As I emphasized in the previous post, trading volume alone is no longer a reliable indicator of whether the season has ended.

What matters far more now is whether the players disguised as ordinary whales have already distributed a large portion of their holdings, or if they are still accumulating.

Since they are the true price setters in the market, if the season had truly ended, they would have already unloaded a significant amount of their supply. The remaining supply would then be used to trigger a major market crash.

On the other hand, if they are increasing their holdings, the market is preparing for an upward move.

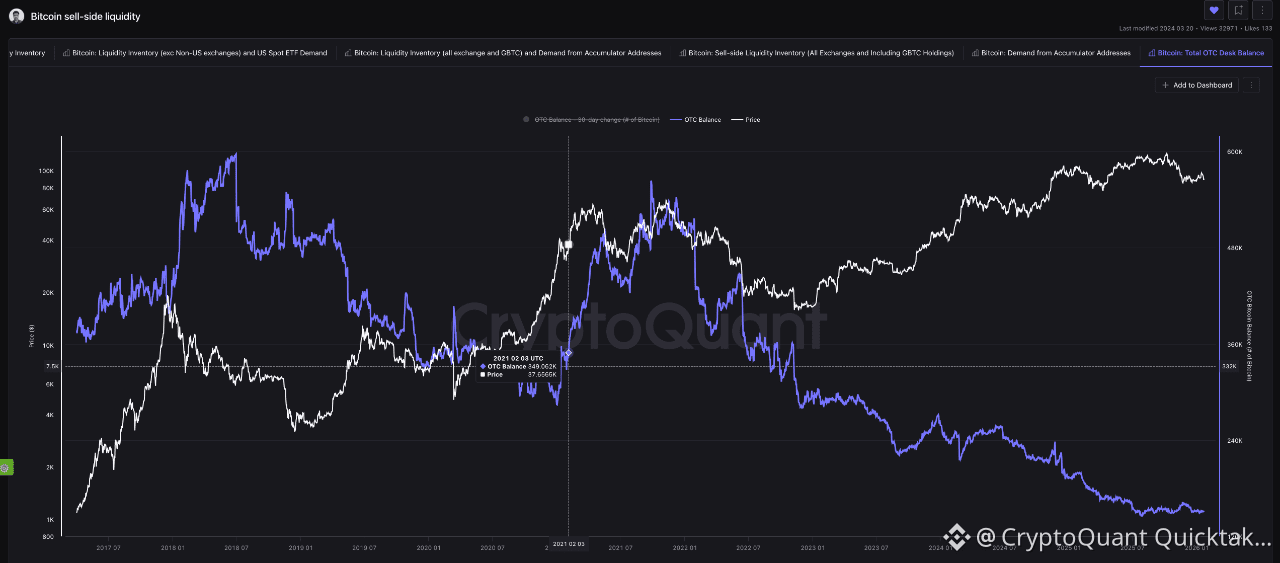

The attached chart shows the amount of Bitcoin circulating in the OTC market.

During the double‑top phase of the 3rd halving cycle, the OTC balance remained high. Look at the period from 2021 to mid‑2022 — it’s very clear.

But what about now?

The current OTC balance is at an unprecedented low.

If the major players wanted to drag the market into a crash, there is no better place than OTC to unload large amounts of Bitcoin while keeping the price stable.

This strongly suggests that we are not at the beginning of a bear market, but rather experiencing a temporary pullback within a larger bullish trend.

Written by CoinNiel