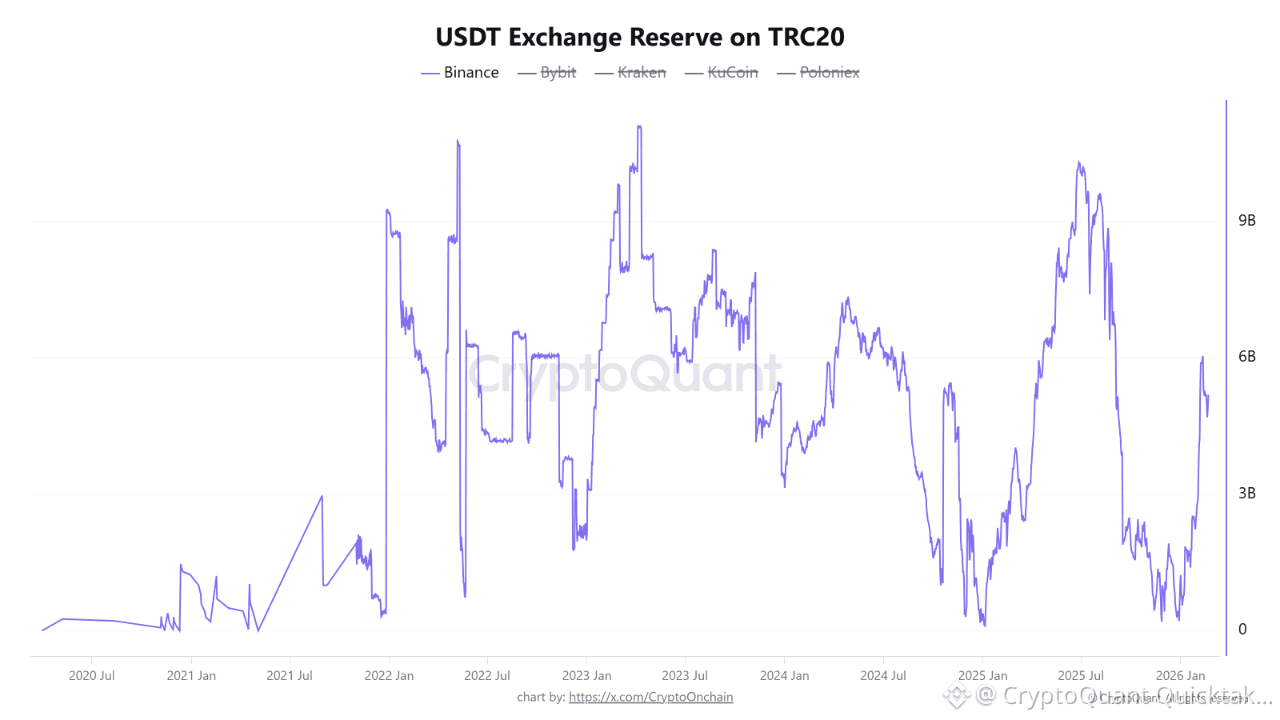

Following the recent market pullback that pushed Bitcoin and Ethereum toward key technical support levels, on-chain data shows a notable structural response. Binance’s USDT Exchange Reserve on the TRC20 network increased significantly, rising from 385M on December 24 to approximately 5.2B.

Key Takeaways & Market Analysis:

Liquidity Inflow During Support Tests:

The timing of this increase is important. A rise of roughly 4.8B USDT on the largest exchange while major assets approach support levels suggests elevated demand and positioning activity that may help absorb sell pressure.

Retail Participation Indicator:

Large institutional transfers are often associated with the Ethereum (ERC20) network, while TRC20 is commonly used by retail participants due to lower transaction fees. The increase in TRC20 reserves may indicate stronger retail engagement during the correction.

Stablecoin Positioning (“Dry Powder”):

An increase in exchange-held stablecoins typically reflects capital being positioned for potential deployment into BTC, ETH, or other assets. Rather than exiting the market, participants appear to be reallocating into stablecoins while waiting for clearer entry conditions.

Conclusion:

With BTC and ETH near major technical support levels and a substantial increase in TRC20-based USDT reserves, market liquidity conditions have shifted. Elevated stablecoin balances on exchanges can provide downside support and create the potential for renewed buying activity if sentiment improves.

Written by CryptoOnchain