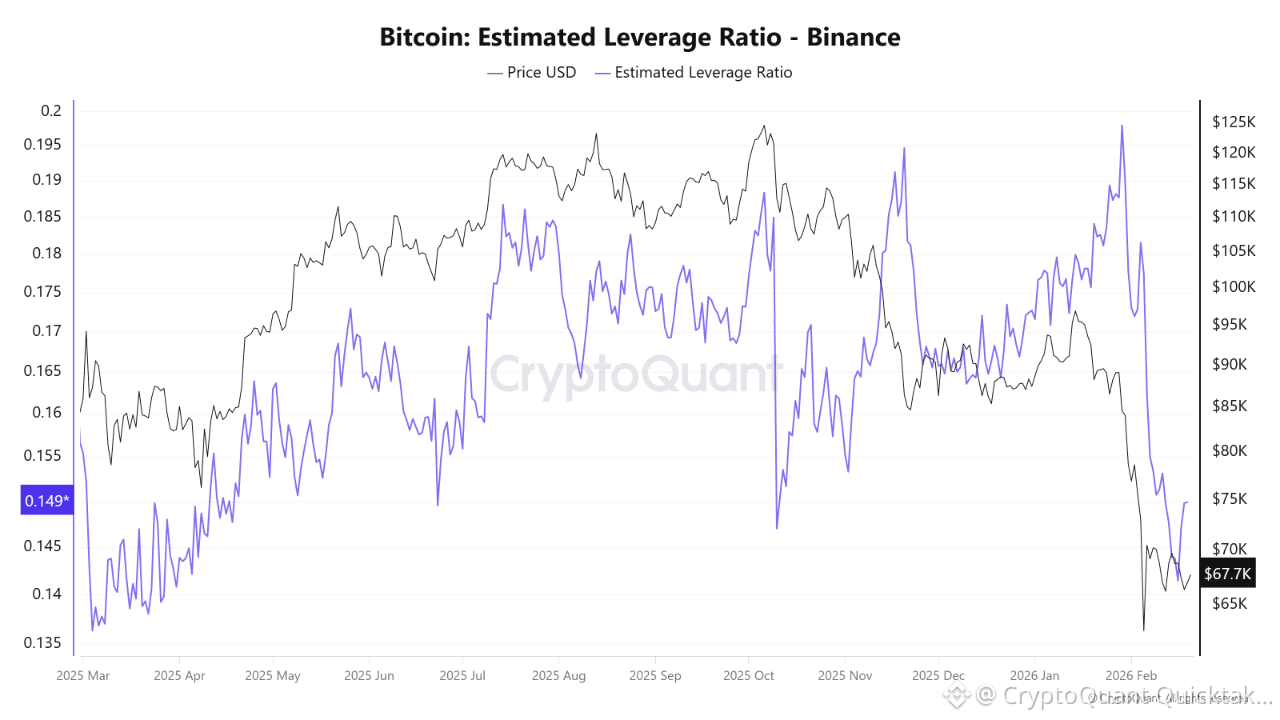

On-chain data reveals a dramatic flush-out in the derivatives market on Binance. The Estimated Leverage Ratio (ELR) has experienced a steep plunge, moving in tandem with Bitcoin’s recent price correction.

On January 29th, while Bitcoin was trading at a high of $84,658, the ELR was highly elevated at 0.1980, signaling an overheated and highly speculative market.

By February 16th, as the price dropped to the $68,858 level, the ELR sharply cascaded down to 0.1414.

Data Interpretation

This massive approximately 28% drop in the Estimated Leverage Ratio highlights key market dynamics:

1. Aggressive Long Squeeze

The swift decline in ELR indicates a severe deleveraging event. The price drop triggered a cascade of liquidations, flushing out over-leveraged long positions and forcing traders to close their contracts.

2. Market Health Reset

While the immediate price action was painful, wiping out excess leverage is fundamentally healthy. It removes the “derivatives bubble” and leaves the market structure much lighter and less susceptible to extreme, sudden volatility.

Conclusion

With the Estimated Leverage Ratio significantly cooled down, the risk of further cascading liquidations is now reduced. The market has been cleansed of high-risk speculative positioning.

For a sustainable upward trend to resume, the market now requires organic buying pressure and genuine demand from the spot market to build a solid foundation.

Written by CryptoOnchain