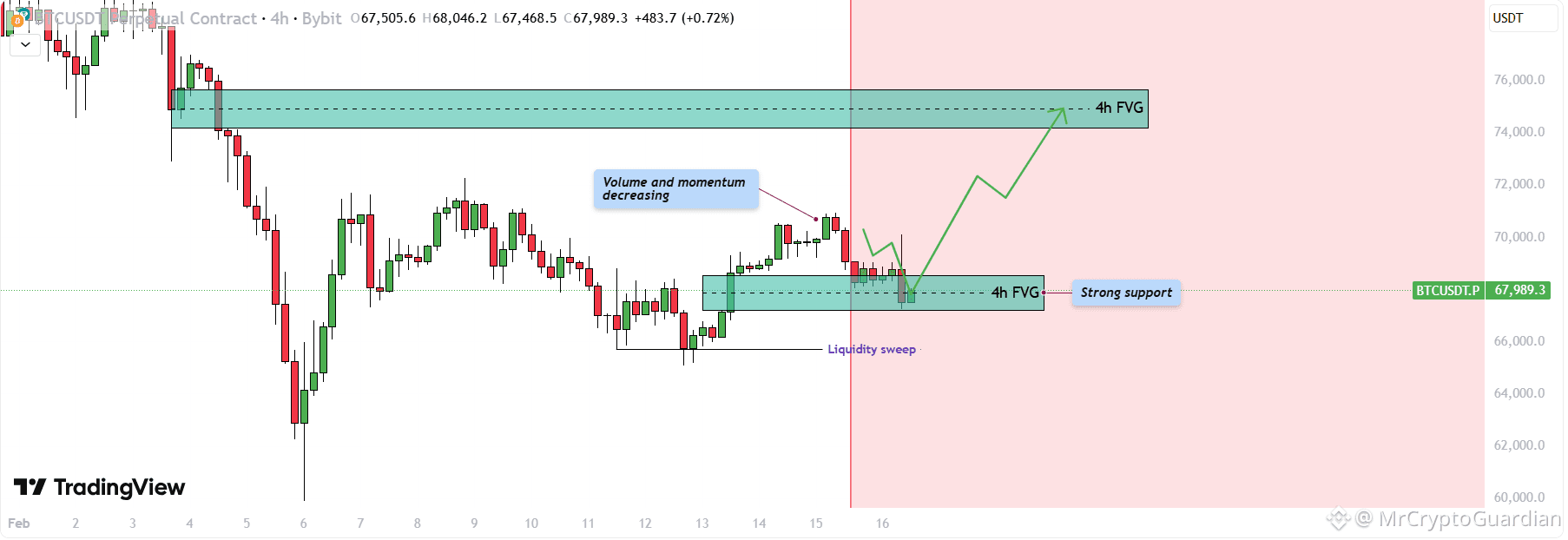

$BTC is currently Trading around $69k after recovering from a recent low. The market structure on the 4-hour Timeframe Shows a clear reaction from a liquidity event followed by a controlled move higher. however, price is approaching a decision point as momentum begins to slow. The interaction between the recent liquidity sweep, the 4-hr bullish FVG, and the higher resistance FVG will likely determine the next directional move.

🛑 Liquidity Sweep

Before the recent recovery, Bitcoin performed a clear liquidity sweep below the previous short-term lows. Price briefly traded beneath the range, triggering stops and collecting sell-side liquidity, before sharply reversing upward. This type of move often signals that the market has completed a short-term corrective phase and is ready for expansion in the opposite direction. The strong reaction from that sweep confirms that buyers were waiting below the lows, using that liquidity event as fuel for the upside move.

🚀4H Bullish FVG

The price impulsively rose after the liquidity sweep, forming a 4-hour bullish FVG. This zone now serves as a solid support and is indicative of the area where buyers aggressively intervened. The short-term structure will continue to be positive as long as Bitcoin stays above this 4-hour bullish FVG. Before continuing higher, a retracement into this area might offer a healthy pullback to correct inefficiencies, so it wouldn't necessarily be bearish. Bullish positioning would be strengthened by a firm grasp of this support.

🔁Decreasing Volume and Momentum

As price pushes upward, volume and momentum appear to be decreasing. The recent candles show less expansion compared to the initial impulsive move off the lows. This slowdown suggests that buyers are becoming less aggressive near current levels, potentially due to overhead resistance. When momentum fades into resistance, the market often either consolidates or retraces before attempting the next leg. This increases the probability of a temporary pullback into the 4H bullish FVG before continuation.

📌Target

The primary upside target sits at the 4-hour bearish FVG above, around the $74,000 – $75,000 region. This zone represents unfilled imbalance and prior selling pressure, making it a logical magnet for price. Markets are naturally drawn toward inefficiencies, and as long as the bullish structure remains intact, this area serves as the next key objective. A decisive break above that bearish FVG would open the door for further upside expansion.

📝Conclusion

Bitcoin remains structurally bullish after the liquidity sweep and strong recovery from the lows. The 4-hour bullish FVG provides clear support, while the bearish FVG above acts as the main upside target. However, decreasing momentum suggests that a short-term pullback into support is possible before continuation. As long as the bullish FVG holds, the bias favors an eventual move toward the higher imbalance zone.

...................................

Thanks for your support. if you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment , I'd love to hear your thoughts! $PIPPIN

#OpenClawFounderJoinsOpenAI #CPIWatch #Alts #BTCNextMove #happyNewChineseYear