The majority of blockchains do not fail due to their lack of features. They fail to be effective since they are not trustworthy to the extent that users can develop habits on their use. The users experiment, teams experiment, and wearisomeness develops. There are changes in prices, performance variation, and tooling malfunction. There is nothing disastrous, however, there is nothing that clings. With time, individuals realize that they do not go back. Such is the breakdown mode that most crypto analysts overlook.

The design decisions made by Vanar are reasonable through this prism. It is not making itself the most innovative chain at the start. It is trying to be predictable to the extent that teams and users can count on it without ever having to reconsider their choices. It is important because the actual adoption is not about excitement, but repetition.

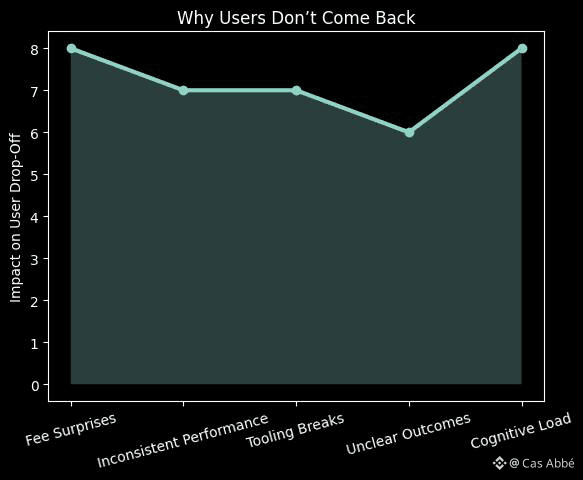

Majority of crypto infrastructure presumes that in case of users leaving, they simply did not get the technology. As a matter of fact, users abandon systems due to inconsistency in their behavior. All the unforeseen charges, delays or edge cases compel individuals to reason. And thinking is friction. Behavior changes when friction occurs recurrently. Individuals do not complain, they just switch off.

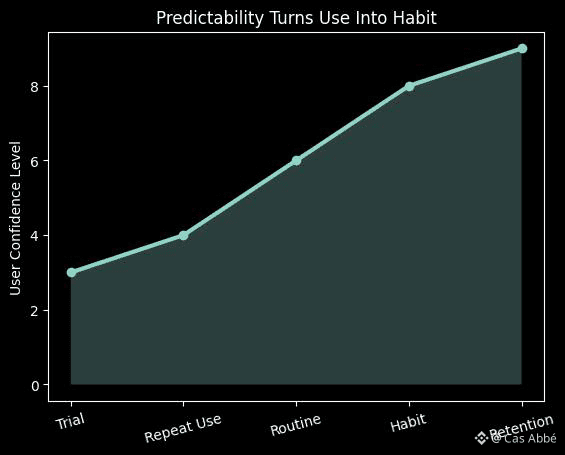

The same issue is addressed through the predictable implementation by Vanar. Predictability is not a cosmetic property it redefines the planning and behavior of teams and users. When the builders are aware of what the system will do tomorrow, they get more committed today. The users stop hesitating when they are sure that just because they did something the same way on previous occasions, it will work. This is the way it becomes habitual.

There is also the issue of predictability in the organizational level. Teams are formed to develop real products, not individuals. Teams operate using roadmaps, budgets, and schedules. On most chains, extrinsic volatility - congestion, cost surges, or ecosystem instability - is continually breaking these plans. Although a chain might be fast, the ambiguity on a chain creates stress in operating it. The design of Vanar is such that it reduces the possible outcomes. The less surprises there are, the less internal debates, emergency fixes and long-term thinking.

On the side of an investor, this question changes. The question is not whether Vanar is more attractive to attention compared to other chains. It is whether it decreases the friction that leads to the degradation of the ecosystems over time. Retention does not only concern users. It is about creators never stopping to create, collaborators never stopping to merge, and products never restarting.

This logic is applied in the design of the tokens by Vanar. VANRY is helpful in sustaining activity and not in temporary hoarding. This causes the ecosystem to be less volatile on hype cycles and less boom and bust dynamics that undermine trust. Incentives which approve speculation tend to distort actions. The tokens that facilitate consumption fall in line with incentives more silently. It is a trade-off and not an accident.

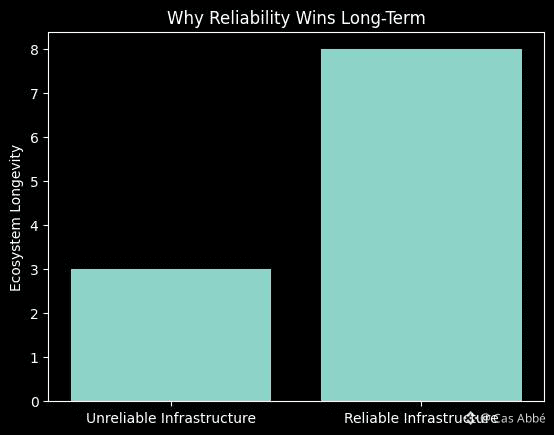

True exposures to this strategy are present. Being predictable may be boring. Chains that are oriented towards coordination and reliability might not be as buzzed in the media as experimental. Should Vanar be unable to give the consistency which he promises, the whole thesis falls down. Infrastructure that promises reliability and acts in an unpredictable manner loses traction within a short time. Mistakes are very few.

Should Vanar succeed, it will not be dramatic headlines that will go around, it will be silent entrenchment. Hardly replaceable are the systems that teams have faith in. There is no need to constantly re-onboard systems of which the users are comfortable returning to. Such retention over time accumulates in some way unamenable to hype.

Price spikes and campaign metrics will not be the most relevant signals so when assessing Vanar. They will be self-governing pointers: recurrent utilization, enduring integrations, products that remain online in response to fluctuations in the markets, and cases where teams remain in place when focus shifts. In crypto, fame is cheap to purchase. Reliability, not.

The bet that Vanar makes is that once reliability is solved sufficiently, adoption will follow without much noise, but in a lasting manner.