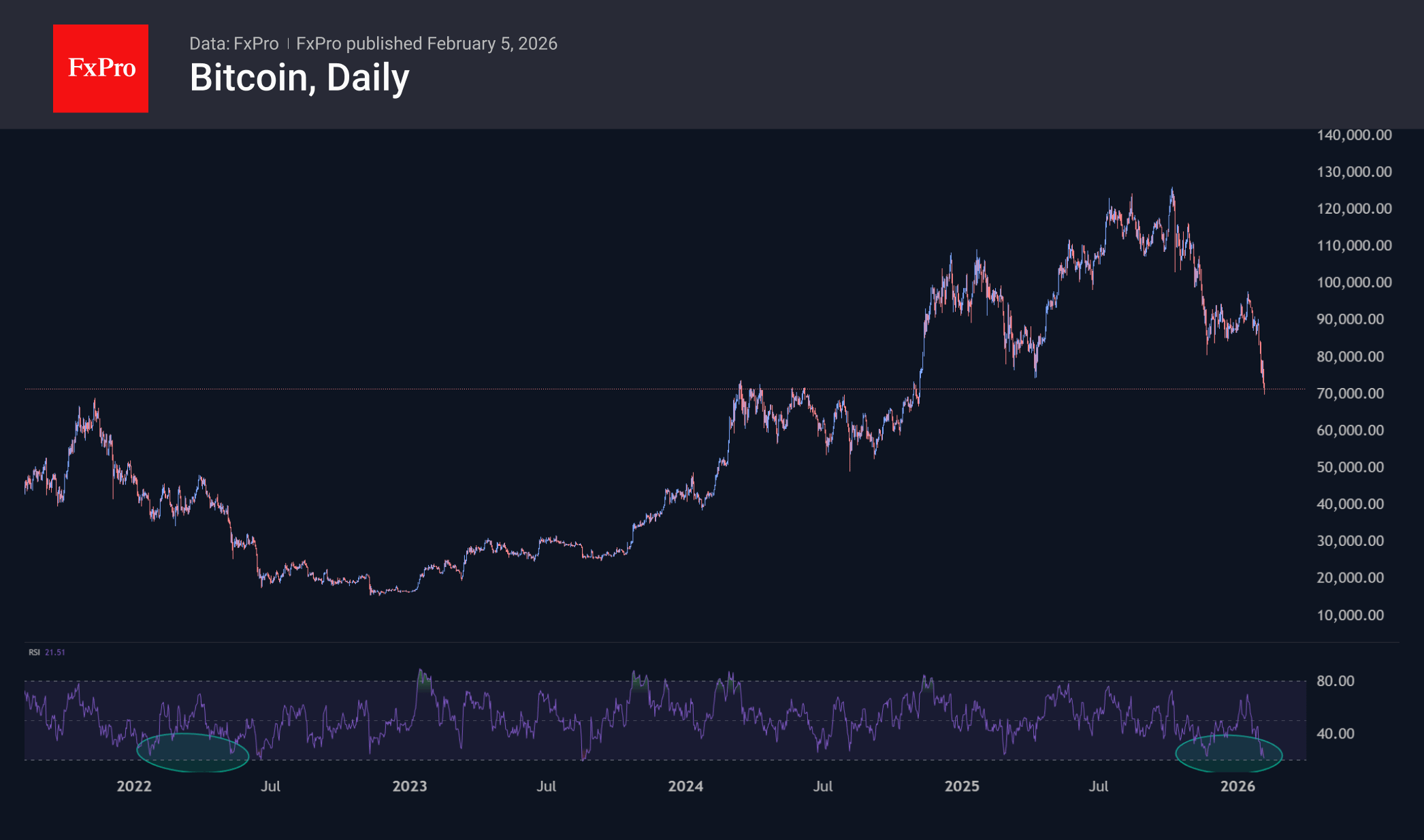

Bitcoin’s decline accelerated, pulling its price down to around $71,000 despite entering oversold territory. The cryptocurrency has now fallen back to a zone that acted as strong resistance throughout much of 2024, attracting some bargain hunters. Although technical indicators suggest the sell-off is extreme, fears of continued losses remain — especially with nearly half of all Bitcoin holdings currently underwater. Some analysts caution that a drop toward $60,000 is possible if historical bear market patterns repeat, though increased institutional involvement may help cushion further falls.

Key Points:

Bitcoin’s sell-off deepened, dropping toward $70K before settling near $71K, erasing gains and revisiting a key resistance area from early 2024.

The daily RSI hit 22 — its most oversold level since August 2023 — signaling extreme selling pressure.

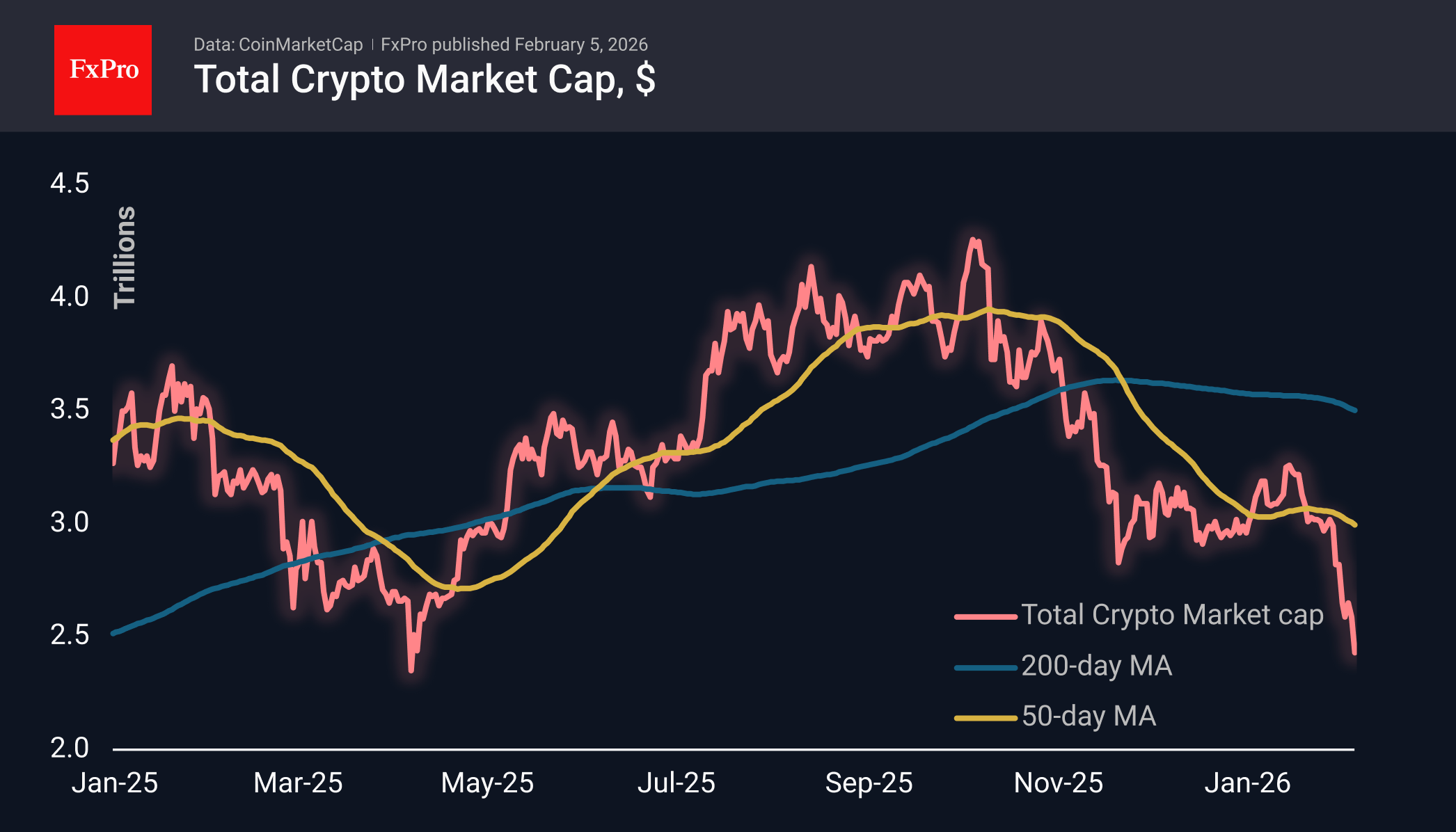

The total crypto market cap fell over 5% to $2.42 trillion, reaching levels last seen in April 2025, with institutional sell-offs possibly worsening declines.

Data shows 44% of Bitcoin supply is now at an unrealized loss, with only 56% of coins still in profit.

Analysts warn that if the 2022 bear market repeats, Bitcoin could fall another 20% toward $60K.

However, some experts believe a collapse like 2018 or 2022 is unlikely due to institutional adoption, regulated products, and expected rate cuts.

In other crypto news: Ethereum’s Vitalik Buterin called for a new L2 model, and Standard Chartered lowered Solana’s 2026 target but sees long-term growth potential.