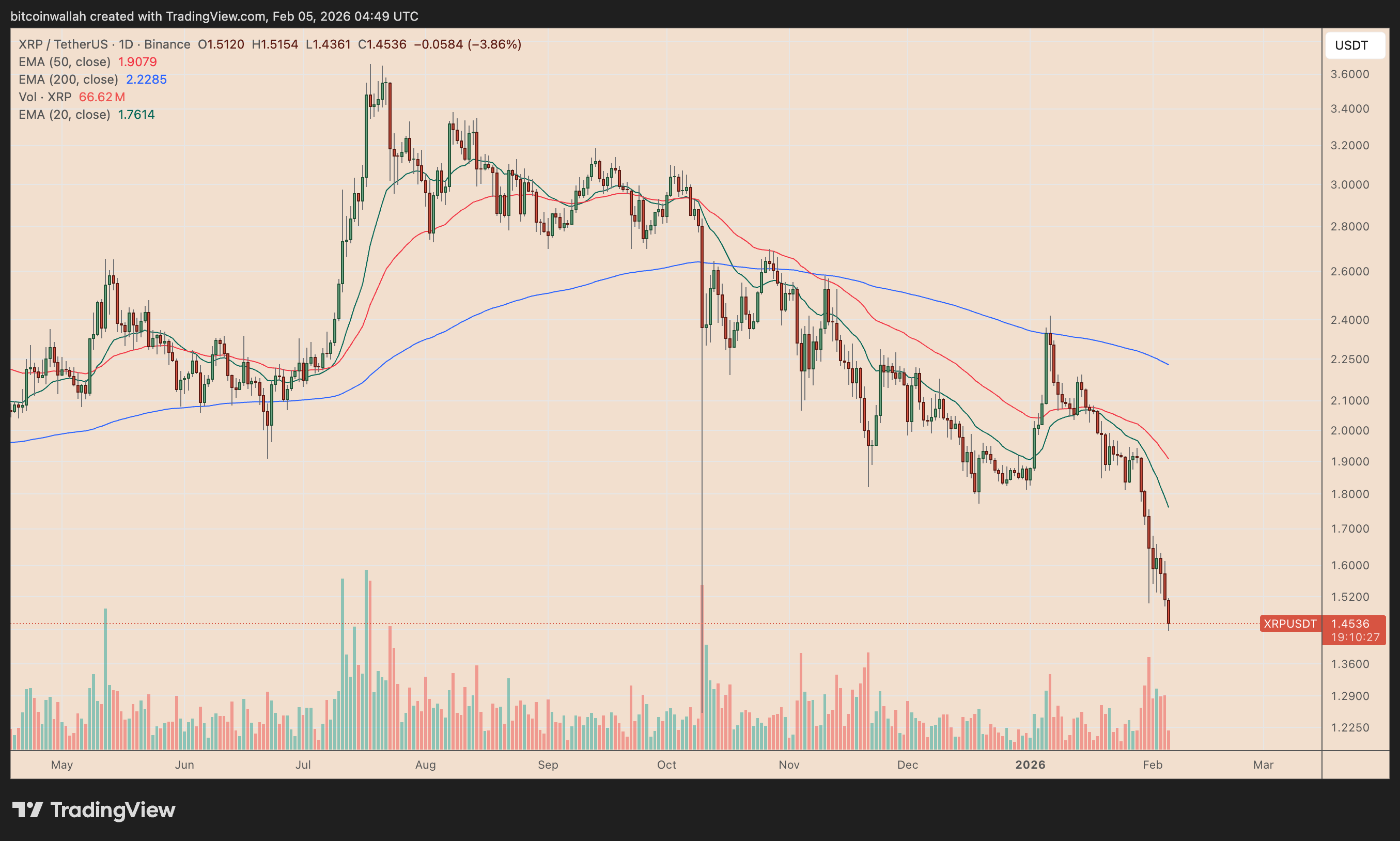

XRP has tumbled sharply, dragged down by a broader sell-off in technology stocks. The token fell over 5% to approximately $1.43, marking its lowest price in four months. This decline mirrors a significant drop in major tech indices like the Nasdaq, as investor sentiment soured over rising AI spending concerns.

Key Points & On-Chain Analysis:

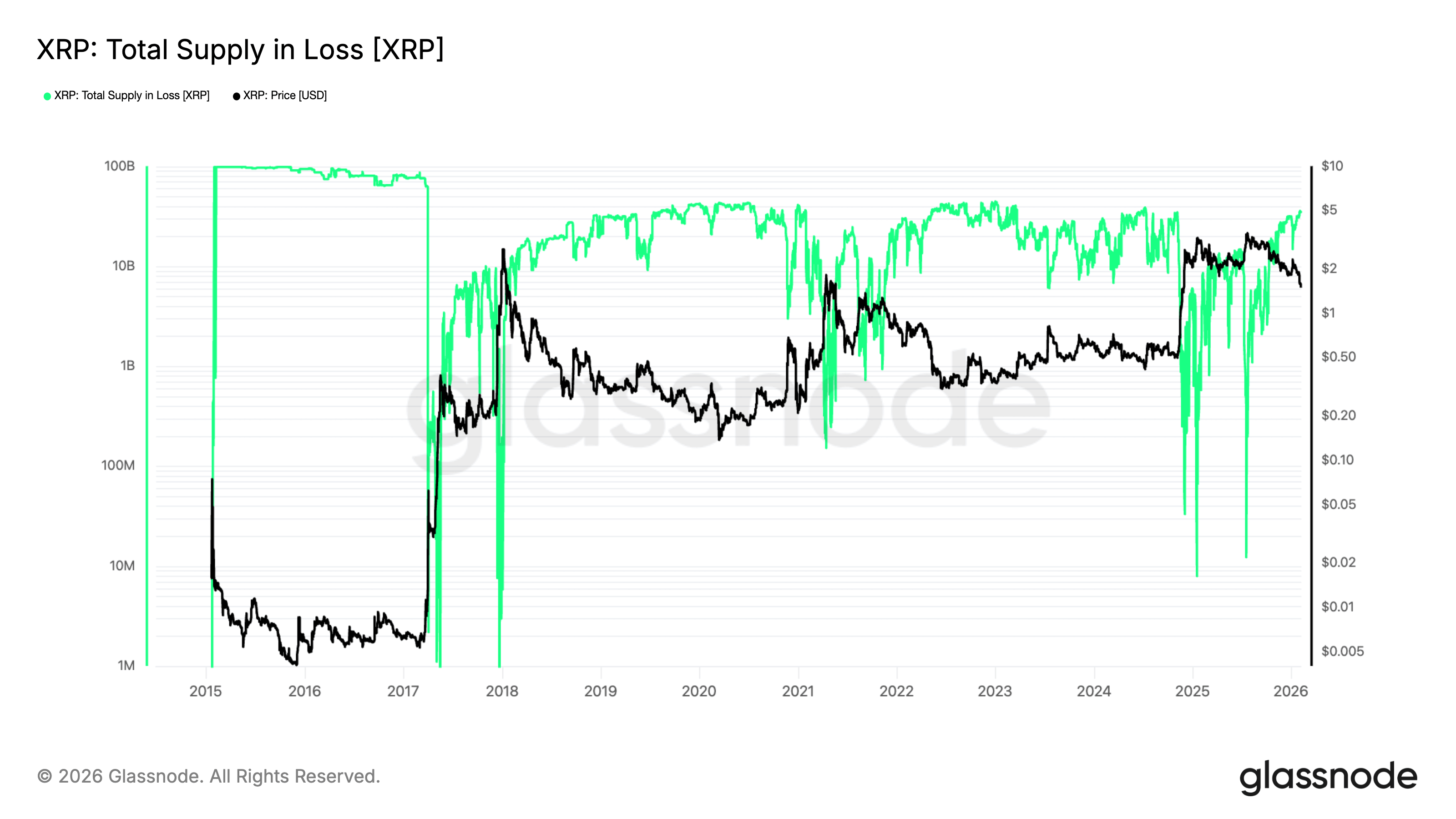

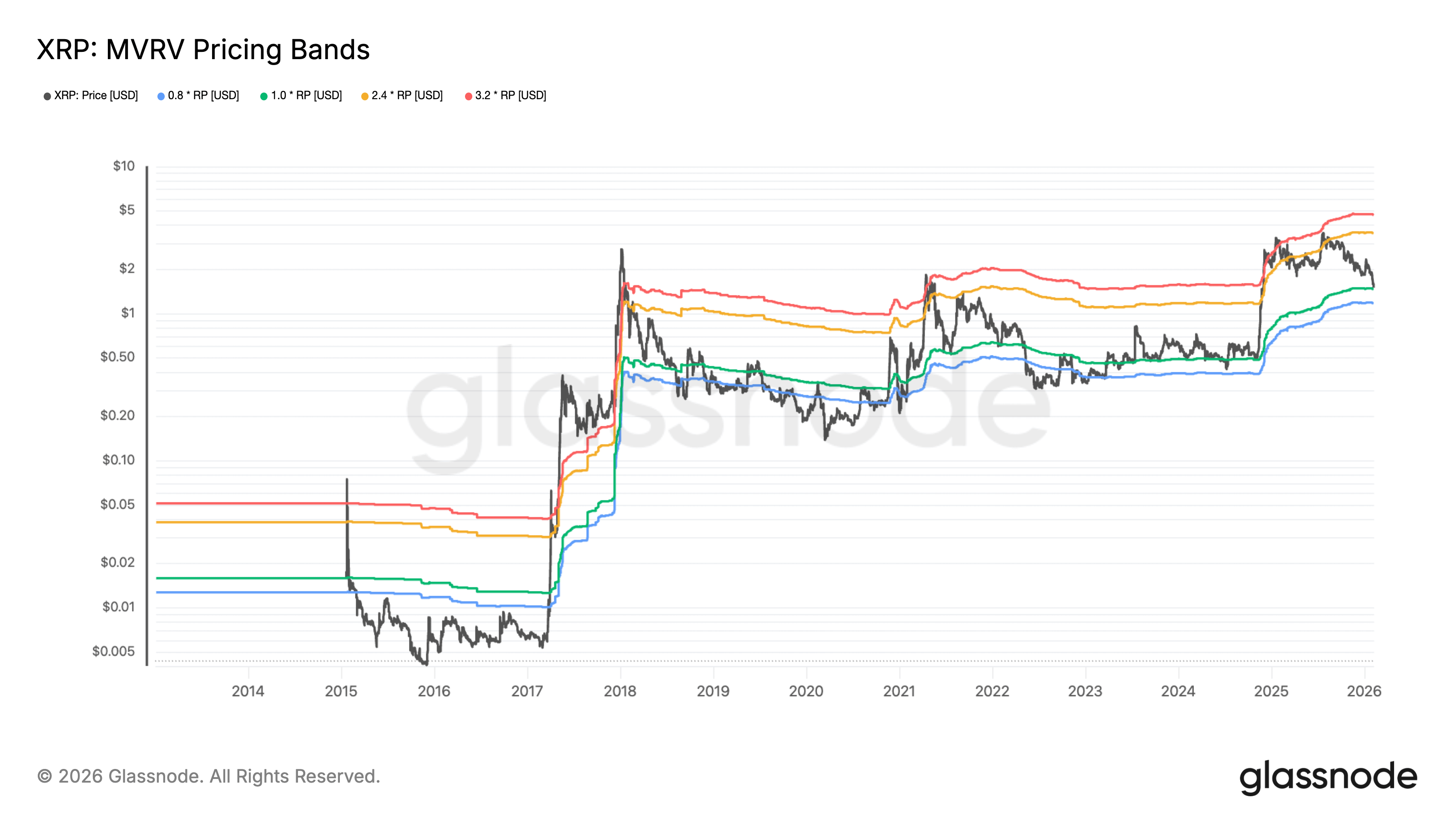

Widespread Losses: A large portion of XRP's supply is now held at a loss, with holder stress reaching levels last seen in October 2024.

Macro Pressure: Unlike the 2024 rally driven by political catalysts, the current downturn is fueled by a hostile macroeconomic climate where crypto is trading in tandem with declining tech stocks.

Critical Price Zone: XRP is trading near a key on-chain metric, the "realized price" (~$1.47). Historically, falling below this level has signaled deeper price corrections, with a potential downside target near $1.15.

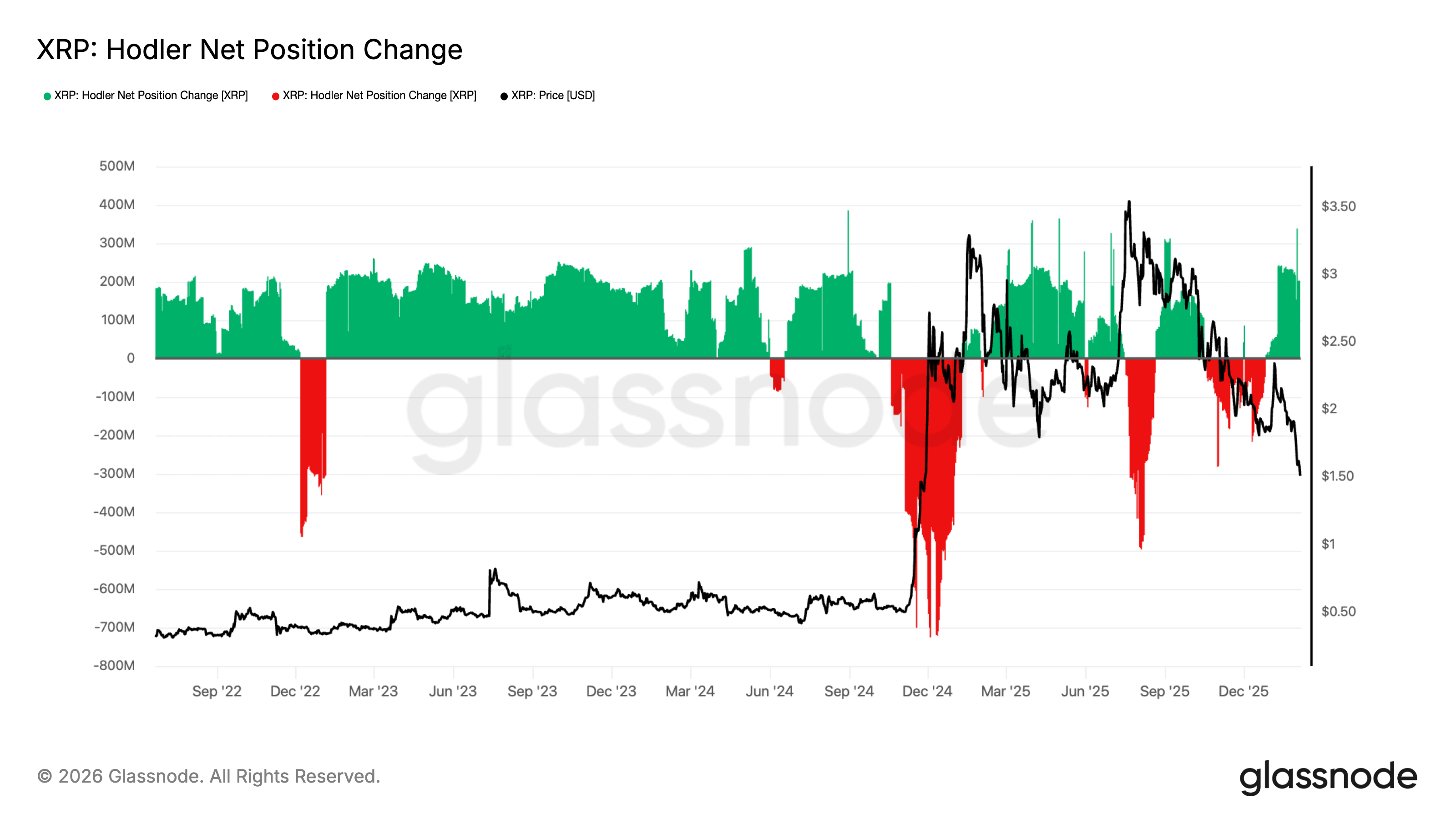

A Glimmer of Hope: Despite the sell-off, long-term holders are accumulating more XRP, a pattern that has previously preceded market stabilization.

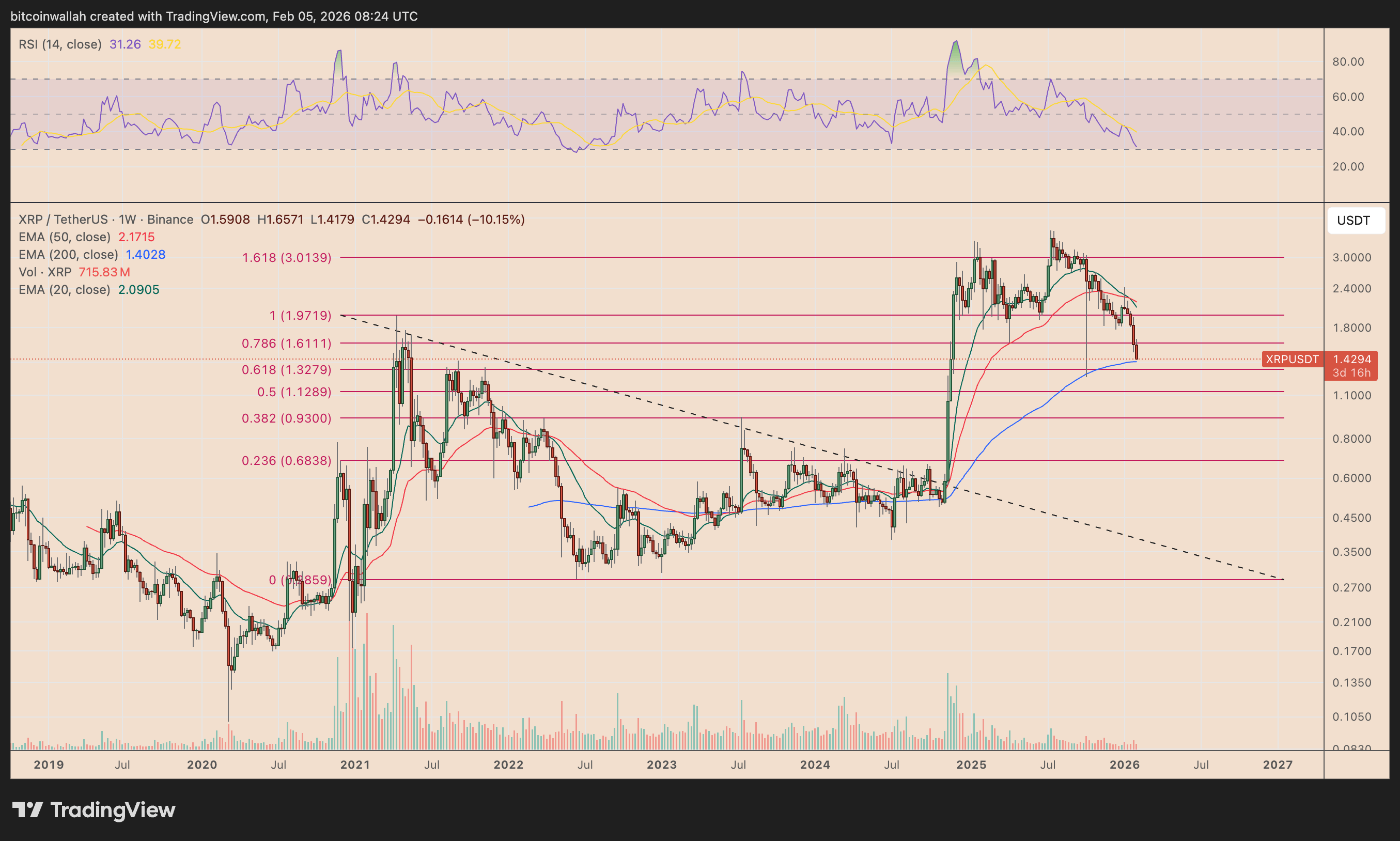

Technical Outlook:

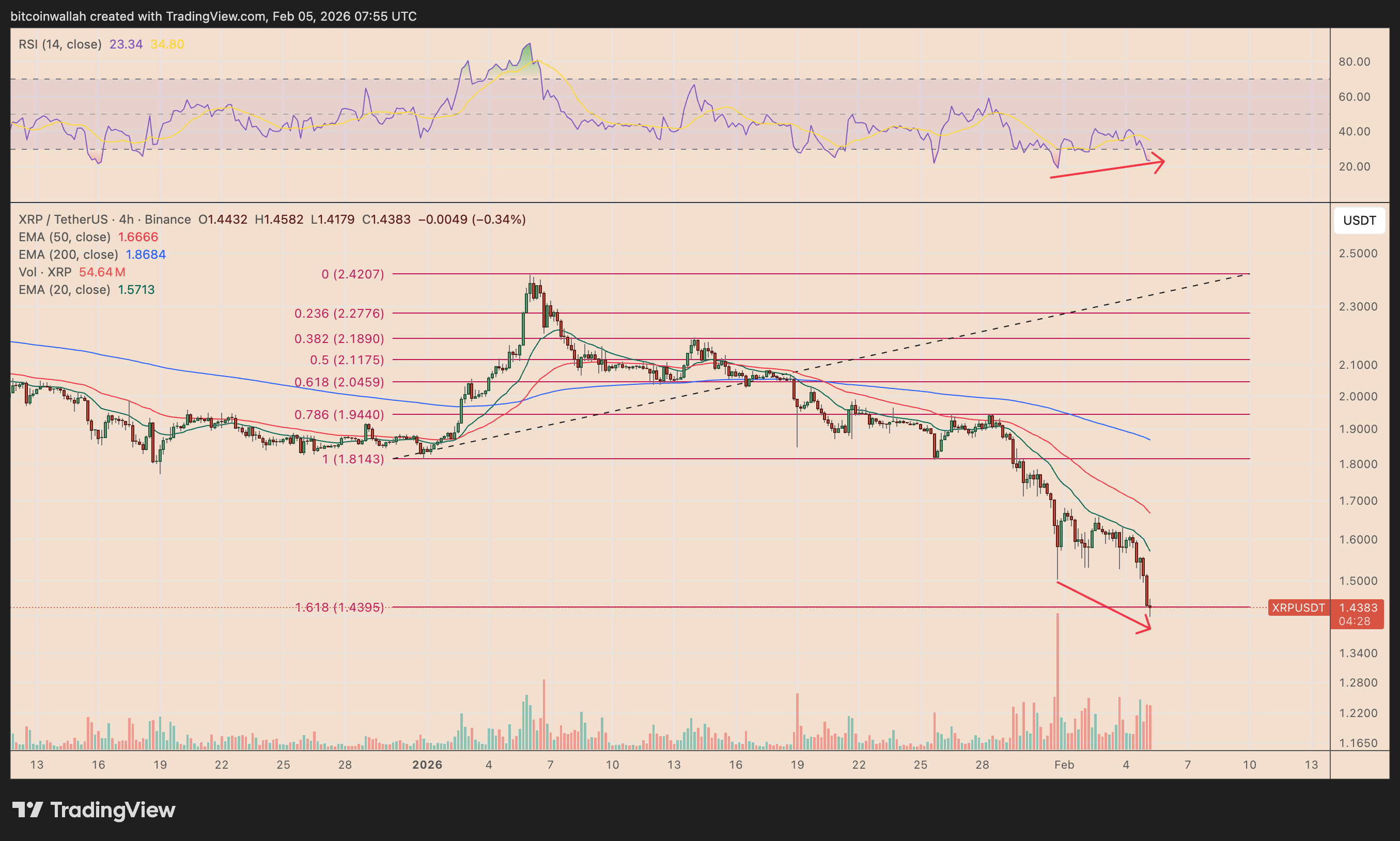

Short-Term: Bullish divergence on the 4-hour chart suggests a potential relief rebound toward $1.57 or higher.

Long-Term: The weekly chart shows XRP testing a major support confluence near $1.40-$1.43. Holding this zone is critical. A breakdown could trigger a steeper fall toward $1.13 or even $0.93.