The Epstein files show that Bitcoin was discussed and evaluated by elite networks as early as 2011 long before mainstream adoption or institutional interest.

Early capital and institutional funding played a significant role in shaping Bitcoin’s development path including developer support infrastructure choices and ideological direction.

A 2016 email suggesting contact with multiple Bitcoin creators reopens questions about Satoshi Nakamoto’s identity and highlights how incomplete the public understanding of Bitcoin’s origins remains.

When the US Department of Justice released a large batch of Epstein related documents in late January the public focus quickly locked onto familiar names. Politicians. Tech executives. Billionaires. Party guest lists. Island travel records.

At first glance this looked like another chapter in a long running scandal. But buried inside the emails and attachments was something unexpected. Bitcoin kept appearing. Not as a joke. Not as a footnote. But as a recurring topic in serious conversations between Epstein and some of the most influential figures in technology and finance.

This was not Bitcoin in hindsight. These discussions took place between 2011 and 2014. At a time when Bitcoin trading volume was tiny and public understanding was close to zero. Long before institutions. Long before ETFs. Long before the idea of digital gold entered mainstream finance.

The documents suggest that Bitcoin was already being studied by people at the very top. And not casually.

BITCOIN WAS NEVER JUST AN UNDERGROUND EXPERIMENT

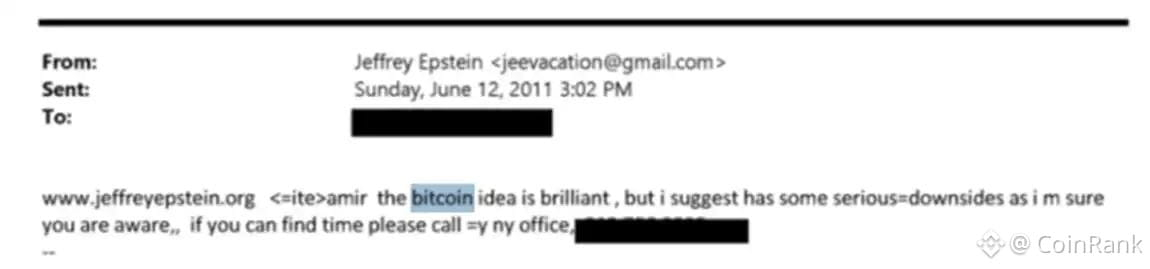

In 2011 Epstein described Bitcoin as a brilliant idea with serious flaws. That timing matters. It was the same year Bitcoin experienced its first major boom and collapse. At that stage most of the world still viewed Bitcoin as an obscure experiment used by hobbyists and fringe communities.

Yet Epstein was already discussing its structural weaknesses. Its ideological contradictions. Its long term implications. These were not retail level conversations. They were the kind of discussions held by people thinking in systems not trades.

By 2013 Bitcoin began to appear more frequently in his emails. Not just Bitcoin itself but the people around it. Advisors. Developers. Early investors. Infrastructure builders. Epstein was not just observing from the outside. He was embedded in the discussion loop.

This matters because it challenges a popular narrative. Bitcoin is often described as something that grew organically from the margins until it surprised the world. The documents suggest a different reality. From a very early stage Bitcoin attracted attention from elite networks that specialize in spotting structural shifts before they become visible.

IDEOLOGICAL BATTLES AND EARLY CAPITAL PRESSURE

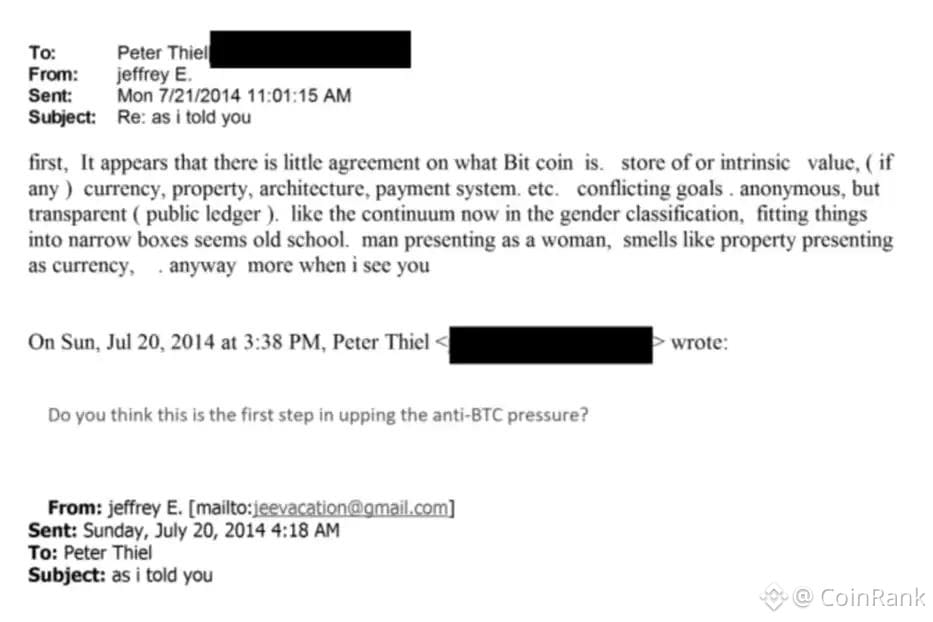

By 2014 Bitcoin was no longer just software. It was an ideological battlefield. Developers and investors disagreed on what Bitcoin should become. A currency. A store of value. A new type of property. Or something entirely different.

Epstein entered this phase not as a theorist but as a participant. Through fund structures he was connected to early investments in Blockstream. A company that played a central role in shaping Bitcoin Core development and promoting a conservative approach to protocol changes.

At the same time other projects such as Ripple and Stellar were pushing faster settlement models and closer relationships with financial institutions. Emails show tension between these camps. Not just technical disagreement but concern over capital alignment.

One message suggested frustration that investors were backing multiple competing visions at once. The implication was clear. Capital was not neutral. It could shape outcomes by deciding which paths received long term support and which ones did not.

This raises an uncomfortable question. How many alternative Bitcoin futures never materialized not because they failed technically but because they lost early capital backing.

THE MIT FUNDING QUESTION AND DEVELOPER CONTROL

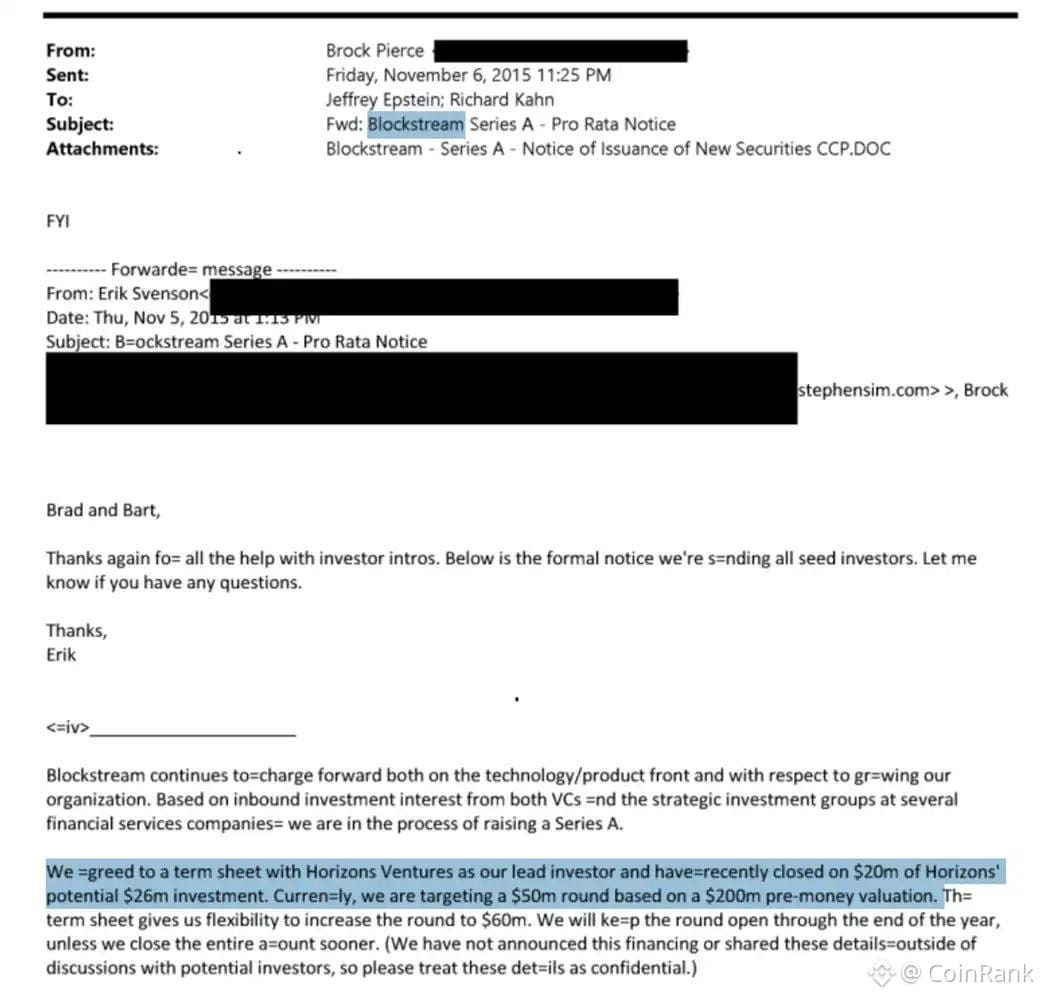

One of the most sensitive periods in Bitcoin history came after the collapse of the Bitcoin Foundation. Core developers faced funding uncertainty. Salaries were unstable. Governance structures were fragile.

During this period the MIT Media Lab Digital Currency Initiative stepped in to fund several Bitcoin Core developers. Publicly this was framed as academic support for open source research.

The Epstein documents add new context. The Media Lab had received anonymous donations from Epstein. Internal emails expressed gratitude and emphasized that this funding allowed the lab to move quickly and secure key wins. Including keeping Bitcoin developers from being influenced by other organizations.

That phrasing matters. It reveals a belief that developers could be controlled. Or at least guided. Through funding stability.

This does not prove that Bitcoin development was captured. But it does prove that powerful actors believed influence was possible. And that they were actively trying to prevent rival influence.

Bitcoin did not evolve in isolation. It evolved inside a network of institutions incentives and funding flows.

DID EPSTEIN MEET BITCOIN CREATORS

The most explosive line in the documents appears in a 2016 email. While pitching currency ideas to Middle Eastern officials Epstein casually mentioned that he had spoken with some of the creators of Bitcoin. He said they were enthusiastic.

The wording is precise. Creators. Plural.

This single sentence reopens one of the oldest questions in crypto. Was Satoshi Nakamoto an individual or a group. If Epstein believed the latter it suggests he thought their identities were known at least within certain circles.

It is possible this was exaggeration. Epstein often used association as a credibility tool. But it is unlikely he would invent such a claim without believing it would be accepted as plausible by his audience.

If he truly met Bitcoin creators then the implications are massive. It would suggest that Bitcoin was never as anonymous as believed. And that governments may have known more than they publicly admitted.

There is no direct proof. But the silence around the issue is notable.

THE IRONY OF EPSTEIN AND BITCOIN

Despite his proximity to early Bitcoin discussions Epstein never became a true believer. In 2017 when asked whether it was worth buying Bitcoin he replied with a simple no.

History did not choose him.

Bitcoin continued to grow beyond the control of any single individual or network. Yet the documents make one thing clear. The myth of Bitcoin as a completely untouched grassroots creation is incomplete.

WHAT THE FILES REALLY CHANGE

Nearly half of the Epstein documents remain unreleased. It is unclear what additional names or connections may still surface. What is already clear is that Bitcoin’s early history was more intertwined with elite capital and institutional power than many would like to admit.

This does not weaken Bitcoin. If anything it strengthens the case for understanding it honestly.

Decentralization is not a starting condition. It is a process. And that process was shaped by real people with real influence making real decisions behind closed doors.

The fog has not fully lifted. But its outline is finally visible.

〈Epstein Files and the Early History of Bitcoin: A Hidden Line of Power and Capital〉這篇文章最早發佈於《CoinRank》。