Dusk Foundation is where tokenization are no longer being a slide and starts touching people who keep spreadsheets open for a living.

Not at trading.

At the first corporate action that changes the state and refuses to ask permission.

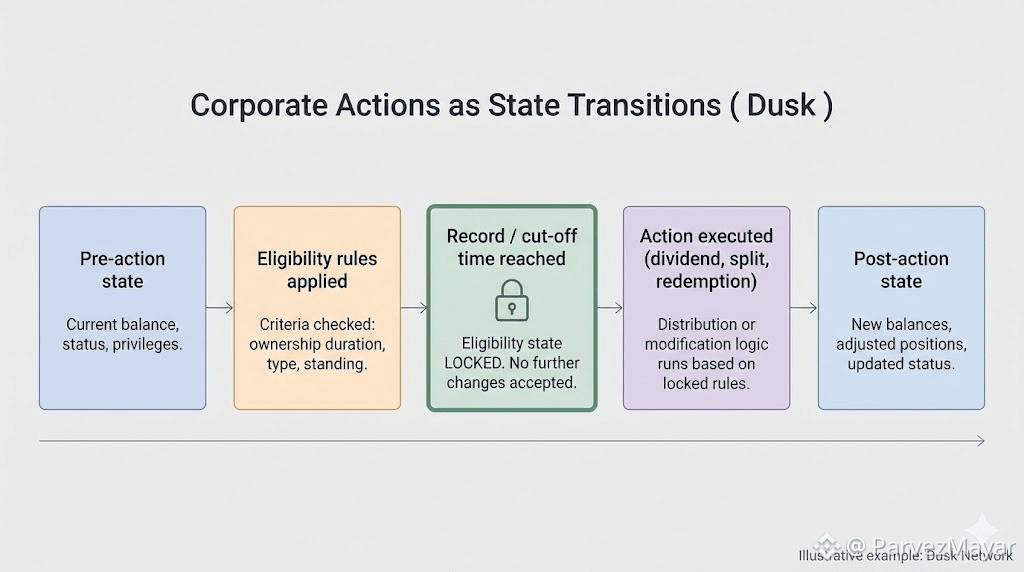

A dividend posts. A split rewrites quantities. A redemption window shuts while someone is still "in progress" though. The asset do not live a tidy object life and starts behaving like a living register.. entitlements diverge in Dusk tokenization eligibility matters at a specific cut-off, and suddenly everyone wants the same thing at once certainty—without turning the cap table into a public exhibit.

Plenty chains don't explode at this point. They fray. Quietly. In the gaps.

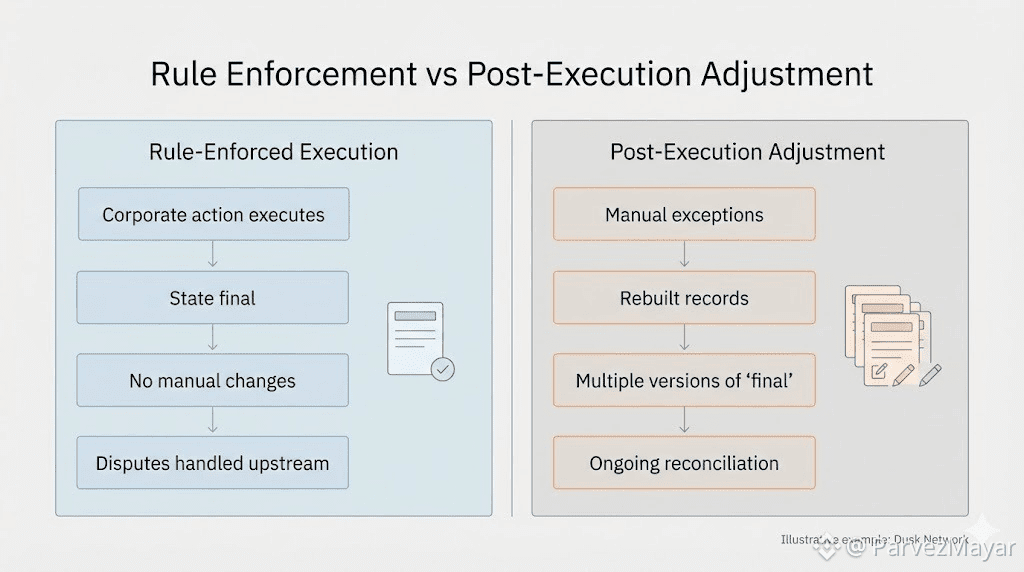

Because corporate actions are not about price. They're reconciliation events with consequences. The annoying kind. The ones ops teams inherit when two systems both claim they're looking at "the final state" and they are not. TradFi hides this under layers of process: snapshots, record dates, adjustment files post-event calls that sound routine until they're not.

Dusk has to survive it without building a second back office out of emails.

When a corporate action fires on Dusk... it is a state transition with rules welded to it. Who qualifies. When eligibility locks. What counts as "in time." What a venue can prove later without begging the issuer for a spreadsheet export. Identity-linked eligibility can be enforced without becoming a public label. Holder lists don't need to be sprayed onto the chain to make a dividend defensible.

A split doesn't need humans rebuilding the cap table by hand at 2 a.m. Redemptions do not need that weird scavenger hunt where everyone tries to reconstruct who crossed the line five minutes too late.

Visibility is still important though, but it's not one-size. Some parties need confirmation. Some need proof. Some need silence because silence is part of the operating model. The trick is keeping those needs from turning into a negotiation after the fact.

That's where Dusk's privacy with auditability posture actually earns its keep. The state can stay confidential...but the trail exists from the moment the action executes. Not as "trust me, we reconciled it". As something verifiable. A narrow claim, tied to execution under the rules in force at that moment.

Then you hit the cases nobody likes to write down.

Record date locked. A credential refresh lands a few minutes late. A holder says "we were onboarding, you know that." Another holder says "they shouldn't be eligible at all." Someone asks whether the split treated Class B the same as Class A. If your answer depends on reconstruction, you arw already drifting. Everyone shows up with their own receipts. Everyone remembers it differently. Everyone is certain though.

In most setups, that is where the "helpful' levers appear. Manual adjustments. Quiet accommodations. "We'll fix it in the next cycle." The same move, every time... because humans hate binary failure when money is on the line.

@Dusk is basically trying to make that move expensive.

No ad-hoc fixes after the snapshot. No polite "we'll adjust this manually"... No soft exception because a large holder missed a window and someone doesn't want the phone call either. Once the action executes, the state is the state. If the rule is wrong, you fight upstream... before the block not inside the ledger afterward.

That's also why corporate actions keep tokenization honest. Everybody loves throughput. Nobody loves record dates.

An ops lead moving over from TradFi doesn't care about ideology. They care that a dividend posts once. That a split resolves once. That downstream systems don't end up carrying two versions of "final" for weeks because someone wanted to be nice.

And the part nobody escapes... the moment the rule is correct the execution is final on Dusk and someone still wants an exception anyway...