Most infrastructure breaks when nothing dramatic is happening. Not during hacks. Not during outages. But during quiet periods, when prices drift sideways and attention moves elsewhere. That’s the environment Walrus seems most interested in surviving.

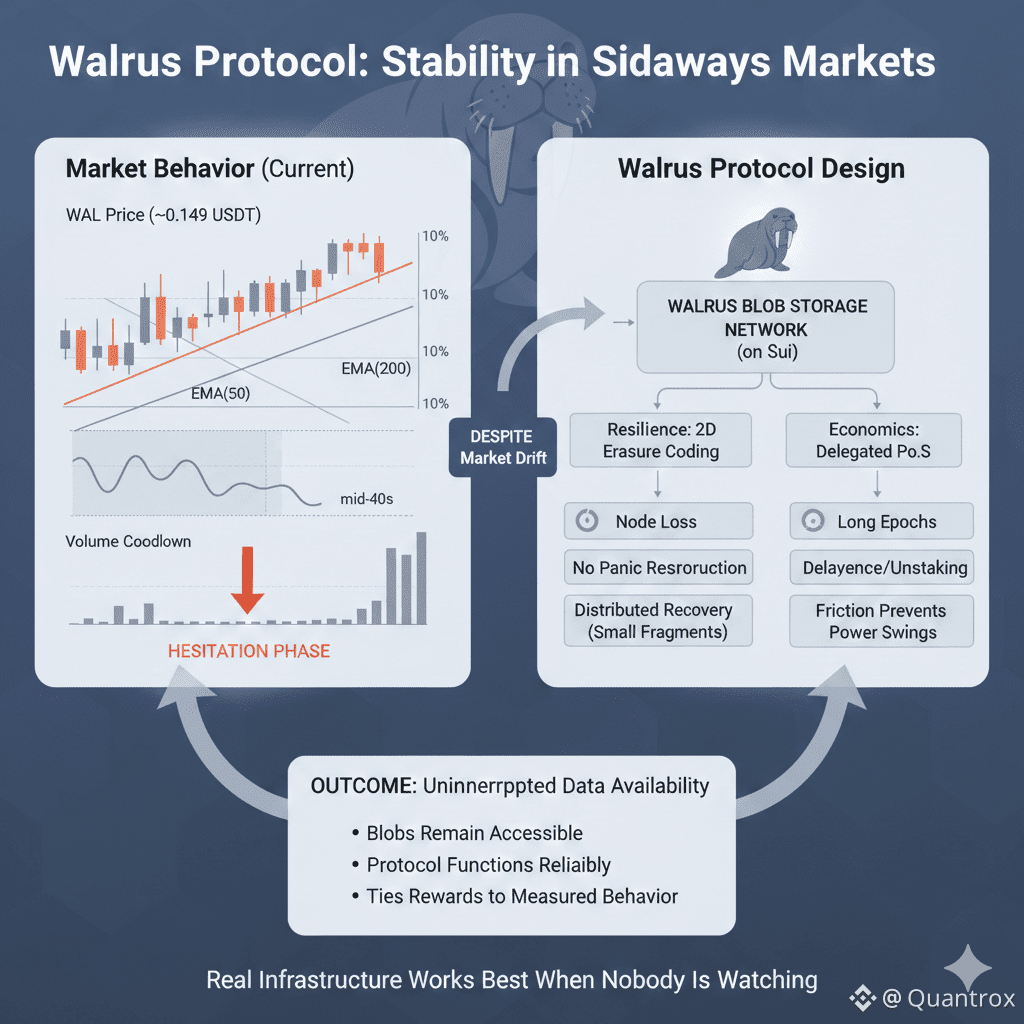

Right now, Walrus isn’t in a hype phase. WAL is trading near 0.149 USDT, slightly below short-term momentum levels, with RSI hovering in the mid-40s. Volume has cooled compared to earlier spikes. This isn’t a market screaming conviction. It’s a market hesitating. And that hesitation is exactly where Walrus reveals what it’s actually built for.

Walrus doesn’t assume constant growth. It assumes churn.

At the protocol level, Walrus is a blob storage network designed on Sui, emerging from Mysten Labs’ broader attempt to rethink how data-heavy infrastructure behaves under stress. Blobs on Walrus aren’t optimized for speed alone. They’re optimized to remain accessible while operators rotate, stake shifts, and epochs roll forward.

This is where Red Stuff matters. Walrus uses two-dimensional erasure coding so that blob recovery stays cheap even when parts of the network disappear. Losing a node doesn’t trigger panic reconstruction. Recovery pulls small fragments from many places, distributing load instead of concentrating it. In practice, this means Walrus can tolerate instability without turning recovery into a bandwidth sink.

That technical choice lines up with Walrus economics. Walrus runs on delegated PoS, but with long epochs and delayed effects. Operators don’t instantly gain or lose influence when WAL moves between wallets. Delegations take time to matter. Unstaking takes time to unwind. This friction isn’t accidental. It prevents sudden power consolidation during moments of market weakness.

Look again at the current chart behavior. WAL is trading close to its EMA(50) and EMA(200), with MACD slightly negative and volume below recent averages. This is the kind of market where opportunistic systems struggle. Participants get bored. Nodes cut corners. Infrastructure decays quietly.

Walrus pushes against that decay by tying rewards to measured behavior, not reputation or size. A small node that stays online and responds correctly earns WAL the same way a large one does. A node that underperforms bleeds stake over time. Delegators feel that pain too. There’s no insulation layer.

What’s interesting is how this affects blob storage users. From their perspective, Walrus doesn’t react to price. Blobs remain available whether WAL is trending or stalling. Epoch transitions still reshuffle shards. Recovery still happens. The protocol keeps doing its job while the market debates direction.

That separation matters. Walrus isn’t trying to convince traders of anything. It’s trying to prove that infrastructure doesn’t need excitement to function.

If WAL stays range-bound for weeks, Walrus doesn’t flinch. If volume thins out, recovery logic doesn’t slow down. If attention fades, blobs don’t vanish.

That’s the quiet claim Walrus is making: real infrastructure should work best when nobody is watching.