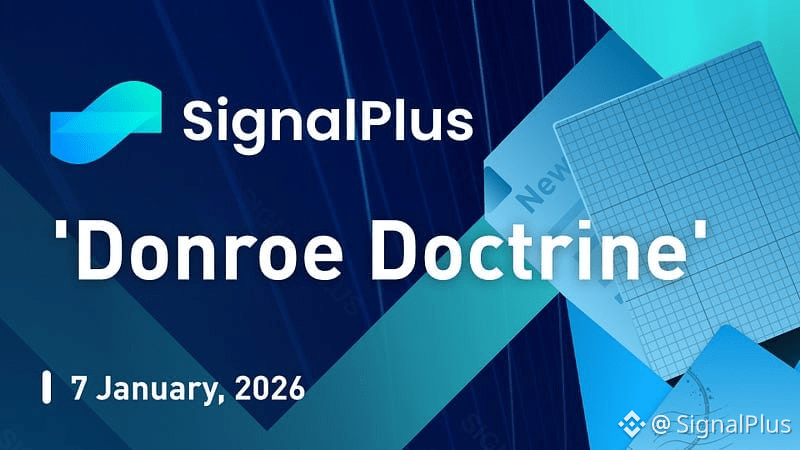

Geopolitical tension or not, markets wasted no time in going back to full risk-on mode with the SPX within a shooting distance away from the 7000 mark.

While a lot has already been about the Venezuela situation and what the next target is under the new ‘Donroe Doctrine’ (Iceland?), what is being made clear is that there is now a global stockpiling effort for precious metals and input substrates, setting up a long-term bullish scenario for commodities in a world where free trade and strategic alliances are breaking down.

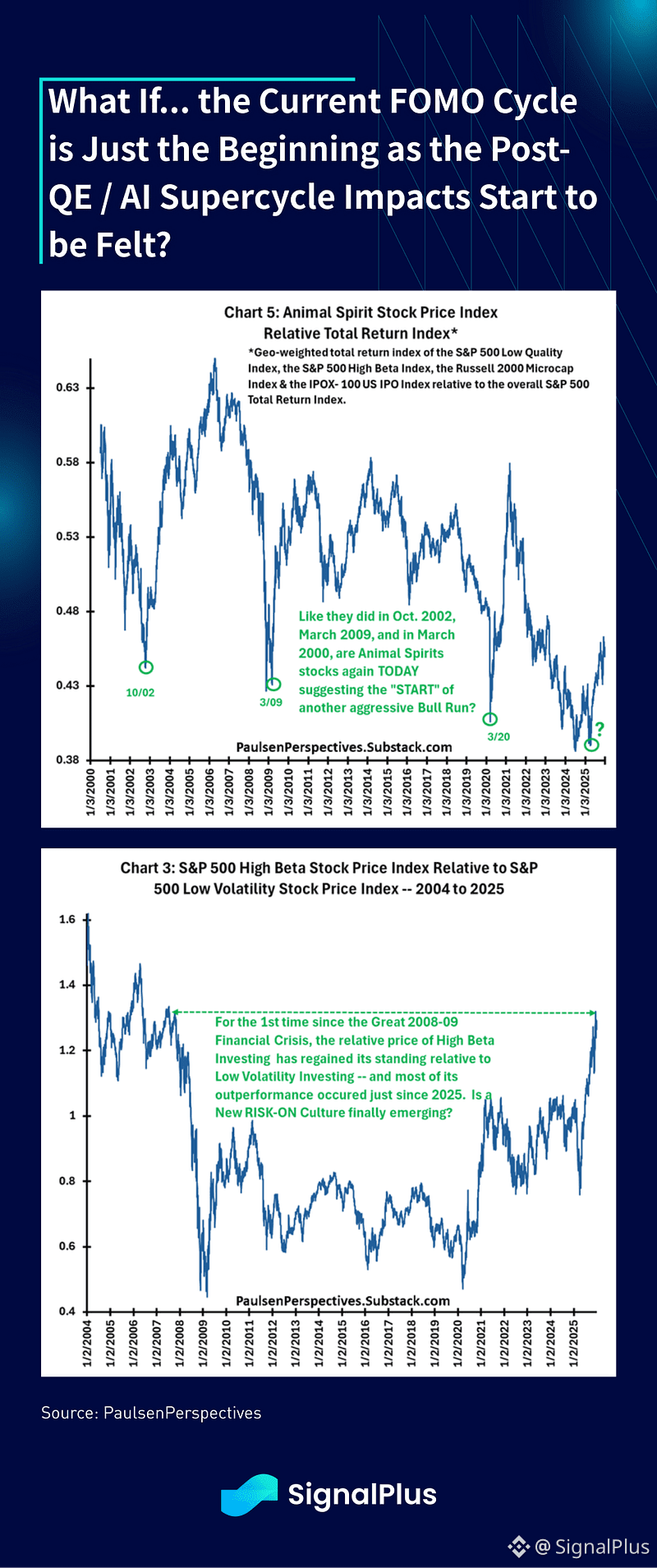

While 2025 was already a banner year for nearly all macro asset classes not-named-crypto, what is scary is that the ingredients for a further pop in animal spirits might be in place.

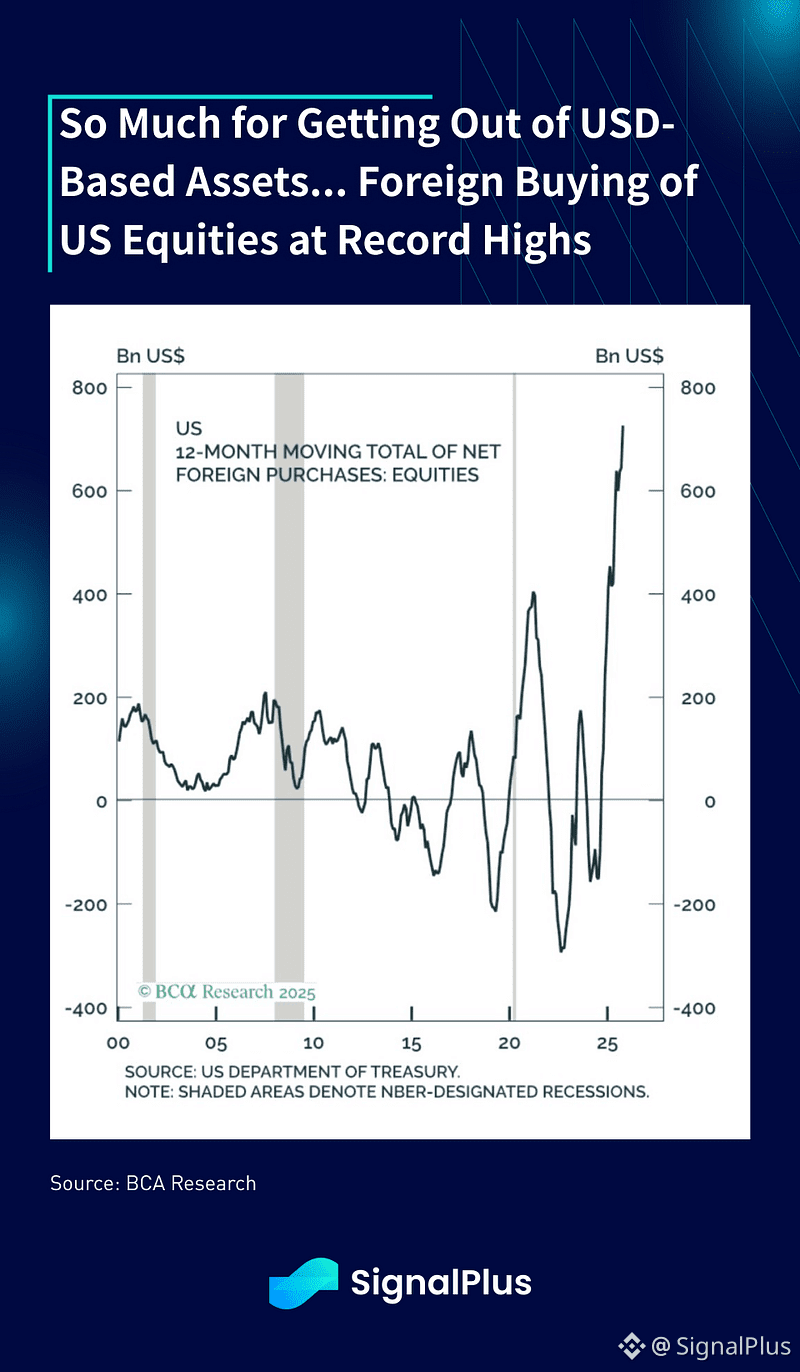

First, despite the incessant concerns over dollar debasement and capital flight out of US markets (ha!), 2025 ended up with the largest rolling 12-month foreigner buying of US equities in like… forever.

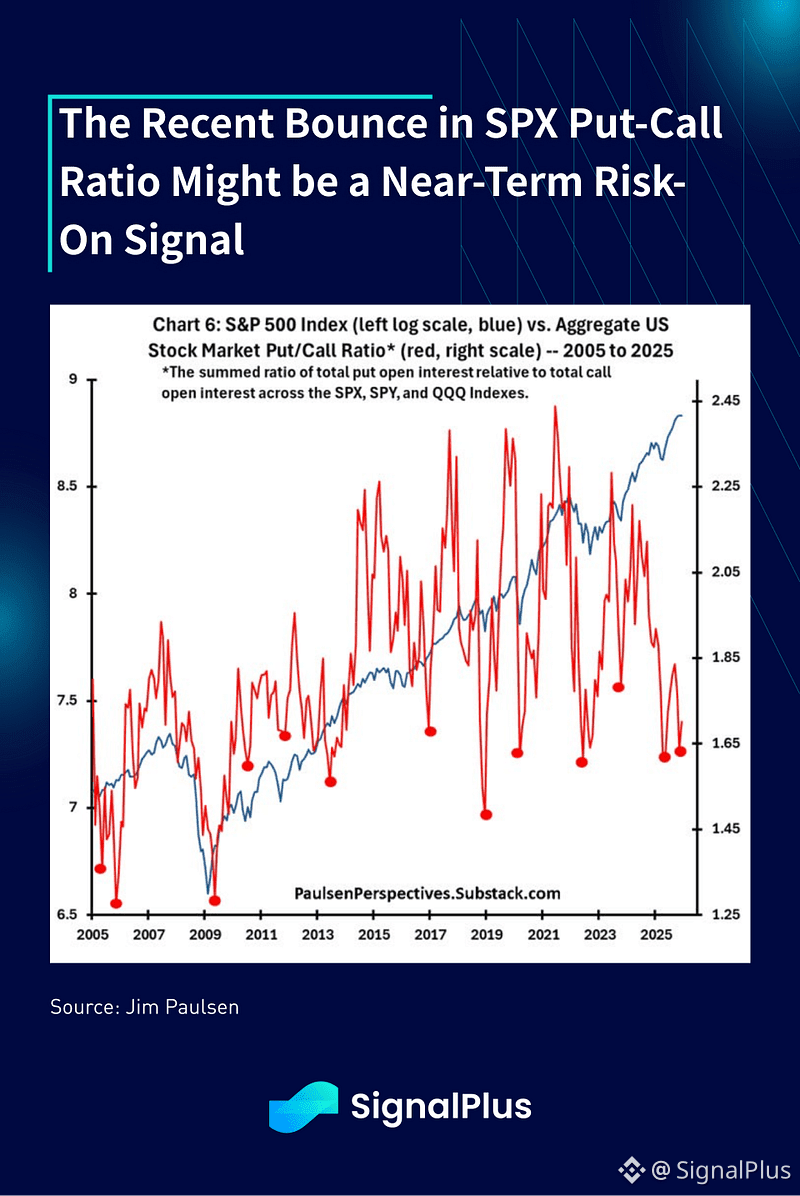

Second, despite the overwhelming flows, put/call ratios on the SPX have been hovering at the lows (cautious) as the index continued to make new highs, and bounces in the ratio (the red dots) have historically led to a strong risk-on period for equities, one of which we observed around year-end. (full credit to Mr. Jim Paulsen’s work).

Third, we might be seeing notable changes in animal spirits, where the recent strengths in high beta, low quality, small cap, and IPO names have really started to regain leadership and outperformance. Ultra-long term charts suggest that we might be seeing a structural break higher on FOMO / animal spirits — is this one of the realized outcomes of a prolonged AI-supercycle and merchantlist superpowers?

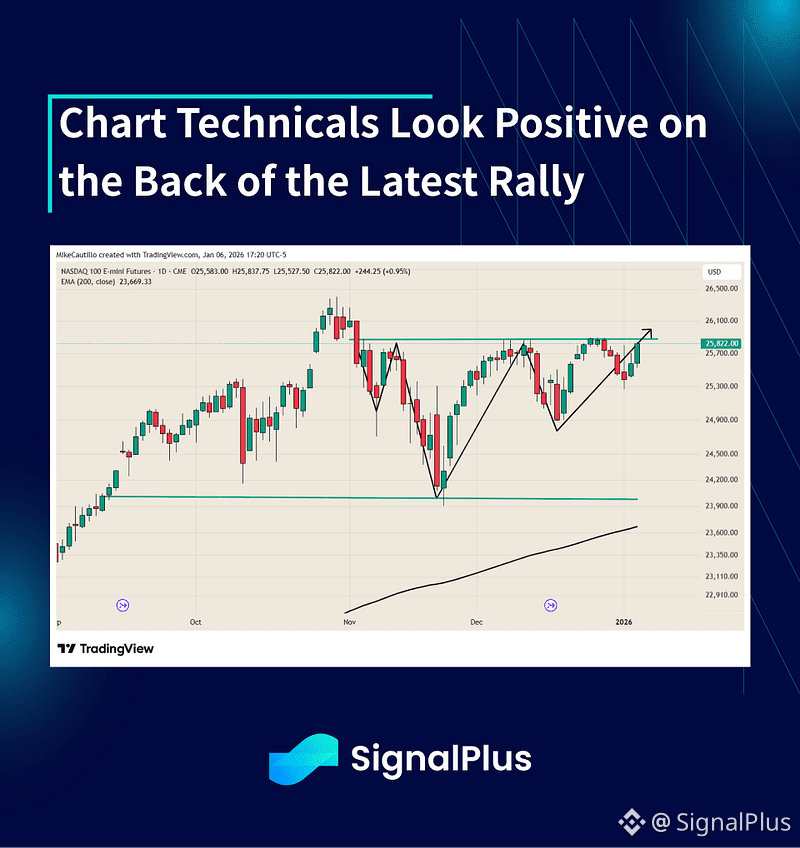

Fourth, technicals are looking constructive as Nasdaq appears poised for a further upside breakout.

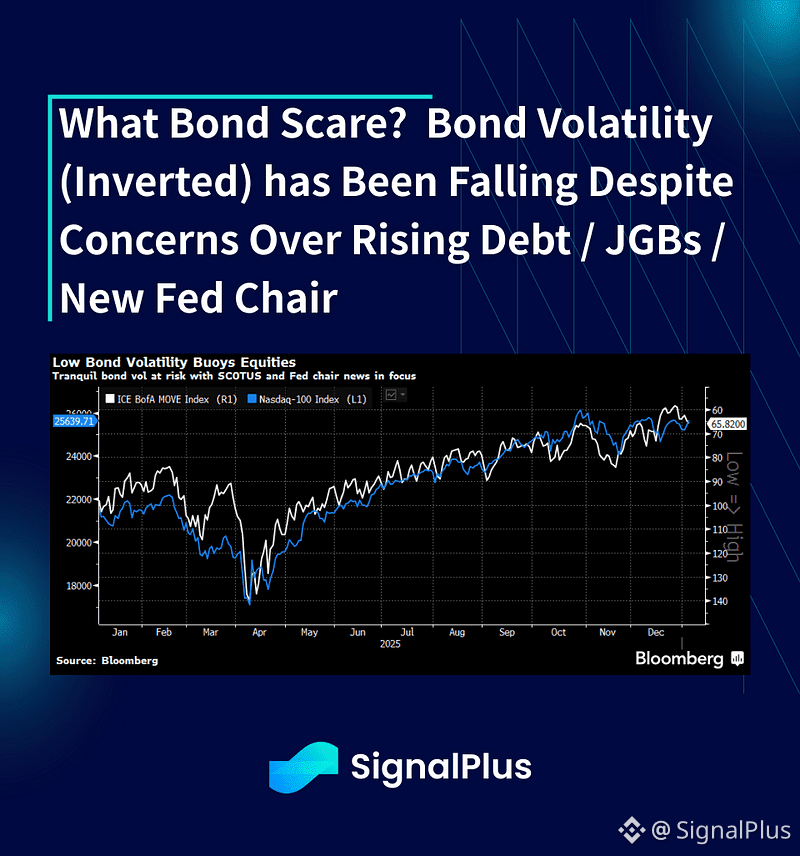

Finally, falling volatility and correlation is another tell. Implied correlation continues to fall as stock breadth improves, while low macro volatility is helping to usher equity prices higher. Despite the usual doomsday talk on rising outstanding debt and JGB yields, fixed income implied vols closed 2025 at the lowest level in years.

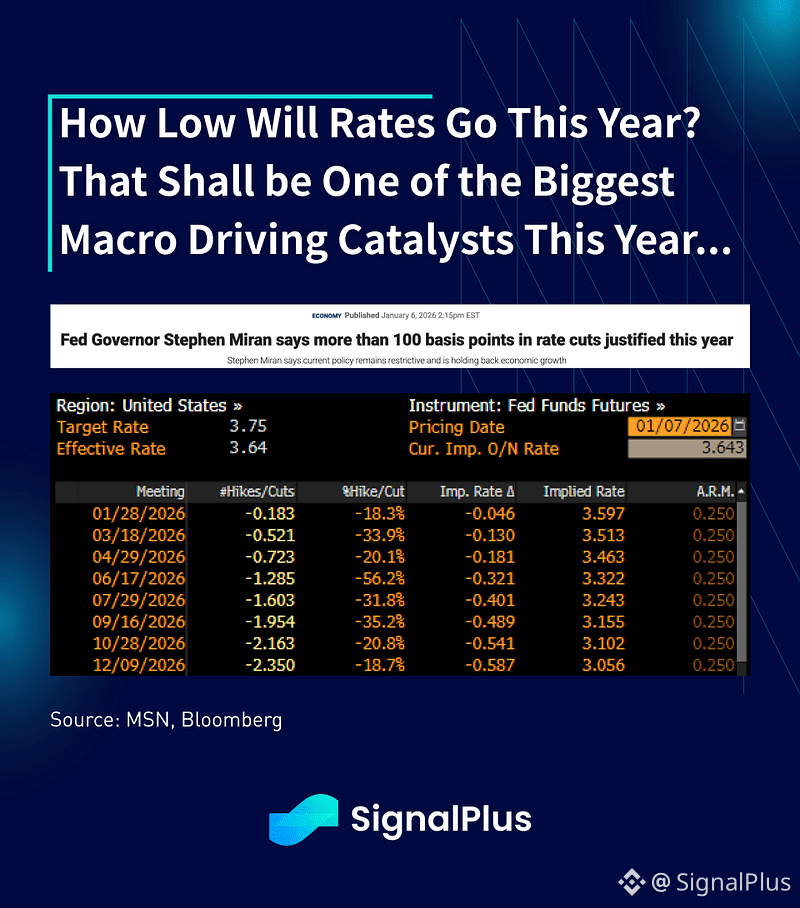

Speaking of rates, markets have started to focus on FOMC with a number of Fed speakers up on the docket. Richmond Fed’s Barkin tried to walk a balancing act as he noted a delicate balance on inflation and employment, while ultra-dove Miran called for “well-over” 100bp of cuts this year, reminding everyone that the era of loose monetary policy shall remain the base-case until further notice.

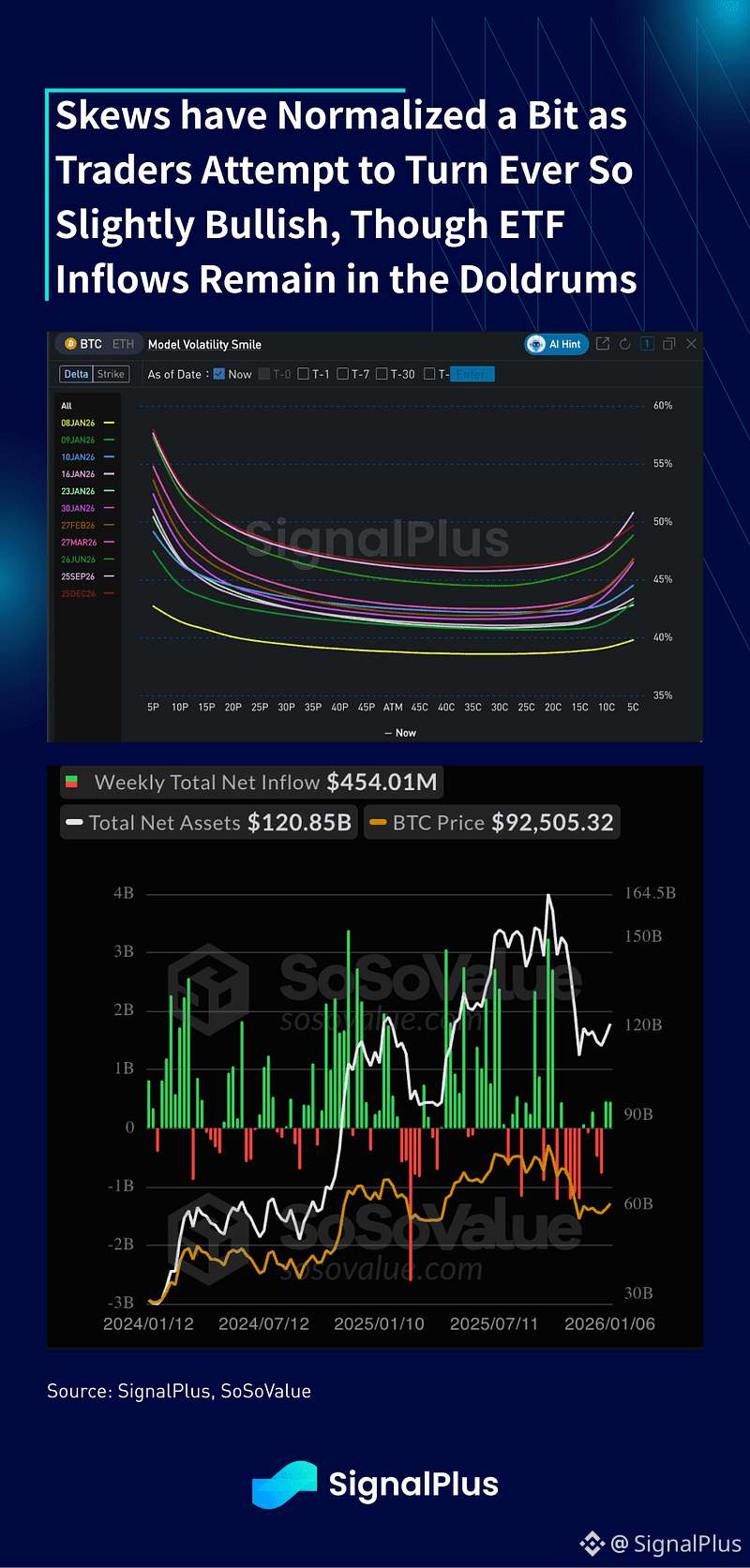

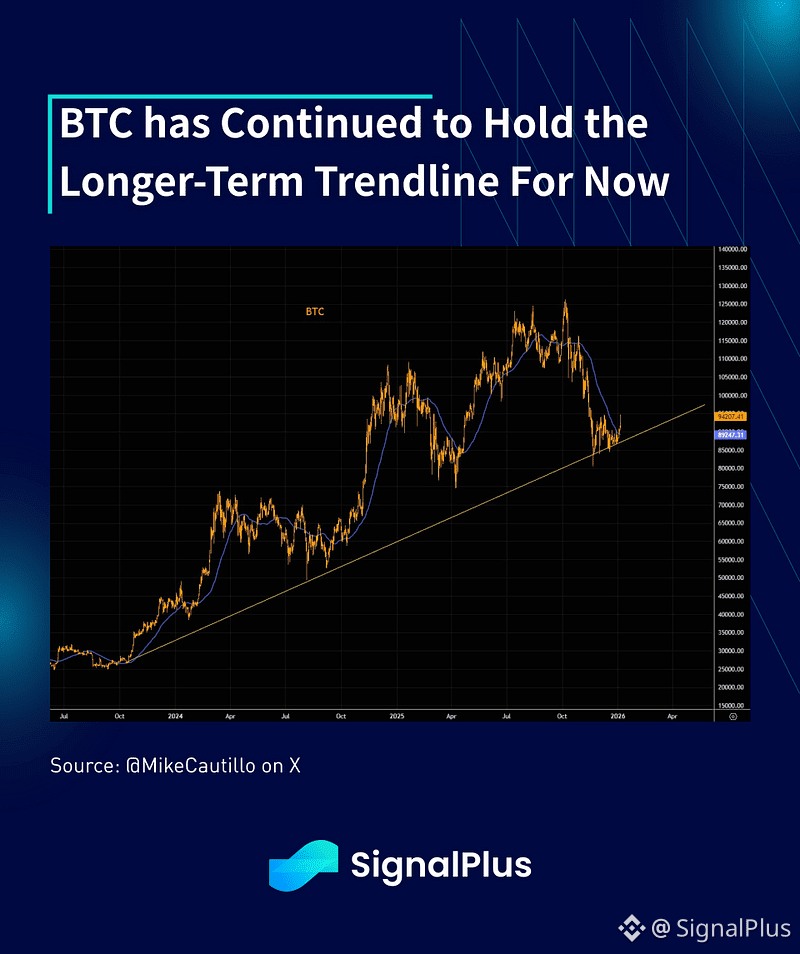

Over in crypto, prices have rebounded smartly to around the $93k area as we’ve held the 2024 trendline, for now. MSCI’s decision to maintain index eligibility for DATs (eg. MSTR) provides a much needed vote of support in the near-term, though the index provider announced that they will launch a “broader consultation” on how non-operating companies should be treated.

Call skews have improved in recent days, particularly against the $100k level as traders ever so slightly constructive on BTC, but remain guarded overall with ETF inflows remaining lackadaisical since November. Activity is quiet otherwise, as markets await a more convincing catalyst to shake us out of the 87–95k range that’s persisted since November. Good luck and good trading.