📰 Daily Market Update:

Retail traders are capitulating with heavy losses.

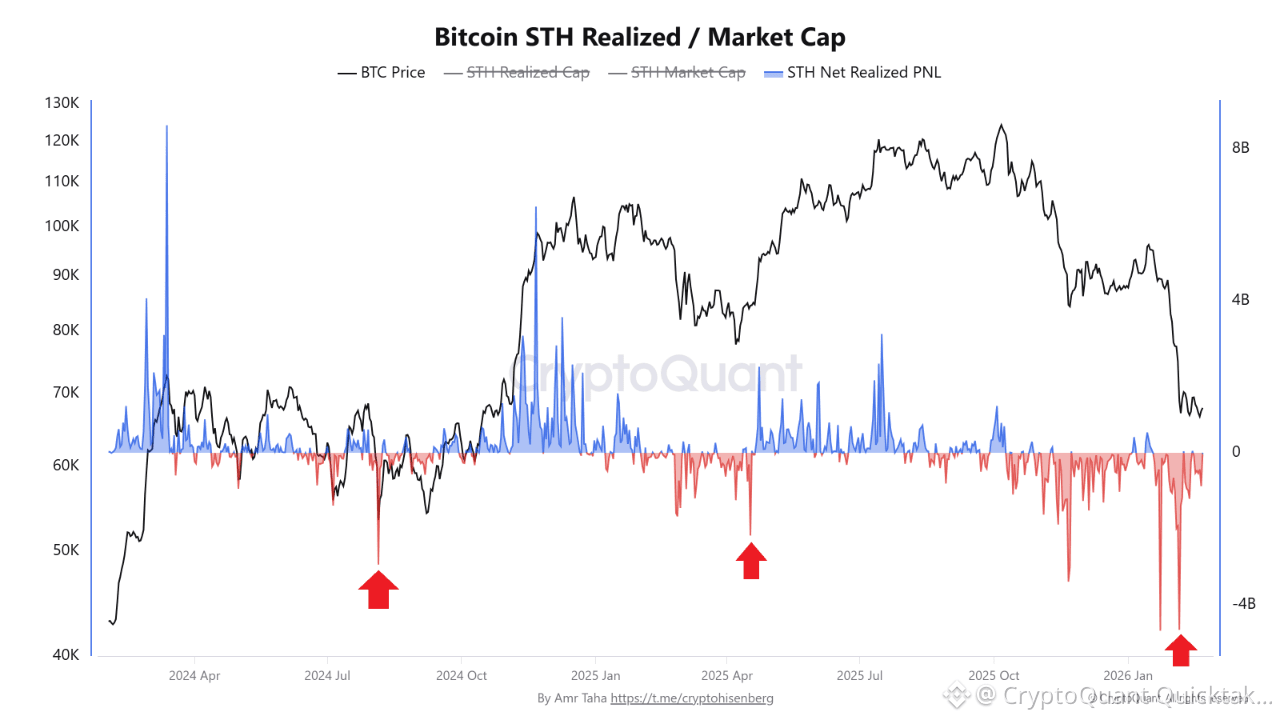

📊 Bitcoin STH Realized / Market Cap

What is STH Net Realized PNL?

This metric measures the actual realized profit or loss of Short-Term Holders when they sell or spend their BTC, by comparing sell prices with their original acquisition cost.

📈 Positive values → buying in profit (Greed)

📉 Negative values → selling at a loss (capitulation)

🔬 Key Observation

📉 The chart shows a sharp drop in STH Net Realized PNL to -$4.65B on Feb 5, coinciding with Bitcoin trading below $69,000.

This is the largest realized loss event since:

📅 April 17, 2025: -$2.16B

📅 August 5, 2024: -$2.93B

⏲️ Historically, similar deep negative readings aligned with major short-term holder capitulation, which later preceded strong price recoveries:

🚀 +94% rally after August 2024

🚀 +56% rally after April 2025

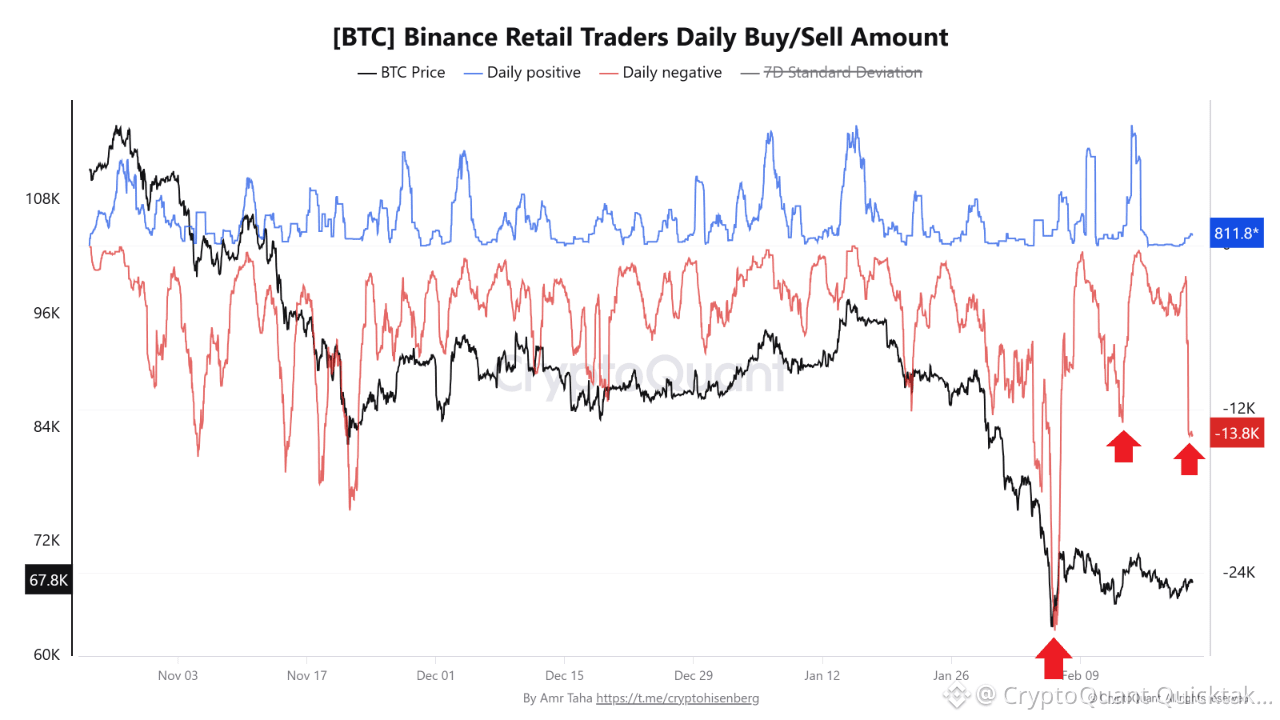

📊 [BTC] Binance Retail Traders Daily Buy/Sell Amount

This chart tracks short-term Bitcoin holder behavior by monitoring BTC flows to and from Binance, allowing us to observe emotional shifts among retail participants.

📈 Daily positive represents buy activity followed by withdrawals.

📉 Daily negative reflects deposits followed by selling activity.

🔬 Key Observation

📉 The chart highlights a large retail sell event on Feb 20, totaling ~13,800 BTC, marking the third major sell-off this month:

📅 Feb 13: Over 12,000 BTC sold

📅 Feb 6: ~27,800 BTC sold right after BTC dropped below $62,000

⏲️ Historically, short-term holders tend to sell near potential local bottoms, especially during periods of fear and emotional stress.

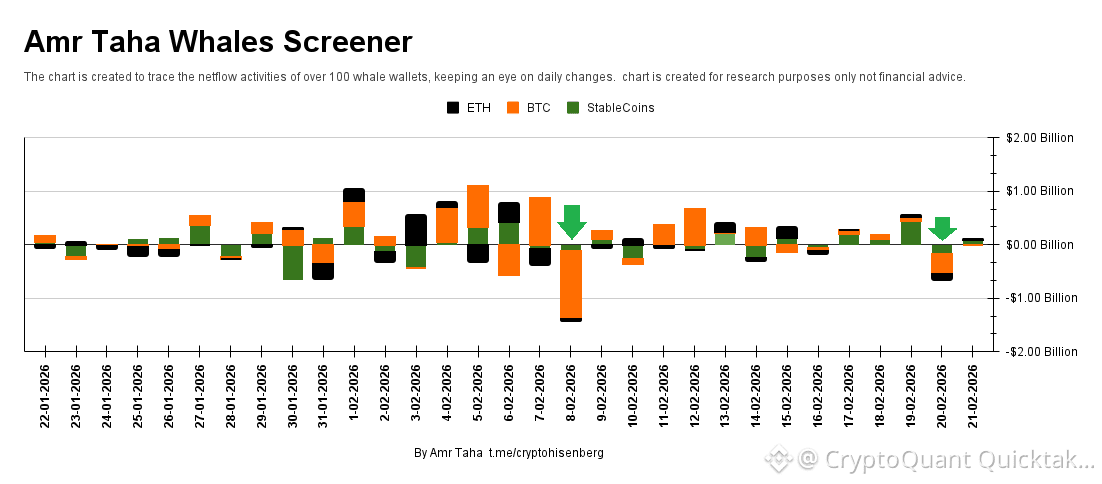

📊 Whales Screener

This model tracks netflows from 100+ whale wallets across BTC, ETH, and stablecoins.

🔬 Key Observation

📅 On Feb 20, the chart highlights:

📉 BTC withdrawals of approximately $365M

📉 ETH withdrawals of around $122M

⚠️ Earlier, on Feb 8, whales pulled $1.25B BTC in a massive withdrawal.

⏲️ Historically, such large withdrawals usually signal accumulation behavior.

Written by Amr Taha