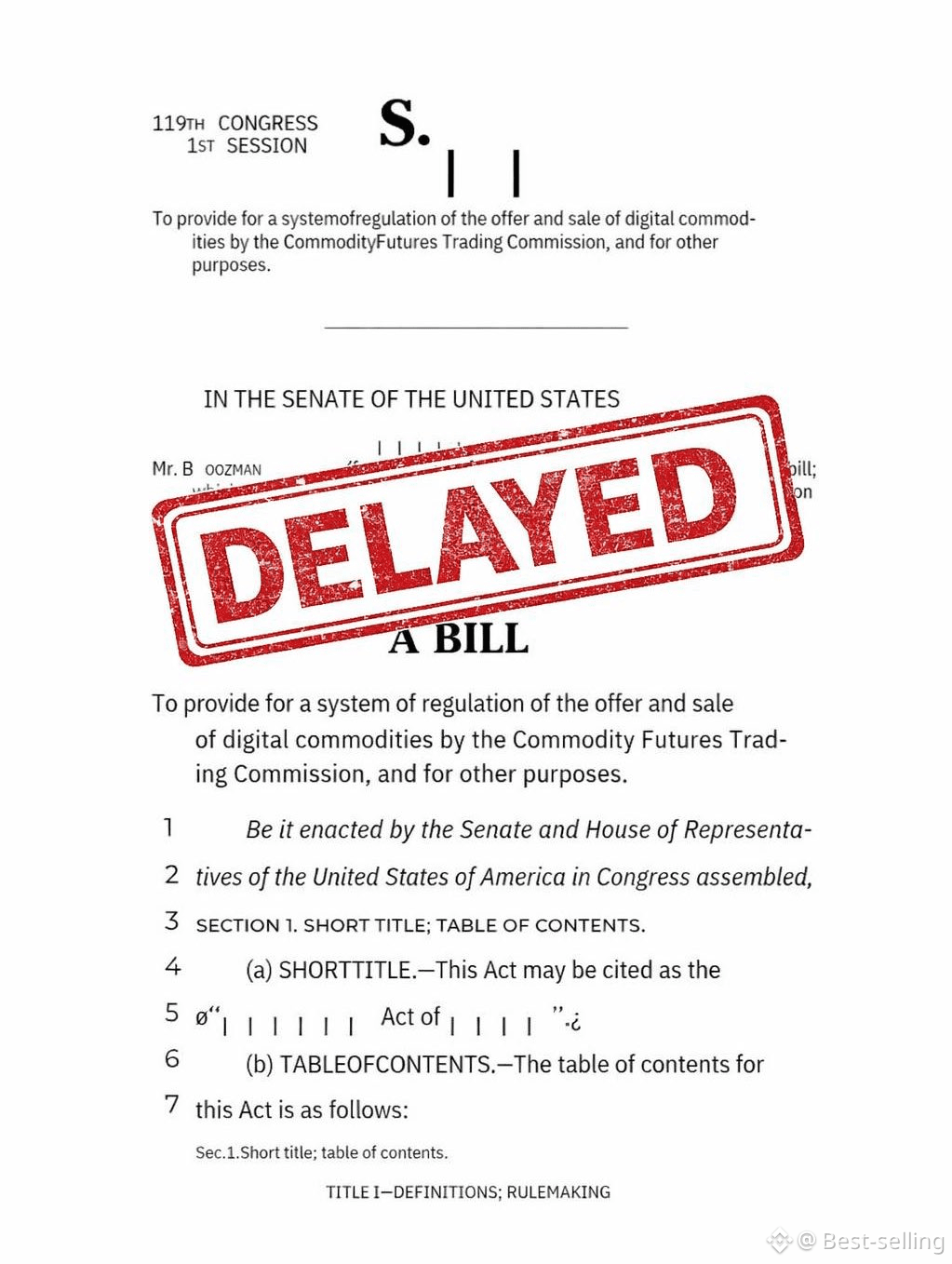

Let us explain this in simple words.

Banks do not want real competition.

DeFi and stablecoins threaten their core business. This bill, in its current form, limits that competition instead of encouraging fair inninnovationEven JPMorgan’s CFO said it clearly:

If stablecoins are allowed to offer yield, banks will see large money outflows.

@Cellula Re-poster #dusk $DUSK

That one statement explains a lot.

Brian Armstrong said this bill would make crypto worse than it is today.

He said directly: no bill is better than a bad bill.

Not because regulation is bad, but because this version protects banks more than it protects innovation.

Now look at what the bill actually does:

1. TOKENIZED STOCKS WOULD BE ALMOST BANNED

Crypto versions of equities would become nearly impossible in the US.

This kills one of the biggest real world use cases of blockchain.

2. DEFI WOULD BE TREATED LIKE BANKS

The government would get broad access to user data. Every transaction would need reporting.

This destroys privacy and kills the whole idea of decentralization.

DeFi stops being DeFi and becomes another bank system.

3. CFTC GETS WEAKER, SEC GETS MORE POWER

Power gets centralized under one regulator. Innovation slows down.

Crypto native projects face higher compliance and more uncertainty.

4. STABLECOIN REWARDS COULD BE BANNED

Stablecoins would not be allowed to pay yield.

Why? Because yield attracts deposits away from banks.

This directly protects the banking system from competition.

So when you connect everything:

• DeFi becomes controlled

• Stablecoins lose yield

• Tokenization gets blocked

• Banks face less competition

This bill does not help crypto much but It protects banks.