After failing to break through resistance, gold (XAU/USD) is now in a consolidation phase, trading within a broad range. The market is currently pausing as buyers defend critical support levels and decide the next directional move.

Key Points:

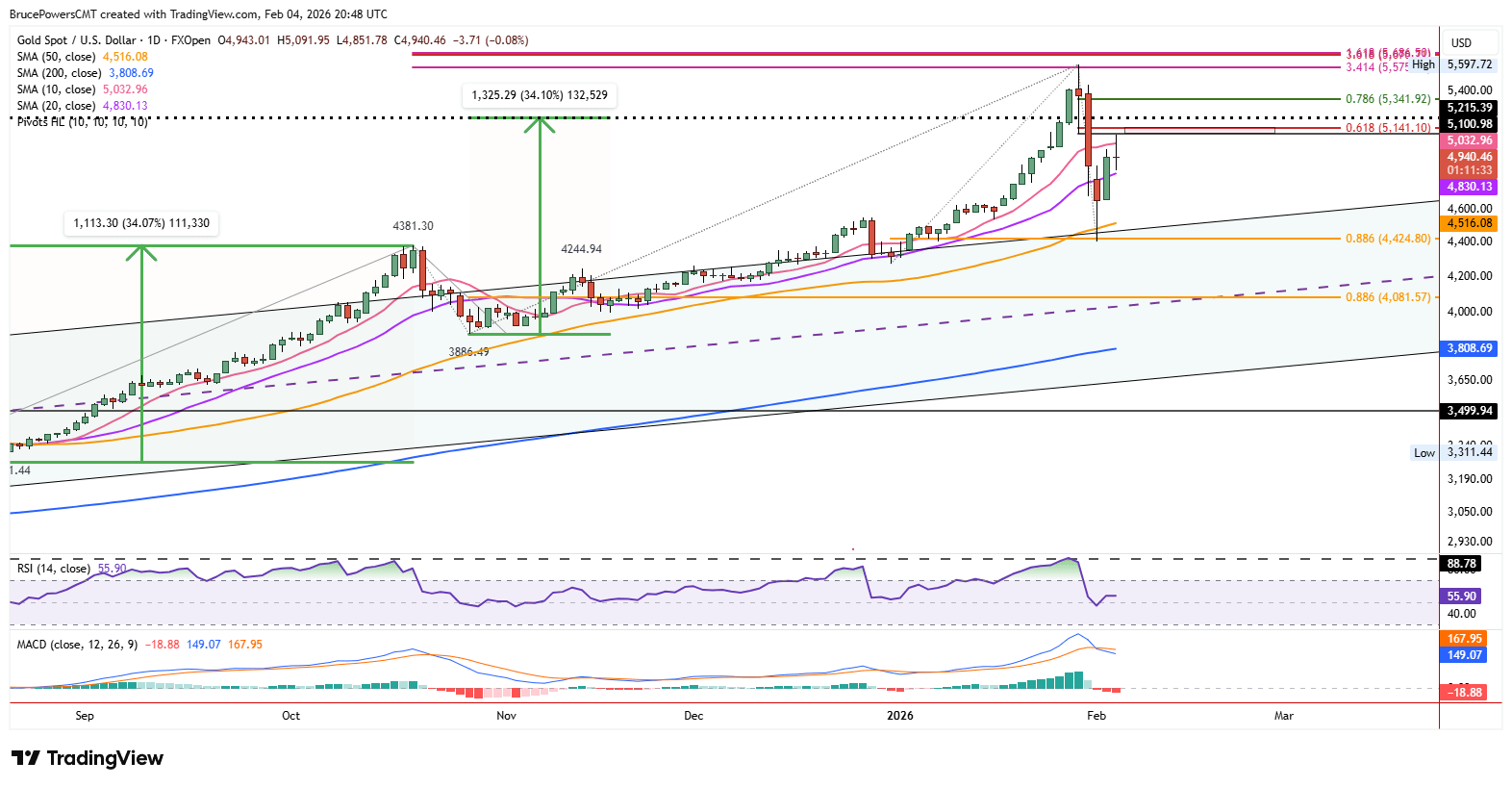

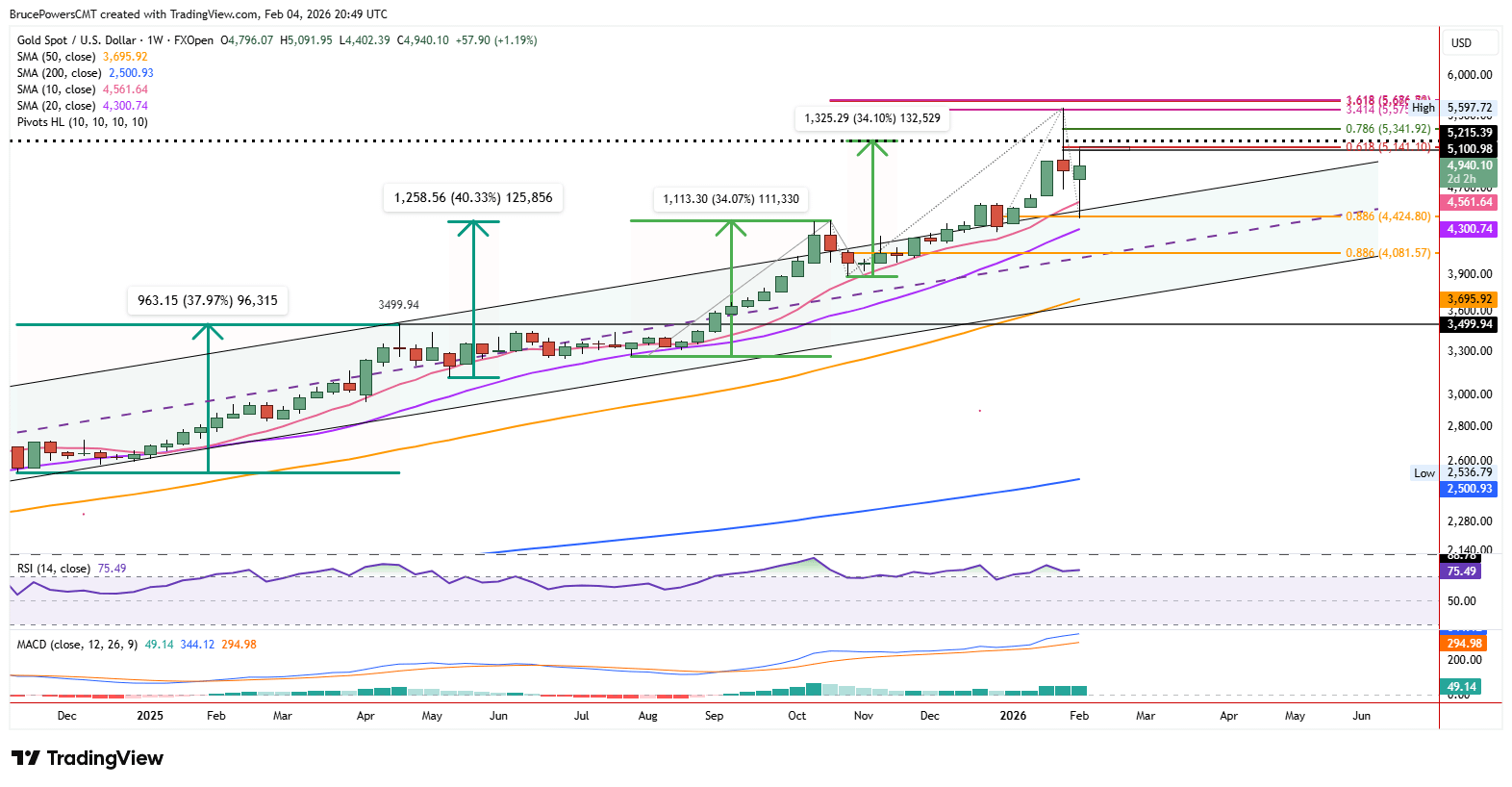

Failed Breakout & Consolidation: Gold's rally was rejected at the $5,092 resistance level, leading to a failed breakout above the 10-day moving average. This signals a potential pause or short-term pullback.

Key Support Holds: Buyers are actively defending the 20-day and 50-day moving averages. A higher daily low at $4,852 and a strong bounce from the 50-DMA ($4,516) confirm underlying buyer strength and keep the intermediate bull trend intact.

Range-Bound Trading: Price action is currently contained within a wide range of $4,402 to $5,598, indicating choppy conditions. Moves within this range may not follow typical patterns.

Critical Resistance Ahead: The next major upside hurdles are the 61.8% Fibonacci level at $5,141 and the 78.6% Fibonacci level at $5,342. A rally toward these zones could reignite bullish momentum.

Overall Trend Still Bullish: As long as gold holds above the 50-day moving average, the broader bullish trend remains in place despite the current consolidation.