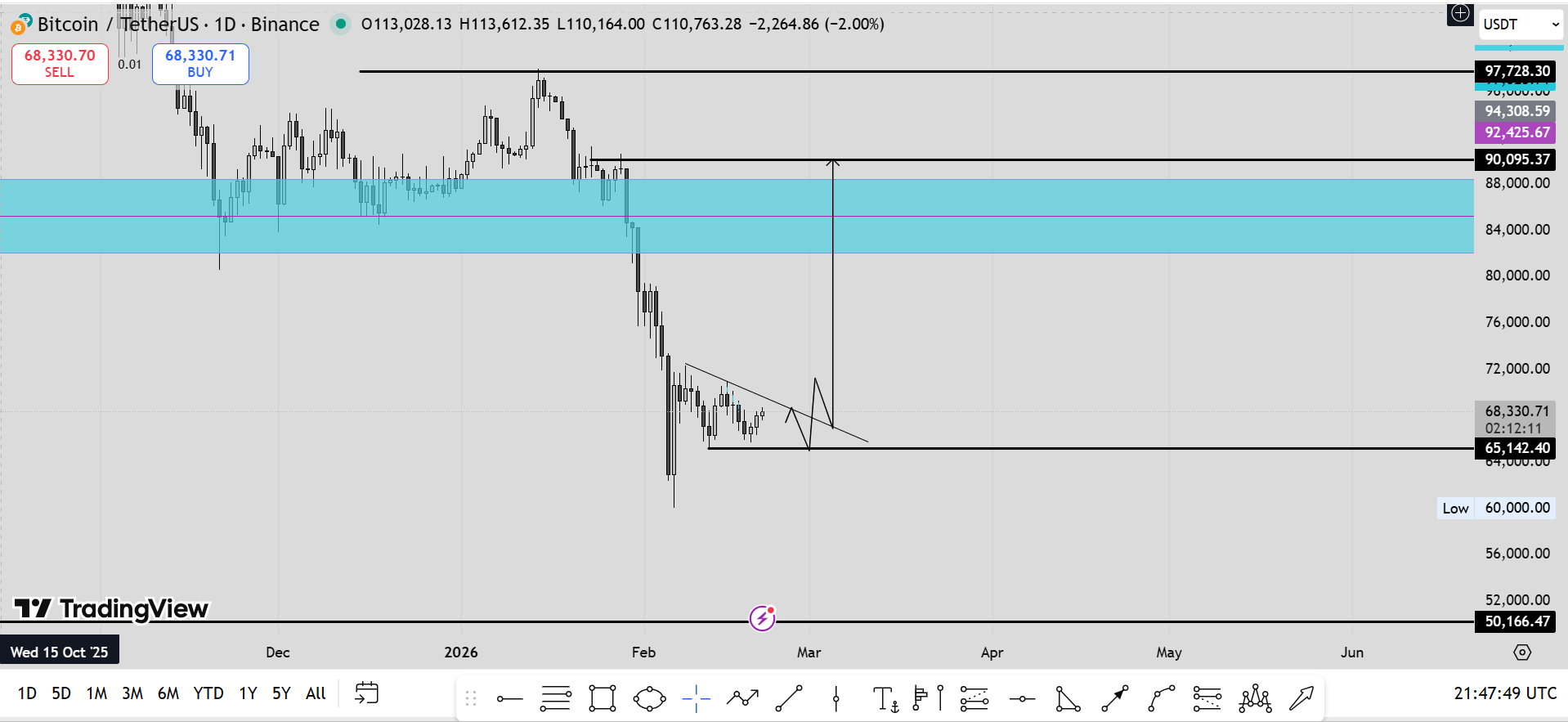

If #bitcoin manages to reclaim the $90K level, the market could witness a significant short squeeze.

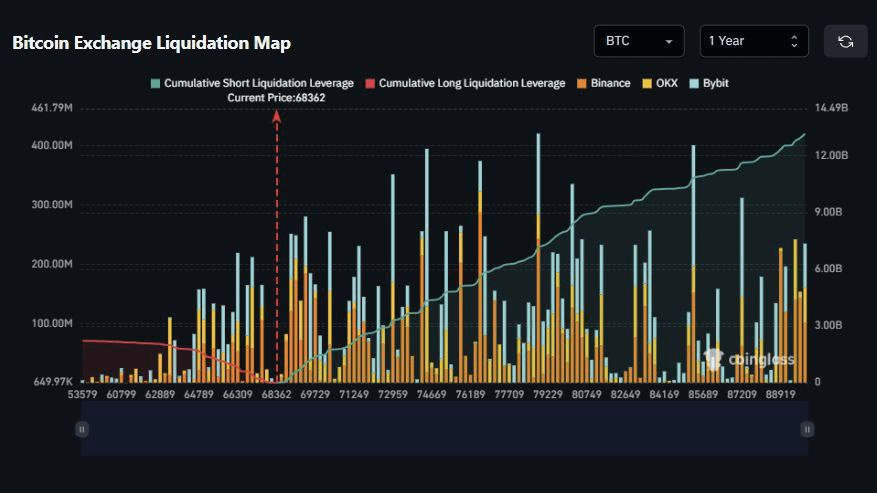

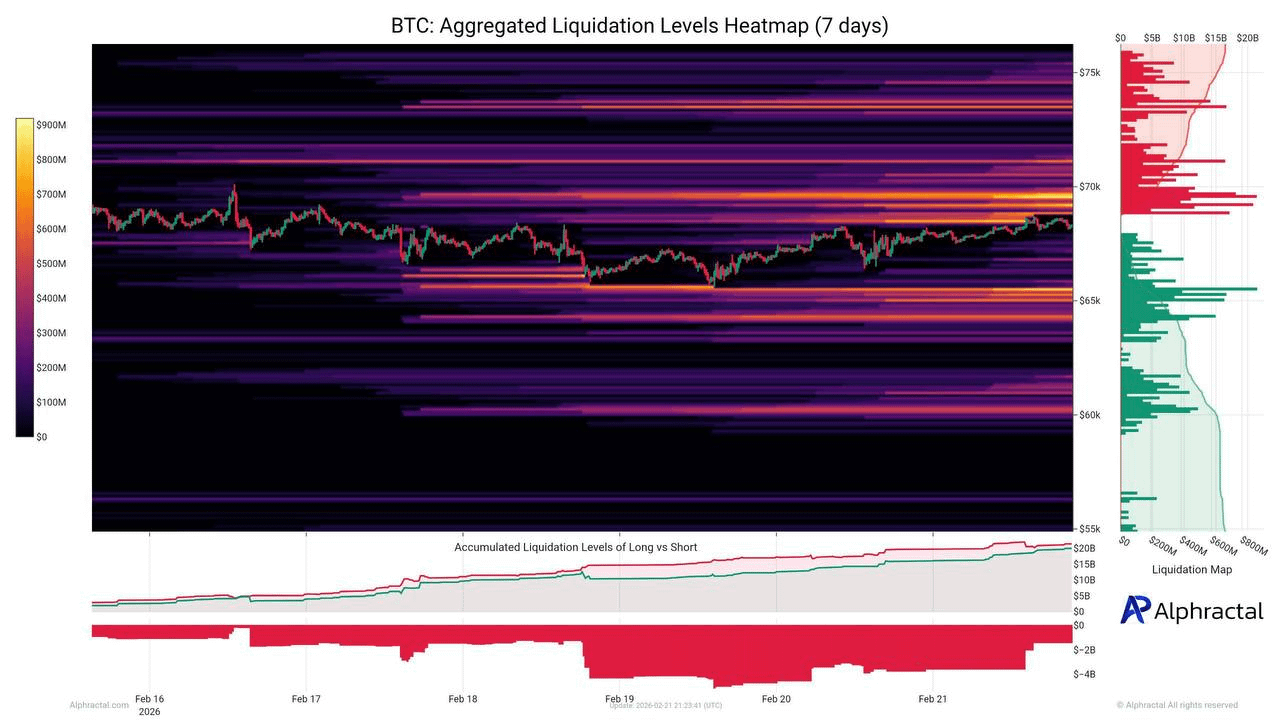

Current liquidation data suggests that over $13 billion in short positions are stacked above that range. That’s a massive pocket of leveraged bets positioned against price continuation.

Why does this matter?

When price moves into a dense liquidation zone, forced buybacks from short sellers can accelerate momentum. Shorts get liquidated → exchanges automatically buy back $BTC to close positions → price pushes higher → more shorts get squeezed. It becomes a reflexive feedback loop.

In other words, $90K isn’t just a psychological level — it’s a liquidity trigger.

If reclaimed with strong spot demand and volume confirmation, the move could be violent rather than gradual. However, it’s important to remember that liquidation levels act like magnets, not guarantees. Price often gravitates toward them because that’s where liquidity sits — but how it reacts once there depends on broader market conditions.

Key factors to watch:

• Spot inflows vs. purely derivative-driven moves

• Funding rates (are longs overheated?)

• Open interest expansion vs. contraction

• Macro backdrop and dollar strength

If BTC clears $90K with conviction, it won’t just be a breakout — it could turn into a cascade.

Liquidity above.

Leverage stacked.

Now it’s a question of whether buyers have enough fuel to ignite it.