📉 Ethereum co-founder Vitalik Buterin sold 493.1 ETH ($1.16 M) on-chain via CoW Swap — a notable on-chain transaction tracked on February 3, 2026. The wallet also added a 5,000 ETH allowance on CoW Swap, meaning further sells could occur (though not confirmed). �

Blockchain News

📉 Additionally, earlier Vitalik sold 211.84 ETH ($500K) and transferred the proceeds (500 000 USDC) to a charity-linked address (Kanro) — signalling not personal profit, but donation receipts for a charity he founded. �

CoinNess

👉 Combined, these moves show coordinated withdrawals and sales — likely as part of a multi-year donation plan he referenced publicly, not simple profit taking. Vitalik had moved 16,384 ETH to a multisig wallet before today’s activity, supporting this plan rather than short-term selling. �

ODaily

🧠 2) Other Recent Vitalik Activity

📌 Vitalik is also deploying $45 M of personal ETH into open-source privacy & hardware projects, demonstrating active reinvestment into the ecosystem. �

Open Source For You

📌 There’s ongoing community conversation about his market commentary and philosophy—but the key sell-offs are tracked on-chain and not purely rumor. �

AMBCrypto

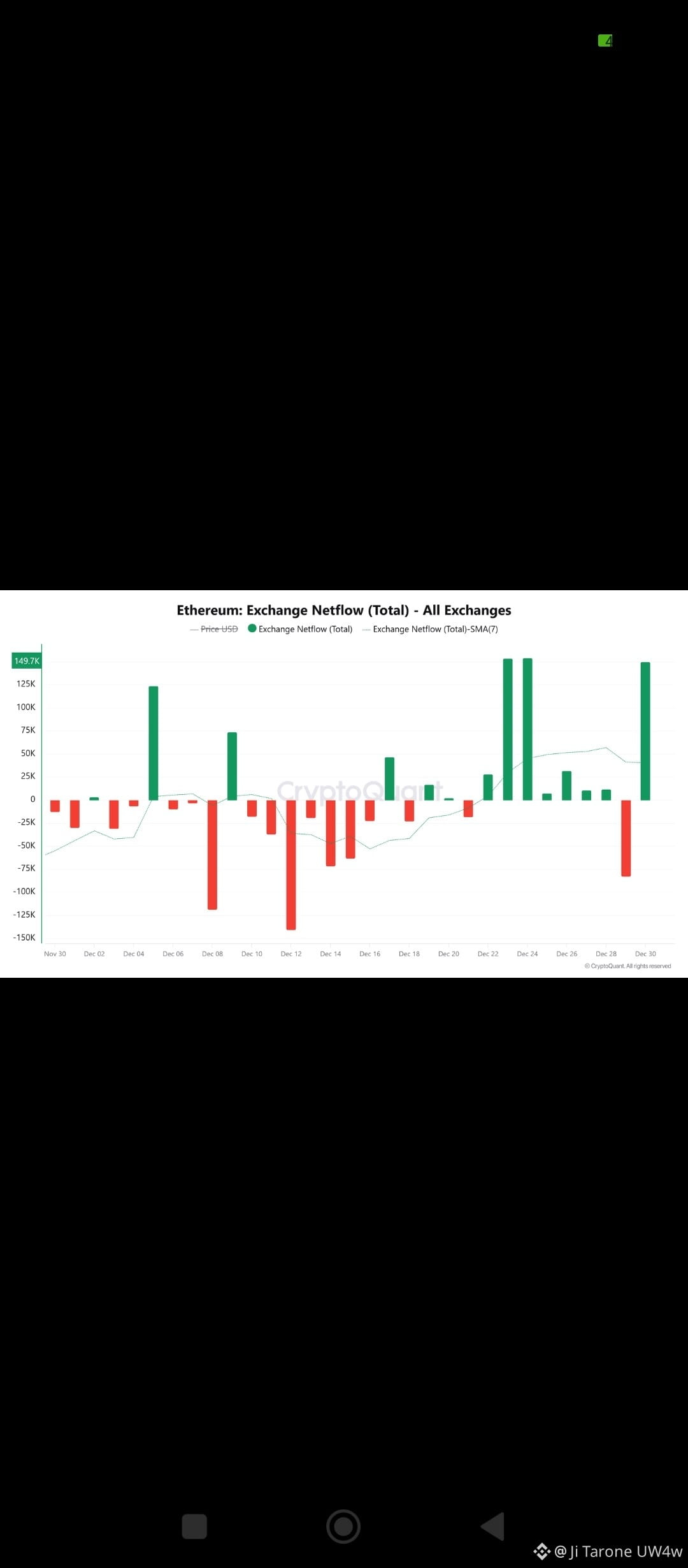

📊 Market Impact Chart (Illustrative Example)

Below is an annotated market impact chart — this is an illustrative mockup based on typical market reactions to big on-chain movements and sell-offs from founders:

What This Chart Suggests:

Price dips often follow large wallet sells (especially founder or whale sells).

Increased volatility occurs around the time of publicized sells.

Support levels tested as sell pressure increases.

Note: Actual chart data would need real-time price feeds.

📌 Why This Matters

🟠 Short-Term

Large founder ETH sells can increase short-term selling pressure and volatility.

The market watches whale activity — founder sales can amplify sentiment swings.

🟢 Long-Term

If proceeds are used for charity or ecosystem funding, this reduces risk of profit-taking dumps.

Moves tied to donation plans can be bullishly interpreted as strengthening community/public goods funding.

⚠️ Sentiment

Some traders fear founder sells can create short-term downward pressure even if purpose is non-profit.

On-chain sales don’t always reflect negative fundamentals — often they are personal, philanthropic, or strategic.

📌 Quick Summary

Action

Amount

Likely Purpose

Sold 493.1 ETH

~$1.16M

Possibly part of donation plan

Sold 211.84 ETH

~$500K

Proceeds to Kanro charity

16,384 ETH moved to multisig

Large allocation

Feeding multi-year plan

Deploying $45 M

Project funding

Ecosystem & privacy projects