Money does not lose value loudly. It loses value slowly. Prices rise step by step, salaries lag behind, and savings start buying less without most people noticing it at first. Over long periods, this silent erosion does more damage than sudden market crashes.

When currencies weaken, people usually react late. They wait for confirmation, for headlines, for panic. But by that time, the protection phase has already started quietly in the background. This is where gold historically begins to separate itself from paper money.

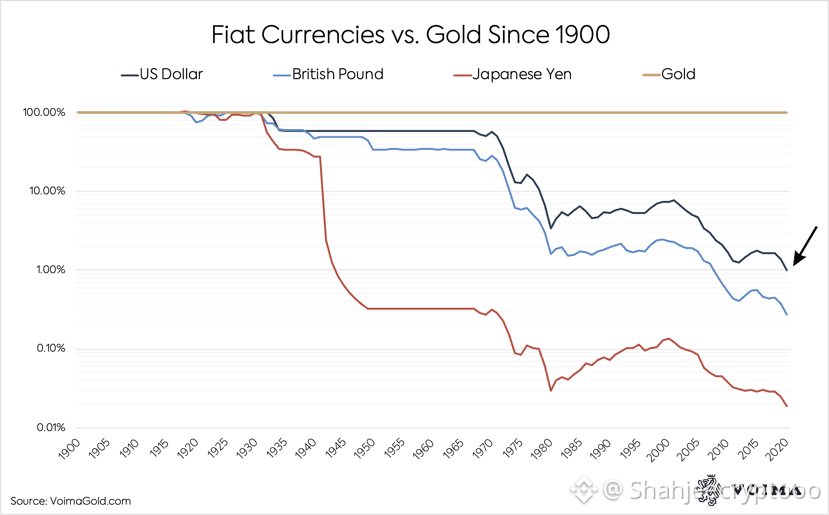

This chart tells a simple story. Currencies change, systems evolve, but their value keeps drifting lower. Gold does not move fast, but it holds its ground. This is why gold is not a trade first. It is protection first.

Every major period of stress pushes people back to this idea. Not because gold is exciting, but because it is reliable when confidence breaks. Inflation, debt growth, and long political uncertainty all feed into the same outcome. Paper value weakens. Hard assets gain attention.

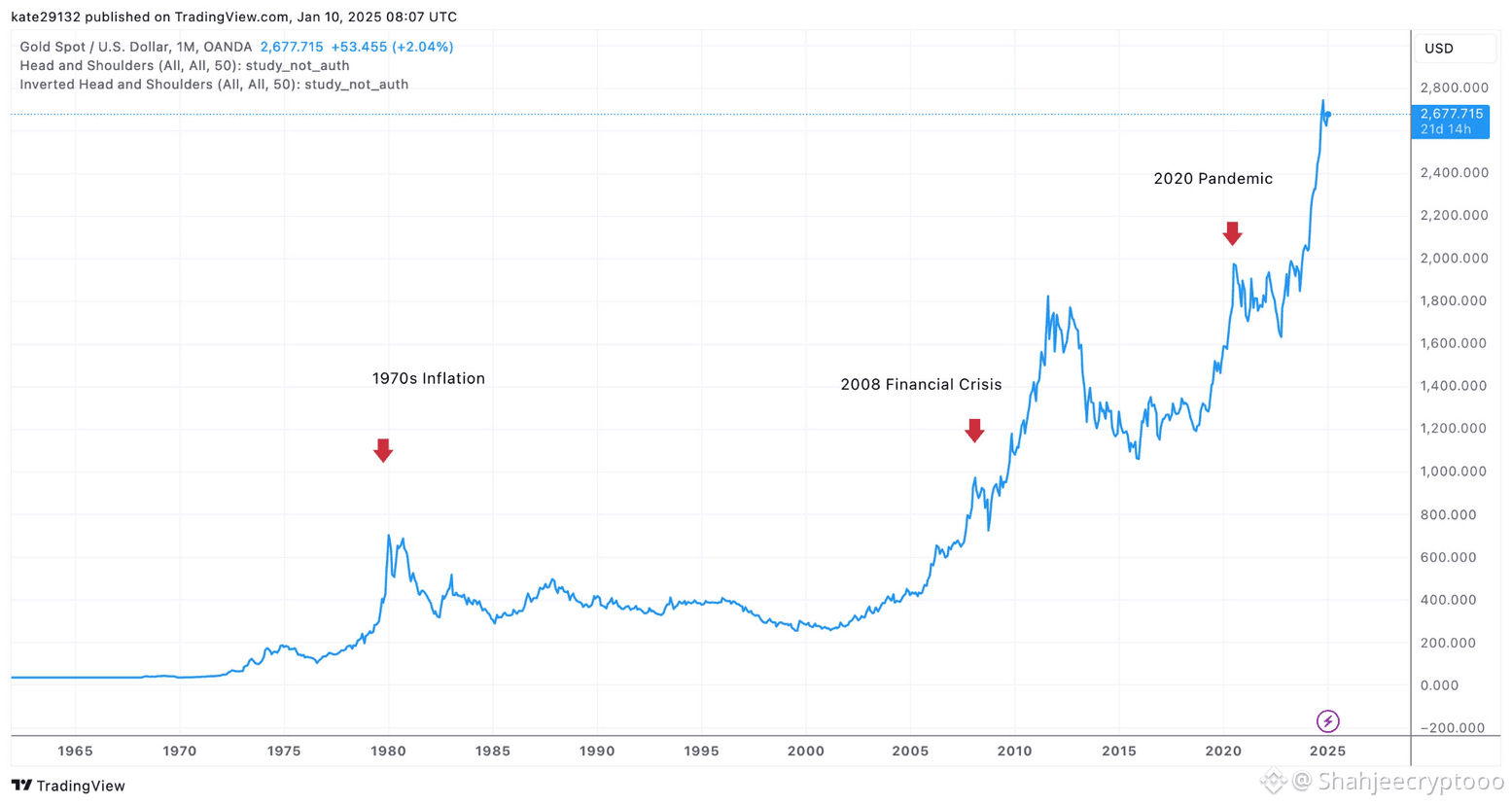

Look closely at this chart. Gold did not rise randomly. It moved when systems were under pressure. In the 1970s inflation era, during the 2008 financial crisis, and again during the pandemic, gold responded as trust moved away from paper assets.

Corrections always happened. Gold never moved in a straight line. But over long time frames, it adjusted to the reality of currency dilution. That adjustment is not speculation. It is mathematics and purchasing power.

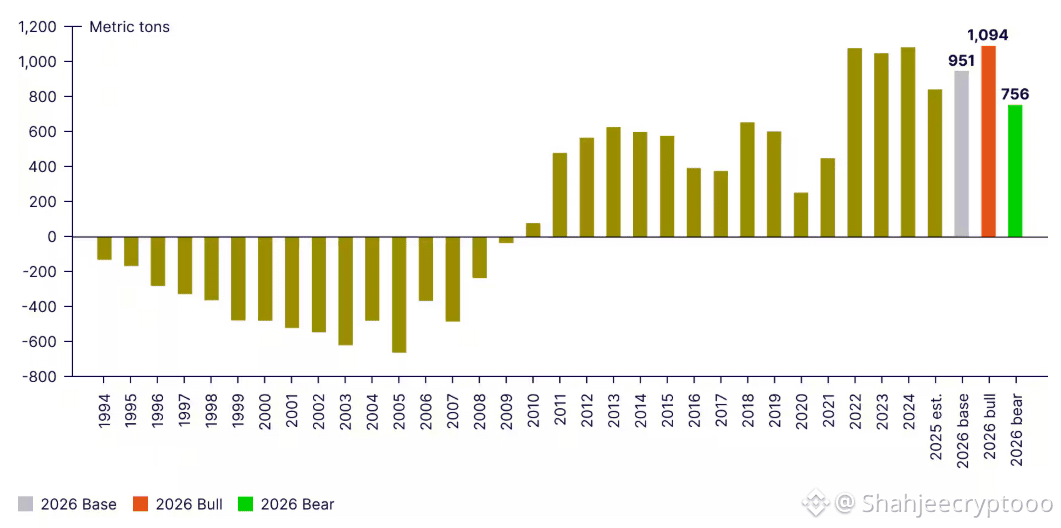

Today, the situation feels familiar. Debt levels are high, currencies are stretched, and uncertainty is not short term anymore. In such environments, gradual accumulation often works better than aggressive positioning. Buying slowly removes emotion and timing risk.

If currency value drops heavily over the coming years, gold prices adjusting higher is not a surprise scenario. Levels like 7000 or even above are not predictions of hype. They are reflections of weakened money rather than extraordinary strength in gold.

This recent chart shows momentum building over time. It also shows pauses and corrections, which is healthy. Protection assets rarely move smoothly, but they move purposefully when needed.

Gold should not be seen as an all or nothing choice. It works best as part of a balance. Cash for flexibility. Gold for protection. Other assets for growth. Ignoring protection entirely often becomes costly during long periods of devaluation.

Preparation is not fear. It is awareness. People who understand this early usually stay calmer when conditions get rough. Gold does not promise excitement. It offers stability when everything else feels uncertain.

And sometimes that is the most valuable return of all.