Most investors are preparing for the wrong crisis.

Most investors are preparing for the wrong crisis.

I spent the morning digging through the latest macro releases. The headline numbers were bad. The internals were worse.

But here’s what really kept me up the mechanism of the next downturn won’t look anything like the last one.

We’ve spent fifteen years stress-testing for global contagion—banks collapsing in a chain, credit freezing simultaneously across borders. That instinct is baked into every risk model. It’s also increasingly obsolete.

The new threat isn’t a synchronized meltdown.

It’s isolation.

The U.S. is quietly becoming a single-point-of-failure for itself.

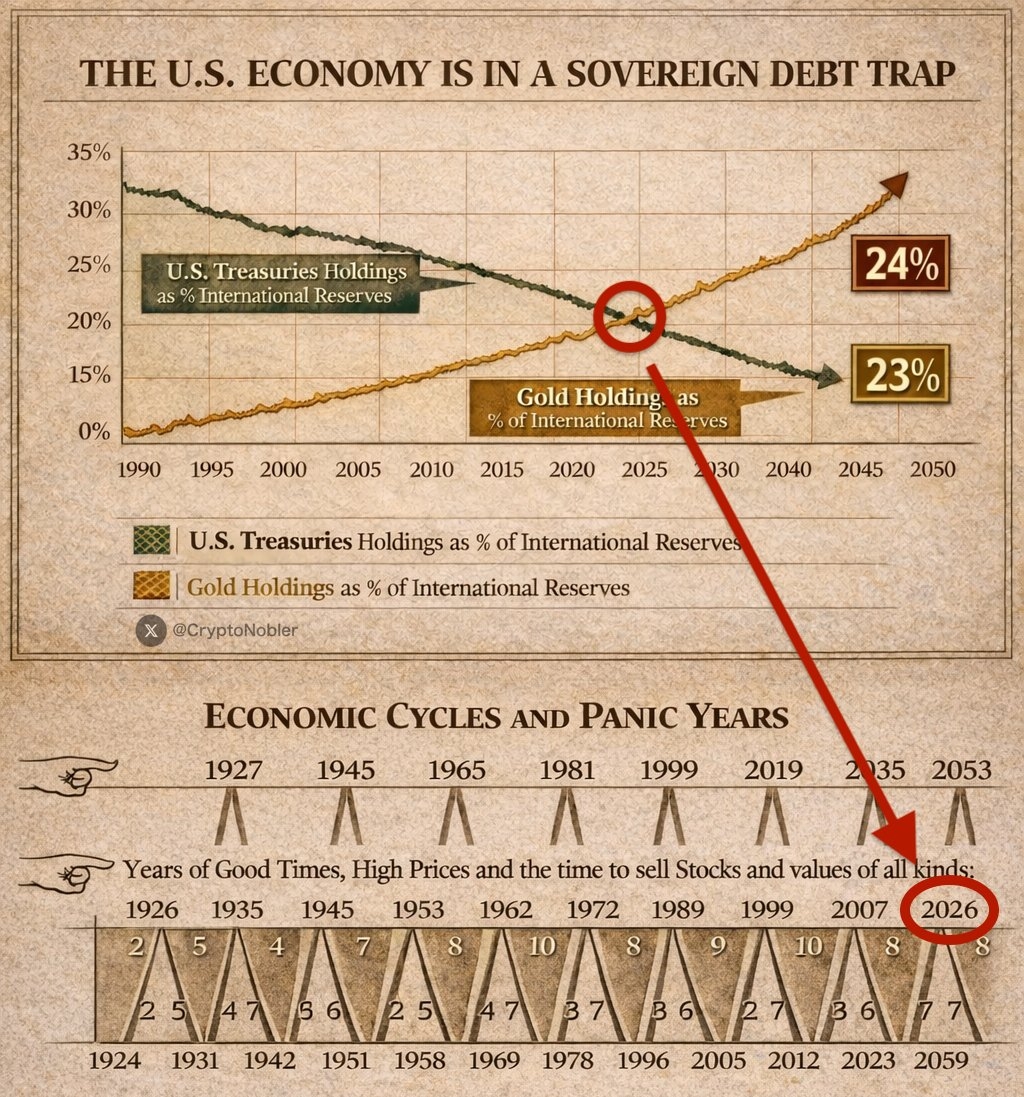

Here’s the uncomfortable reality. The dollar’s reserve status let us borrow at fantasy rates for decades. That was always going to end, just not how we expected. No sudden strike from foreign creditors. No coordinated dumping of Treasuries. Just a slow, grinding realization that the U.S. is now managing its debt through inflation and captive buyers—because the alternatives are worse.

The Fed isn’t confused. It’s trapped. Every choice now is between bad and worse. Let yields rip, and the Treasury financing path collapses. Step in, and the dollar absorbs the damage.

This is fiscal dominance. Not a default. Something slower and harder to flee.

What’s changed since 2008? Three things, mostly overlooked.

First, banking regulation. Basel III didn’t just raise capital requirements—it forced foreign banks to ring-fence their U.S. operations. A commercial real estate crash in Cleveland no longer forces a liquidity crunch in Frankfurt. The shock absorbers are localized now. That’s stabilizing in the short term. It also means the U.S. can’t export its pain the way it once did.

Second, trade and capital flows have rewired. Emerging markets spent the last decade building bilateral swap lines and local currency settlement systems. They still need dollars. But they don’t need U.S. growth the way they did in 2007. The American consumer is no longer the sole marginal buyer of the world’s exports.

Third, policy divergence. The Fed stays higher for longer, fighting the last war against inflation while growth cools. Europe and China are already easing. That pulls capital toward dollar yields in the near term. But it also isolates the U.S. from global monetary conditions in a way we haven’t seen in a generation.

Meanwhile, the concentrated exposure is real. The worst assets—downtown office towers, regional bank bond portfolios, Treasury duration held at par—are overwhelmingly held by domestic institutions. The rest of the world has been quietly reducing its U.S. footprint for years.

This isn’t a global depression. It’s a localized one.

The counterarguments are worth watching.

Productivity could accelerate. AI adoption or a manufacturing resurgence might generate enough real growth to outrun the interest cost spiral. It’s possible.

Commercial real estate could stabilize before the 2025–2026 refinancing cliff. Leasing momentum, interest rate relief, or aggressive loan modifications could prevent a full-blown solvency crisis.

And a genuine global shock—a resource war, a major sovereign default, a China hard landing—could still prove that financial markets remain more interconnected than we think.

I’m watching all three.

But here’s the investment implication most people miss.

When U.S.-specific risk is contained rather than eliminated, capital doesn’t vanish. It rotates.

Not out of risk entirely. Out of passive U.S. equity exposure.

Into things the U.S. doesn’t control. Commodities with supply constraints. Real assets with hard collateral. Public equities outside the U.S. trading at valuation gaps we haven’t seen in years.

The world isn’t ending. The global economy isn’t stopping. The U.S. just isn’t the only game anymore—and that adjustment is going to be painful for anyone still positioned like it’s 2019.

The glass dome is real. You can see through it. You just can’t breathe in it forever.

Diversification isn’t an old saw. It’s the only answer when your home market is carrying weight it was never designed to hold.

Please don’t forget to like, follow, and share! 🩸 Thank you so much ❤️

#CZAMAonBinanceSquare #USNFPBlowout #USRetailSalesMissForecast #USTechFundFlows #WhaleDeRiskETH