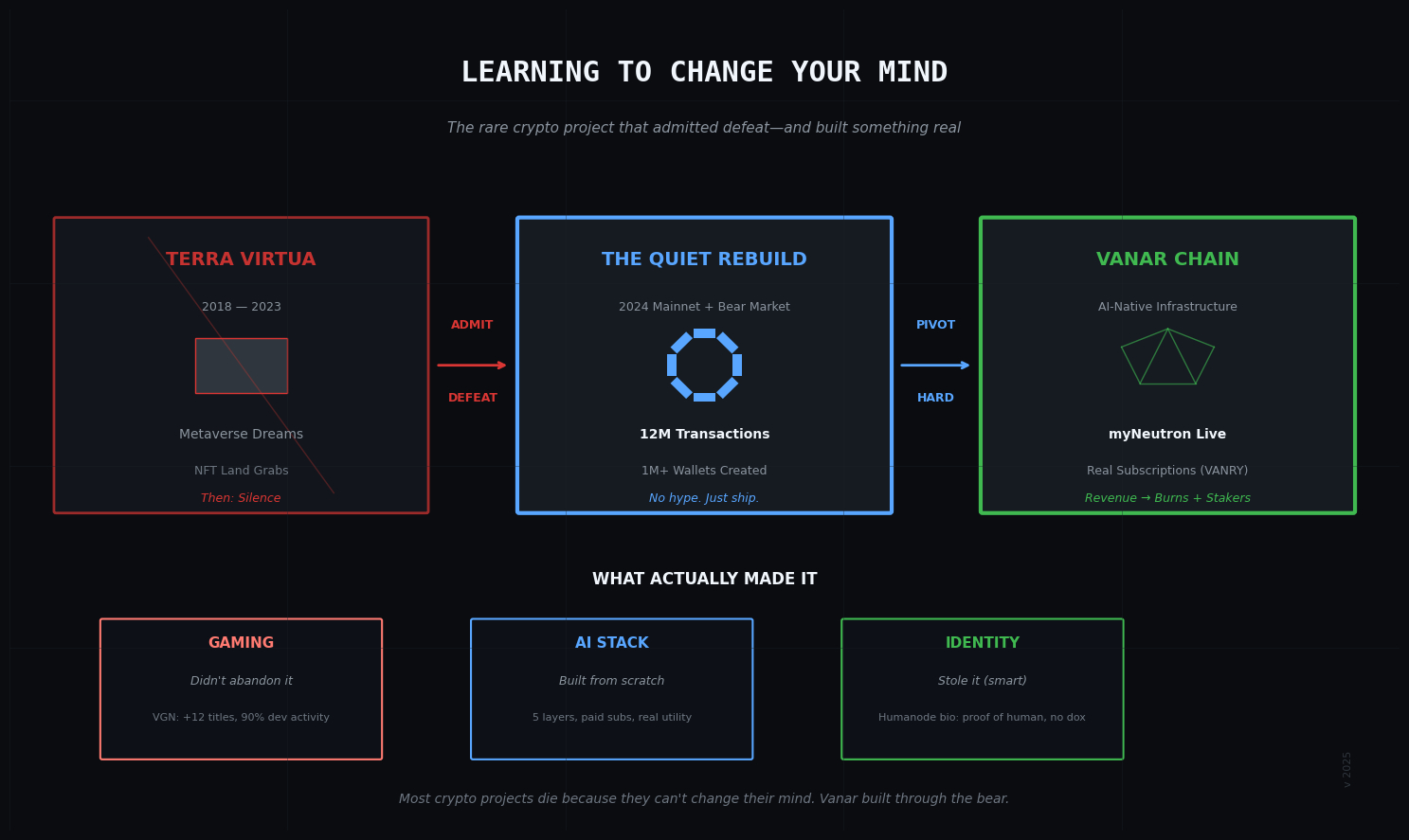

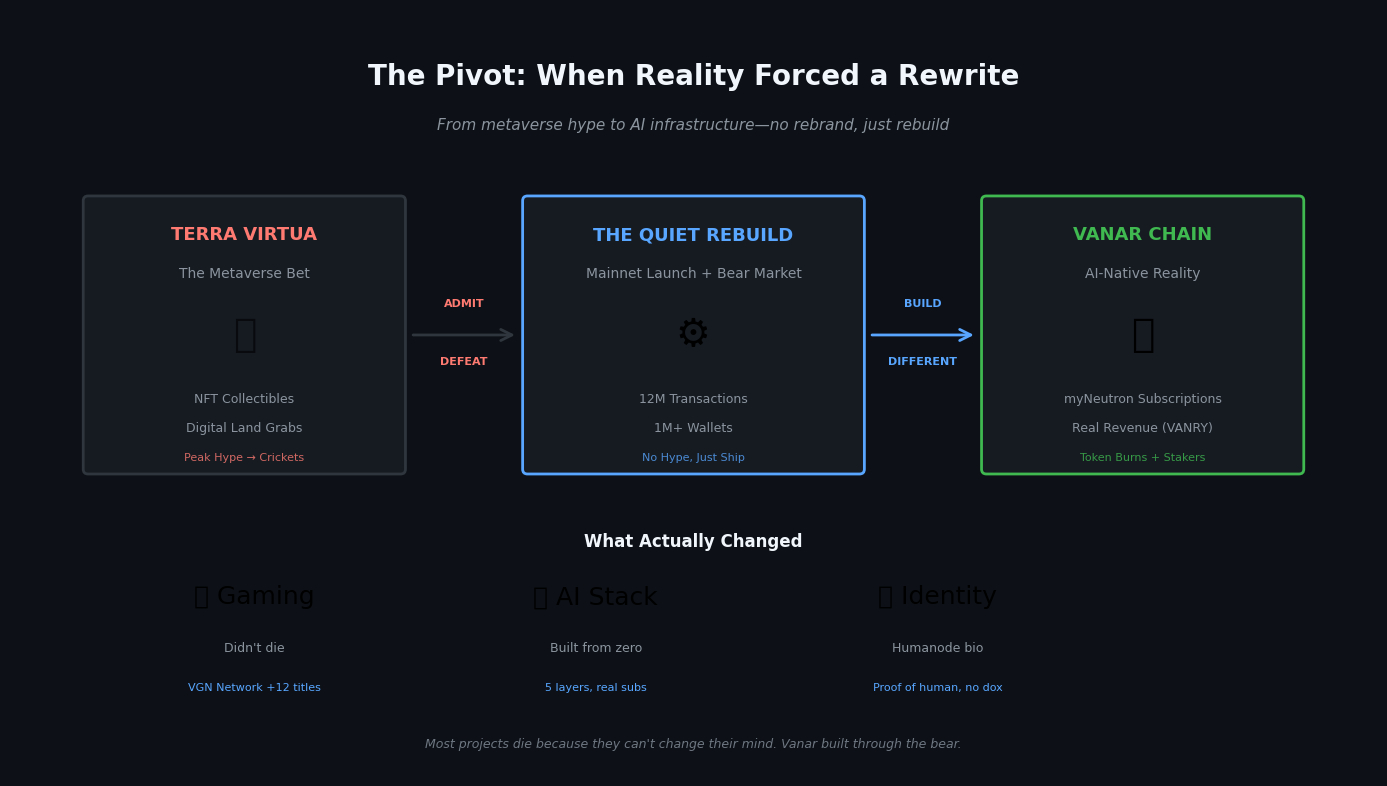

Every crypto veteran has watched projects die because they refused to budge. The roadmap says one thing, reality says another, and the team just keeps building toward a cliff. @undefined took a different path. What started as Terra Virtua Kolect—a metaverse token with big dreams and shaky foundations—morphed into something far more interesting. The team looked at the market, admitted their original vision wasn't working, and rebuilt from the ground up. That kind of honesty is rare in this space, and it deserves a closer look.

When the Party Ends, You Get to Work

Vanar's 2024 mainnet launch felt like a typical crypto moment. Big promises, flashy announcements, plenty of raised eyebrows. But something unexpected happened after the confetti settled. While other chains chased whatever narrative was hot that week, Vanar's team went quiet and started shipping. They processed twelve million transactions in those early months and created over a million unique wallets. Those numbers won't blow anyone away compared to Ethereum, but they came during the depths of a bear market when most new chains were absolute ghost towns.

The real surprise came later. Instead of doubling down on metaverse hype that had already peaked, the team looked at where the world was actually heading. AI was exploding. Developers needed infrastructure that could handle intelligent agents and autonomous systems, not just digital land deeds. So Vanar pivoted hard, repositioning itself as an AI-native chain while keeping the gaming infrastructure that had actually proven itself.

This wasn't a rebrand with new colors and a fresh website. They built a five-layer AI stack from scratch. The myNeutron tool, which uses AI to compress and store data, moved from concept to actual paid product. Real users now subscribe with real money, paying in VANRY, and that revenue gets split between stakers and token burns. For the first time, the token has a direct line to actual utility rather than just hope and speculation.

The Biometric Gamble

One of the smartest moves came through partnership rather than trying to build everything in-house. By integrating Humanode's biometric verification, they solved a problem that plagues every financial app on blockchain: proving you're a real person without doxxing yourself. Developers can now build apps that verify unique humans while keeping personal data private. This matters for everything from airdrops to lending platforms, and it positions Vanar as infrastructure that serious builders might actually want to use.

The ConftApp integration for readable wallet addresses seems like a small thing, but it removes a massive friction point. Normal people don't copy-paste hexadecimal strings. They want to send money to "alice.vanar" and know it'll reach the right place. These quality-of-life improvements add up, making the chain feel finished rather than like some experimental science project.

Gaming Never Went Away

The pivot to AI didn't mean abandoning entertainment. The VGN Games Network keeps growing, adding twelve new titles in 2025 with developer activity up nearly ninety percent. Virtua Metaverse still runs as the flagship, proof that the original vision had merit even if it needed to expand beyond it.

What changed is the toolbox available to game creators. Partnerships with Farcana brought AI-driven characters that actually learn from players. SoonChain AI simplified the brutal process of moving traditional games onto blockchain. These aren't features for the sake of features—they solve real headaches for developers who want player ownership without rebuilding their entire tech stack from scratch.

This hybrid approach—gaming familiarity plus AI capability—gives Vanar a unique position. Players show up for fun, not financial engineering. If the blockchain stays invisible while enabling new experiences, adoption happens naturally. No forced tutorials about seed phrases required.

Token Economics That Actually Make Sense

VANRY has a 2.4 billion token cap with most already in circulation. No shadowy unlock calendar waiting to wreck holders six months from now. The token does three jobs: pays for transactions at half a cent each, rewards validators who secure the network, and now powers subscription services that generate actual revenue.

The staking system evolved too. Early versions relied on reputation and authority, but January 2025 brought Delegated Proof of Stake. Regular holders can now delegate to validators and earn rewards, creating actual incentive to hold rather than just trade. Combined with the burn mechanism from myNeutron subscriptions, the supply dynamics start looking sustainable instead of the usual inflationary death spiral.

Early investors and the team hold significant portions, which always makes people nervous about potential dumps. But the shift toward subscription revenue should create steady buying pressure that offsets those risks. If the AI services attract real users, the token finds natural demand separate from the usual speculative casino.

The Problems Nobody Wants to Talk About

Honesty means looking at what could go wrong. Vanar now fights wars on multiple fronts. Established gaming chains like Flow and Enjin have deeper relationships with studios. AI infrastructure competitors like Bittensor moved faster and raised more. The pivot created opportunity but also opened new battlegrounds where they're not the incumbent.

Regulation hangs over everything like a storm that might break at any moment. Biometric verification and AI agents exist in legal gray zones that courts haven't even begun to map. European privacy laws clash with blockchain permanence in fundamental ways. The technology works, but whether it works everywhere legally remains an open question.

Market conditions offer no mercy. VANRY trades far below its peak, yanked around by Bitcoin's volatility like every other altcoin. Building through bear markets forges resilience, but it also drains treasuries and tests team cohesion. Many projects with solid tech died because they ran out of money before the market turned.

The Human Element

What makes Vanar worth watching isn't any single feature. It's the pattern of behavior. The team admitted when their original direction needed changing. They built through a bear market when hype was impossible. They created revenue streams that don't depend on the token price going up forever. These are the actions of people playing a long game rather than chasing quick pumps.

The myNeutron subscription model proves they understand something fundamental: tokens need actual jobs. Every subscription creates buy pressure. Every fee split rewards stakers. Every burn makes the remaining tokens slightly more scarce. These loops feel obvious in hindsight, but most crypto projects never actually build them.

What Comes Next

@undefined enters 2026 with momentum but no guarantees The roadmap promises Axon and Flows for scalability plus Governance 2.0 giving token holders real control The partnership with Movement Labs creates support structures for builders that extend beyond initial grants These are solid next steps but execution determines everything

The real question is whether developers will actually choose this chain. Whether gamers will notice the difference in their experiences. Whether the AI tools prove as useful in practice as they sound in theory. The foundation is there. The team showed they can adapt when necessary. Now they need to convince the world that their particular flavor of infrastructure actually matters.