Key metrics: (5Jan 4pm HK -> 12Jan 4pm HK)

BTC/USD -1.0% ($92,600-> $91,700), ETH/USD -0.5% ($3,165 -> $3,150)

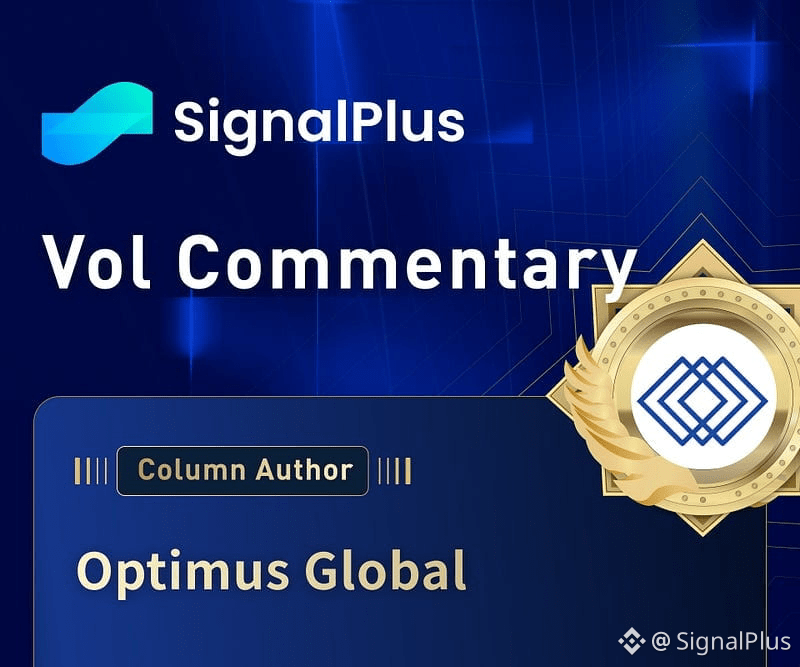

The BTC spot market continues the sideways motion it has exhibited since November end, frustrating both the bulls and bears with its falling realised vol. We can visualise the price action in a wedge which does lean slightly more probabilistically towards a final move lower (and ultimate reversal) but given the decent support seen over the last 2 months there is a good chance that this is part of a complex corrective movement higher (eventually). For now, the jury is out, but we hold the general view that the downside from here will be limited in both quantum of move and its volatility, whereas the topside has much more potential in terms of terminal movement, though again we don’t expect explosive price action or volatility here. Below $89k or above $95k are likely to catalyse a shift away from this holding period/wedge and we advocate patience while the market attempts to resolve its next move

Market Themes

First full trading week of 2026 and ultimately price action across asset classes was broadly muted as ‘full liquidity’ returned to the market and some of the extreme daily moves over the illiquid holiday period (in precious metals for example) began to normalise. The broad backdrop remains risk supportive and SPX printed a new all-time high, falling just short of the psychological $7k level and closing out the week around $6966. While geopolitical noise continues in the background (Venezuela, Iran, Greenland), the themes are untraceable on a day-to-day basis and market participants are looking to position themselves more structurally for the year ahead, looking through short term noise

Crypto once again lagged the move in the broad risk complex, after an encouraging start to the year lost momentum ahead of key resistance at $94–94.5k in BTC. ETF flows reversed to outflows for most of last week, leaving the net flows effectively flat on the year despite $1bn of net inflows after the first 2 days of the year. From a portfolio allocation perspective, it seems the market remains far more comfortable allocating to gold even at these levels for a currency (USD) debasement play, and for equity/risk-on the market still prefers to allocate directly to equities. Until we see a material shift in momentum/evidence of some upside vol, or a structural catalyst shift (e.g. US buying BTC for reserves), crypto may continue to be overlooked in favour of other assets in the current regime

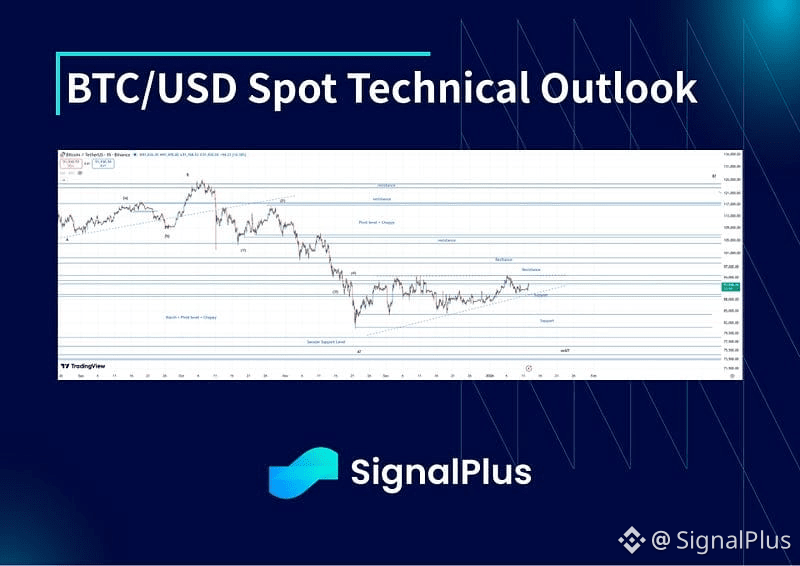

BTC$ ATM implied vols

Implied vols broadly trended lower last week as realised remained contained in a 30–35vol range, and the initial surge of topside buying to start the year faded (in fact flows turned to sellers/unwinds of topside after the failed break of $94k)

The term structure of implied vols began to steepen up as daily vols in short-dates priced down to the mid 30 region, converging to recent realised performance. This inevitably weighed on expiries out to end January, where daily vols were being priced in the mid-high 40s, leading to the steepening effect. While we remain in this $88–94k range the market will likely roll-down the front-end quite quickly and as such we could continue to see pressure on the front-end, while further out the curve the market is more cautious about structurally selling volatility at these levels after the bout of high volatility we saw in Q4 last year

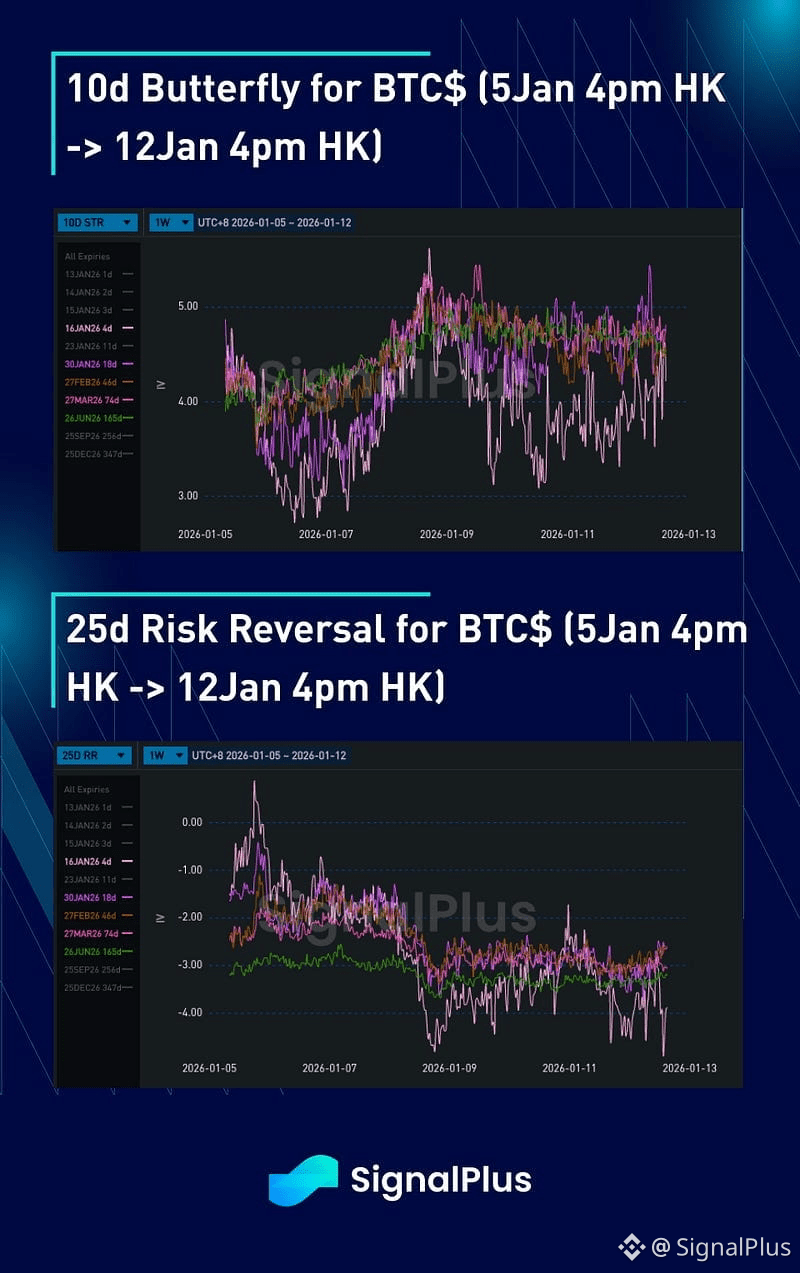

BTC$ Skew/Convexity

Skew prices moved further for puts over the course of the week as the initial upside momentum from the start of the year faded and some supply of topside vol hit the market. Realised volatility was muted on the move higher in spot, while it accelerated on the pullbacks in spot, suggesting quite a clear local spot-realised vol correlation. However given positioning is much cleaner and the macro backdrop remains supportive of risk, the market does not seem concerned about an extended volatile move lower at this juncture and this is keeping risk reversal prices relatively contained

Convexity prices have been broadly sideways as spot finds a footing in the broad $88–94k range. Directional plays either side of this range have been in call-spread or put-spread format supplying more wings to the market, with limited expectation of a material break of this range anytime soon

Good luck for the week ahead!