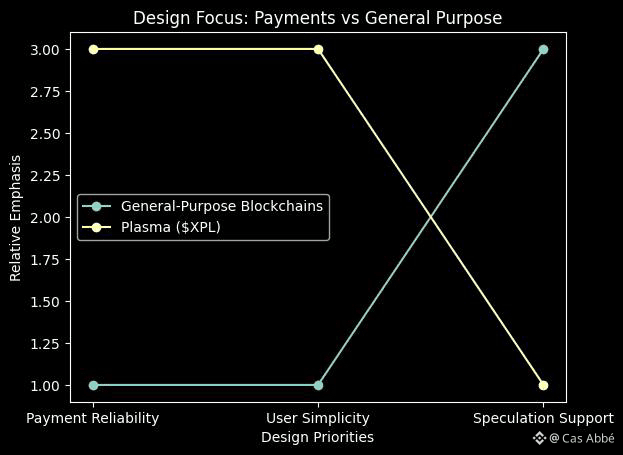

The failure of most blockchains to make payments has little to do with the speed of the payment and everything to do with their distraction. Their intention is to do it all simultaneously, and thus it makes payments another feature that struggles to take up space, attention, and incentives.

Plasma begins with another assumption: payments are not an app category, it is infrastructure. And infrastructure does not work when it is exciting, unpredictable, or noisy.

This is the only assumption that describes nearly all the design choices that Plasma makes.

Why Generalised-purpose Blockchains Destroy payment systems.

Stablecoins in most chains are on the top of experimentation systems. Fees shift minute to minute. Implementation is subject to moods on network. To transfer value that is stable, users need to have volatile assets.

That is good in speculation, but not in money.

Plasma acknowledges that, unlike money infrastructure, the underlying infrastructure is not designed to support the use of stablecoins just like money. Rather than introducing another layer to rectify this, Plasma focuses on making that base layer perfect in value movement first.

It is a scope choice, but not a feature choice.

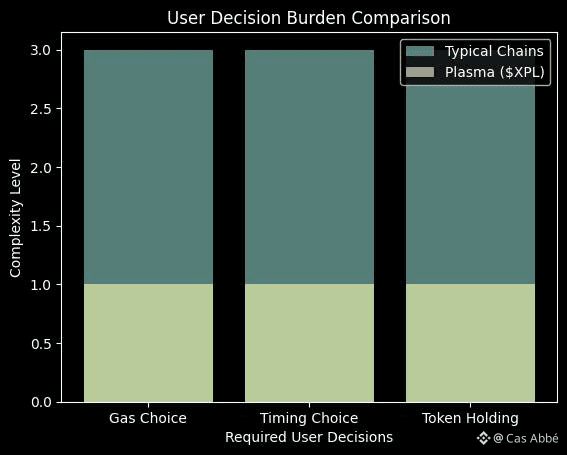

The Real Innovation of Plasma: The Decision-Making Out of the User.

There is a minor yet significant concept behind the design of Plasma: users do not need to make a choice to transfer money.

With most chains, users always choose the time to transact, the amount of gas to pay, the token to keep, and the probability of the execution being successful. Plasma corrects these attitudes as failure of the system, and not the user responsibility.

Through fee abstraction, execution stabilization and predictable settlement to the priority, Plasma moves complexity out of the users to protocol design. That is the mechanism of traditional payment rails - and why they go social, and not simply technical.

Why Zero-Fee Stablecoin Transfers Are Important Than Speed Claims.

Zero-fee transfers of stablecoins do not involve being cheaper. They change behavior.

Once the user no longer sees fees in his/her head, it becomes normal use rather than a tactical use. Money ceases to be an event and becomes a habit. This is essential to remittances, payroll, treasury movement and daily transfers.

Plasma understands that in case stablecoins are supposed to act like cash, there can be no fee anxiety. The protocol takes up that complexity such that users do not need to even consider it.

Ethereum PROs Ethereum Compatibility, minus Ethereum Economics.

The compatibility of EVM with plasma is not a pursuit of developers. It is in order to prevent isolation of the ecosystem.

Plasma creates new financial applications, which already exist and are compatible, reducing friction. Meanwhile, it does not assume the congestion tendencies and fee randomness of Ethereum.

This balance matters. Plasma is not hostile to the current ecosystems, but it is not willing to take the inefficiency of the systems and buy them wholesale.

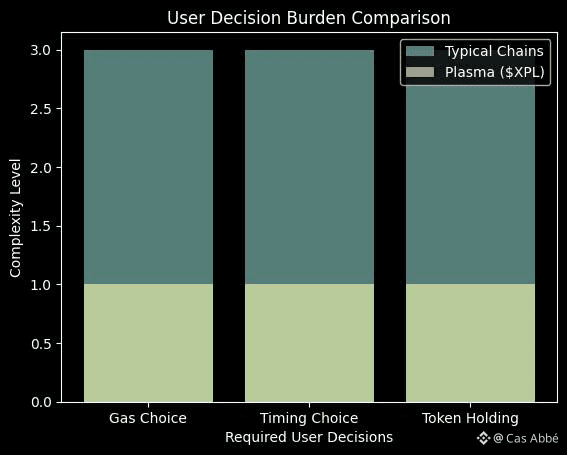

The Importance of XPL Is Deliberately Silent.

The intentions of the Plasma can be seen in one of the most obvious ways, i.e. how it handles the native token.

XPL does not need to be touched, traded, and displayed on a regular basis. It recruits validators, aligns incentives and aids governance - and leaves the rest to itself.

This is an outright refusal of token-first economics. Plasma holds the assumption that compelling users to deal with a volatile asset undermines a belief in a payment system. Stability is achieved as the movement of money and token exposure are separated.

The reason why plasma will never become the loudest chain.

Plasma is not very likely to take up attention cycles. It does not generate glittering numbers and go viral stories. It is seen in its success through low tension, constant use, predictable circulation.

This translates to slow observable growth. However, too fast payment infrastructure is prone to breakdown due to its own incentives. Plasma trades agility of adoption in favor of durability of usage.

That trade is intentional.

The Risk Plasma Accepts

Focus is also the greatest risk and conviction of Plasma.

Plasma narrows its surface area by putting stablecoins and payments at the center. In case the market does not focus on the use of the stable coins or the regulations become aggressive, the network has to respond by being careful.

Plasma does not claim that this risk does not exist. It selects it carefully, and does not dilute itself in all possible stories.

Plasma is not attempting to capture the attention race.

It is attempting to complete the race that is all.

It considers payments as infrastructure and not entertainment. It does not add features, but removes them.

It does not like thrill, it likes being neutral.

Impression is not constructed into the plasma. It is built to be trusted.