Most spot losses don’t come from bad coins—they come from no exit plan.The market doesn’t punish opinions, it punishes unplanned exposure.

Most spot losses don’t come from bad coins—they come from no exit plan.The market doesn’t punish opinions, it punishes unplanned exposure.

In the last 48 hours we’ve had the kind of “fast dip, fast bounce” tape that makes spot traders overtrade: BTC slid hard on Jan 25 and then rebounded into Jan 26–27 (from ~86.6k back toward ~88.7k on daily data). At the same time, Binance-side pair cleanups are still happening (example: LINEA/BNB, MOVE/BNB, PLUME/BNB and others scheduled for removal on Jan 27 on Binance TH), which is a reminder that liquidity and pair availability can change faster than your plan.

Any Binance update/announcement I saw: Removal of multiple spot pairs (example list includes LINEA/BNB, MOVE/BNB, PLUME/BNB on Jan 27 via Binance TH)

Market move to explain (BNB/BTC/ETH): BTC whipsawed—down on Jan 25 then bounced into Jan 26–27 (daily close view)

One education pain point to teach: People enter “spot for safety” but don’t define exits One debate/opinion idea: “Spot is low-risk” is only true if you cap downside

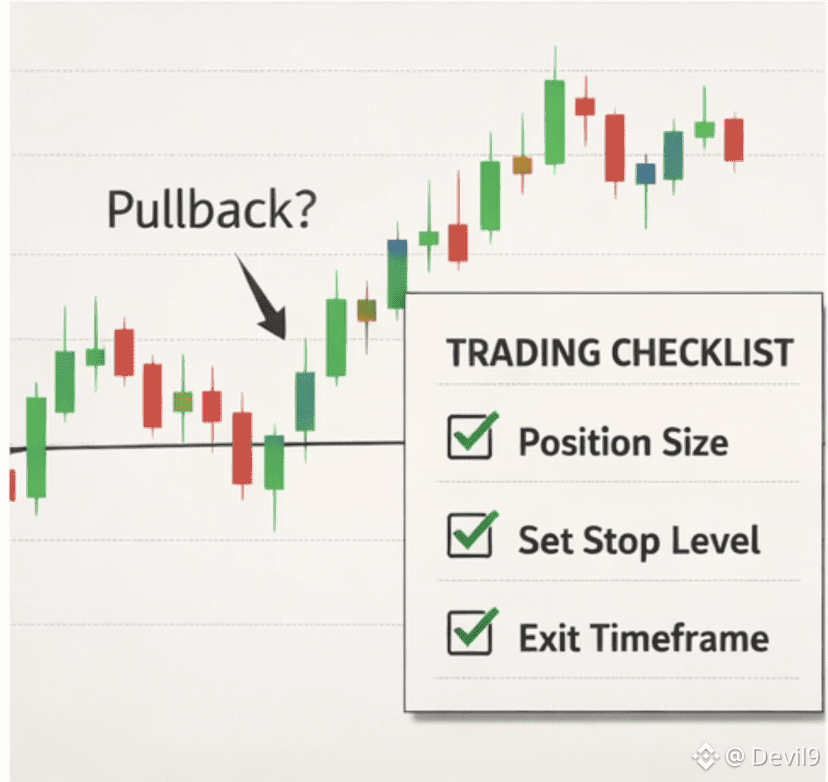

3 Key Points (3-rule risk control for spot traders)

Position sizing: decide risk first, not coin first

If you can’t say “I’m willing to lose X% of my account on this idea,” you don’t have a position size you have a feeling. In a whipsaw tape, big size turns normal pullbacks into panic decisions. The simplest rule I’ve seen work: keep any single spot idea small enough that a clean stop doesn’t hurt your mood (and definitely doesn’t force you to revenge trade). When you size correctly, you can actually follow your plan; when you oversize, every candle becomes personal.Stop plan: define the “wrong” price before you click buy

Spot traders often avoid stops because they hate getting wicked out, so they replace stops with hope. Hope is an unpriced derivative. A stop plan can be mechanical without being perfect: pick a level that invalidates your reason for entry (structure break, range low, key moving average you used, whatever your method is) and decide what you’ll do if it hits—sell all, sell half, or hedge. The key is not the exact level; it’s making the decision while you’re calm, not while the chart is screaming. This matters even more on pairs that can lose liquidity or get delisted, because the “exit later” option can become expensive quickly.Time-based exit: if it doesn’t work soon, stop marrying it

This is the spot trader’s blind spot: price can be “not down much” while your opportunity cost is huge. A time stop is simple: give the trade a window to prove itself (example: 24–72 hours for short-term spot, or a weekly close for swing). If price goes nowhere or keeps failing at the same level, you exit—not because it dumped, but because your thesis didn’t translate into movement. Time stops protect you from the slow bleed: the kind of trade that keeps you busy, stressed, and underperforming while the market rotates elsewhere.

I don’t know if this bounce turns into a real trend or just another short-lived relief move.

What I’m watching next How price reacts after the first clean pullback—does it hold a higher low, or does it slice back into the prior range?

Do you plan exits before entry, or only after it goes wrong?  #BNB #BTC $BNB

#BNB #BTC $BNB