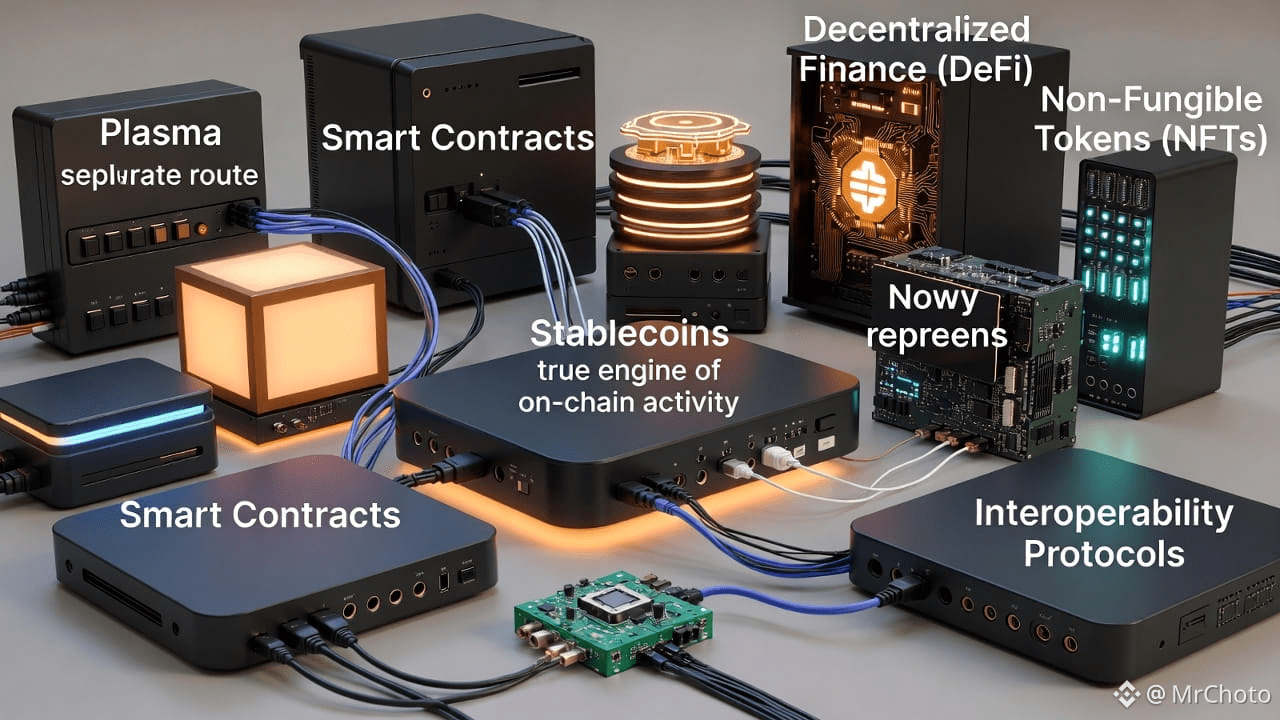

The majority of blockchains are constructed like multifunctional devices, attempting to be everything at once and relying on developers to figure out the rest. Plasma follows a distinct route. It begins with a straightforward insight that many users and dealers already have but few express. Despite being the true engine of on-chain activity, stablecoins continue to operate on infrastructure that was never intended for them. The reason plasma exists is because actual market activity consistently exhibits that mismatch.

The bulk of economic activity is not fueled by speculative tokens, based on current on-chain volumes. The movement of stablecoins across exchanges, protocols, market makers, payroll systems, and international transactions is what propels it. They serve as basis pairings for traders. They serve as settlement layers for funds. They are used by businesses as currency substitutes. In spite of this, stablecoins are still viewed by the majority of blockchains as just another smart contract. Plasma challenges that reasoning by posing the question of what would happen if the chain's architecture prioritized stable value movement.

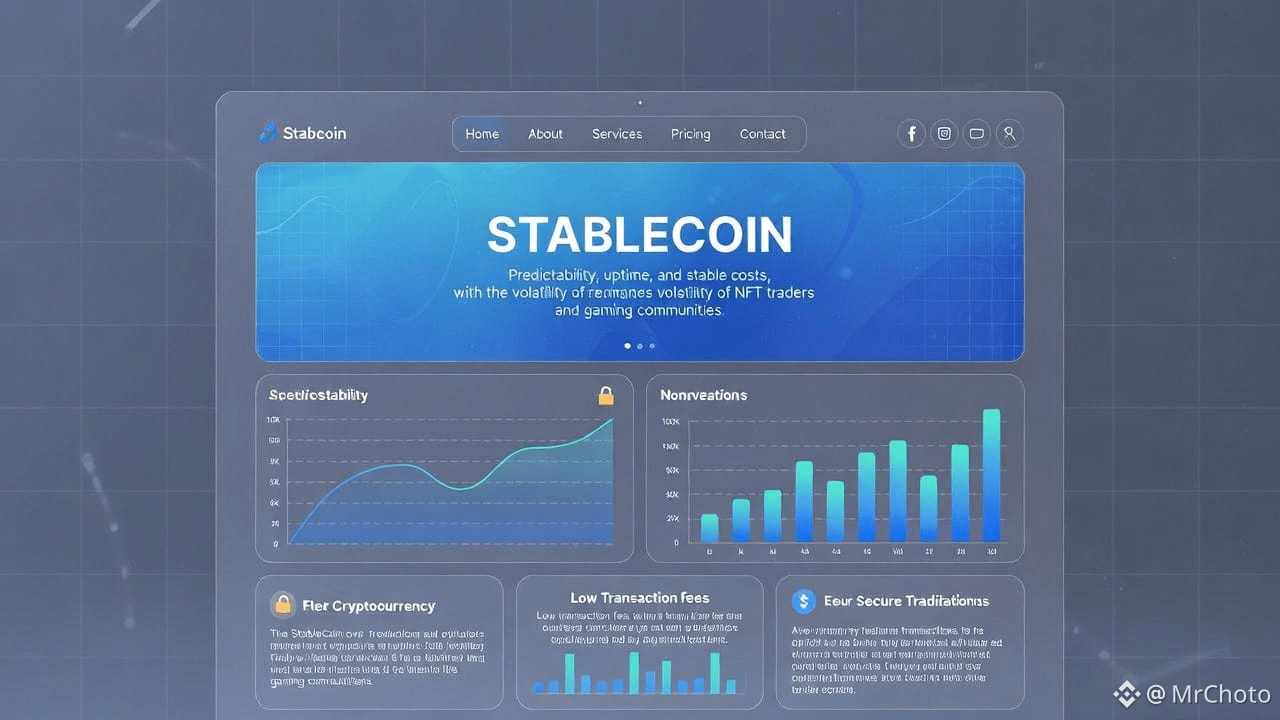

That design decision is more important than it would seem. Compared to NFT traders or gaming communities, stablecoin users have different priorities. Predictability, uptime, costs that don't increase amid volatility, and regulations that don't abruptly alter are important to them. Plasma does not aim to win every category. It is attempting to excel at one. It differs from the one-size-fits-all strategy that predominates in crypto infrastructure because of this focus.

Considering how traders actually operate in stressful situations is a useful method to comprehend this. People do not rush to mint collectibles or use complicated contracts when markets are moving quickly. They hurry to control risk, rotate exposure, and park value. Moving stablecoins is nearly always necessary for that. These are the exact occasions when fees increase and confirmation times become questionable on a crowded general purpose chain. The premise that these instances are not edge cases is the foundation of plasma. They constitute the main use case.

Once that behavioral reality is evident, the technical decisions made for Plasma become more understandable. The network favors stablecoin settlement, compliance-friendly primitives, and throughput patterns that align with financial flows rather than social activities, rather than optimizing for maximum flexibility. This does not imply that Plasma opposes innovation. It implies that the demands of financial stability limit innovation. That restriction is deliberate.

Additionally, traders and investors are no longer able to overlook the regulatory aspect. Regulators in several jurisdictions have direct access to stablecoins. That reality must be taken into consideration when designing chains that host them at scale. @Plasma Plasma presents itself as a piece of infrastructure that organizations may use for more than just experimentation. This differentiation is typically more important for long-term capital than short-term yield.

This focus becomes particularly crucial when it comes to the retention issue. During hype cycles, many blockchains draw users, but once incentives wane, they find it difficult to retain them. Users come for incentives, depart when costs increase or stories change, and proceed to the next chain. Users of stablecoins act differently. People tend to stick with a system if it is shown to be dependable for settlement, payments, or treasury administration. Rather than enthusiasm, retention is motivated by habit and trust. Rather than pursuing fleeting attention, Plasma is obviously striving for that dynamic.

An example from everyday life clarifies this. Think about a modest trading company that transfers money several times a day between decentralized venues and centralized exchanges. The newest feature set is not what they require. They require transactions that don't create unexpected risk, settle fast, and cost the same at noon as they do during a market spike. The company has little incentive to depart if Plasma can deliver that on a regular basis. That is retention based on usefulness rather than rewards.

From the standpoint of an investor, this is more robust and less ostentatious. It is unlikely that a stablecoin-focused chain will make news. As infrastructure, it is more likely to discreetly collect consumption. This makes it more difficult to evaluate on an emotional level but simpler to comprehend on a basic level. Whether Plasma can support every potential application is not the question. Whether stable value movement will continue to increase as a percentage of on-chain activity is the question. According to all available data, it does.

Plasma is not a maximalist wager. It's a wager on specialization. That is a counterintuitive position in a market that frequently conflates strength and breadth. Additionally, it closely resembles the evolution of established financial systems, where specialized railroads do particular tasks and dependability is more important than novelty.

Plasma is an indication that traders should keep an eye on. A significant indication of the direction of actual usage is provided if volume and liquidity start to concentrate on chains that optimize for stablecoins. It provides investors with exposure to infrastructure that strives to be as dull as possible.

The call to action is straightforward. #Plasma should not be assessed using the same criteria as general-purpose blockchains. Examine it by determining whether specialized infrastructure typically prevails in established systems and whether stablecoins are becoming increasingly important to cryptocurrency markets. Plasma is not attempting to be everything if both questions are answered in the affirmative. It is attempting to be indispensable. $XPL