a performance-driven outcome rather than a structural dependency. The team continues to expand and diversify revenue sources across chains while prioritizing deployments that demonstrate strong product-market fit."

6) Monthly active users

Monthly active users (MAU) measures the number of unique wallet addresses interacting with Silo over a rolling 30-day period. Q4 MAU averaged 6.60k, down 40.09% from Q3's 11.0k and down 30.63% from Q4 2024's 9.5k. Despite the decline in user counts, revenue per user increased substantially year-over-year. Sonic remained the largest chain for user activity at 62.63%, though its share declined sharply from 84.84% in Q3. Arbitrum One and Avalanche both saw notable growth, tripling their shares to 16.94% and 15.86% respectively.

👥 Silo team commentary

"This metric is not a primary focus for us, as MAU is often influenced by short-term incentive programs rather than underlying economic activity. The Q4 decline, however, reflects broader market trends across the industry."

7) Definitions

Metrics:

Total value locked: measures the total USD value of collateral deposited and outstanding loans on Silo.

Active loans: measures the total USD value of outstanding borrows across Silo lending markets.

Fees: measures the total USD value of interest paid by borrowers across Silo lending markets.

Revenue: measures the total USD value of fees retained by Silo.

Monthly active users: measures the number of unique wallet addresses that have interacted with Silo over a rolling 30-day period.

8) About this report

This report is published quarterly and produced leveraging Token Terminal’s end-to-end onchain data infrastructure. All metrics are sourced directly from blockchain data. Charts and datasets referenced in this report can be viewed on the corresponding Silo Q4 2025 Report dashboard on Token Terminal.