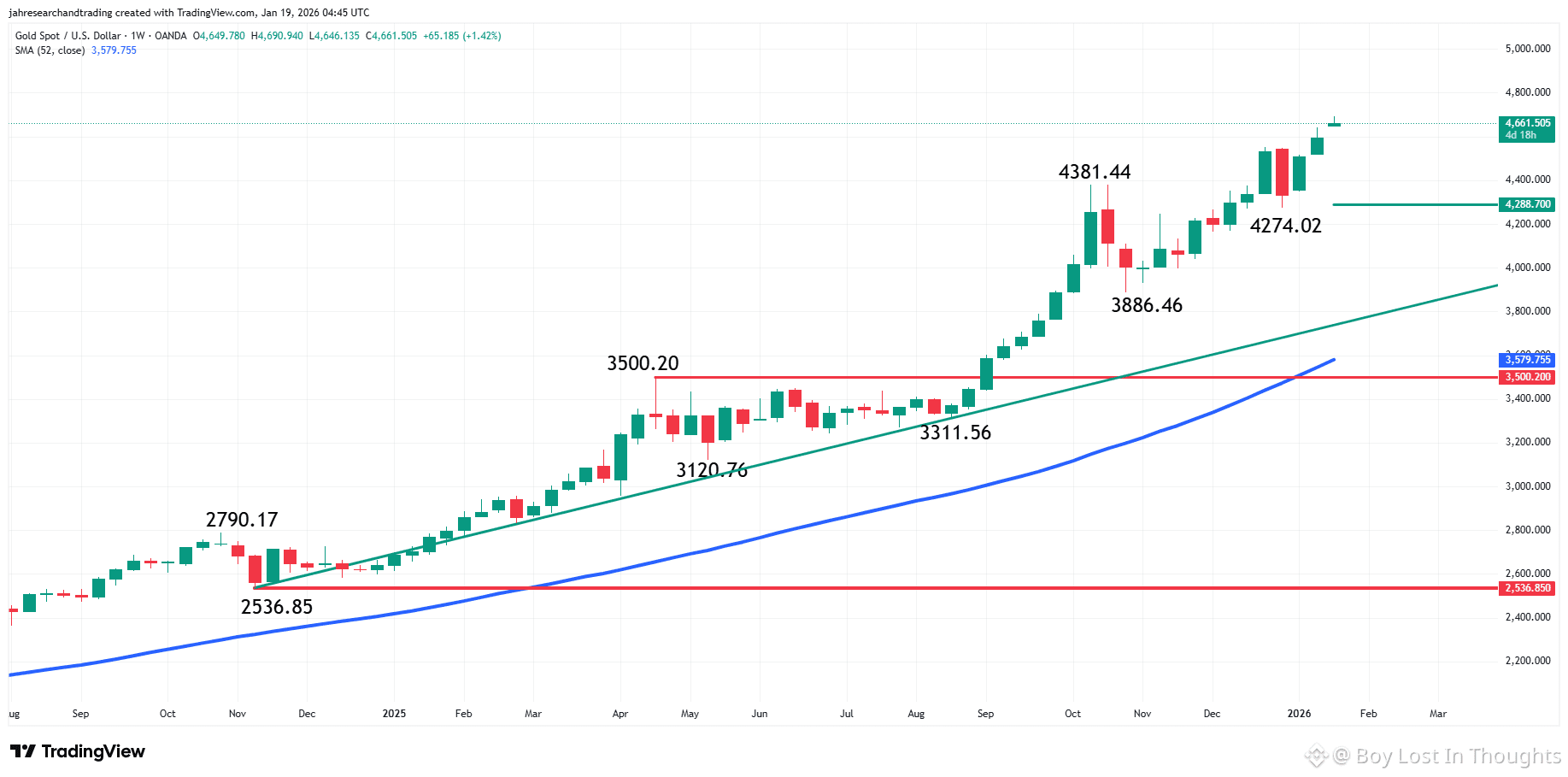

Gold surged to a new all-time high above $4,690 early this week, driven by safe-haven demand following former President Trump's tariff threats toward European nations over Greenland. The rally extends last week’s record-breaking performance, fueled by central bank buying, geopolitical tensions, and shifting U.S. monetary policy expectations. This week, traders are watching U.S. PCE inflation data and consumer sentiment figures for further direction.

Major Points Highlighted:

💰 Record High: Gold broke above $4,690, continuing its unprecedented rally.

🛡️ Safe-Haven Demand: Trump’s Greenland tariff threats spurred buying amid geopolitical uncertainty.

🏦 Central Bank Support: Structural de-dollarization moves by central banks propelled gold past $4,600 for the first time.

📉 Fed Policy in Focus: Recent U.S. data has shifted rate-cut expectations to June 2026, impacting gold's momentum.

📊 Key Data Ahead: Thursday’s PCE inflation report and Friday’s Michigan Consumer Sentiment data could determine if gold extends gains.

⚔️ Geopolitical Watch: Tensions with Iran and U.S. military movements remain market-sensitive.

📈 Bullish Technical Setup: The trend remains upward, with strong support near $4,288.

Bottom Line:

Gold’s rally is being driven by a mix of geopolitical risks, central bank demand, and shifting Fed expectations—with key U.S. economic data ahead likely to dictate the next move.