I’ve watched institutional trading for years, and one thing never changes: every big order leaks before it hits the market. Front-runners spot size. Market makers shift quotes. It’s expensive, and everyone just accepts it. Until DuskTrade.

Launching in 2026 through NPEX, DuskTrade flips that script. Orders stay encrypted until execution. Buyers and sellers match at price without revealing position size. On the surface, it looks like normal trading. Underneath, Dusk’s Hedger layer hides the information that used to make institutions nervous.

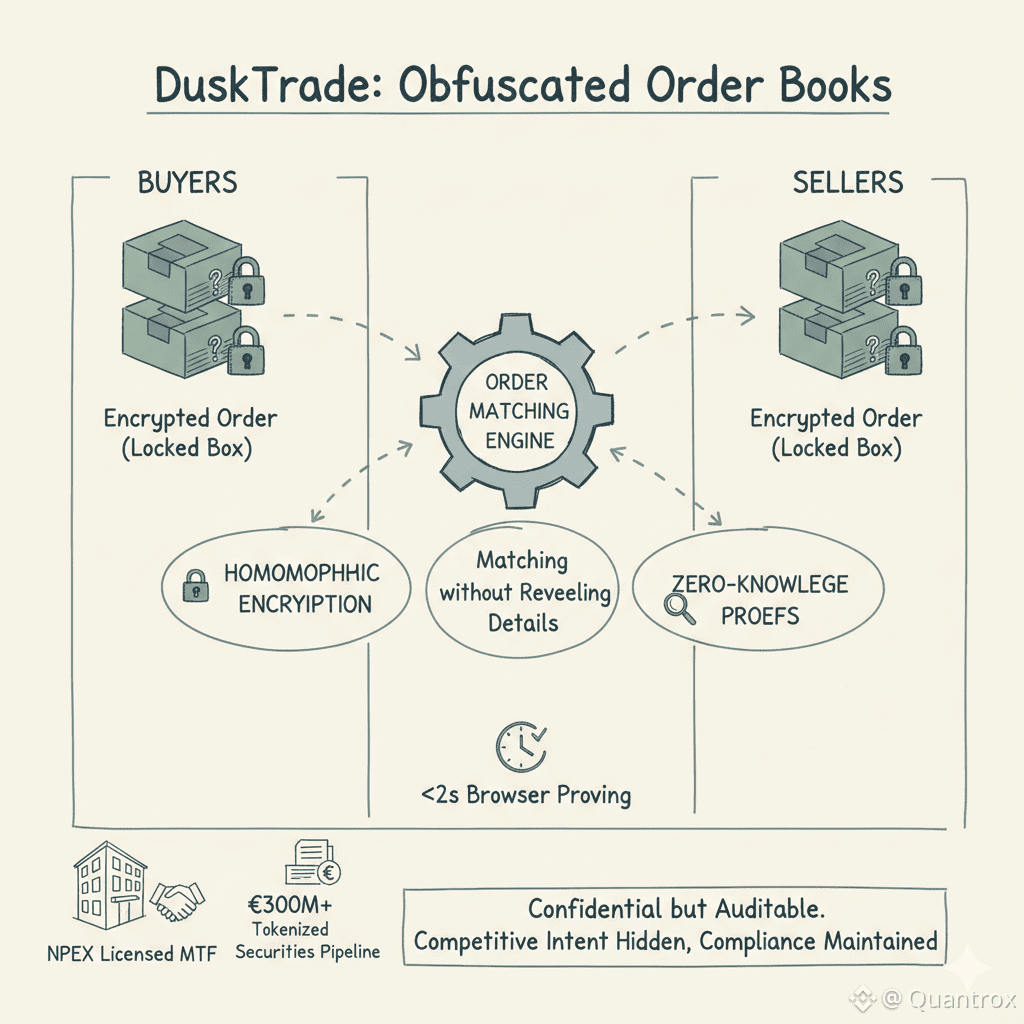

What’s happening under the hood is clever. Dusk uses homomorphic encryption over elliptic curves, so the matching engine sees that a bid meets an ask without ever decrypting either order. Zero-knowledge proofs confirm funding and validity without exposing holdings. It’s not magic—it’s applied cryptography—but it’s applied in a way that makes DuskTrade practical.

Speed matters too. Hedger generates proofs in under two seconds, right in the browser. That’s the difference between something theoretical and something institutions will actually trust with millions. Imagine waiting five minutes for every order to prove itself—it just doesn’t scale. Dusk solved that before going live.

NPEX didn’t just build a pilot. They went all in. Licensed MTF, under Dutch financial authority oversight, choosing DuskTrade means the exchange trusts Dusk’s compliance and operational reliability. They even became a shareholder in Dusk—clear signal this isn’t temporary.

The €300 million pipeline of tokenized securities isn’t a thought experiment. These are real assets, moving from traditional infrastructure to Dusk’s blockchain because obfuscated order books actually work. Volume patterns show the market noticed: 99.5 million tokens changed hands, RSI at 34.13, pullback to $0.0669—all signs of steady accumulation, not hype. Dusk isn’t just a story on a chart.

The waitlist opening in January is more than marketing. It gives institutions access to confidential trading while staying fully auditable. That’s what sets DuskTrade apart. Privacy here doesn’t hide from regulators. It hides competitive intent from other traders. Dusk is solving a problem that cost institutions billions annually, without breaking compliance.

Watching DuskTrade, it’s clear something subtle is happening: blockchain isn’t just about decentralization or flashy yields. With Hedger and DuskEVM behind it, Dusk is quietly giving regulated finance tools that actually work. And that’s why institutions are paying attention.