BITCOIN – What timing for the end of the bear market?

It has now been 122 days since Bitcoin printed its cyclical peak at USD 126,000. Since then, its price and time evolution has been reproducing, with almost unsettling precision, the structure of the 2022 bear market—the last genuine “bear market.” However, caution is required: this analogy has its limits and cannot hold indefinitely.

$BTC is currently showing a drawdown of around 40% from its all-time high reached on Monday, October 6. Historically, from one bear market to another, the magnitude of drawdowns has tended to decrease, while still remaining consistently above 70%. Personally, I believe that the drawdown of the current cycle will be more moderate, mainly due to the now significant weight of institutional players, which is unmatched compared to previous cycles.

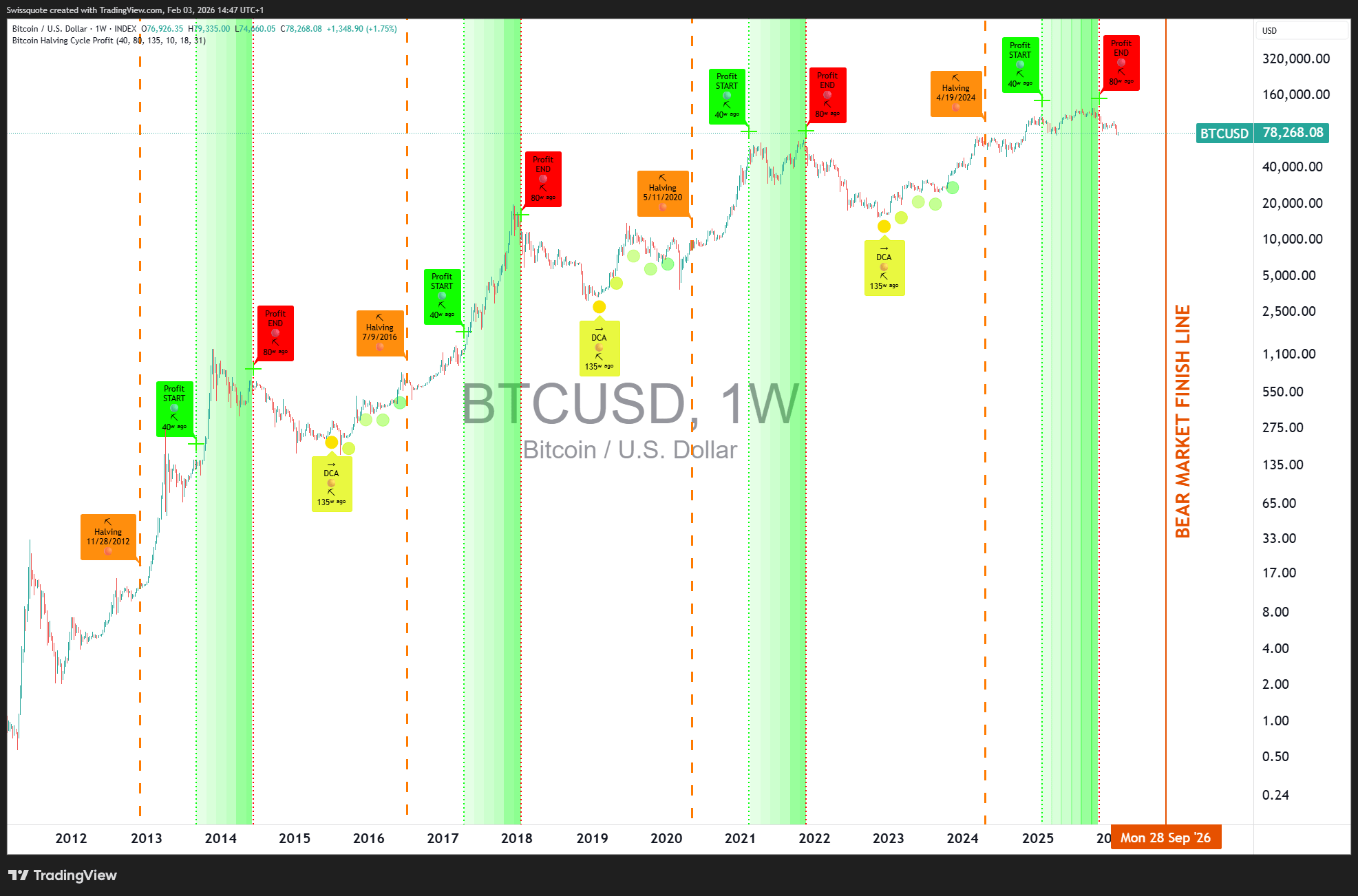

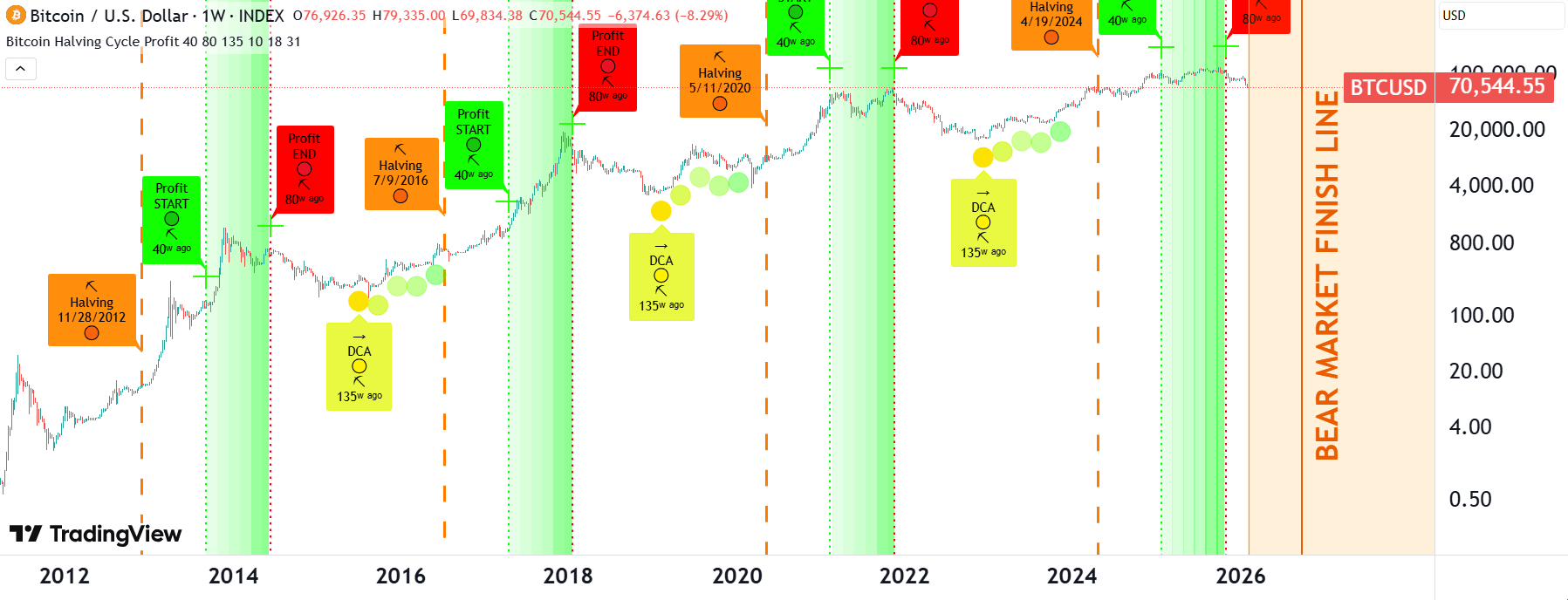

That said, it is undeniable that Bitcoin is still, at this stage, following the technical and cyclical logic observed in 2022. But $BTC has never exactly replicated a past pattern: history rhymes, it does not repeat itself. The market top formed 80 weeks after the halving (all data are shown on the chart below), while the theoretical bottom zone has historically been located around 130 weeks post-halving, projecting us toward the month of September. However, several indicators suggest that the bottom could be reached earlier, notably through relative dynamics and arbitrage with precious metals.

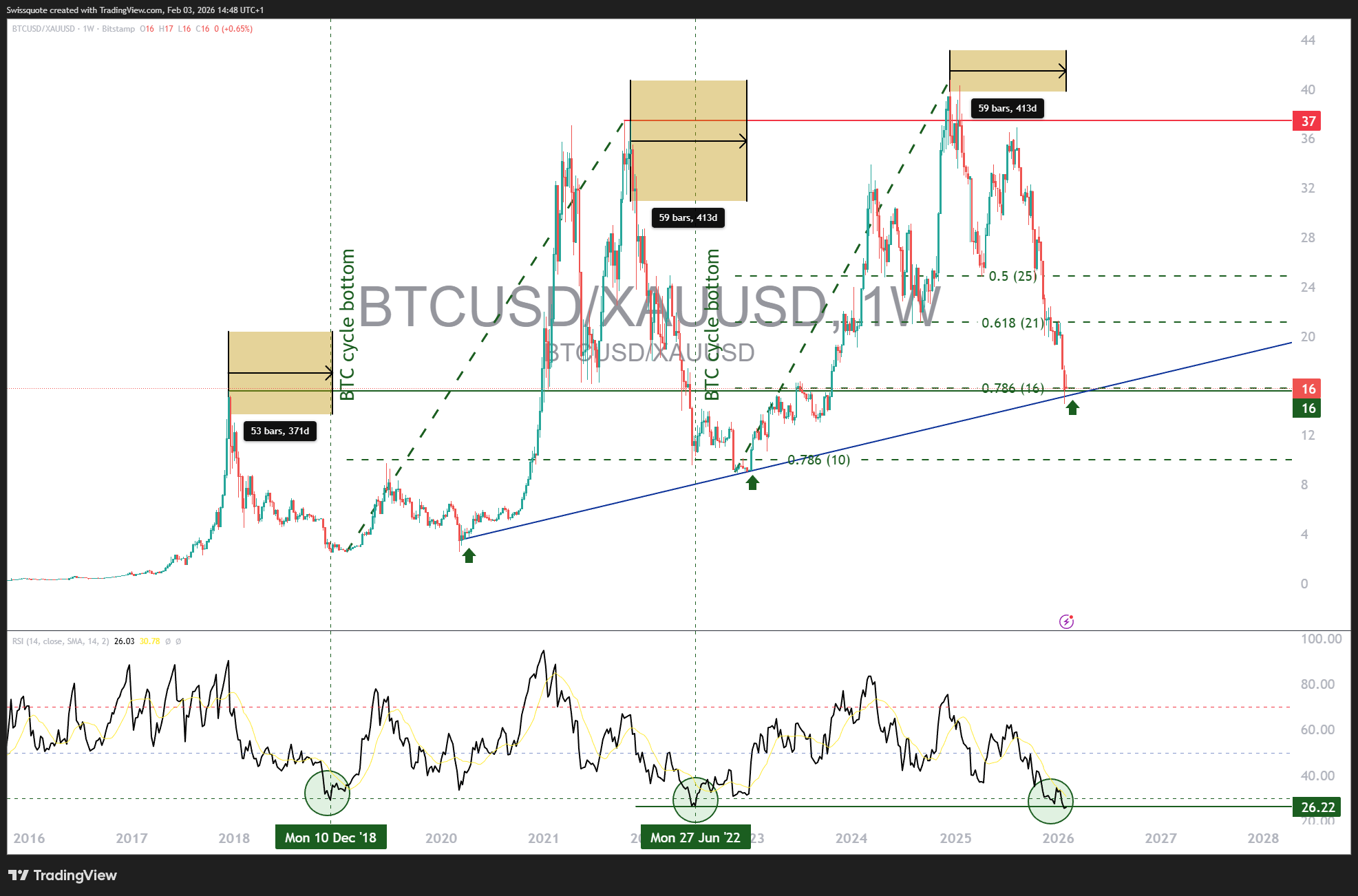

The latter have in fact entered a corrective phase since the end of last week, likely marking the bursting of a speculative bubble that had become particularly excessive since the last quarter of 2025. Technical analysis of the BTC/GOLD ratio indicates that a major bottom could be near. This ratio is currently entering its 59th week of bear market territory, a duration that corresponds exactly to the end of the 2022 bear market. Added to this is a key proportion: the BTC/GOLD ratio has corrected approximately 80% of its previous bullish cycle, once again a level that coincided with the final bottom in 2022.

It therefore becomes plausible, even if the BTC low in US dollars could still be slightly lower, that Bitcoin will not fully replicate the trajectory of the 2022 bear market.

This nuance is fundamental. The macroeconomic and structural context of 2026 bears no resemblance to that of 2022. At the time, the market was undergoing brutal monetary tightening, the collapse of several major players in the crypto ecosystem, and a generalized risk-off environment. Today, despite a significant correction, the environment is far more mature: robust infrastructure, deep institutional liquidity, and regulated financial products help cushion periods of stress.

In summary, even if Bitcoin continues to rely on its cyclical and temporal benchmarks, it is unlikely to reproduce their final intensity. Everything points to a bear market that is shorter, more contained, and structurally different. According to my scenario, the maximum drawdown would lie in a range between USD 50,000 and USD 70,000.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

TRADE $BTC HERE

BTCUSDT

Perp

71,239.6

-7.02%

#bitcoin #BTC #TrendingTopic