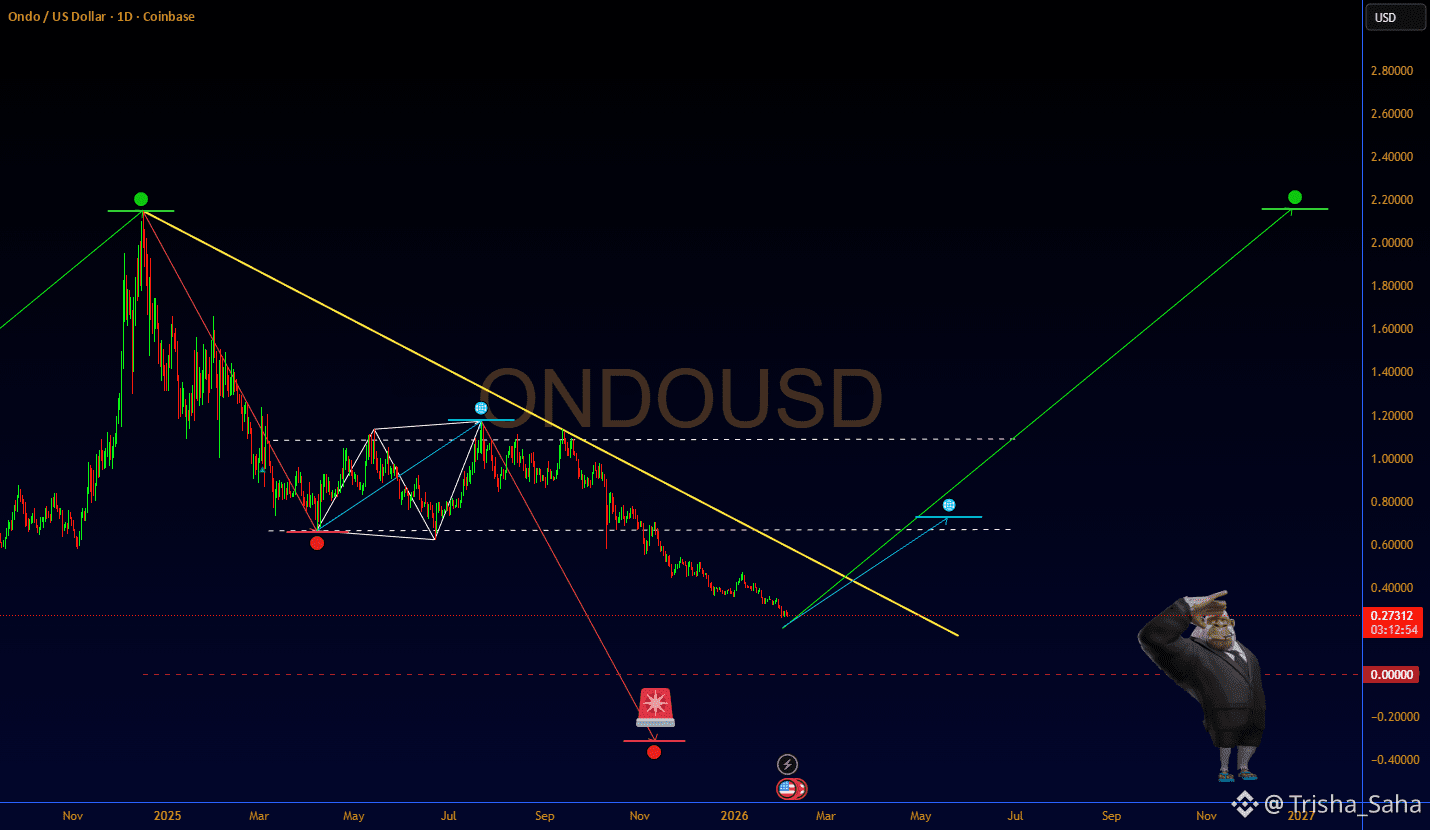

ONDO Dips to $0.28: RWA Gem Undervalued Amid 2026?

1Grab this chart

18

Title: 🚨 ONDO Dips to $0.28: RWA Gem Undervalued Amid 2026 Unlocks or Supply Trap? Deep Dive!

Hello TradingView community! 👋

Today, let's dive into ONDOUSD with a detailed analysis focusing on fundamentals, SWOT, and technicals. 📊 This isn't financial advice just an in-depth look based on public data.

Current Snapshot:

Price: $0.28 💵

52-Week High/Low: $2.14 / $0.20 📈📉

Market Cap: $2.84B 💰

Fundamental Analysis (e.g., Intrinsic Value and Ratios):

For crypto tokens like ONDO (governance for RWA tokenization), adapt traditional methods to tokenomics and protocol metrics. No EPS or D/E, but use MC/TVL ratio (1.1x at $2.84B MC / $2.6B TVL), book value per token approximated via circulating supply (~3.2B pre-unlock, post ~5.1B after 1.94B unlock).

For instance, DCF models might project a value range of $0.30 to $0.50 based on growth assumptions of 20% TVL increase (historical 39% rise), terminal growth 5%, and 15% discount rate, using annualized fees ~$64M as cash flow proxy. Compare to peers for relative valuation (e.g., Centrifuge lower MC/TVL but less adoption; ONDO premium due to institutional ties).

Key ratios: Negative ROE analog ( -75% 1-year return), P/E N/A, but FDV/Fees ~42x highlights efficiency and valuation status (undervalued below $0.30 without unlock pressure, but $0.41 to $0.74 forecasts imply upside post-absorption). 📈

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats):

Strengths: 💪 Leader in RWA tokenization with $2.6B TVL, products like OUSG/USDY for tokenized Treasuries, institutional partnerships (Franklin Templeton, MetaMask), and scalable multi-chain presence.

Weaknesses: ⚠️ Heavy supply unlocks (1.94B tokens in Jan 2026, 61% increase), high volatility from market corrections (88% drawdown from ATH), and limited direct revenue accrual to token holders.

Opportunities: 🌟 Growing RWA market with regulatory clarity, new integrations (e.g., Solana stocks, perpetuals platform), and events like Ondo Summit driving adoption.

Threats: 🛑 Competition from Centrifuge/others, macro risks delaying institutional inflows, and persistent unlock dilution until 2026.

Technical and Risk Insights:

Incorporate non-repainting indicators like 200-day SMA ($0.70) for support/resistance. Current RSI (30) signals oversold 🚨. Risk factors: Volatility (beta ~1.8 vs BTC, implied from altcoin nature), or factor exposure (e.g., to interest rates via Treasuries).

Consider performance attribution how much return comes from sector vs. stock selection (60% from RWA trends vs. ONDO-specific unlocks). 📉

Historical Context and Examples:

ONDOUSD has shown -75% annualized returns over 1 year, with examples like the Jan 2026 unlock leading to recovery potential (from $0.20 low rebounding amid TVL growth).

This illustrates how methods like SWOT or relative valuation can inform decisions in real markets. 📜

What do you think does this align with your view on ONDOUSD for 2026? Share your analyses or charts below! ❓