Over the last 48 hours, the move looked “sudden” on the surface, but the way price travelled makes more sense if you think in levels and positioning, not headlines. When BNB accelerates without a clean staircase, it’s often because the market found a pocket of orders and cleared it quickly. That doesn’t automatically mean a new trend started, but it does tell you where traders were leaning and where they got forced to adjust.

Key level tested: price pressed into a widely watched zone and got a reaction, which matters more than the size of the candle.

Key level tested: price pressed into a widely watched zone and got a reaction, which matters more than the size of the candle.

Volume/OI change: activity picked up as price moved, suggesting fresh participation and/or forced positioning shifts.

Invalidation: the move only “holds” if the market can defend the same area on a retest, otherwise it’s just a fast sweep.

On the level side, the cleanest way to read today’s action is to ask one boring question: did price reclaim and hold a prior area that used to reject it? When BNB pushes into a known level, two camps show up—breakout chasers and fade sellers. If the level is important enough, the first push tends to be messy: wicks, quick reversals, and speed. That’s not noise; it’s the market discovering where real resting orders are. A lot of people judge the move by the candle body (“big green = bullish”), but the more useful information is usually in the rejection points and where price didn’t spend time. If price blasts through a zone and barely pauses, it often means there wasn’t much supply there, or sellers got absorbed. If price spikes, stalls, and snaps back, that’s typically liquidity being collected rather than a stable shift.

The second part is positioning. When you hear “volume went up” or “open interest changed,” the key is not the number—it’s the story it implies. If volume rises while price breaks a level, it can mean real demand, but it can also mean forced buying from shorts covering into a thin book. If open interest rises with the move, it can mean new leverage is entering (people pressing the direction), which is healthy for continuation only if the market can handle it without instantly mean-reverting. If open interest falls as price rises, that’s often short covering—still bullish in the moment, but sometimes less durable because the fuel (shorts being squeezed) gets used up quickly. Either way, a sharp move plus a noticeable shift in participation is usually a sign that the market is re-pricing the “fair” area, not just drifting.

I can’t know from the outside whether today’s push was mostly new buyers stepping in or mostly forced flows clearing stops, so I treat the first move as information, not confirmation.

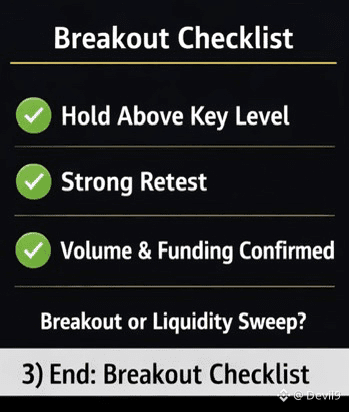

This is where invalidation matters. If you want a credibility-first read, you don’t need to predict the top or bottom you need to define what would prove your idea wrong. For a “real breakout,” the simplest version is: BNB should be able to hold above the reclaimed area, and ideally retest it without instantly losing it. Retests are uncomfortable and slow; that’s normal. What’s not normal (and often bearish) is a clean break above a level followed by an immediate drop back below it with no fight. That’s the classic signature of a liquidity sweep: price goes where it hurts the most traders, triggers a cluster of stops or liquidations, then returns to the prior range once that liquidity is collected. The move still matters, but it changes the plan: in a sweep, the range often remains the game until proven otherwise.

Another practical check is tempo. Trend moves usually build a “map” with higher lows (or lower highs) and repeated defense of an area. Liquidity moves often look like one big impulse and then a messy drift. If BNB keeps printing higher lows above the key zone and dips get bought quickly, that’s the market accepting higher prices. If it chops, re-enters the old range, and trades like nothing happened, that’s the market rejecting the breakout attempt. Neither outcome is “good” or “bad” by itself, but only one is a reliable environment for pressing directional bets.

What I’m watching next is whether BNB can defend the reclaimed level over the next 24 hours, and whether funding/positioning stays reasonable instead of getting one-sided. If it holds and builds, the move has a chance to become a trend; if it fails quickly, it was likely a liquidity sweep and the range still rules.

👉📌Is this a breakout that can survive a retest, or just a liquidity sweep that borrowed tomorrow’s momentum today? #BNB #BTC $BNB