I sat alone and reviewed a string of test transactions on VanarChain late one long evening, not to chase excitement, but to see where users money quietly slips through the cracks. I have lived through too many cycles to still believe in promises, I believe in how a system treats a small order when nobody is watching

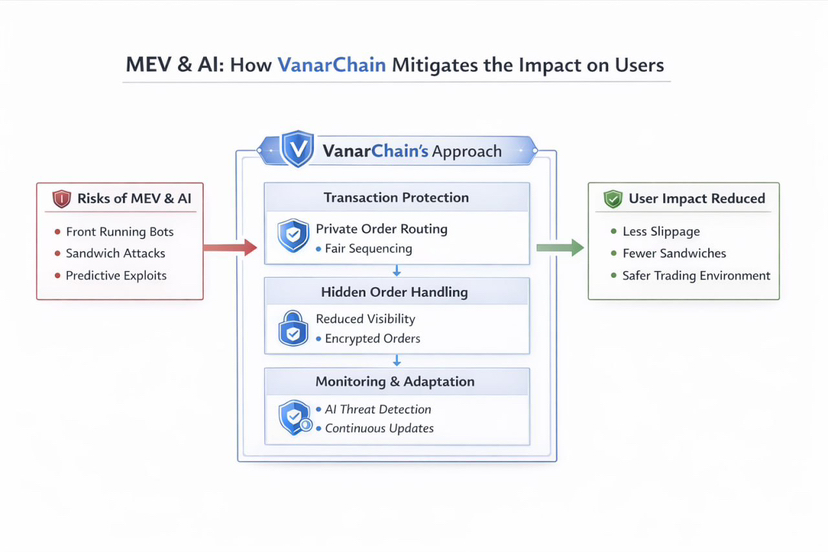

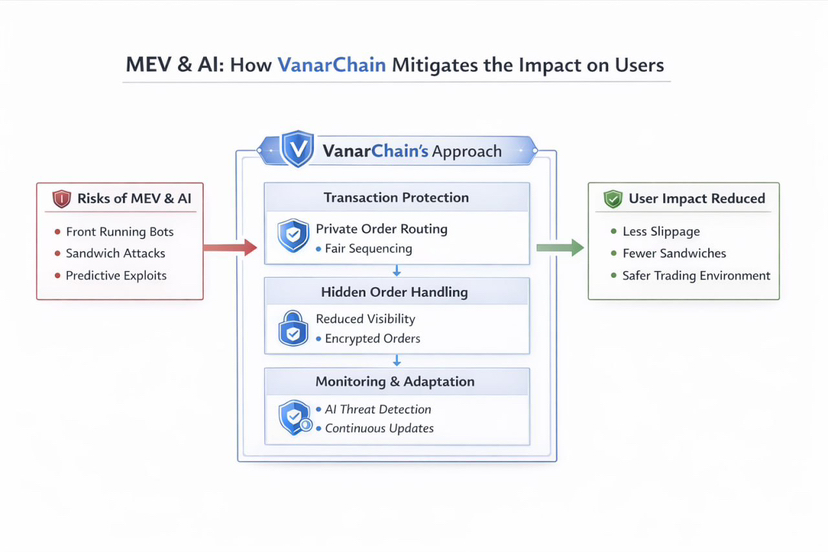

MEV is not an abstract concept, it is a trap built from ordering and timing. Your transaction appears early, someone sees it, someone cuts in front, someone nudges the price just enough, then you pay the spread like a fee that never shows up on the screen. When AI gets bolted onto MEV, the trap turns into an assembly line, it scans faster, picks victims more precisely, and executes clean two sided squeezes, users only notice slippage and blame themselves

The new risk in MEV plus AI is modelability, you are not only being outpaced, you are being understood. Bots learn when you tend to enter, how big you tend to size, how you react when price twitches, then they place you into a behavioral bucket that can be exploited. I have watched newcomers trade all week, then look back on the weekend and realize they have been working for someone else, because each time they lose a little, enough little losses add up into exhaustion

So I look at VanarChain with a practical eye, where exactly does it reduce user impact in that chain of actions. What matters is usually in how the network handles transaction ordering, and in making queue jumping less profitable. If VanarChain narrows the window in which orders can be observed before they are sealed, or makes self serving reordering harder, then the hunter has to pay more for every bite

I also pay attention to the product layer, because users do not live inside technical papers, they live inside wallets and button presses. If VanarChain offers safer default transaction routes, or options that reduce information leakage before inclusion, that is MEV mitigation that a newcomer can actually use without studying a whole new complexity layer. A good product does not force users to carry the entire weight of market cunning, it quietly rounds off the sharp edges

AI can serve predators, but it can also serve defense, that is the part many projects talk about and few sustain. I want to see VanarChain track repeating attack patterns, identify clusters that look like squeezes, and adjust execution so those advantages grind down over time. If VanarChain exposes a simple dashboard or in product signals that show average slippage, squeeze incidence, or warnings when liquidity is thin, users are less likely to walk into the dark with their eyes closed

Of course I am not naive, MEV does not disappear, it changes shape, and AI makes it change faster. Today it is one squeezing method, tomorrow it is predictive models that select the easiest orders to bite, then a different playbook once the old one gets blocked. If VanarChain is serious, it has to treat this as a war of attrition, continuous updates, continuous measurement, and an acceptance that reducing impact is a slow downward curve, not a bright victory

I am tired of watching the same game repeat under new names, and I no longer expect miracles. I only trust systems that make hunting harder, and make the user experience less quietly eroded over time, VanarChain should be judged exactly there. If @Vanarchain keeps the discipline of design and the discipline of operations, users can still lose to the market, but they will lose less to invisible teeth, and to me, that is a rare kind of fairness