Key metrics: (12Jan 4pm HK -> 19Jan 4pm HK)

BTC/USD +1.1% ($91,700-> $92,700), ETH/USD +1.6% ($3,150 -> $3,200)

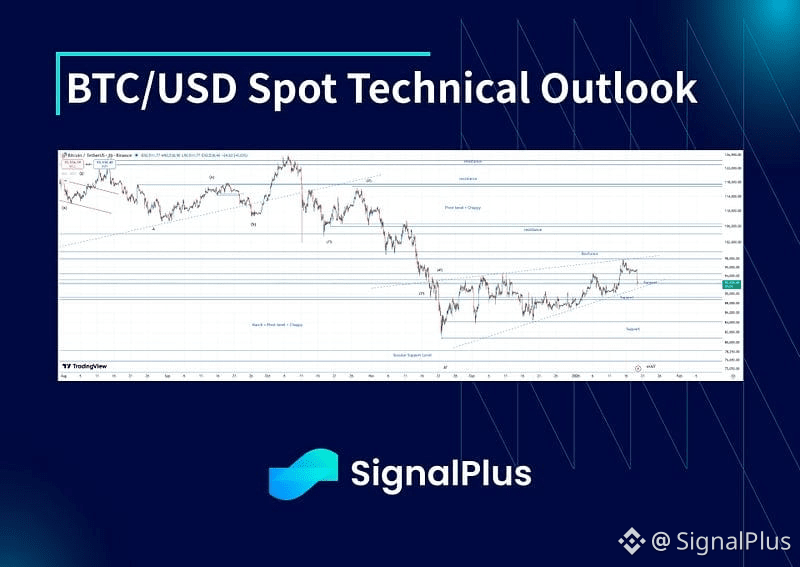

The jury is still out on the next directional move for BTC, with initial positivity on the break of $94.5–95k resistance early last week failing to follow through — touching briefly the next key resistance level at $98k before retracing quickly. The move back below the $94.5k pivot early Asia Monday morning has put us firmly back in the wedge formation that may suggest another test of $92k, ahead of more material support down at $88–90k

We continue to maintain the view that the downside should be more contained in both quantum of move and expected volatility compared to the top side, but that it could take a little longer before we start breaking out higher. Below $88k and above $98–100k are the key range resistance levels, with spot likely to chop between for now

Market Themes

The broad risk supportive backdrop that we’ve had so far in 2026 continued as the market resumed allocating to risk for the year ahead, with equities buoyant and the USD initially gaining some footing after a big sell off last year with Fed rate cuts being pushed further out on the back of strong US data. Of course it’s never that straightforward with Trump in charge and weekend headlines of Tariffs on Europe pertaining to Greenland negotiations set the USD back on the Asia Monday open and put equity futures in the red (US holiday today so we won’t know where the market really settles until tomorrow), also putting crypto under pressure as the equity-beta dominated vs the USD-beta. Ultimately while equities have looked well supported, momentum has definitely been waning ahead of the psychological level of $7k in SPX, and the new-year inflows are likely to fade in the coming weeks which could lead to some downward pressure especially if geopolitical noise continues to bubble away

Crypto initially saw some upward momentum last week as continued buying from Saylor buoyed spot back above key resistance at $94k, and this upward momentum coupled with a risk-supportive backdrop attracted four consecutive days of large ETF inflows last week, only to be reversed by outflows Friday and then the Monday Asia sell-off on Trump tariffs plus threats of pulling support for the crypto market structure bill in light of the stand-off with Coinbase. Unfortunately the lack of upside vol and the persistent weakness on any risk sell-off continues to put crypto in the ‘high risk, low reward’ category of assets out there, and this may continue to be a hurdle preventing a more fundamental shift in the inflow/allocation dynamic that is needed to really see spot push back through the pivotal $100–101k resistance level

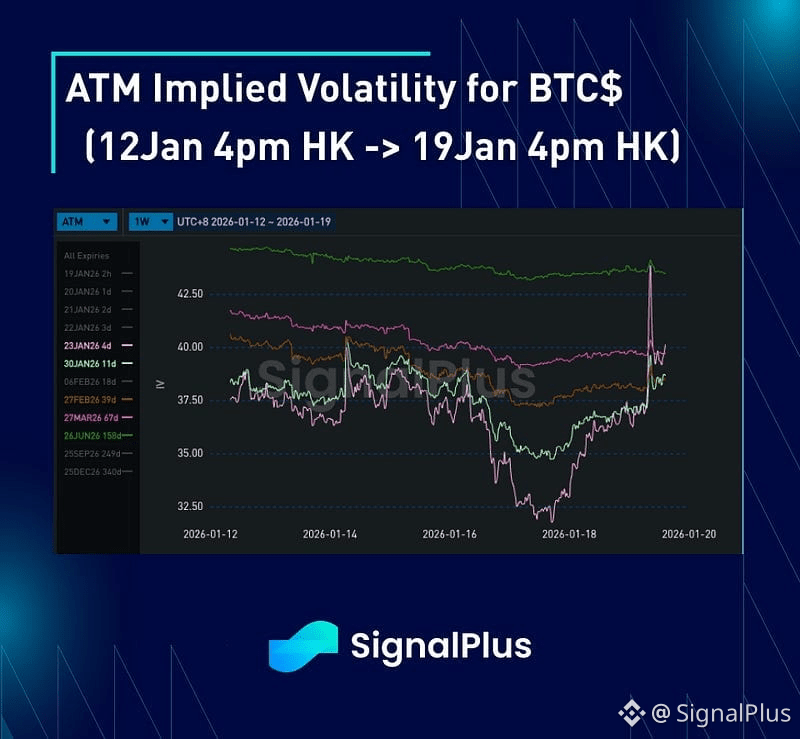

BTC$ ATM implied vols

Implied vols broadly trended lower last week as realised remained contained in a 30–35vol range, despite a couple of high realised vol days on the initial break of $94k and then on the eventual reversal below $94k. Buyers of calls were briefly seen on the break above $94k, though the market absorbed the demand quickly and the lack of momentum and realised following the break saw implieds trade lower quickly, with the market clearly long some legacy topside from over-writing flow. On the flipside the market saw some short-dated downside protection buying on the Monday morning plunge below $94k, though again without any extension in price action the market has been able to digest the demand, suggesting the overhang of long vol/gamma is quite large

The term structure of implied vols continued to steepen out last week as the daily vols began pricing down to the low 30s in line with recent realised, and this put pressure on the 2w-1m region in particular where daily vols were still pricing in the 42–45 region

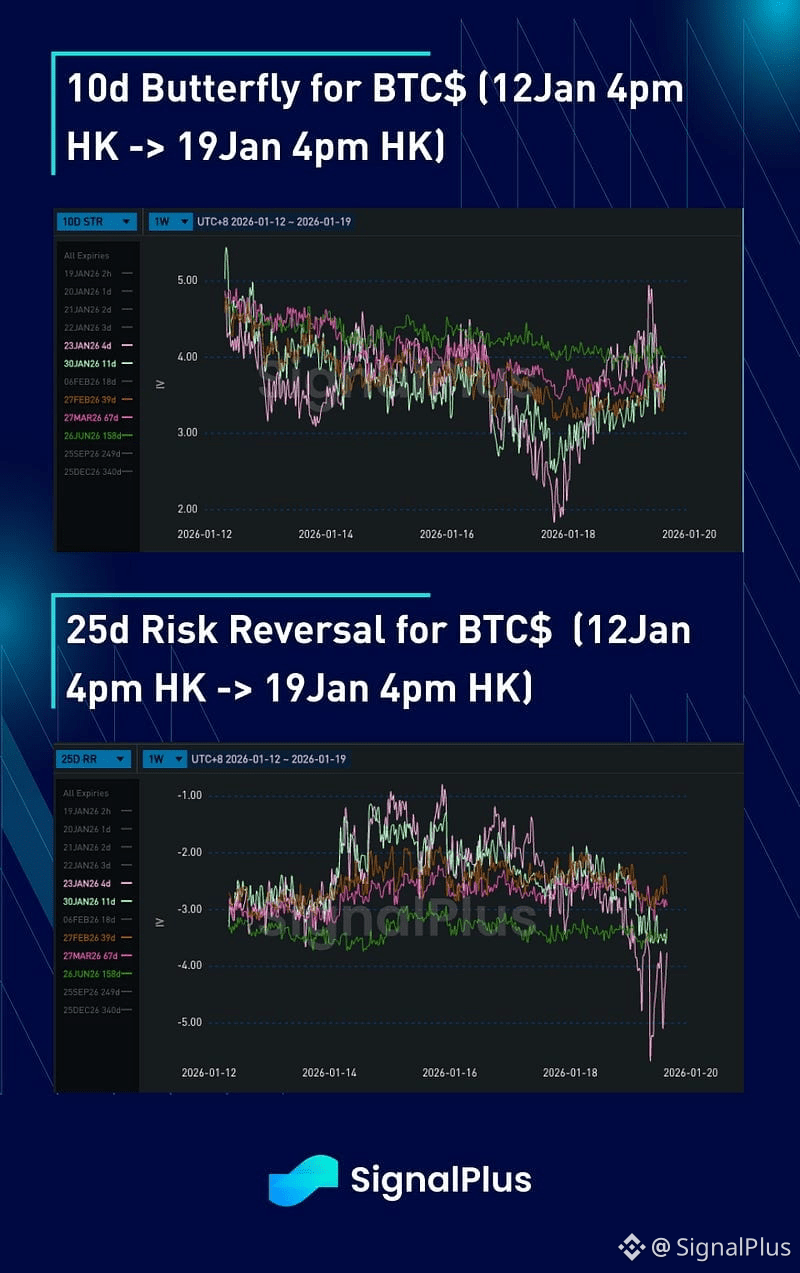

BTC$ Skew/Convexity

Skew prices moved less negative (puts remained higher than calls but by a narrower margin) at the start of the week, respecting the technical break higher in spot above $94k and the subsequent call buying demand that followed. However skew prices struggled to materially price for calls over suggesting the market does not have any material derive issues on the topside, and as spot stalled and momentum waned, the market began to move riskies further negative quickly, before the plunge below $94k on Monday morning saw a fairly quick reprice in short-dated skew particularly

Convexity prices have been broadly sideways as spot finds a remains in the broad $88–98k range. Directional plays either side of this range have been in call-spread or put-spread format supplying more wings to the market, with limited expectation of a material break of this range anytime soon

Good luck for the week ahead!