At the end of 2024, when Europe’s MiCA regulation officially went live, the crypto industry reacted the way it usually does when rules appear. With anxiety. Some saw it as a ceiling on innovation. Others treated it as a blessing in disguise. Two years later, the answer is less dramatic and more practical. MiCA did not kill experimentation. It filtered it. It rewarded projects that were built to survive regulation rather than outrun it. In that sense, regulation did not slow time. It shortened patience. And that shift matters deeply for Dusk Network, a project that has spent years building for a world that is only now arriving.

Throughout 2025, a noticeable change spread across Europe’s financial sector. Banks stopped asking whether blockchain had a place in capital markets. Exchanges stopped debating if tokenization was legal. Small and mid-sized enterprises began exploring new ways to raise capital. The reason was simple. MiCA turned uncertainty into process. By clearly defining how crypto assets are issued, traded, and safeguarded, the regulation removed the guesswork that had kept institutions on the sidelines. Compliance was no longer a philosophical debate. It became an operational checklist. Once that happened, experimentation moved from whiteboards to pilot programs.

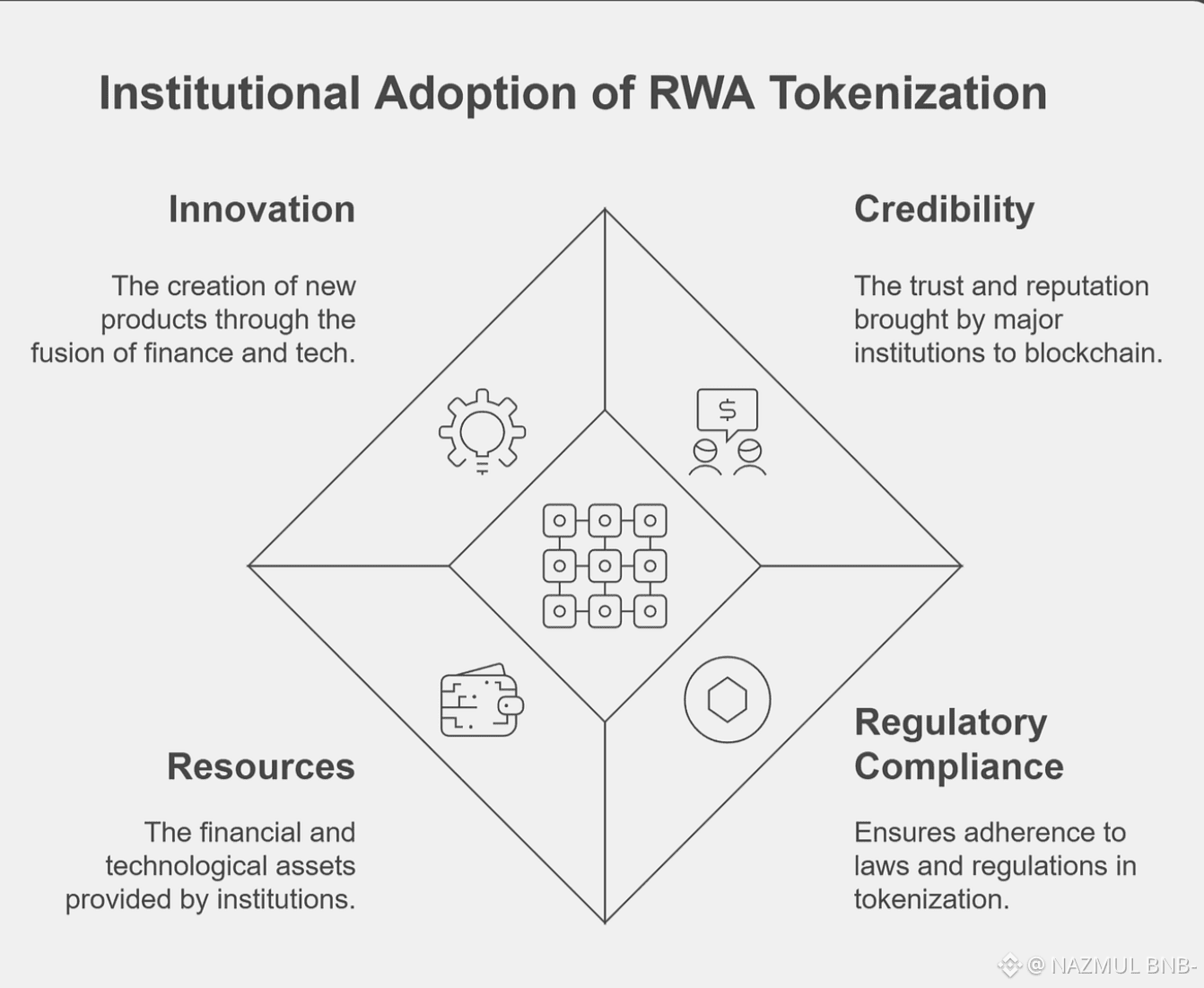

MiCA’s structure is often misunderstood. It does not force every token into an old securities box. Instead, it creates new categories with specific rules. Asset-referenced tokens follow one path. Utility tokens follow another. Custody, disclosure, and investor protection are spelled out in plain terms. For real-world asset tokenization, this matters more than innovation speed. It answers basic questions. Who can issue. Who can trade. Who is responsible when something goes wrong. The costs are real, but so is the certainty. In regulated markets, certainty is what unlocks participation.

This is where Dusk’s long-term positioning starts to look less abstract. If real-world assets move on-chain under MiCA, they need infrastructure that respects both privacy and compliance. Transactions on DuskEVM use DUSK for fees. That ties network activity to real usage rather than speculation. More importantly, regulated assets create repeat behavior. Investors return to platforms that feel stable and familiar. Issuers prefer systems that regulators already understand. Over time, this creates a quiet gravity. Not viral growth, but durable relevance.

The partnership with NPEX offers a concrete test of this idea. NPEX operates under strict Dutch and European rules for trading and funding securities. To tokenize assets on Dusk, it must comply with MiCA and MiFID II standards. If this collaboration succeeds, it does not prove that Dusk is the best blockchain. It proves something more valuable. That it works in the real world, under real rules, with real accountability. That kind of proof travels far inside institutional circles.

Custody is another quiet pressure point. Institutions want control without complexity. That is where Dusk’s work with Cordial Systems becomes relevant. Self-custody with enterprise-grade safeguards aligns with MiCA’s investor protection goals. It allows users to hold their keys while meeting regulatory expectations. This balance matters. Without it, tokenization remains a niche exercise. With it, participation broadens. Slowly, then suddenly.

Time, however, is not neutral. 2026 sits in a narrow window. Early movers have learned the rules. Late entrants are preparing to deploy. Competitors like Polymesh and Securitize already have production experience. Traditional market infrastructure providers are also watching closely. If Dusk delays until 2027 or beyond, the advantage of being early fades. Technology alone will not reopen that door. Markets rarely wait twice.

MiCA’s dividend period is not infinite. Regulations mature. Standards harden. Winners become defaults. For Dusk, 2026 is less about transformation and more about confirmation. Either it proves that its compliance-first design can support real asset markets in Europe, or it risks being remembered as a project that understood the future too early and moved too slowly. The coming months will not be loud. But they will be decisive.