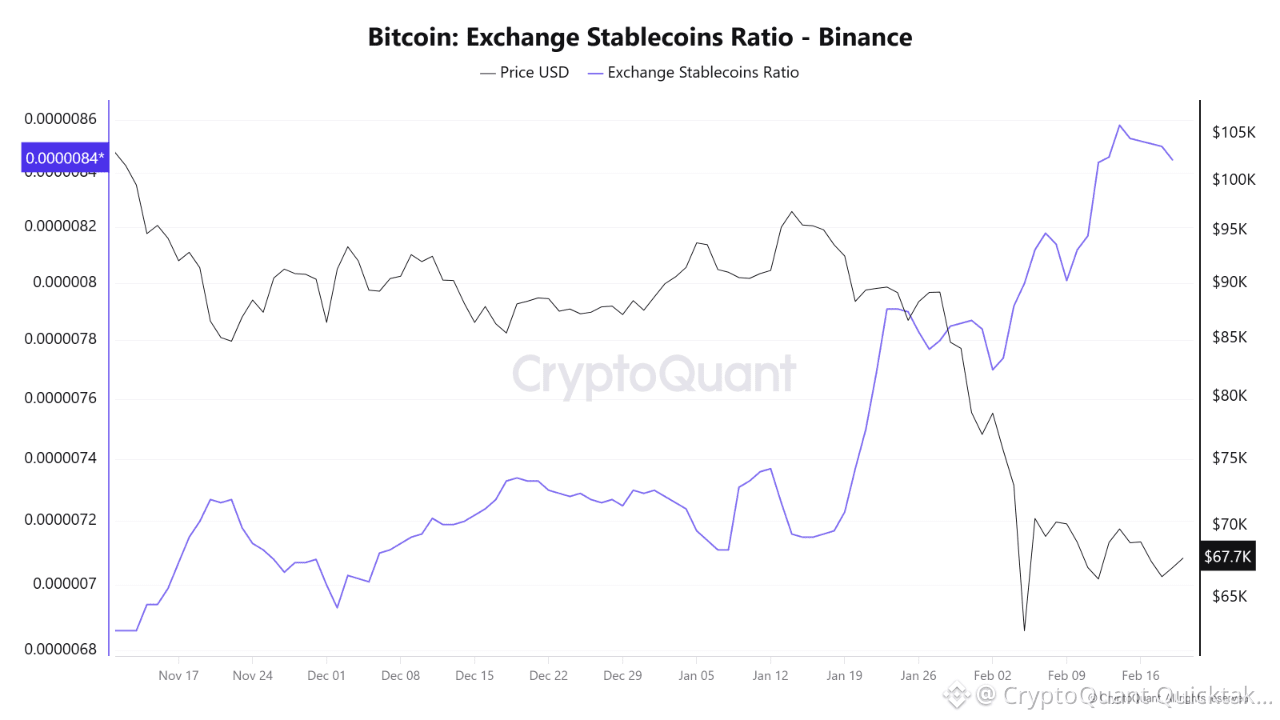

A closer look at the on-chain data for Binance over the past month reveals a significant divergence between Bitcoin’s price action and the Exchange Stablecoins Ratio.

On January 17th, with Bitcoin trading at a high of roughly $95,108, the ratio stood at 0.00000716.

However, exactly one month later, on February 18th, as Bitcoin’s price plummeted to the $66,423 level, this ratio experienced a sharp upward spike, reaching 0.0000085.

Data Interpretation

The Exchange Stablecoins Ratio is calculated by dividing the exchange’s Bitcoin reserves by its stablecoin reserves. A rapid increase in this metric carries crucial market implications:

1. Depletion of Dry Powder

The surging ratio indicates that the supply of stablecoins (potential buying power) is shrinking relative to the supply of Bitcoin sitting on the exchange.

2. Selling Pressure Outweighing Demand

The strong negative correlation between the rising ratio and the approximately 30% price drop suggests that while investors may have deployed their stablecoins to “buy the dip,” the available liquidity was insufficient to absorb the massive selling pressure.

Conclusion

The market is currently facing a liquidity vacuum on Binance. Purchasing power has been significantly drained. Until we observe a fresh inflow of stablecoins returning to exchange wallets to replenish this “dry powder,” a strong V-shaped recovery remains unlikely.

Traders should exercise caution and prioritize risk management until this ratio begins to cool off, signaling renewed buying capacity.

Written by CryptoOnchain