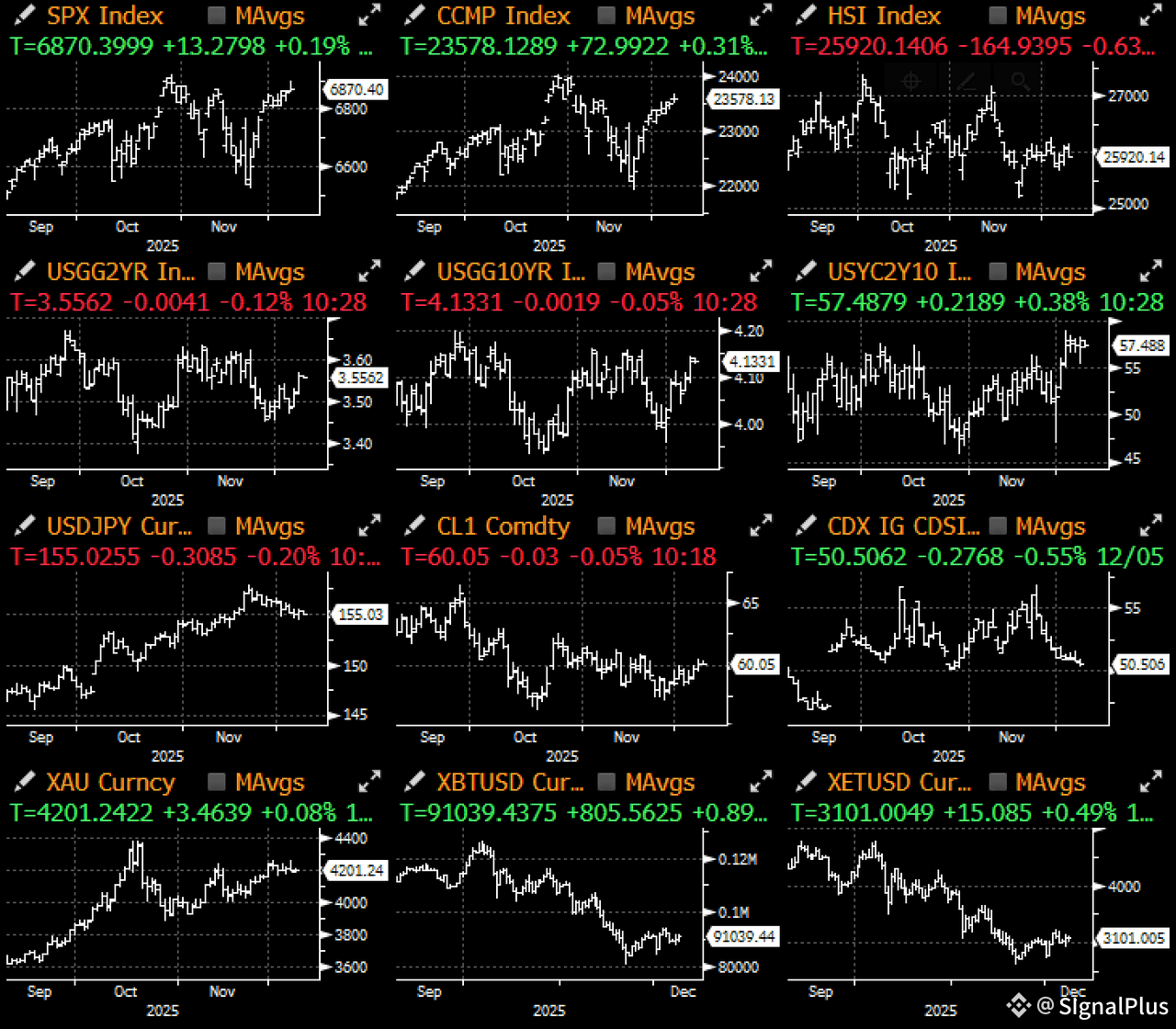

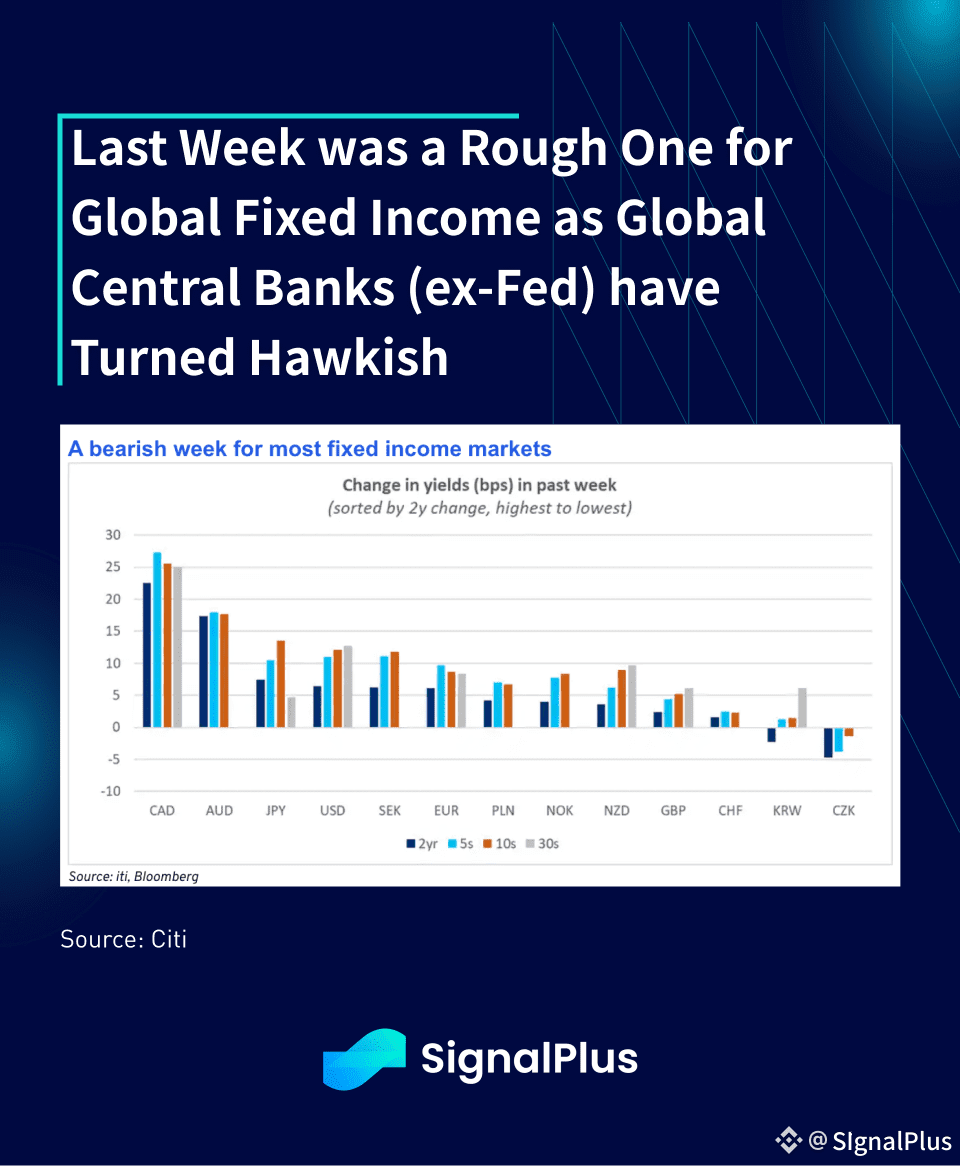

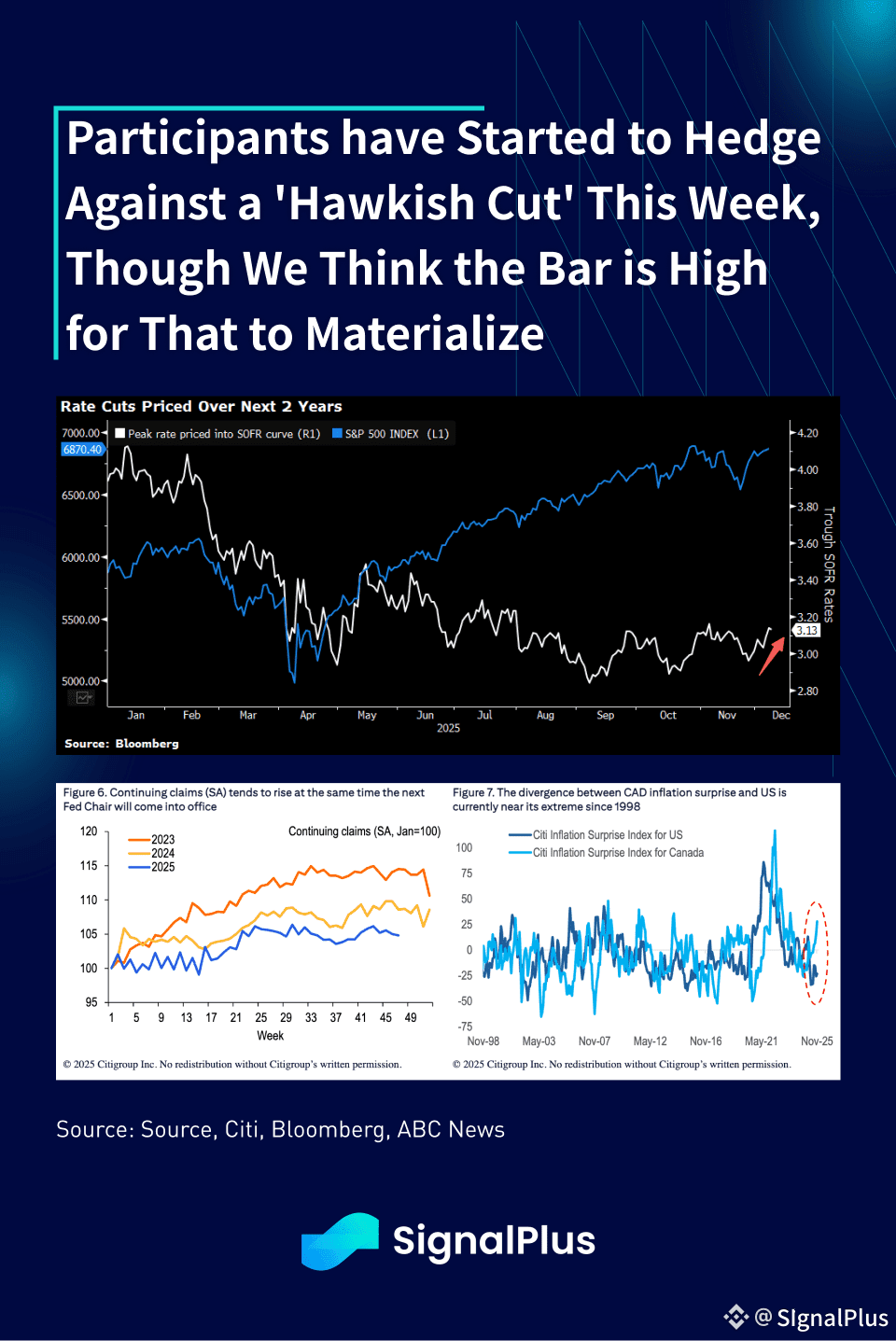

While risk sentiment steadied last week, G7 fixed income had a rough go as a number of Tier-1, non-US economic indicators surprised to the upside. Australia CPI came in at 3.8% vs 3.6% expected, triggering a 15bp gap up in their 5yr yield and AUDUSD +2.5% higher on the month. Canada’s job report was up next with an extremely strong upside beat (unemployment at 6.5% vs 7.0% expected), which triggered the sharpest daily move in the Canadian 5yr bond since 2022 (+20bp), and the CAD soaring by 2%. Over in Japan, despite weak capex spending, the market is pricing in a 90% chance of a BOJ hike this month, making the dovish Fed the odd one out of the G7.

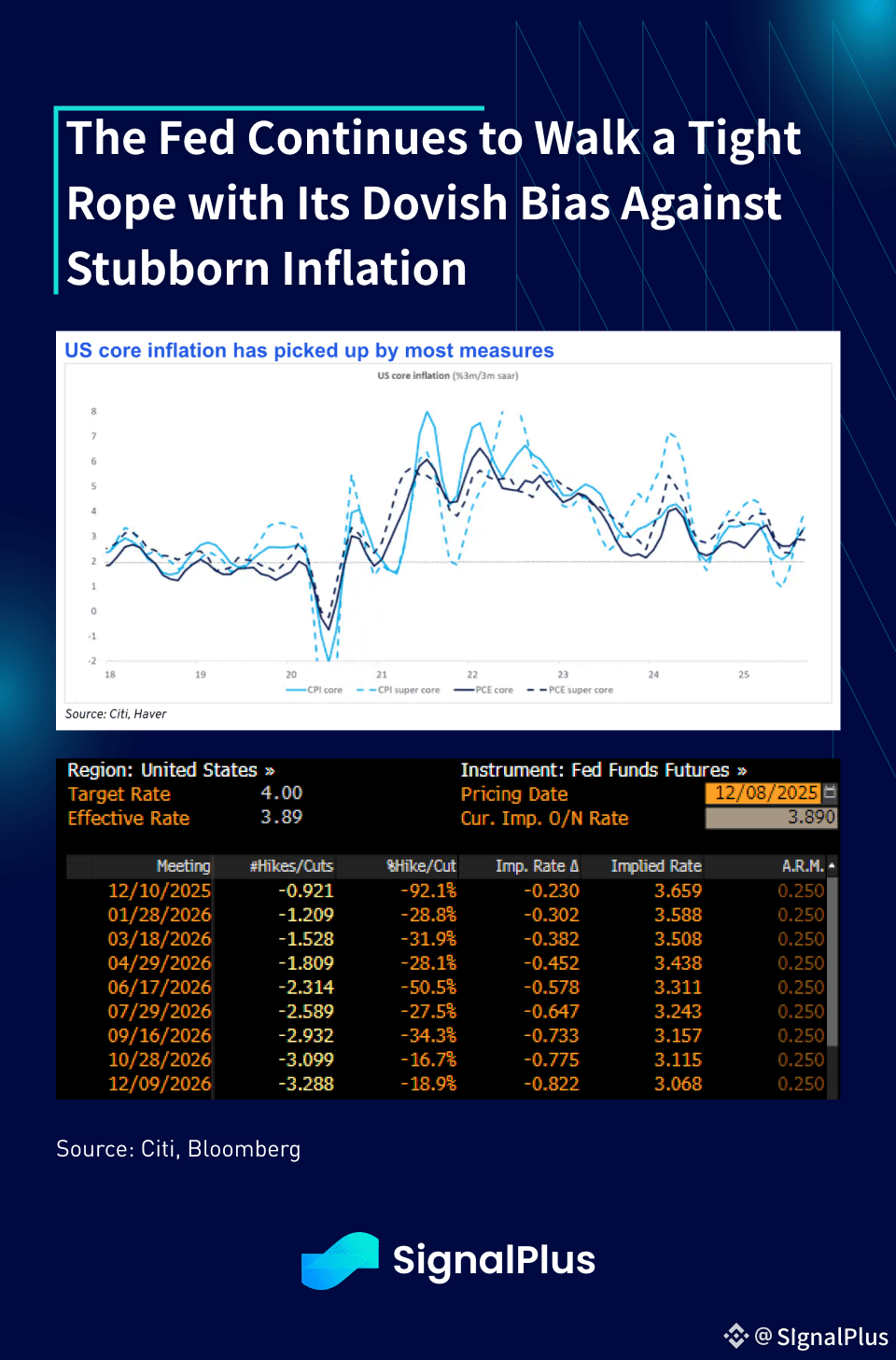

The market widely expects a 25bp in the FOMC this week, with an addition 2 more priced in for all of 2026. Despite stubborn inflation, the Fed has hinted that they will lean on the softness in the unemployment rate (~4.5%) to justify the final cut of the year. Furthermore, with 2 more jobs reports between the Dec and Jan FOMC, we expect Chairman Powell to keep his options open for another rate cut in January or March, with the 2026 ‘dot plot’ similar to before.

Unsurprisingly, the Fed dovishness is starting to meet some market resistance, with market participants starting to price in the chance of a ‘hawkish cut’ through Powell’s Q&A guidance or a change in SEP forecasts. In order to make that happen, the Fed would need to be rather explicit in his forward guidance, such as by shifting the 2026 rate cuts expectations to 1 or less, which we think has a low probability of happening.

On the other hand, with President Trump strongly hinting at Kevin Hasset being the next chair, that’s likely going to be the market’s modal outcome, which implies a more ‘easier’ Fed Chair taking the helm starting next June. As such, the medium views of 1) weaker USD, 2) higher inflation, 3) Treasury curve steepeners and 4) higher asset prices are likely to stay without a meaningful change in realized macro conditions.

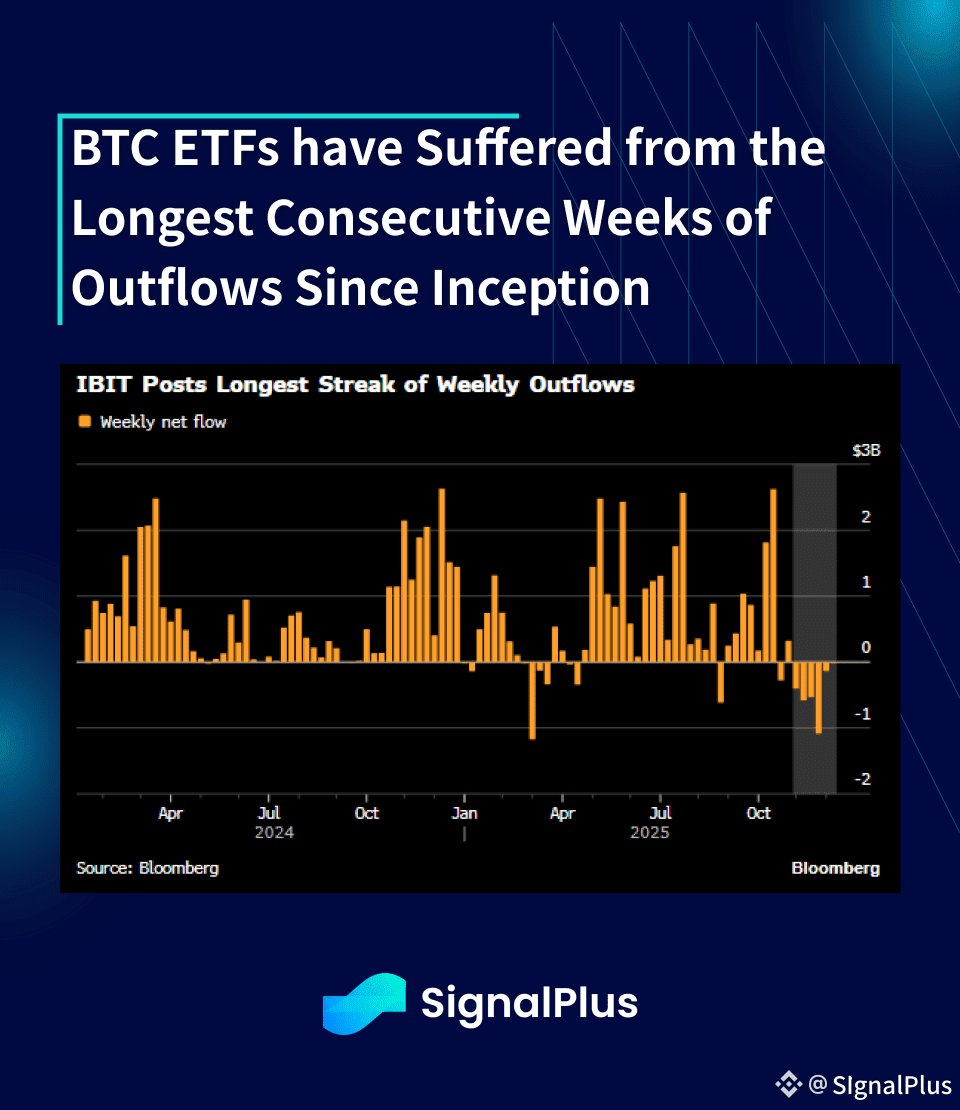

All that hasn’t meant a lot of crypto, which saw BTC prices rebound to the 86–92k price range after a quiet week of trading. Unfortunately, underlying sentiment appears to have turned for the worst as Blackrock’s IBIT has suffered its longest streak of weekly outflows since inception, with nearly $2.9bln of cumulative outflows over the past 6 consecutive weeks.

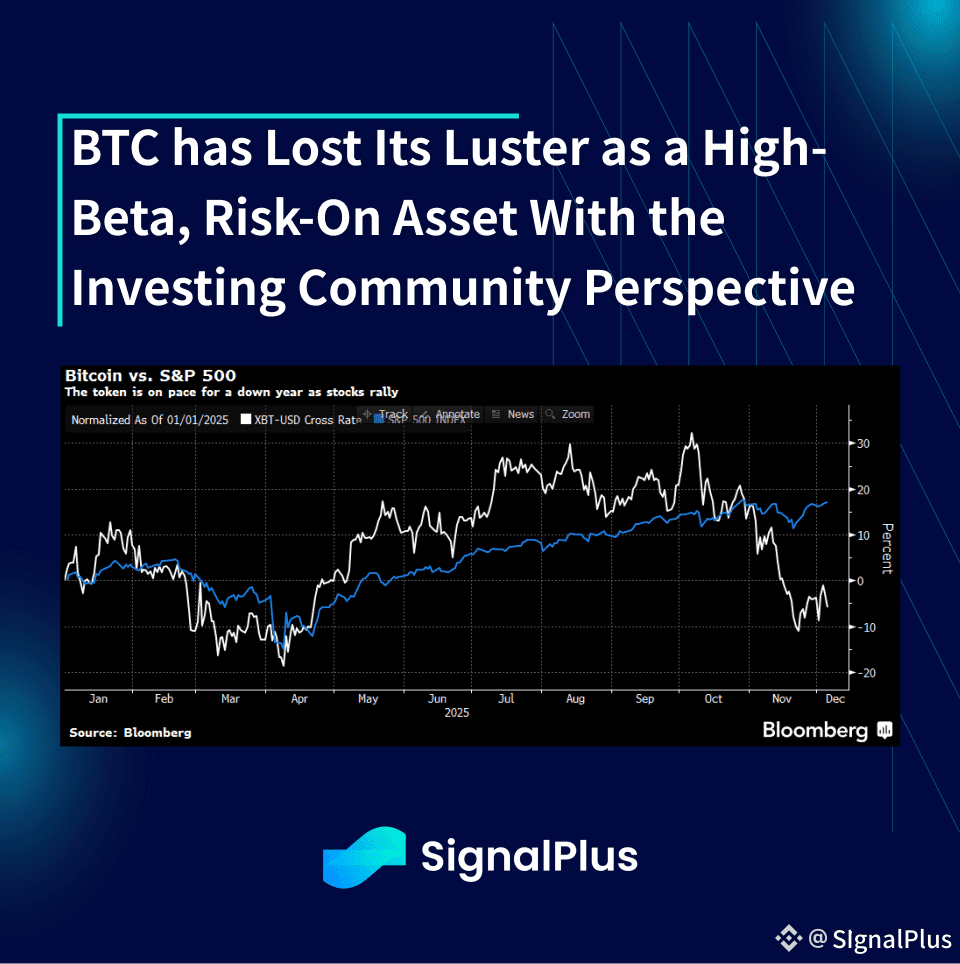

The structural mood change can be seen from BTC’s recent correlation (or lack off), as it has dramatically underperformed the rest of the high-beta, risk-on complex over the past 8 weeks. The asset decoupling is happening at a time when the investor mindshare has fully pivoted to AI and related stocks, with global retail traders flocking back to day trading stocks (and prediction) markets, while gold and silver are still within a stone’s throw from ATHs.

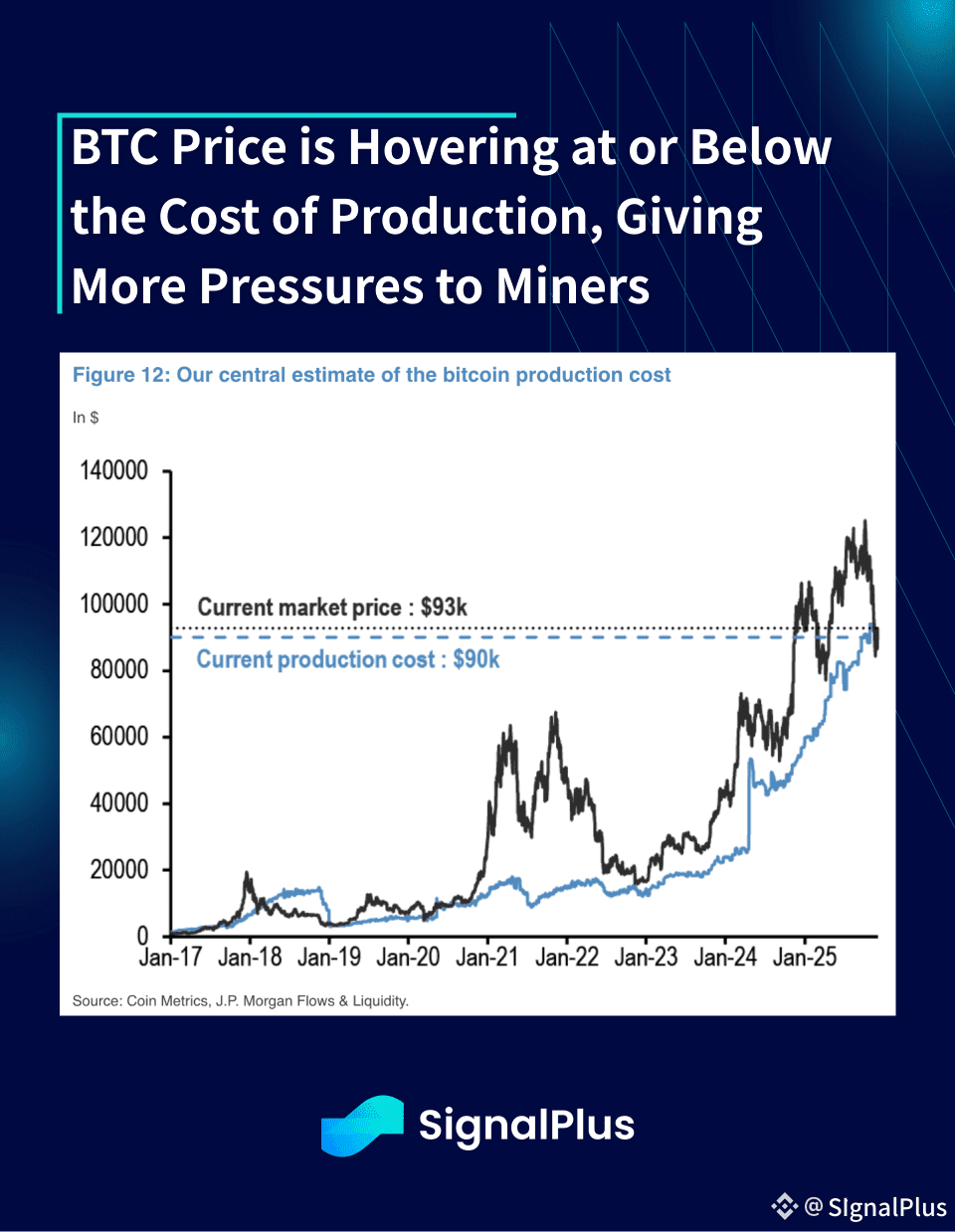

From a production perspective, BTC continues to cover below most measure of product costs. Hash rate has fallen precipiously given China’s recent regulatory turn against crypto activities, as well as miners having shifted its compute resources towards AI and downsizing on their pure mining activities. A protracted stay underneath the product cost shall put additional pressures on miners which could lead to a further retreat in the hash rate and mining difficulty, leading to a more negatively reflexive loop of lower BTC prices in the medium term.

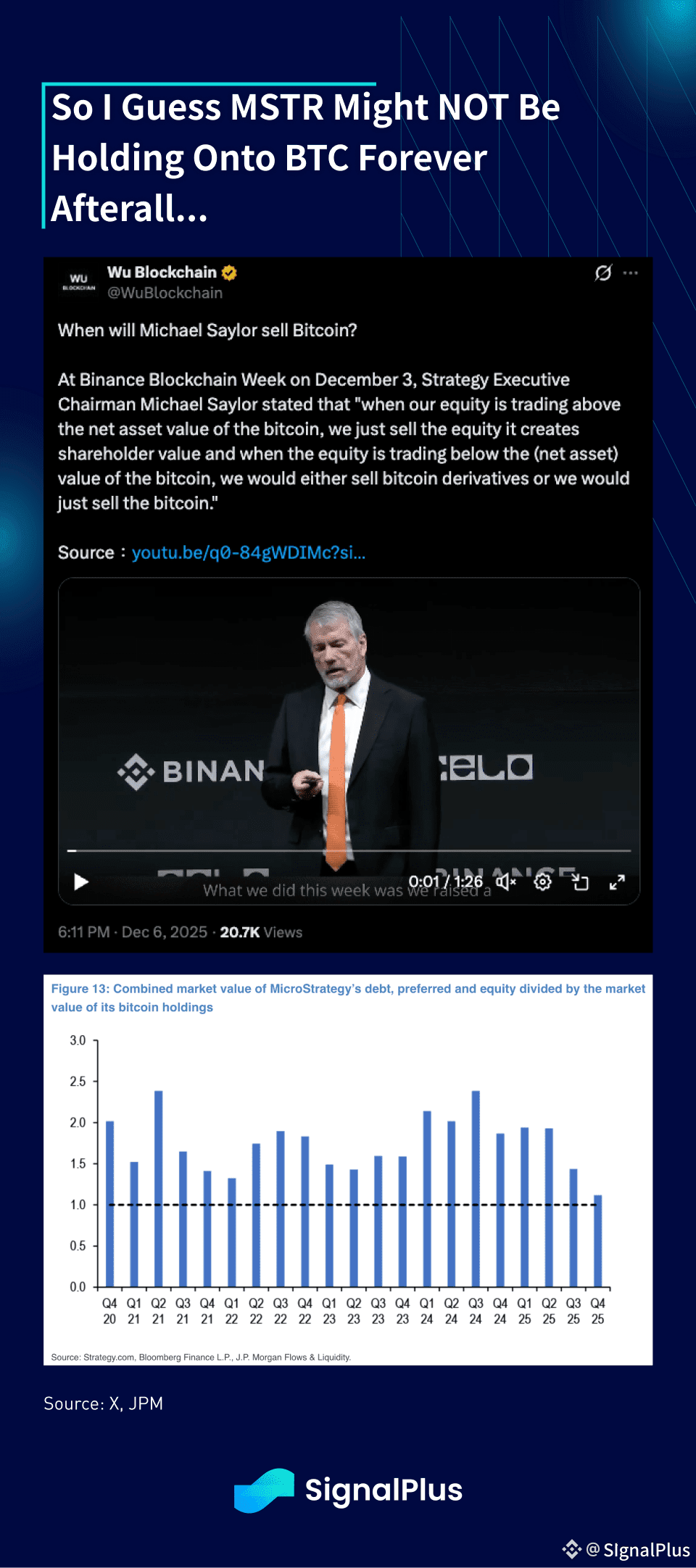

To make matters trickier, the collapse in global DATs has brought a lot of negative attention to supply overhang and possible forced selling should these listed equity prices trade significantly beneath their BTC treasury values. MSTR has been under the most pressure, with the company’s combined debt + equity values now barely trading at a premium to its BTC holdings. When pressed against the uncomfortable question of what happens if the ratio was to dip below 1, Saylor worrisomely said:

“When our equity is trading above the net asset value of the bitcoin, we just sell the equity it creates shareholder value and when the equity is trading below the (net asset) value of the bitcoin, we would either sell bitcoin derivatives or we would just sell the bitcoin.” — Michael Saylor at Binance Blockchain Week, December 3rd

Let’s hope that MSTR’s $1.4bln reserve fund will be able to keep them from force liquidating its BTC reserves in the foreseeable future.

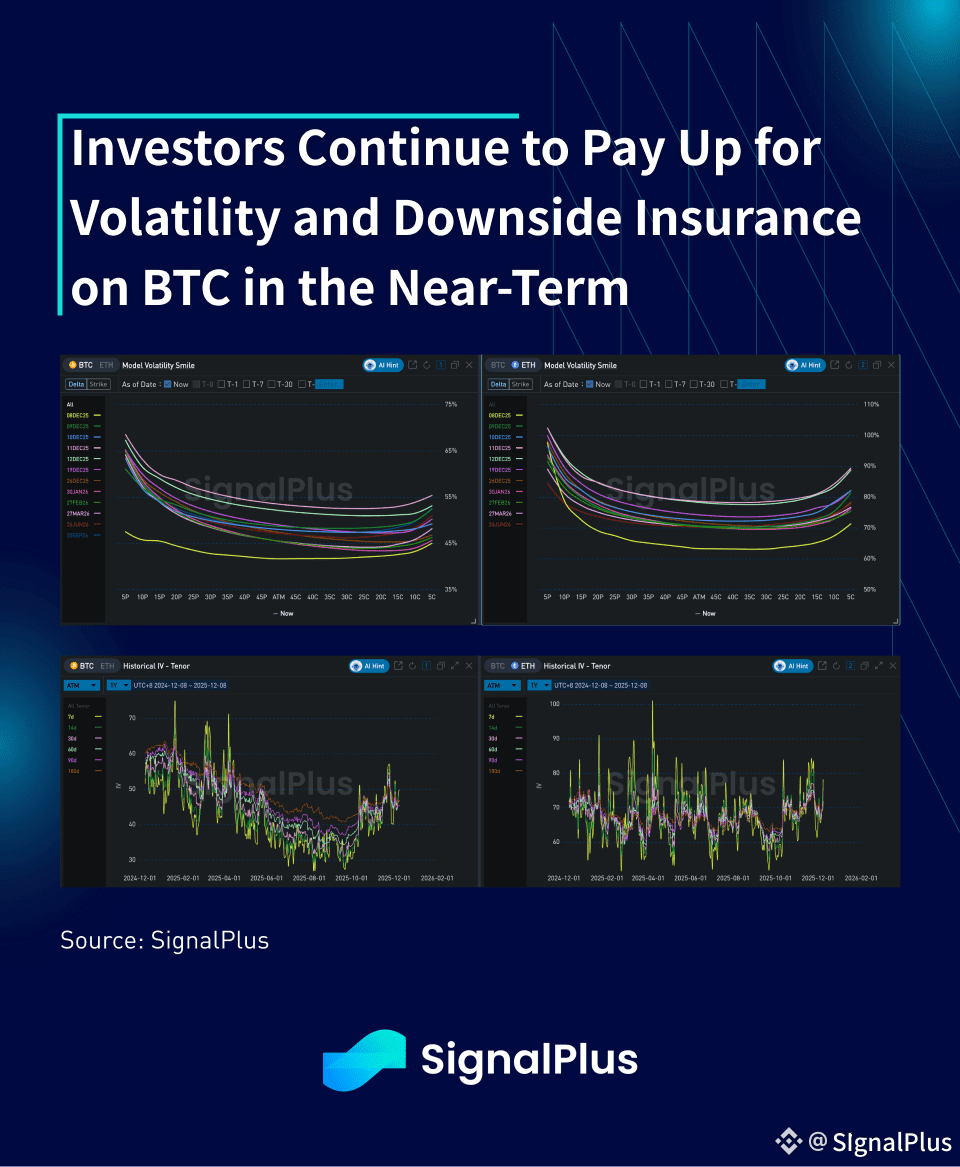

Looking ahead, pretty much the same playbook as before — equities are likely to hold up heading into year-end, with fixed income underlying a near-term adjustment as yields trend higher with global central banks turning more neutral/hawkish outside of the Fed. We fear that crypto remains in a near-term bear market until proven otherwise, and is reflected in the vol market where traders continue to pay-up for protection against lower prices. It would likely take a very dovish cut (or a surprise SPX index inclusion decision) to reverse the near-term trend, so we expect more of the same grind lower in interest and sentiment heading into the new year.

Good luck & good trading.