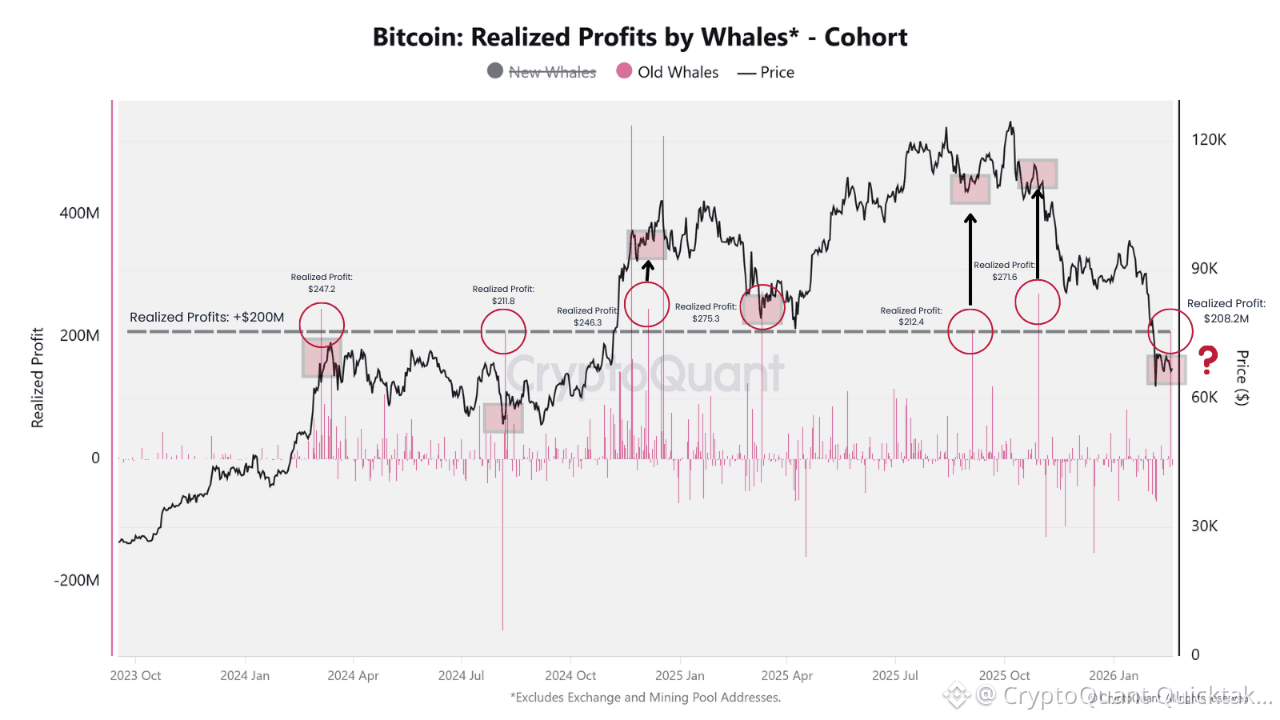

Old whales have just realized +$208M in profits, marking the seventh event in the past two years where realized profits exceeded $200M for this cohort.

Historically, these spikes have not occurred in isolation. Each prior +$200M event aligned with short-term regime shifts in price action. In most cases, Bitcoin experienced immediate volatility expansion and, more often than not, formed local bottoms shortly after the distribution wave. Only in a minority of cases did these events coincide with local tops.

What makes this metric powerful is precisely the behavioral consistency of this cohort. Old Whales, wallets that have held BTC through multiple cycles, don't sell impulsively.

When they do realize profits at scale, it signals conviction about near-term price exhaustion or strategic repositioning. Their selling pressure, even if temporary, is sufficient to introduce liquidity imbalances that trigger outsized moves.

If history rhymes, this seventh event increases the probability of near-term turbulence, but also raises the odds that we are closer to a local exhaustion point than to the start of a prolonged bearish regime.

Old whales are distributing. The question is not whether they sold, but who is absorbing.

Market participants should monitor price action closely in the coming days. If the pattern holds, a volatility spike or definitive directional resolution is likely imminent.

Written by MorenoDV_