1) Executive summary

Solv Protocol $SOLV is an onchain Bitcoin reserve that enables users to earn yield on BTC while preserving liquidity and composability across DeFi, CeFi, and institutional rails.

Users deposit BTC and receive SolvBTC (1:1 backed), a universal Bitcoin asset designed to be composable and be utilized across multiple ecosystems. In practice, SolvBTC has become a core liquidity and collateral layer, including on BNB Chain, where SolvBTC.BNB is integrated across major BNB DeFi venues. For yield exposure, SolvBTC can be converted into yield-bearing positions (e.g., xSolvBTC) that route into diversified strategies across DeFi lending/markets and BTC security ecosystems.

Q4 2025 saw users rotate from active yield into liquid holdings: SolvBTC's supply increased while xSolvBTC declined, yet the protocol generated $17.05m in fees. As it stands, Solv Protocol is the third largest liquid staking project by revenue over the last 365 days.

🔑 Key metrics (Q4 2025)

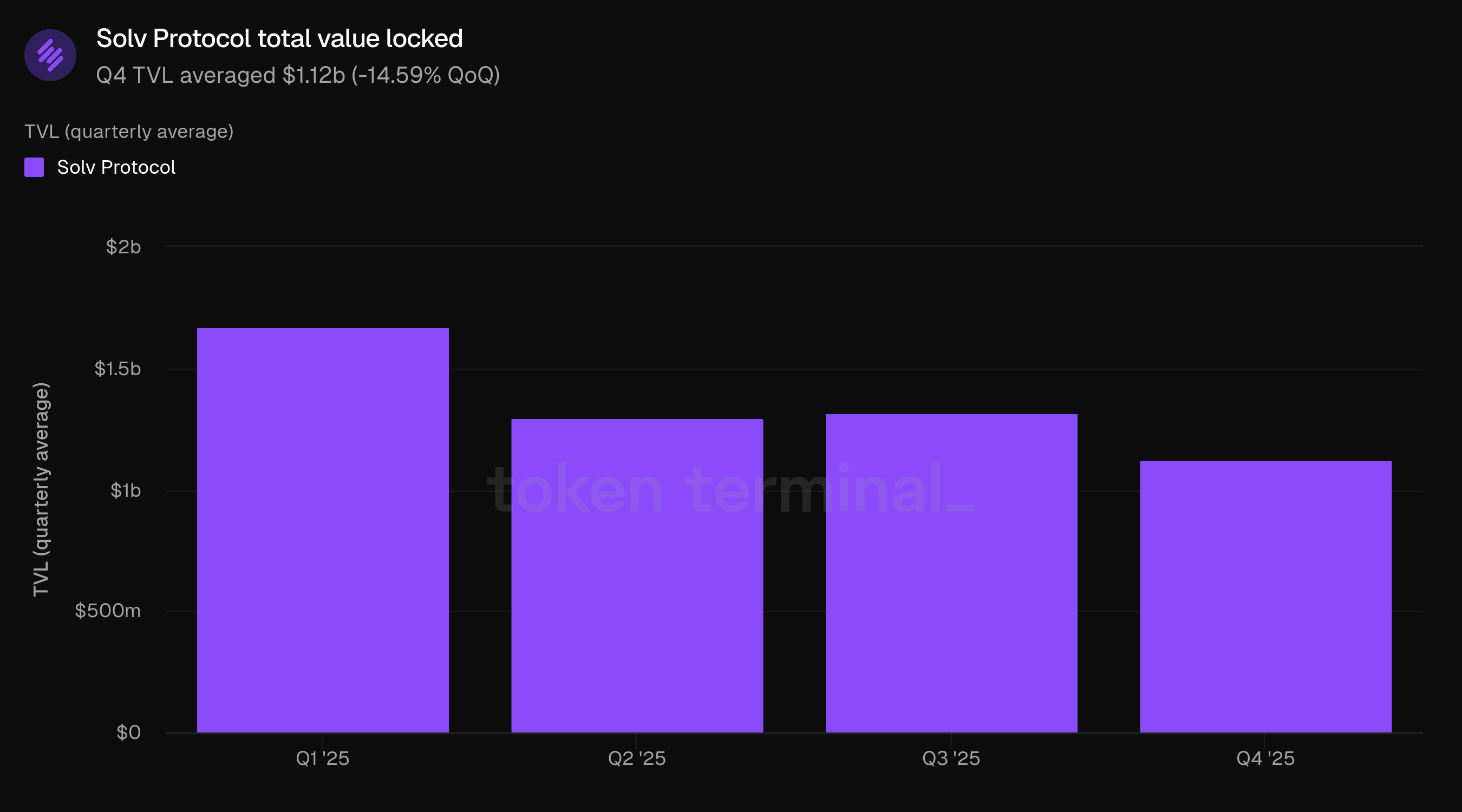

Total value locked: $1.12b (-14.59% QoQ)

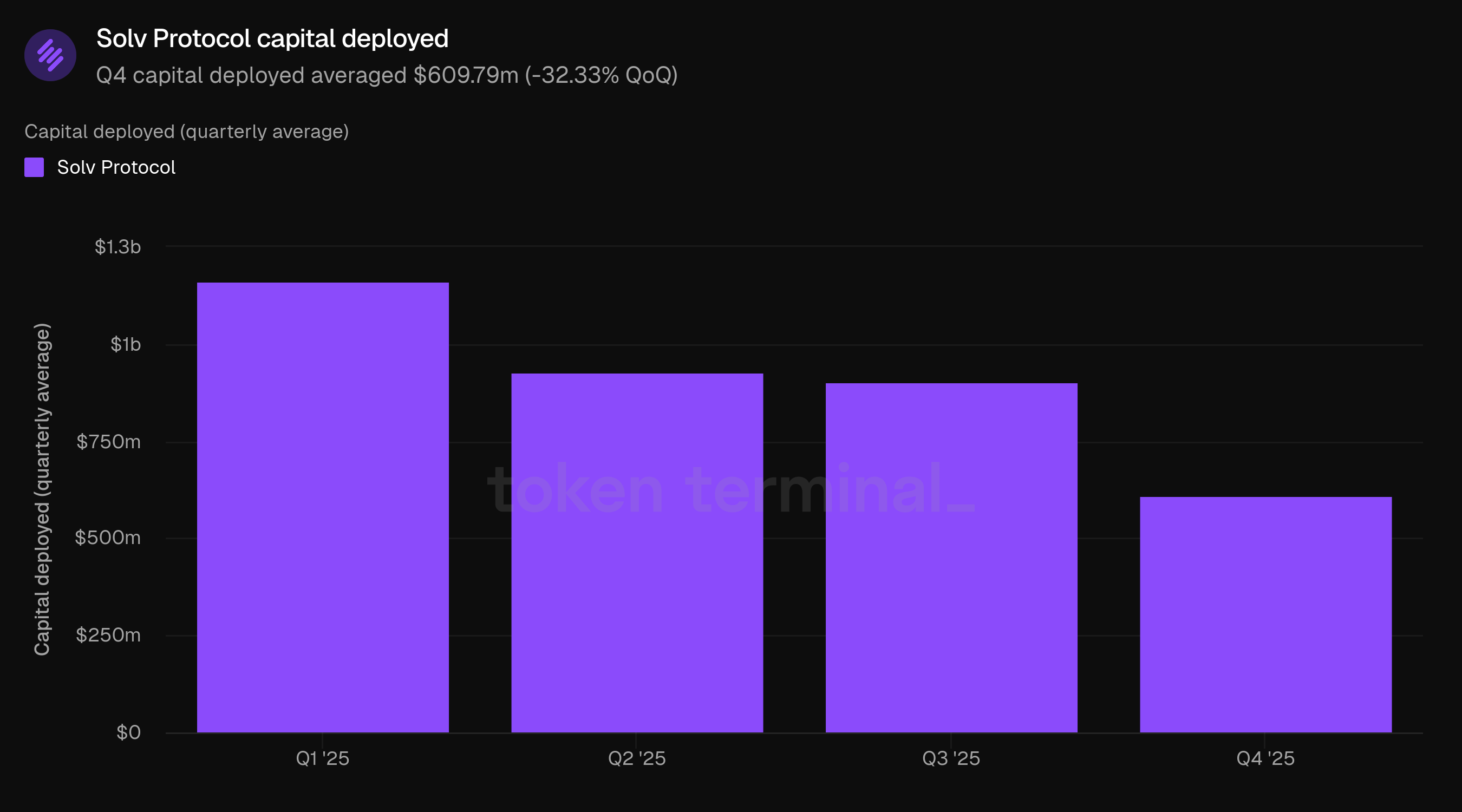

Capital deployed: $609.79m (-32.33% QoQ)

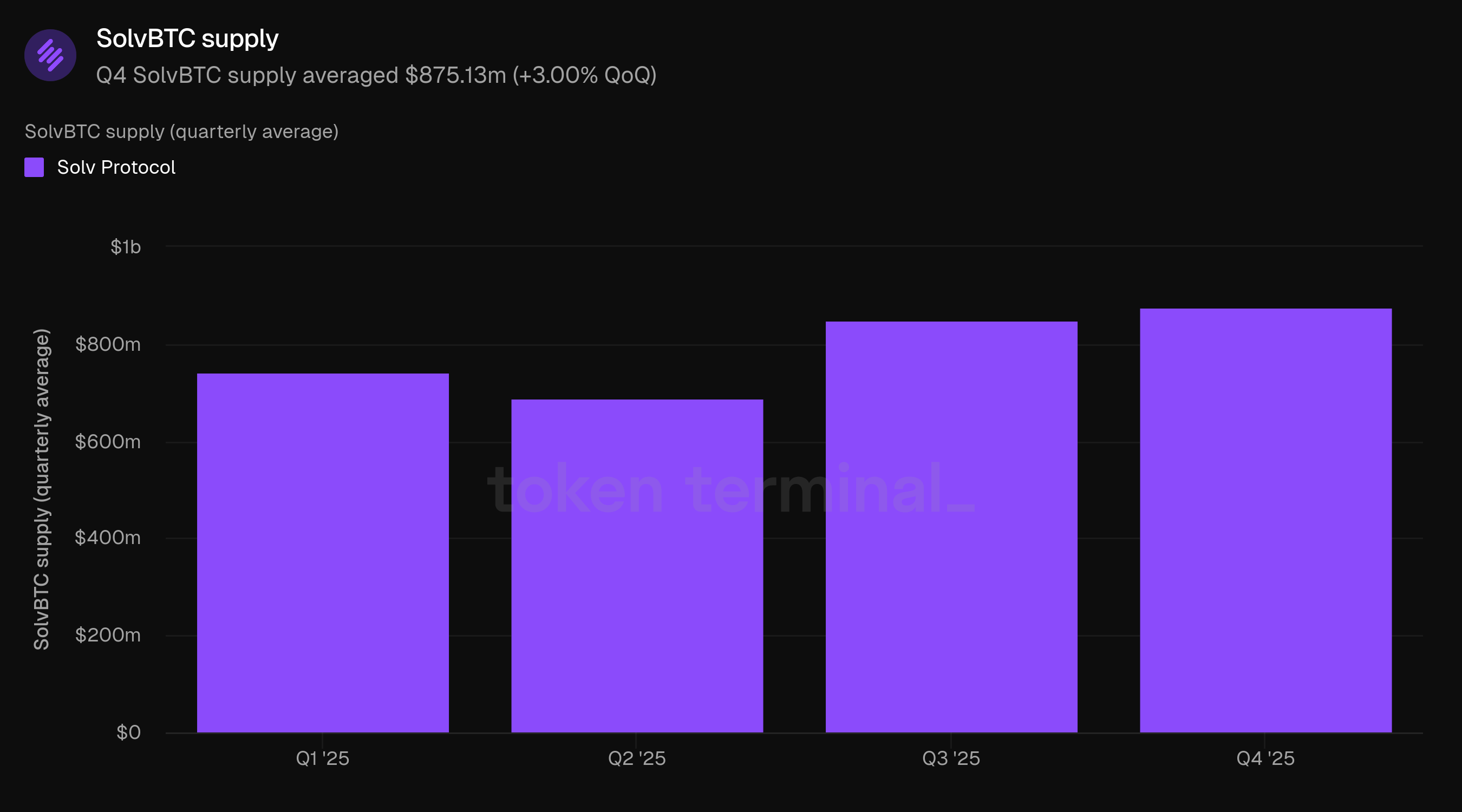

SolvBTC supply: $875.13m (+3.00% QoQ)

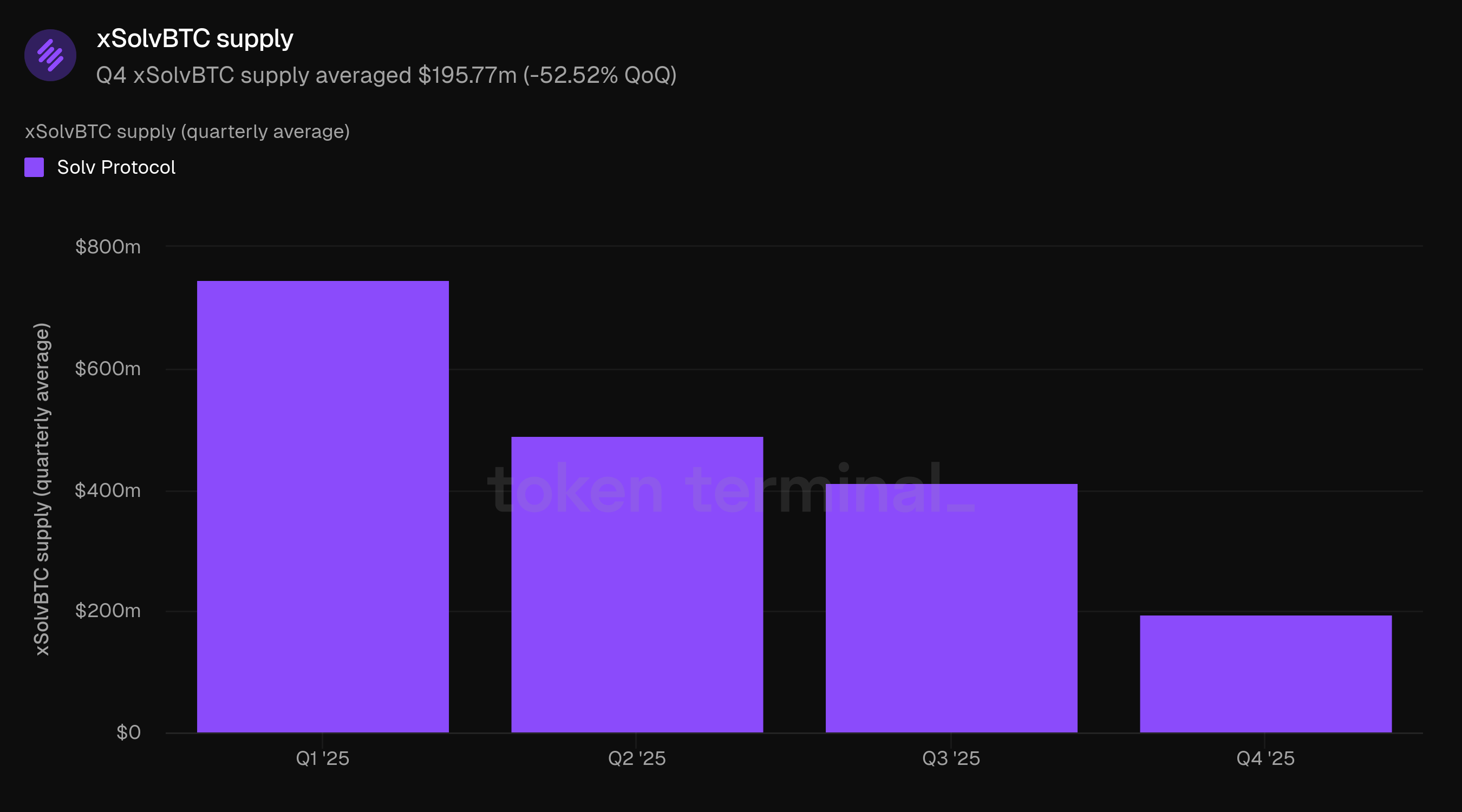

xSolvBTC supply: $195.77m (-52.52% QoQ)

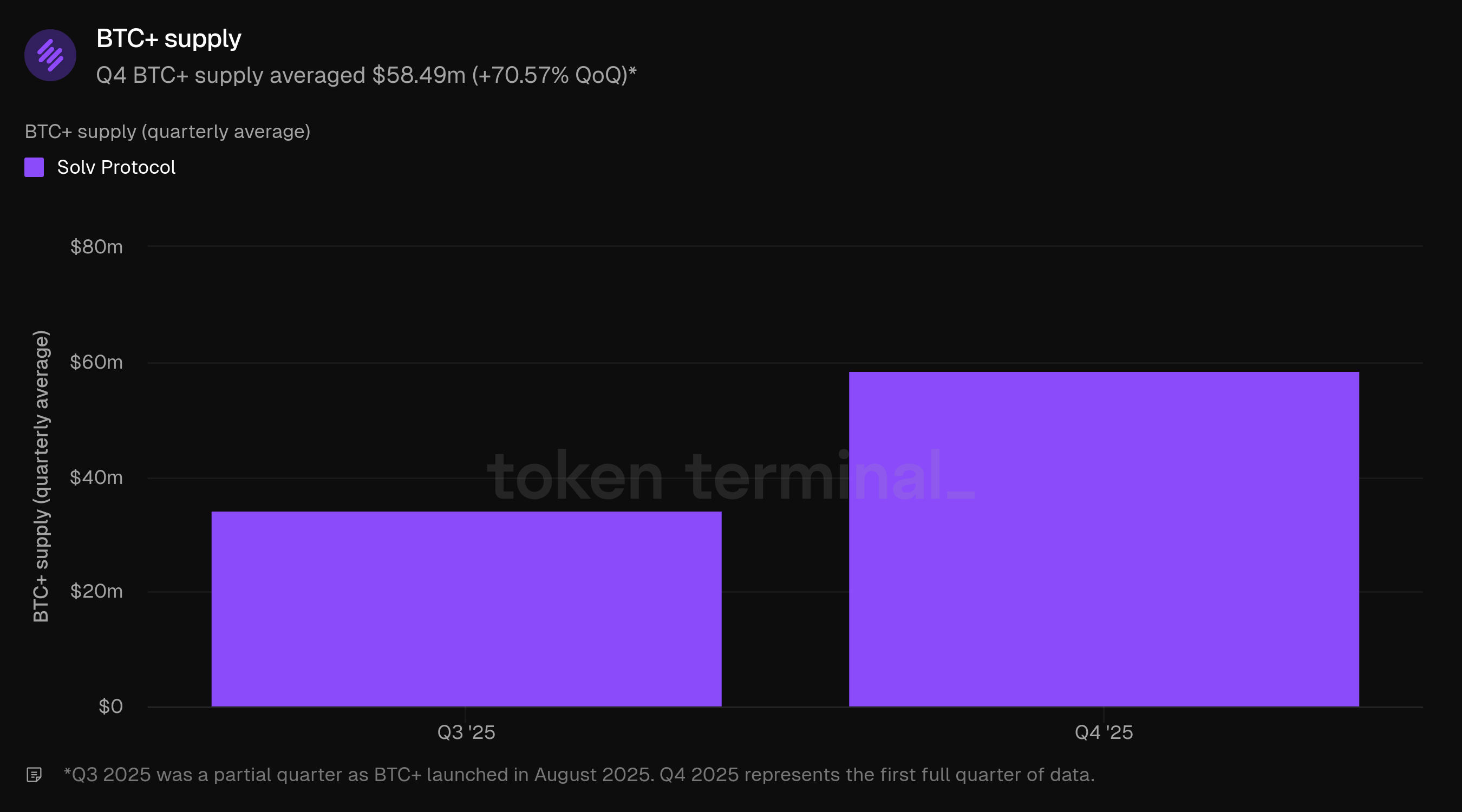

BTC+ supply: $58.49m (+70.57% QoQ)

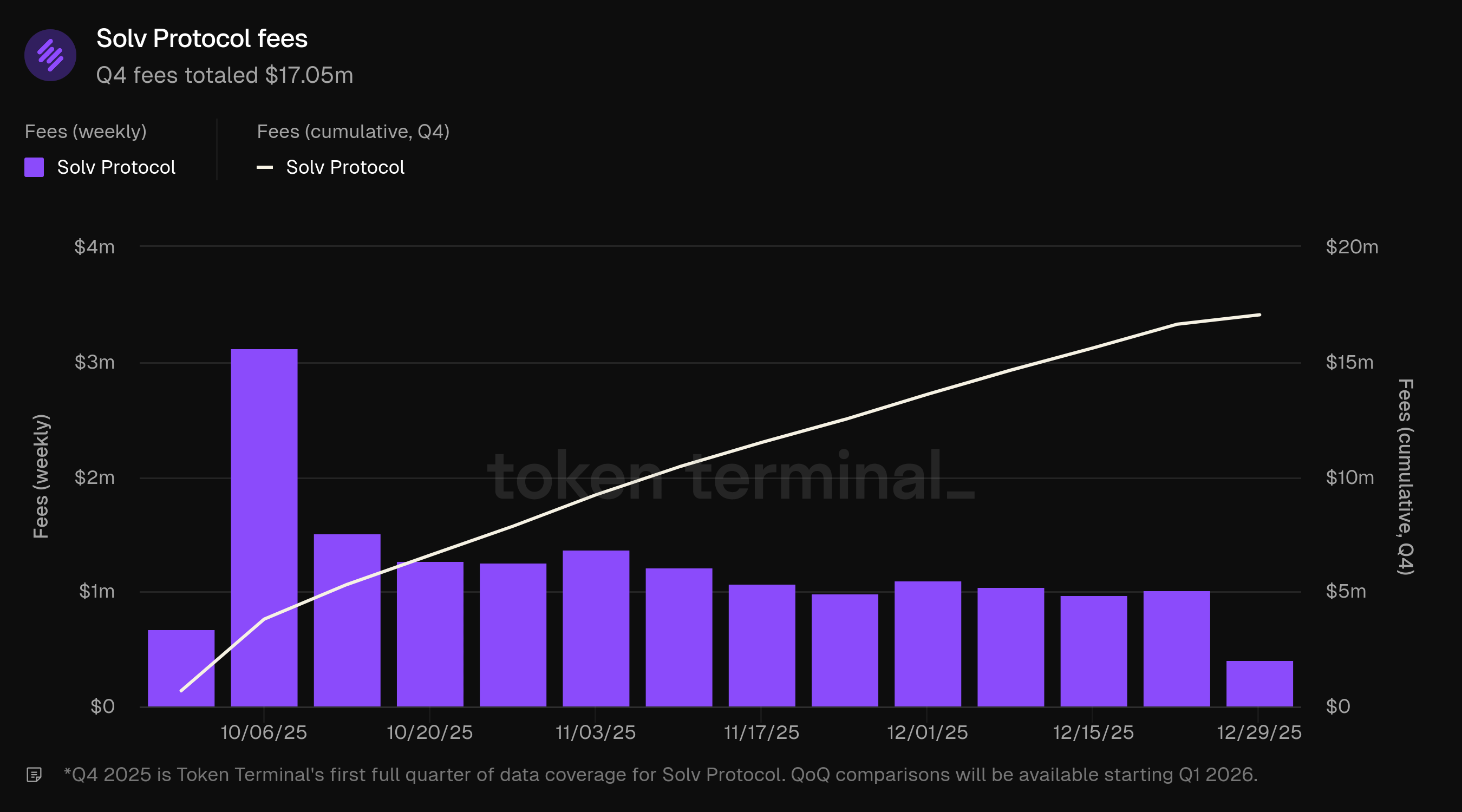

Fees: $17.05m

👥 Solv Protocol team commentary

"Looking ahead, Solv is pushing two institutional-grade upgrades in parallel: (1) expanding beyond BTCFi into RWA yield pathways, and (2) upgrading custody infrastructure via a Solv-developed FROST Network (based on the IETF-standardized FROST threshold signing protocol, RFC 9591) to harden operational security at scale. This institutional trajectory is also reflected in partnerships focused on treasury adoption, such as Solv’s collaboration with Animoca Brands to support corporate Bitcoin yield distribution and infrastructure."

2) Total value locked

Total value locked (TVL) measures the total USD value locked in Solv Protocol's Bitcoin-backed token ecosystem, aggregating Bitcoin held across EVM-chain tokens and native Bitcoin custody addresses. Q4 TVL averaged $1.12b, down 14.59% from $1.32b in Q3. Over the full year, TVL peaked in Q1 before declining in Q2, with the second half showing partial recovery and relative stabilization.

👥 Solv Protocol team commentary

"The bigger story is institutional adoption getting stickier. TVL is still meaningfully higher on a multi-quarter view, and the growth pattern is maturing, from one-off spikes to repeatable, distribution-led inflows as more allocators treat SolvBTC as a finance-grade Bitcoin liquidity layer.

What’s driving that resilience is where the demand is coming from: treasury-style holders, sovereign wealth funds, and institutional programs that prioritize transparency, custody robustness, and deployability over chasing short-term yield. You can see that in the data, SolvBTC supply held up and even grew while active deployment fell. Its more like capital parking in base liquidity, waiting for the next institutional-grade deployment path.

On the distribution side, TVL has been supported by deeper rails into institutional venues, expanding integrations that make SolvBTC composability easier, and deployable across multiple ecosystems. As these channels widen (and as more institutional partners integrate SolvBTC into their own products), the addressable pool shifts from retail rotations to funds-driven balance sheets, which is exactly the kind of flow that sustains TVL over time."

3) Capital deployed

Capital deployed measures the total USD value of Bitcoin-backed assets managed across all Solv Protocol vaults and tokenized Bitcoin products. Q4 capital deployed averaged $609.79m, down 32.33% from $901.13m in Q3. Capital deployed declined each quarter throughout 2025, falling from its Q1 peak of $1.17b. The Q4 decline outpaced the decline in TVL, widening the gap between total deposits and actively deployed positions.

👥 Solv Protocol team commentary

"This reflects a preference for liquidity and optionality over committing to active yield strategies. More importantly, this looks like users parking in SolvBTC, staying on-platform and waiting for the next wave of vault deployments and product opportunities.

What’s making that liquidity sticky is that SolvBTC isn’t idle. SolvBTC has become the largest Bitcoin-denominated asset on BNB Chain and one of the most actively utilized BTC assets in the ecosystem, consistently showing up as a core unit of account for collateral and liquidity routing.

Notably, external demand from lending markets remains strong. Protocols like ListaDAO can utilize up to 90% of SolvBTC as BTC collateral, which increases borrow demand and real utilization. This kind of always-on collateral demand helps sustain SolvBTC minting and circulation even when internal vault deployment temporarily steps down, because the asset is still working across the broader BNB DeFi stack."

4) SolvBTC supply

SolvBTC supply measures the total USD value of SolvBTC tokens in circulation across 11 supported EVM chains. Q4 SolvBTC supply averaged $875.13m, up 3.00% from $849.60m in Q3. After dipping in Q2, SolvBTC supply grew in the second half, diverging from the declining trends in TVL and capital deployed. SolvBTC supply now represents approximately 78% of TVL, up from 64% in Q3.

👥 Solv Protocol team commentary

"SolvBTC continues to grow as the base liquid Bitcoin layer for the ecosystem. Its growth alongside reduced vault deployment reflects its dual utility: users can hold SolvBTC for liquidity while still accessing external yield opportunities through lending protocols and DeFi integrations. This external demand, rather than internal vault activity, sustained minting in Q4."

5) xSolvBTC supply

xSolvBTC supply measures the total USD value of xSolvBTC tokens in circulation across 10 EVM-compatible chains. Q4 xSolvBTC supply averaged $195.77m, down 52.52% from $412.24m in Q3. xSolvBTC supply declined each quarter throughout 2025, contrasting with SolvBTC supply which recovered in the second half. xSolvBTC as a share of SolvBTC dropped from 49% in Q3 to 22% in Q4, indicating a shift in the ratio between yield-bearing and liquid positions.

👥 Solv Protocol team commentary

"Users prefer active strategy exposure, keeping the same BTC exposure, just opting for liquidity and flexibility in SolvBTC over liquid staked assets like xSolvBTC.

That shift is normal, as we observe relative yields compress or rotate across venues. And in Solv’s case, holders staying in SolvBTC so they’re ready to redeploy quickly to new vaults when there are new yield opportunities, RWA pathways, and product rails."

6) BTC+ supply

BTC+ supply measures the total USD value of BTC+ tokens in circulation. Q4 BTC+ supply averaged $58.49m, up 70.57% from $34.29m in Q3.* As Q4 represents the first full quarter of data, BTC+ grew while xSolvBTC supply declined, suggesting early traction for the newer product.

👥 Solv Protocol team commentary

"BTC holders are facing a 'yield ceiling' where basic lending or staking protocols no longer meet expectations. Over the past quarter, BTC+ has achieved a ~70% growth in AUM, reaching a critical milestone of 1,000 BTC. This traction validates a clear market shift: users are moving towards on-chain vaults that combine institutional-grade management with sophisticated hybrid strategies. By bridging BTC liquidity with high-quality yield sources like RWA and delta-neutral strategies, BTC+ is effectively solving the core tension between risk, complexity, and performance. We are now ready to scale this verified demand to the broader market."

7) Fees

Fees measures the total USD value of fees generated across Solv Protocol's vaults, including pool fees, collaboration fees, redemption fees, and subscription fees. Q4 fees totaled $17.05m, averaging $1.31m per week. Weekly fees peaked above $3m in early October before stabilizing around $1m per week through November and December.

👥 Solv Protocol team commentary

"Solv generates fees from vault operations including NAV increases, partner collaborations, redemptions, and subscriptions. The fee structure aligns protocol revenue with user activity and AUM growth.

The stabilization around $1m per week through November and December reflects a floor of ongoing vault activity. Fee generation correlates with active vault positions rather than base SolvBTC holdings, so the Q4 pattern mirrors the capital deployed trajectory. At current run-rates, annualized revenue would total approximately $26m."

8) Definitions

Products:

SolvBTC: Solv's base liquid Bitcoin token, backed 1:1 by BTC. SolvBTC can be used across DeFi applications or converted into yield-bearing xSolvBTC.

xSolvBTC: Solv's yield-bearing Bitcoin token (formerly SolvBTC.BBN), which earns returns through staking, lending, liquidity provision, and other DeFi strategies.

BTC+: Solv's institutional yield vault combining decentralized, centralized, and traditional finance returns, targeting treasuries and family offices with a "one-click, trust-first" user experience.

Metrics:

Total value locked: measures the total USD value locked in Solv Protocol's Bitcoin-backed token ecosystem, aggregating Bitcoin held across EVM-chain tokens and native Bitcoin custody addresses.

Capital deployed: measures the total USD value of Bitcoin-backed assets managed across all Solv Protocol vaults and tokenized Bitcoin products.

SolvBTC supply: measures the total USD value of SolvBTC tokens in circulation across 11 supported EVM chains.

xSolvBTC supply: measures the total USD value of xSolvBTC tokens in circulation across 10 EVM-compatible chains.

BTC+ supply: measures the total USD value of BTC+ tokens in circulation.

Fees: measures the total USD value of fees generated across Solv Protocol's vaults, including pool fees, collaboration fees, redemption fees, and subscription fees.

9) About this report

This report is published quarterly and produced leveraging Token Terminal’s end-to-end onchain data infrastructure. All metrics are sourced directly from blockchain data. Charts and datasets referenced in this report can be viewed on the corresponding Solv Protocol Q4 2025 Report dashboard on Token Terminal.