In a closely divided 5-4 vote, the Bank of England's Monetary Policy Committee chose to hold the key interest rate steady at 3.75%. While acknowledging that inflation is expected to fall to the 2% target from April—primarily due to falling energy prices—the majority opted for caution, wanting more assurance that underlying wage and price pressures would sustainably subside. However, the Committee clearly signaled that further rate cuts are likely in the near future, noting that the risk of persistent high inflation has receded while risks from weaker economic demand are growing. The decision highlights a delicate balancing act: pausing to confirm inflation is truly defeated while preparing to ease policy to support a sluggish economy.

Key Points :

Hold: The Bank of England kept its key interest rate unchanged at 3.75%.

Reason: The decision comes as inflation remains above the 2% target (currently 3.4%), though the economy shows signs of recovery.

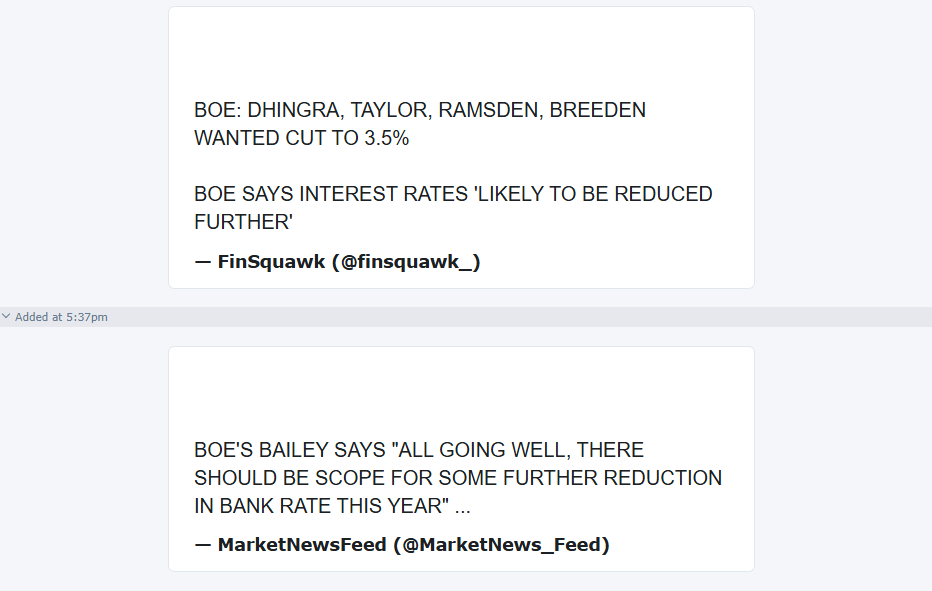

Divided Vote: The decision was tight, with the rate-setting committee voting 5-4 (the minority wanted a cut).

Future Outlook: The Bank signaled that rate cuts are likely later this year, forecasting inflation will fall to target "by the spring."

Context: This follows a long cycle of steady rate reductions. The government is banking on falling inflation to pave the way for cheaper borrowing to boost growth.

Balancing Act: The Bank is trying to tame inflation without unnecessarily stifling economic growth.