Recently, some individuals have inquired whether cryptocurrency U merchants can operate and what legal risks are involved. For cryptocurrency U merchants, they provide a channel for a large number of cryptocurrency users to exchange their legal currency for USDT. During the trading process, they may face the risk of having their cards frozen or even encountering criminal liability due to receiving funds from unknown sources. Today, let’s analyze the criminal risks faced by cryptocurrency U merchants through real cases.

Overview of U merchants' OTC business model

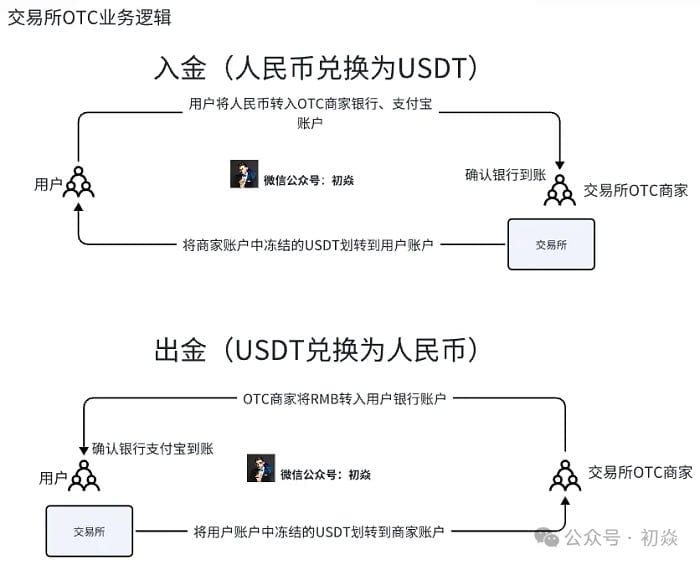

From the perspective of domestic cryptocurrency users, to invest in virtual currency, they first need to exchange legal currency for stablecoin USDT through U merchants. U merchants' exchange channels are primarily divided into OTC products within exchanges and off-exchange OTC.

Both channels adopt a P2P model, with RMB and other legal currencies circulating between merchants' and users' bank cards, WeChat, and Alipay accounts. The difference is that OTC within exchanges can temporarily freeze the seller's USDT account to ensure that the transaction is executed as agreed, eliminating the transaction risks of who transfers money or coins first.

Furthermore, exchanges' OTC requires both parties to undergo real-name authentication, implementing anti-money laundering measures to mitigate risks. In contrast, off-exchange OTC transactions operate outside the platform's anti-money laundering measures, with non-real-name funds entering accounts potentially resulting in card freezing or even criminal cases. This part can be referenced in previous articles (Discussing why trading cryptocurrencies can easily involve aiding and abetting crimes based on cases).

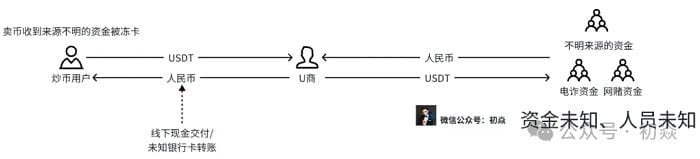

From the perspective of U merchants, the challenge is how to circulate USDT and legal currency. The logic of OTC business is to earn profits through low buying and high selling, so finding a large volume of low-priced funding sources is key to determining OTC business profits. To pursue larger price differences in OTC transactions, many U merchants' sources of funds come from currency exchange and illicit funds from fraud, online gambling, etc. Below, we will analyze the criminal risks of these two OTC models through recent real cases.

Real cases of U merchants involved in criminal cases

Case One: U merchants using USDT as a medium for foreign exchange trading sentenced for illegal business operations

Case Facts:

From August to October 2021, Chen, in pursuit of illegal profits, colluded with others to use virtual currency as a medium to illegally buy and sell foreign exchange outside the regulated trading venues. Chen rented office space, provided work phones, computers, and SIM cards, and instructed defendants Wu, Xue, Chen, and others to use bank accounts to receive RMB funds from currency exchange personnel Wang, Chong, and Shao, and used Wu's virtual currency trading account to buy and exchange Tether (USDT) and other virtual currencies, cooperating with overseas individuals through selling and withdrawing coins, then selling virtual currencies to exchange for foreign exchange.

Auditing revealed that from August to October 2021, defendants Wu, Xue, Chen, and others transferred over 400 million RMB through the involved bank accounts during their work, with over 60 million RMB coming from currency exchange personnel. From September to October 2021, during the work of defendant Chen, over 300 million RMB was transferred through the involved bank accounts, with over 60 million RMB coming from currency exchange personnel.

In October 2021, defendant Wu knowingly allowed his bank account to be used by Chen and others for cybercrime activities while still utilizing his bank account to collect and pay RMB funds for them. Investigations revealed that over 50 million RMB was transferred into Wu's bank account, with over 10 million RMB coming from currency exchange personnel Zhang Wei, Wang Qiang, and others.

Lawyer's Analysis:

Although stablecoins like USDT and USDC can be exchanged at a 1:1 ratio with the dollar, they are essentially issued by the issuer through collateral such as BTC and debt, and are not currencies issued by any country. In domestic regulatory documents published by the People’s Bank of China and other ministries, it is clearly stated that Bitcoin is not issued by monetary authorities, does not have the characteristics of legal tender and compulsory legal status, and is not true currency but a specific virtual commodity. Therefore, stablecoins like Tether that are exchanged for USD do not constitute foreign exchange.

Ordinary cryptocurrency users purchase USDT using RMB for deposits and exchange USDT back to RMB during withdrawals. The entire process is merely the buying and selling of this virtual commodity with RMB, without engaging in foreign exchange trading to evade foreign exchange regulations or capital outflow. Specific analysis can be found in previous articles (Current criminal risks faced by OTC businesses in the cryptocurrency world).

In the case reviewed by the Shanghai Putuo District Court, Chen instructed team members to receive RMB from currency exchange personnel through bank accounts, buy USDT with the exchanged funds via OTC deposits at exchanges, and then exchange USDT for Japanese yen overseas. Throughout the transaction process, this criminal group utilized the instant cross-border transfer characteristics of USDT as a medium, evading foreign exchange regulation through 'RMB-USDT-JPY', achieving the purpose of exchanging domestic RMB for Japanese yen, which constitutes disguised foreign exchange trading.

According to Article 2 of the Interpretation on Handling Criminal Cases of Illegally Engaging in Fund Payment and Settlement Business and Illegal Foreign Exchange Trading, violating national regulations by engaging in illegal buying and selling of foreign exchange or disguised foreign exchange trading that disrupts financial market order, and in serious circumstances, shall be convicted and punished for illegal business operations according to Article 225, Item 4 of the Criminal Law.

In addition, in this case, Wu was aware that his bank account might be used for cybercrime activities but still used his bank card to assist the criminal group engaged in illegal currency exchange in receiving and paying RMB funds, ultimately being sentenced for aiding and abetting.

Many financial personnel working in small foreign trade companies are required by their bosses to use their personal bank accounts for payments. If the company uses virtual currency as a medium for fund circulation, once the foreign trade company is suspected of illegal business operations, employees using personal accounts to assist the company in collecting and paying funds may face significant criminal risks.

Case Two: U merchants receiving fraud funds for OTC sentenced for concealment crimes.

Case Facts:

Between March 6 and March 8, 2024, defendant Sun and others traveled from Shanghai to Maoming, Guangdong, using bank cards opened by Wei at the Industrial and Commercial Bank of China, assisting in telecommunications network fraud activities by transferring a total of 225,000 RMB by trading USDT. Investigations revealed that victims Luo, Wu, and Wang were defrauded online under the guise of investment and financial management, totaling 150,000 RMB, which was transferred into Wei's Industrial and Commercial Bank account. After the funds arrived, Wei transferred them into his postal bank and construction bank accounts, and then, along with Sun and others, withdrew cash to transfer, illegally profiting over 1,400 RMB.

Between March 6 and March 8, 2024, defendants Sun, Wei, and Lou traveled from Shanghai to Maoming, Guangdong, using Wei's bank card opened at the Industrial and Commercial Bank of China, to assist telecommunications fraud activities by transferring a total of 225,000 RMB through trading USDT. Investigations revealed that victims Luo, Wu, and Wang were defrauded online for a total of 150,000 RMB under the pretext of investment and financial management, transferred into Wei's bank account. After the funds arrived, Wei transferred them into his postal and construction bank accounts, and then, along with Sun and Lou, withdrew cash to transfer, illegally profiting over 1,400 RMB.

Lawyer's Analysis:

Telecom fraud criminal groups urgently need to transfer victims' funds to evade police investigation. The anti-fraud center freezes bank cards to intercept defrauded funds, so collaborating with U merchants to exchange for USDT can help fraud groups avoid law enforcement tracking. For U merchants, receiving fraud funds means they can sell USDT at a relatively high price compared to exchange market rates, and then transfer the received fraud funds into the bank accounts of users selling currency, thereby seeking larger price differences.

In the case reviewed by the Hubei Hanchuan Municipal Court, defendants Sun and others partnered in U merchants' OTC business, receiving defrauded funds from victims at abnormal prices, buying low and selling high to earn significant price differences. This behavior constitutes knowing that the funds were obtained from fraud, providing bank cards and exchange accounts to assist in the transfer, and utilizing abnormal cash withdrawal methods, ultimately constituting the crime of concealing and disguising criminal proceeds.

Summary and Reflection

From the two real cases in this article, it can be seen that U merchants, seeking to profit from arbitrage through OTC trading, may take risks to pursue fraud, online gambling, or currency exchange involving illicit or even illegal funds. For illegal currency exchange, USDT serves as a medium, leveraging its instant cross-border payment characteristics to bypass foreign exchange controls, posing a significant threat to social economic order and national financial security. From last year to this year, public security organs and foreign exchange management departments across the country have jointly enforced the law, severely cracking down on certain U merchants involved in illegal currency exchange with huge amounts of money.

The model of receiving and transferring fraud and gambling funds using USDT yields low profits for U merchants; however, the criminal risks are extremely high and law enforcement agencies find it relatively easy to crack down. In summary, the operation model of U merchants in domestic markets seeking arbitrage through price differences can lead some U merchants to take risks to engage with the black and gray industrial chain's funds. Therefore, when choosing to engage in domestic U merchant OTC business, it is crucial to carefully and seriously assess the criminal risks and avoid testing the law.

After the analysis in this article, retail investors in the cryptocurrency world should understand the legal risks during fund inflows and outflows. Investing in virtual currency itself is not illegal, and fund inflows and outflows are merely exchanges between USDT and RMB. The risk lies in the potential receipt of illegal funds leading to frozen bank cards or even criminal cases.

When conducting OTC transactions with U merchants, it is essential to require the other party to use their real-name bank card for payment, avoiding transactions through abnormal methods such as off-exchange OTC, cash deposits and withdrawals, or anonymous software like Telegram, which can help minimize the risks of freezing cards and criminal liability during fund inflows and outflows. Specific analysis can be referenced in previous articles (Under what circumstances will buying and selling U in the cryptocurrency world involve concealment crimes).