Recently, the market for altcoins has been booming, with many older projects doubling in price within just a few days. However, many NFT projects that emerged during the last bull market have performed poorly in trading markets due to liquidity issues. In recent years, some NFT digital collection platforms in China have collaborated with various well-known IPs to issue NFT digital collections, and during issuance, they planned a series of empowering measures and ownership rights for NFT digital collections. However, later, due to regulatory and market conditions, the empowerment was postponed, leading to a price crash and ultimately resulting in users seeking to protect their rights. Today, we will discuss the paths for protecting rights related to domestic NFT digital collections through case studies.

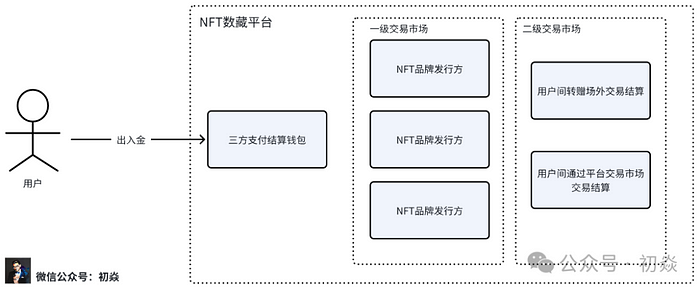

The path for users participating in domestic digital collection NFT platforms

The path for users participating in domestic NFT digital collection platforms differs from that of NFT projects on overseas public chains. Users participating in domestic digital collection platforms generally use third-party payment channels to deposit RMB. After depositing, they can purchase, bid on new NFT digital collections issued by brands in the primary market of the digital collection platform, or buy NFT digital collections listed for sale by other users in the secondary trading market. In this process, NFT digital collection issuers build narratives and empower IP to continuously provide rights and benefits to NFT digital collection holders. The prices of NFT digital collections will fluctuate accordingly, and some participants will earn investment returns through buying and selling transactions.

Judicial practice in which the contractual validity of users purchasing NFT digital collections is determined

From the above analysis, it can be seen that the operational model of NFT digital collection platforms is similar to virtual currency trading. Technically speaking, NFTs are also non-fungible tokens, which raises doubts about the contractual validity of users purchasing NFT digital collections through domestic platforms.

Let’s take a look at the contractual validity involving NFT digital collections through cases in judicial practice; how does the court determine this?

Typical case from Shandong High Court - Yang vs. a cultural company regarding a sales contract dispute

Case Facts:

In April 2022, a cultural company developed an APP to engage in the online issuance and platform operation of digital collectibles, issuing series such as Space on the River, Guardian Shield, Three Religions, Spirit Beast Card, Digital Human, etc. During the issuance of digital collectibles, the cultural company employed marketing strategies such as empowering digital products with free participation in offline salons, art exhibitions, and providing dividends and tangible rewards based on trading rankings.

Yang registered an account on the aforementioned APP in July 2022 and frequently purchased the series of digital collections issued by the platform. During this process, Yang also engaged in secondary market transactions of digital collections with other registered players on the platform, both buying and selling digital collectibles. Yang stated during the court hearing that 'the purchase of digital collectibles was due to their novelty and potential for appreciation' and 'valued the empowerment of digital collectibles such as dividends, lotteries, and offline salons.' Yang accumulated a recharge of 22,685 yuan on the APP platform. After September 2022, as the enthusiasm for digital collections waned, the digital collections that Yang purchased significantly depreciated in value. Yang believed that the cultural company had engaged in false advertising and illegal marketing, and thus brought the case to court.

The court believes:

Digital collectibles refer to unique digital certificates generated using blockchain technology that correspond to specific works or artworks, distributed, purchased, collected, and used digitally over the internet. Digital collectibles, based on their artistic characteristics, non-replicability, and scarcity, have certain exchange value and can be exchanged as commodities. Moreover, there are currently no legal prohibitions on the issuance and trading of digital collectibles in China. According to the principle that what is not prohibited by law is permitted in civil and commercial activities, the trading of digital collectibles should not be deemed illegal. Therefore, the trading behavior between the parties regarding digital collectibles is a civil legal act voluntarily undertaken by both parties and should be recognized as legal and valid.

Shanghai Xuhui District Court - Wang vs. Wu regarding a contract dispute

Case Facts:

The plaintiff Wang entrusted the defendant Wu with managing virtual currencies such as ETH, BUSD, USDT, SAND, GALA, and NFT digital collectibles like Doodles and Azuki. Wu later, due to his own need for capital turnover, sold all of Wang's aforementioned virtual assets for USD without Wang's consent and misappropriated the 572,245 USD obtained.

The court believes:

According to relevant legal provisions, civil subjects engaging in civil legal acts must not violate mandatory provisions of laws and administrative regulations, nor contravene public order and good customs. In this case, the plaintiff Wang entrusted the defendant Wu with managing and operating virtual currencies such as ETH, BUSD, USDT, SAND, GALA, and NFT digital collectibles like Doodles and Azuki. Wu further engaged in the conversion of virtual currencies and investment activities including exchanging virtual currencies for USD. The agency contract relationship between the two parties was established. However, according to notifications and announcements issued by the People's Bank of China and other departments, virtual currencies are not issued by currency issuance authorities, do not possess legal tender and mandatory characteristics, and are not true forms of currency. They cannot and should not circulate as currency in the market, and citizens’ investments and transactions in virtual currencies are not protected by law. Based on this, Wang's entrustment of Wu to invest and trade virtual currencies also violates the mandatory provisions of relevant laws and regulations, undermining public order. Therefore, the relevant part of the agency contract should be deemed invalid. However, since digital collectibles themselves are not prohibited by laws and regulations, contracts involving digital collectibles are valid.

From the cases of the Shandong High Court and the Shanghai Xuhui Court, it is evident that in judicial practice, the courts recognize that the issuance and trading involving NFT digital collections are not prohibited by laws and regulations, and voluntarily engaging in NFT digital collection transactions should be deemed legal and valid. The courts distinguish NFT digital collections from other virtual currencies and do not apply regulatory provisions such as the '94 Announcement' and '924 Notification.'

The path for NFT digital collection users to protect their rights in judicial practice

1. Request to terminate the contract and return the purchase amount

Users participating in the purchase of NFT digital collections generally buy directly from the NFT digital collection issuers through the digital collection platform or trade with users within the platform. Essentially, this trading behavior of NFT digital collections belongs to a sales contract.

If an event occurs during the performance of the NFT digital collection sales contract that prevents the realization of the contract's purpose, the statutory right to terminate the contract can be exercised in accordance with Article 563 of the Civil Code, and the other party can be requested to return the purchase amount of the NFT digital collection. Specifically, if due to technical reasons, transaction restrictions, etc., the NFT digital collection cannot be delivered during the transaction process, making it impossible for the buyer to obtain the NFT digital collection and thus the contract's purpose cannot be achieved, the buyer can request to terminate the contract and return the purchase amount.

In the case (2022) Zhe 0726 Minchu 4021 heard by the Pujiang County Court of Zhejiang, the plaintiff Chen signed a sales contract for NFT digital collections with the defendant. Subsequently, due to an announcement by the Tencent Huanhe digital collectibles platform stating that it would cease the issuance of digital collectibles starting August 16, 2022 (i.e., transfer would no longer be possible), the contract's purpose could not be realized due to transaction restrictions. The plaintiff could not obtain the NFT digital collections, and the court ultimately ruled to terminate the contract and return the purchase amount.

2. Claim a refund based on the Consumer Rights Protection Law

In the case (2022) Yu 0106 Minchu 26755, heard by the Shapingba District People's Court of Chongqing, the plaintiff Wu claimed that the defendant failed to fulfill the promised rights when selling NFT digital collections, citing false advertising and consumer fraud under Article 20 of the Consumer Rights Protection Law. The plaintiff requested the defendant to refund the purchase cost of the digital collection and compensate him threefold, amounting to 47,051.85 yuan. Ultimately, the court ruled that no fraudulent behavior occurred during the NFT digital collection sales process as claimed by the plaintiff, and the promised rights by the defendant had been fulfilled. Thus, the court rejected all of the plaintiff's litigation requests.

In the case (2022) Yue 0606 Minchu 35095 heard by the Shunde District People's Court in Foshan, the plaintiff also based their claim for a refund of the purchase price of NFT digital collections on the Consumer Rights Protection Law, arguing that the defendant engaged in inducement and fraudulent behavior. However, during the hearing, the plaintiff admitted that the digital collectibles had collectible value and were not consumer goods, and acknowledged that they voluntarily purchased after considering the transaction. The court ultimately rejected all of the plaintiff's claims.

In the two cases mentioned above, the purchasers of NFT digital collections relied on the Consumer Rights Protection Law to protect their rights, claiming that the issuers of the NFT digital collections promised many rights during the sale, but ultimately did not fulfill them, constituting false advertising. However, it is necessary to clarify that Article 2 of the Consumer Rights Protection Law stipulates that consumers who purchase and use goods or services for daily life consumption needs are protected by this law. Many users purchasing NFT digital collections do so because of the uniqueness and scarcity of NFTs, which have collectible value and can be traded to earn price differences, rather than for daily consumption purposes, thus they do not fall under the protection of the Consumer Rights Protection Law. In the case heard by the Shunde Court, the plaintiff acknowledged their purpose for purchasing NFT digital collections during the hearing.

3. Currency-involved NFT digital collection transactions can claim contract invalidity

Investors in NFT digital collections may encounter situations where they need to deposit funds first, exchanging RMB for USDT, and then using USDT to purchase NFT digital collections on the platform. Such cryptocurrency-involved NFT trading behavior can claim to be invalid due to violations of the '94 Announcement' and '924 Notification' regulations. In judicial practice, some regions may rule on the consequences of invalid cryptocurrency contracts by ordering the return of property or sharing losses based on the faults of both parties. In the case (2023) Xiang 0105 Minchu 13207, heard by the Kaifu District People's Court of Changsha, the court ruled the contract for the sale of USDT invalid and supported the plaintiff's request for the return of the purchase amount.