At first glance, Dusk looks steady. A proof-of-stake network with over 30 percent of its token supply locked in staking feels healthy, even reassuring. In crypto, staking ratios are often used as shorthand for confidence. Ethereum sits around 25 percent, Solana and Cardano are far higher, and by comparison Dusk seems comfortably placed. On paper, roughly 150 million DUSK tokens are staked out of a circulating supply just north of 500 million. That number alone invites an easy conclusion: holders believe in the network. But staking ratios, like many surface-level metrics in crypto, can be misleading when viewed in isolation. Once you slow down and follow the incentives behind that 30 percent figure, a more fragile picture begins to emerge, one that has less to do with belief and more to do with short-term economics.

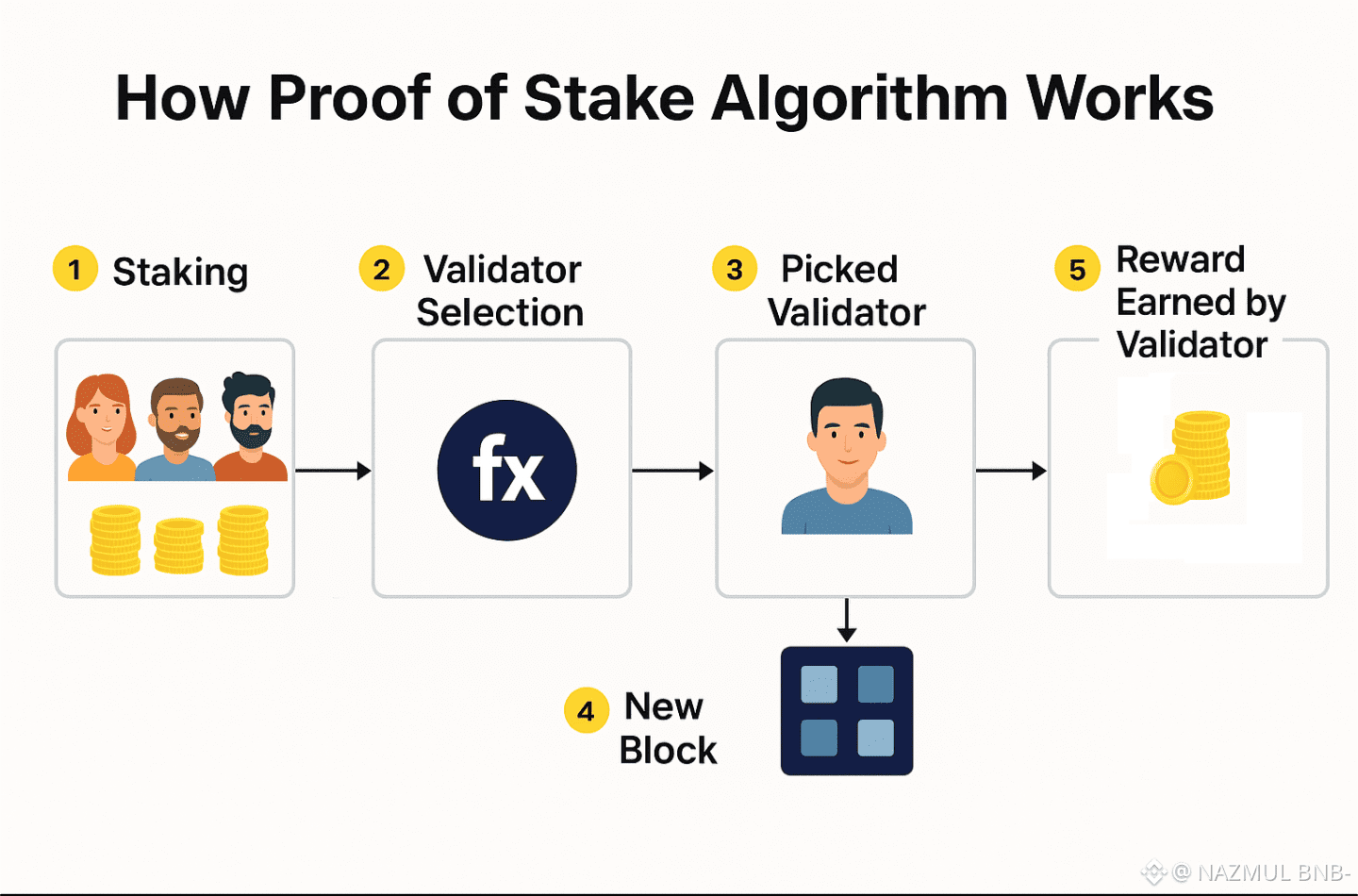

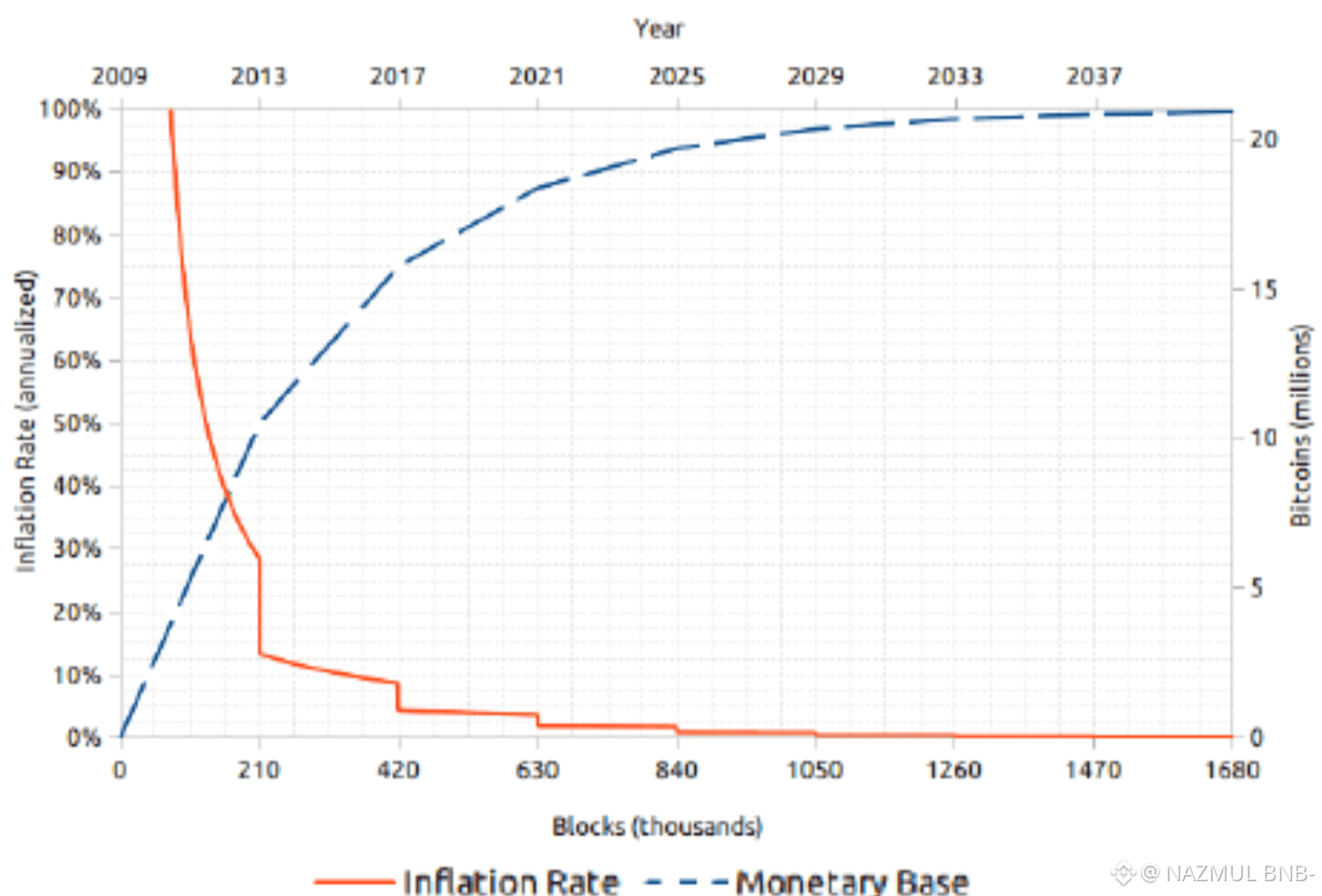

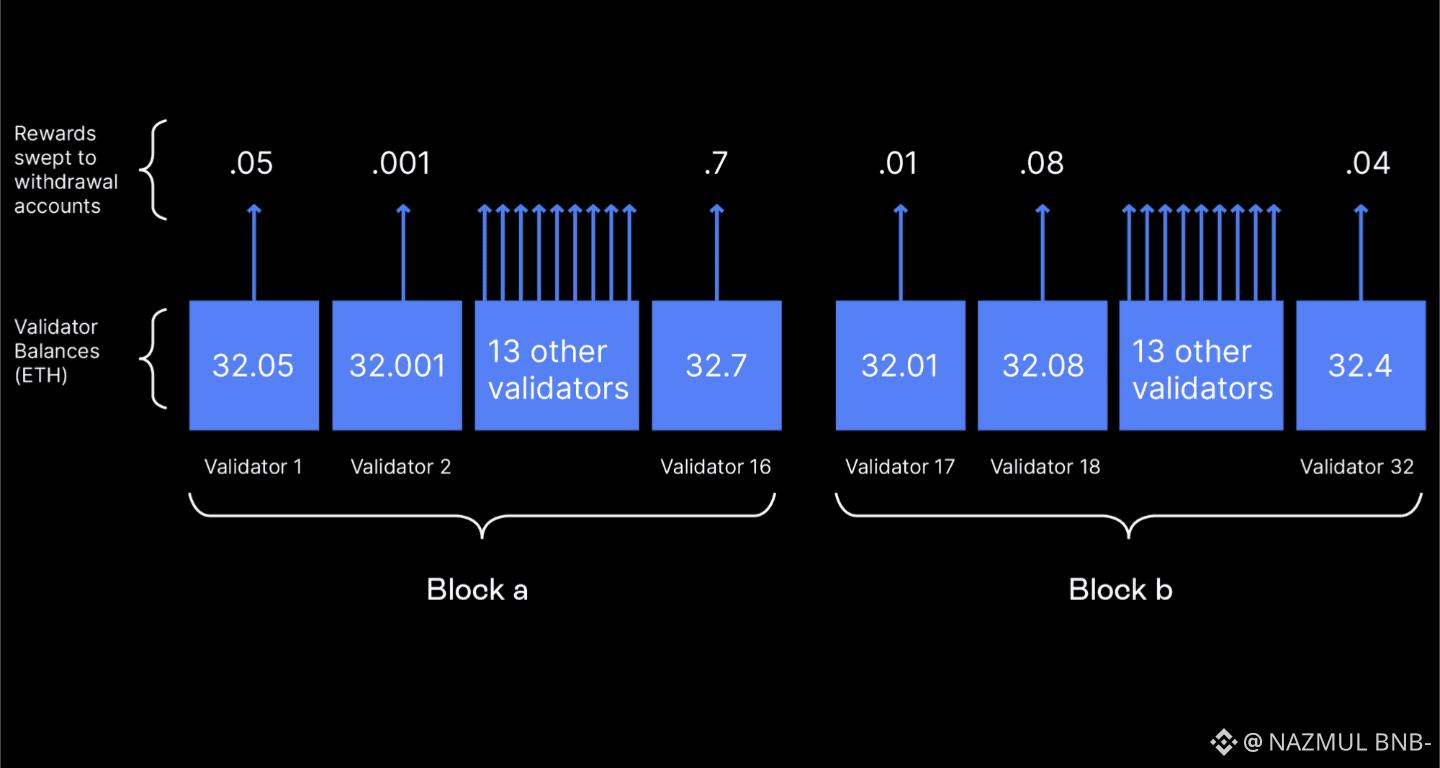

The main driver behind Dusk’s staking participation is not usage or fees, but yield. The advertised staking return sits around 27 percent, a number that naturally pulls in tokens. For most participants, the math is simple. If you already hold DUSK, staking feels like the rational move. Leaving tokens idle means watching them dilute, while staking at least offsets that dilution. The problem is where that yield comes from. Validators are not being paid through meaningful network activity. They are being paid through newly minted tokens. This is a familiar pattern in early-stage proof-of-stake networks. Inflation is used as a tool to bootstrap security and attract validators. Dusk follows this model closely, with a long-term emission schedule that stretches up to a billion total tokens over several decades through geometric decay. On paper, it sounds patient and responsible. In practice, the early years still release tokens at a pace that demands real demand to absorb them. Without that demand, the rewards paid today quietly become selling pressure tomorrow.

That pressure becomes more dangerous when you look at who actually holds the supply. Token distribution is where Dusk’s risk profile sharpens. A large majority of DUSK is controlled by a very small group of addresses. Depending on the chain and wrapper you look at, the top five holders control somewhere between roughly two-thirds and more than four-fifths of the total supply. On some chains, centralized exchanges alone account for an outsized share. This level of concentration changes the meaning of decentralization in practical terms. It also changes market dynamics. When a small group holds most of the tokens, liquidity becomes fragile. Price discovery becomes thin. And most importantly, the behavior of a few large holders matters far more than the actions of thousands of smaller ones. In that context, a high staking ratio does not necessarily reflect broad conviction. It can just as easily reflect large holders optimizing yield while waiting for a better exit.

Staking is often framed as a locking mechanism that reduces sell pressure, but in Dusk’s case that lock is surprisingly light. The unstaking or unlocking period is short. After roughly two epochs, measured in a few thousand blocks, staked tokens can be withdrawn. Depending on block times, this can mean hours rather than days or weeks. From a user perspective, this sounds flexible and user-friendly. From a network stability perspective, it weakens the entire security model. In calm markets, this flexibility feels harmless. In stressed markets, it becomes a liability. If sentiment turns or price drops sharply, validators and stakers can exit quickly. That can lead to a sudden reduction in staked supply, instability in the validator set, and additional selling pressure all at once. The system works smoothly when everyone stays rational and calm. Markets rarely oblige.

The final and most important issue is utility, or rather the lack of it today. Dusk currently generates little to no meaningful fee revenue. There is no substantial on-chain economy absorbing DUSK through regular use. Validators are not earning from applications, users, or transactions. They are earning from emissions alone. This model can function temporarily, but it cannot sustain itself indefinitely. Without applications that require DUSK to operate, pay fees, or access services, the token has no natural sink. It circulates outward from the protocol into the market. That creates a simple but uncomfortable question for any rational holder. Why hold DUSK if its primary role is to be emitted and sold? Optimists may argue that future applications, privacy use cases, or enterprise adoption will arrive in time. That may happen. But until it does, holding DUSK is less about utility and more about speculation on future relevance.

When you compare this setup to other privacy-focused projects, the contrast becomes clearer. Some networks with similar staking models already support real on-chain activity. Their tokens are used to pay for computation, to interact with decentralized exchanges, or to enable specific services. Others, even without staking, have carved out real-world payment niches that give their assets practical value. In those systems, emissions are at least partially balanced by usage. In Dusk’s case, that balance has not yet formed. The result is a token economy that looks stable on the surface but relies on continued belief rather than demonstrated demand. A 30 percent staking rate feels reassuring until you realize how quickly it can unwind, how concentrated the supply truly is, and how little stands between emissions and the open market.

None of this means Dusk is doomed. Early-stage networks often look like this before they find their footing. But the risks are real and structural, not cosmetic. High inflation paid as yield, concentrated ownership, fast exits, and zero-fee dependency form a fragile combination. If the ecosystem grows and real utility appears, these concerns fade into history. If it does not, the system risks entering a slow erosion phase where dilution outpaces conviction. The lesson here is simple and broadly applicable. Numbers like staking ratios and APYs are not truths. They are signals. And in Dusk’s case, those signals point less to strength and more to a system still searching for a reason to exist beyond its own incentives.