I did not understand the real-world asset problem the first time I read about tokenization. Like many people in crypto, I assumed it was mostly a technical issue. Put an asset on chain. Add a token. Let the market do the rest. That belief holds only until you try to map real finance onto blockchains. Real assets come with laws, identities, reporting duties, and consequences when things go wrong. Once that clicks, the RWA debate stops sounding futuristic and starts sounding operational. This is where Dusk Network quietly makes sense. Dusk did not start as a yield machine or a trend-driven platform. It started in 2018 with a narrower and less exciting goal: build infrastructure that regulated financial workflows could actually use. That framing explains almost every design choice that followed. Privacy is not optional. Auditability is not optional. Speed without rules is meaningless. Dusk does not try to pick between privacy and compliance. It forces them to coexist, even when that tension feels uncomfortable to crypto-native instincts.

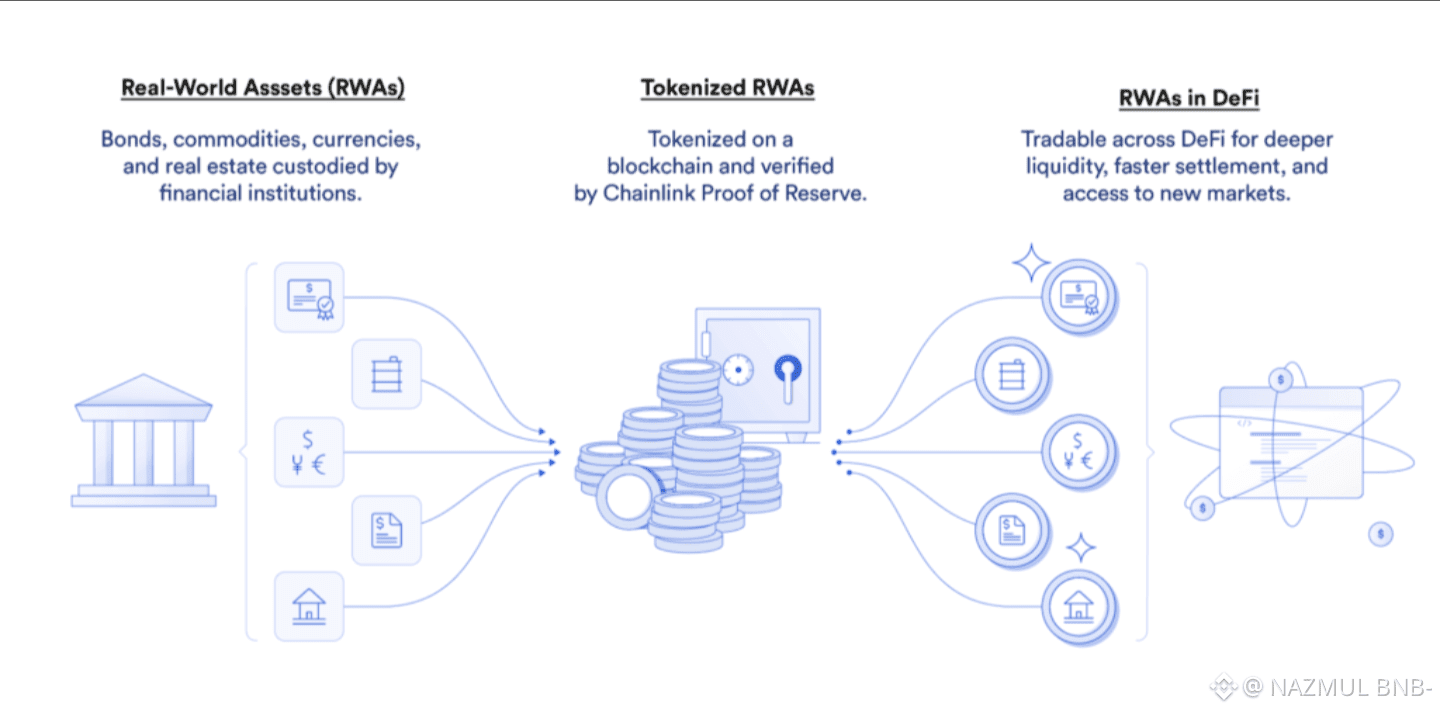

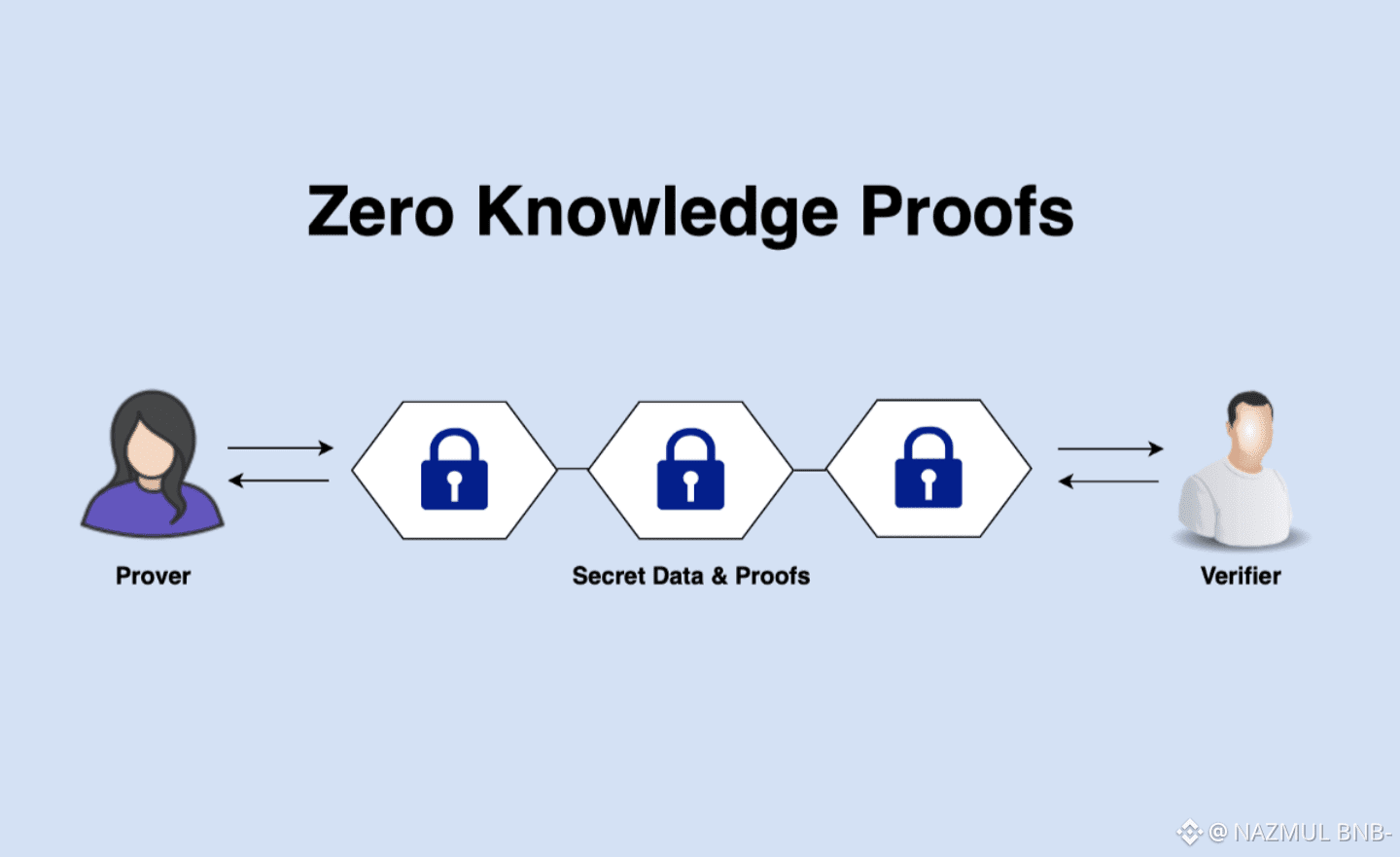

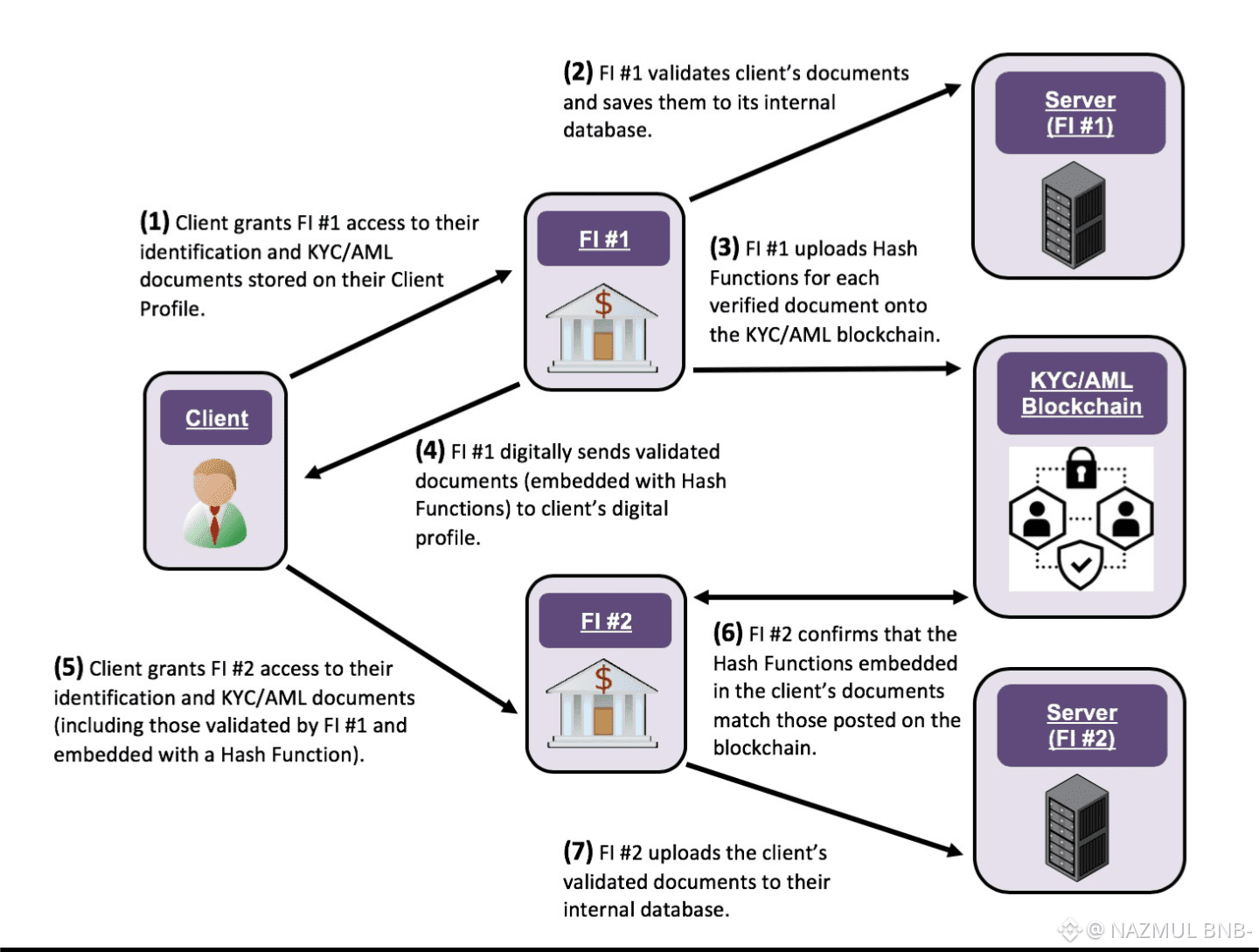

Tokenization itself is not hard. Anyone can issue a token. The hard part is everything around it. Finance is not just ownership, it is permission. Who is allowed to buy. Who is allowed to sell. Who must be reported to, and when. In traditional markets, these rules live in legal documents, registries, and back offices. Most blockchains ignore that reality and hope compliance can be added later. Dusk takes the opposite approach. Its architecture assumes that sensitive data must stay private by default, while still being provable to the right parties. Think of a bond issued to a limited group of investors. The balances should not be visible to the public. But a regulator or auditor must be able to verify ownership if required. Dusk is built around that exact use case. Zero-knowledge proofs and confidential smart contracts are not marketing features here. They are practical tools for enforcing rules without exposing everything to the world.

As of mid-January 2026, DUSK trades around 0.1 to 0.12 cents, with daily volume in the low tens of millions and a market cap hovering near thirty million dollars. Those numbers do not prove anything about future success. Price never does. But they do show something simpler and more important. The network is alive. It has liquidity. It is being watched. Many RWA projects fade long before they reach this stage because they underestimate how slow and demanding regulated adoption can be. Surviving is not the same as winning, but it matters. Real-world asset infrastructure does not grow in explosive cycles. It grows through pilots, reviews, delays, and revisions. A chain that is still operating and liquid after years of quiet building has at least cleared the first hurdle

The risks are real and should not be softened. Regulation differs across countries and often changes mid-process. Licensing takes time and can stall without warning. Institutions move slowly and are allergic to uncertainty. Competition is everywhere. Ethereum-based layers, enterprise blockchains, and traditional finance sandboxes all want a piece of tokenization. Dusk still needs issuer distribution and live pilots that can survive legal and regulatory scrutiny. Code alone is not enough. None of this makes the project weak. It makes it honest. RWAs are not about speed or hype. They are about trust, accountability, and minimizing failure. Any platform claiming otherwise is either early or unrealistic.

Why this still matters comes down to how finance actually works. Big money prefers boring systems that do not break. It values predictability over innovation slogans. Dusk is not designed for hype cycles or fast narratives. It is designed for environments where mistakes are expensive and public. My take is simple. If tokenization remains niche, Dusk will likely remain niche. If tokenization becomes standard, the winners will be platforms that respected legal and institutional realities from day one. Dusk fits that profile. Execution will matter more than stories. Adoption will matter more than price charts. But if real-world assets truly move on chain at scale, the infrastructure that looks slow and cautious today is usually what ends up holding real money tomorrow.