Everyone talks about speed and fees but Plasma is betting that boring reliability is what crypto actually needs.

When I analyzed the current Layer 1 landscape something felt off. Dozens of chains are still competing on raw TPS numbers even though most real users don't experience blockchains through stress tests or dashboards. They experience them when sending money settling trades or moving stablecoins across borders. Plasma stood out to me because it does not feel like it’s chasing the next narrative cycle. It feels like it’s preparing for what crypto looks like after speculation matures.

Stablecoins have quietly become the backbone of crypto. According to Visa’s Onchain Analytics report published in 2024 stablecoins processed more than $11 trillion in settlement volume over the last year exceeding Visa’s own annual transaction volume. Yet most of this activity still runs on infrastructure that was never optimized for payments. In my assessment, Plasma is one of the first Layer 1 that openly admits this mismatch and builds directly around it.

Why Plasma treats stablecoins like infrastructure not just assets?

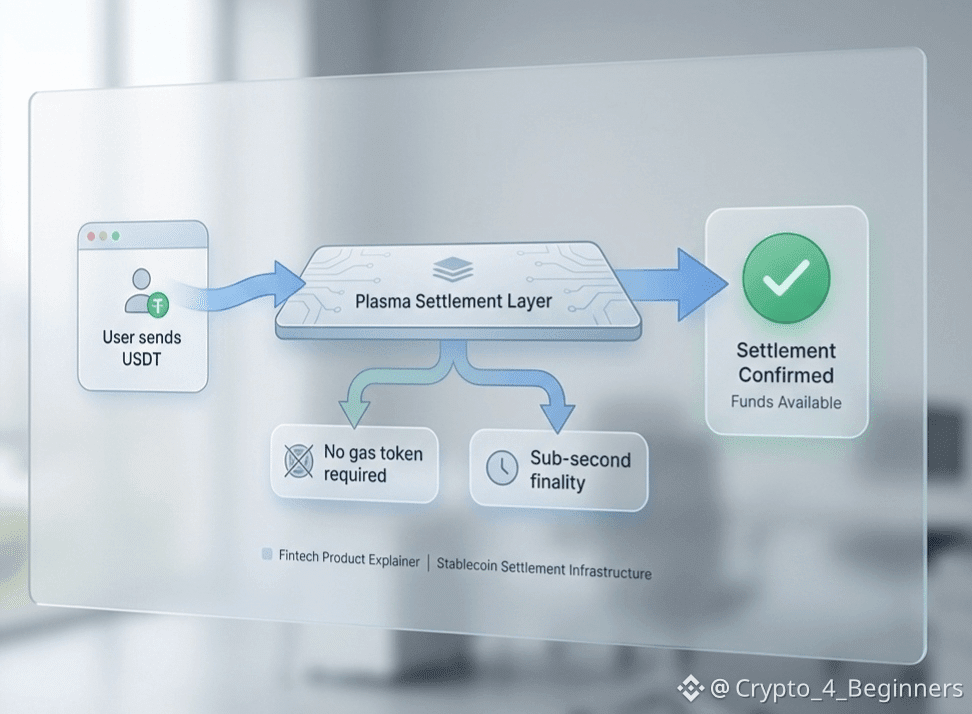

My research into Plasma’s design made one thing clear is this chain is less concerned with maximizing optionality and more focused on reducing friction. Plasma allows gasless USDT transfers at the protocol level meaning users don’t need to hold XPL just to send dollars. That may sound like a small UX tweak but if you have ever onboarded a new user in an emerging market, you know how often “you need ETH for gas” becomes a dead end.

To put this into context, Tether’s own transparency page shows that USDT now has over 350 million users globally with the highest growth rates in Latin America, Africa and Southeast Asia. These are regions where users care less about DeFi composability and more about whether a transaction settles instantly and cheaply. Plasma’s sub second finality via PlasmaBFT directly targets that need making transactions feel more like sending a message than waiting for block confirmations.

A useful chart here would compare average confirmation times for USDT transfers across Ethereum, Tron, Solana and Plasma under normal network conditions. Another visual could show effective transaction cost volatility during periods of congestion highlighting how gasless transfers change user behavior. A simple conceptual table could also compare user requirements across chains such as needing a native gas token, confirmation certainty and average settlement delay.

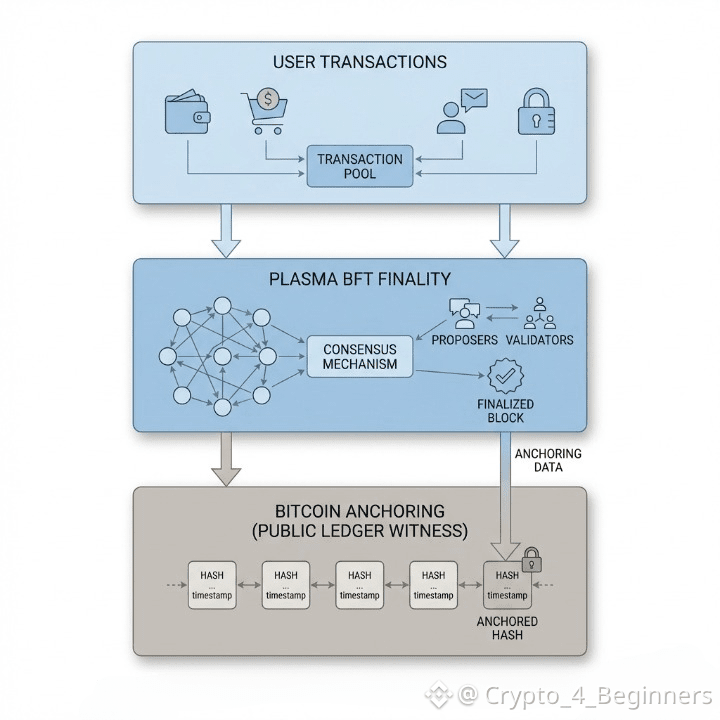

What I find interesting is that Plasma did not invent exotic new cryptography to achieve this. Plasma BFT is derived from Hot Stuff style consensus a model already used in enterprise systems and researched extensively in academic literature. I often explain it like a coordinated hand raise instead of a roll call. Everyone agrees at once rather than waiting in line which drastically reduces confirmation time.

Bitcoin anchoring signals a long term view on trust

One of the most misunderstood aspects of Plasma is its Bitcoin anchoring. Many traders initially assume this is a marketing hook aimed at Bitcoin maximalists. Once I looked closer the explanation made a lot more sense. Bitcoin really stands out as the most politically neutral censorship resistant blockchain out there and honestly even regulators seem to recognize that whether they say it out loud or not.

According to the Bank for International Settlements 2024 Annual Economic Report neutrality and auditability are two of the biggest concerns institutions have when evaluating blockchain settlement layers. Plasma periodically anchors state commitments to Bitcoin and enables BTC backed liquidity through pBTC which is minted via a trust minimized bridge. In simple terms. Plasma uses Bitcoin like a public ledger witness making history harder to alter without detection.

Stablecoins are not just for regular folks anymore. Circles 2024 report found that more than 70% of fintech companies already use stablecoins for things like settling accounts internally or making cross border payments. These institutions don’t just want speed. They want real finality and neutrality. That’s where Bitcoin anchoring comes in. It gives Plasma a layer of trust and credibility that most proof of stake chains just can’t offer.

Picture a simple table that lays out how different Layer 1 chains handle security is pure proof of stake, Ethereum rollups and then Bitcoin anchored setups like Plasma or imagine a diagram showing how a Plasma transaction moves from when the user sends it to Plasma BFT finality to finally anchoring on Bitcoin. It’s a clear way to show how these layers stack up to protect users.

Honestly, I think this design sets Plasma up for a world where compliance and decentralization are not enemies. They are things you have to balance carefully. Plasma’s planned privacy options like zero knowledge selective disclosure push this even further. They let users protect their data without dragging Plasma into any regulatory mess.

Adoption signals suggest Plasma is building for the next phase of crypto

What ultimately convinced me that Plasma deserves attention was not just the architecture but the early adoption signals. Public reporting from CoinDesk and The Block confirmed that Plasma raised over $500 million in combined funding and liquidity commitments with participation from Tether affiliated entities and Founders Fund. That level of backing suggests this is not a short term experiment.

Even more telling is liquidity behavior. During Plasma’s early beta phase more than $5.5 billion in stablecoins was committed according to figures shared by the team and echoed by multiple crypto analytics outlets. Liquidity tends to be brutally honest. It does not move unless there is a clear use case or strategic incentive.

Plasma’s decision to use Reth an Ethereum client built in Rust fits right in with where the industry’s heading. The Ethereum Foundation keeps pushing for more client diversity to make the network stronger and honestly. Rust is becoming a popular choice because it’s fast and has a solid reputation for safety. Plasma inherits Ethereum’s tooling while tuning execution for payments rather than yield farming congestion.

Messari’s 2025 Crypto Theses report says payments and stablecoin infrastructure will likely do better than broad DeFi platforms when speculation cools off. That matches what I have seen as a trader. When markets get quiet projects with real usage stick around while hype fades fast.

I keep asking myself a simple question. When the next wave of users enters crypto will they care which chain had the highest TPS in 2023 or will they care whether their money arrived instantly and intact? Plasma feels like it’s answering that question ahead of time.

If Plasma succeeds it won’t dominate headlines every week. It will quietly sit underneath payment flows, treasury movements and cross border settlements. In a market obsessed with visibility and noise betting on invisible infrastructure might be the most asymmetric trade of all.