The market is missing the biggest pivot in Ethereum history.

For the last two years, the "Smart Money" trade was to Long L2s and Short L1. That trade ended this week.

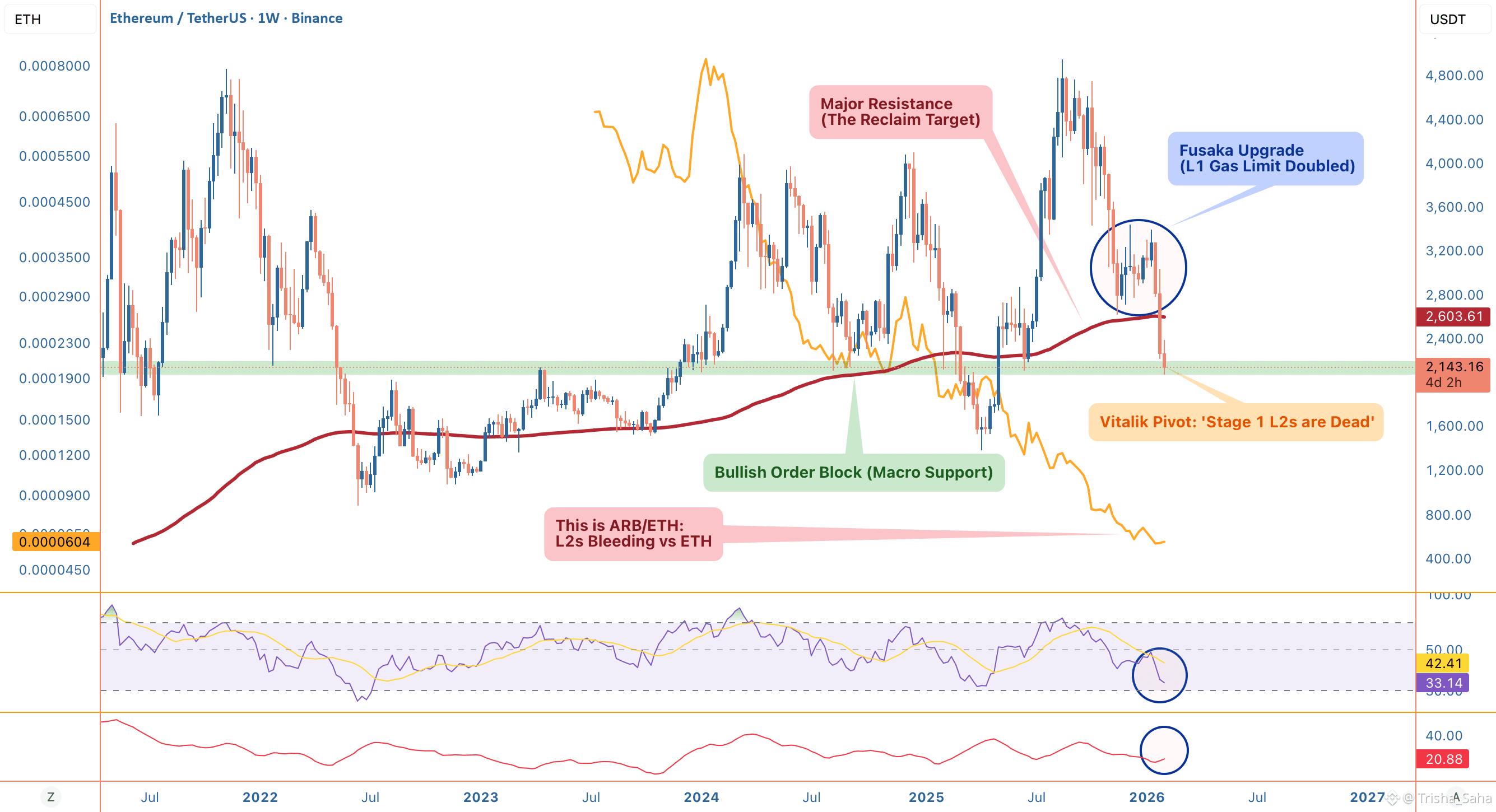

On February 3, Ethereum co-founder Vitalik Buterin published a seminal critique declaring that the "Rollup-Centric Roadmap" (L2s acting as branded shards) "no longer makes sense".

Why? Because Ethereum L1 is scaling faster than anyone expected, and "Generic L2s" are failing to decentralize. Today, we are going to analyze the Fundamentals (The Research) and the Technicals (The Charts) to prove why the rotation back to Mainnet has already begun.

__________________________________________________________________________________

1. THE FUNDAMENTAL SHIFT (L1 is the Captain Now) 🚢

The narrative that "L1 is unscalable" was shattered by the recent upgrades.

* The "Fusaka" Upgrade: This upgrade has already doubled the L1 Gas Limit to 60 Million. Developers are now targeting 200M gas later this year.

* The Reality: With L1 capable of handling 20-30 TPS at sub-2 gwei fees, the average user does not need to bridge to a centralized L2 anymore.

* The "Stage 2" Ultimatum: Vitalik explicitly stated that L2s relying on multisigs (Stage 1) are NOT scaling Ethereum.

The "Parasitic" Economics ⚠️

Why is this bearish for L2 tokens? Look at the revenue split.

* Base Revenue (2025): >$75 Million.

* Rent Paid to ETH: ~$1.52 Million.

* The Squeeze: Base is operating at a 98% profit margin. But with the new EIP-7918, L2s will be forced to pay a "Price Floor" for blobs, crushing their margins and forcing revenue back to L1.

__________________________________________________________________________________

2. THE TECHNICAL PROOF (The Charts Don't Lie) 📉

The "Smart Money" is actively dumping L2 governance tokens to buy Spot ETHUSD.

A) ARBETH (The "Dilution" Chart)

This chart confirms the "L2 Death" thesis.

* Trend Strength: The ADX is at 63.6 (Weekly). This is not a dip; it is a violent, trending crash.

* Structure: Price is trading below every major EMA (20, 50, 200). We have broken all support.

* Target: The bearish structure points to a flush to the swing low at 0.000029 ETH (-51% from here).

B) $OPETH (No Buyers)

* Price Action: We just printed a "Hammer" candle, but with Low Volume ($119k). Without institutional volume, this is just a pause before the next leg down.

* Risk: If support breaks, there is no structural demand until 0.000063 ETH.

__________________________________________________________________________________

3. THE "COMEBACK KING" PLAY (

ETHUSD) 💎

While L2s bleed, Ethereum is setting up for a "Generational Opportunity."

* The Zone: We are testing critical support at $2,112 (Bottom of the Bullish Order Block).

* The Signal: Weekly RSI is resetting at 30 (Oversold border).

* The Confirmation: ADX has dropped to 20. This is the "Smoking Gun." It means the bearish trend momentum has died. Sellers are exhausted, and the reversal structure is building.

__________________________________________________________________________________

🎯 THE VERDICT

The "Pure Rollup" narrative is fading.

* Sell: Generic L2s (ARBETH, $OPETH) -> They are losing their moat.

* Buy: Spot ETH (at $2,112) -> Captures the value of returning L1 users.

* Watch: Only "Specialized" L2s (like Fuel or Aztec) are safe from the pivot because they offer features L1 cannot (Privacy/UTXO).

Are you rotating back to Mainnet?

Vote Below! 👇

A) Yes, Long ETH (L1 is King) 💎

B) No, Long L2s (Fees are lower) ⚡