I can’t believe remittances still work like this, & keep thinking this should be simple.

You earn money in one country, you send some of it home, it arrives. Done. But when I dig into how remittances actually move, it still feels like a maze built decades ago.

I’ve watched people send $200 to $400 at a time, because that’s what they can spare. Then they wait. Sometimes 2 days, sometimes 3. And the fees… they don’t look scary at first. Until you do the math and realize you’re losing 6 to 10 percent on something that’s basically a lifeline.

Remittances globally are now over $700 billion a year. That number keeps circling in my head, because it means this isn’t a small problem. It’s everyday life for millions.

Where the money gets “lost” on the way :

Here’s the part that gets me. The money doesn’t go straight from you to your family. It bounces.

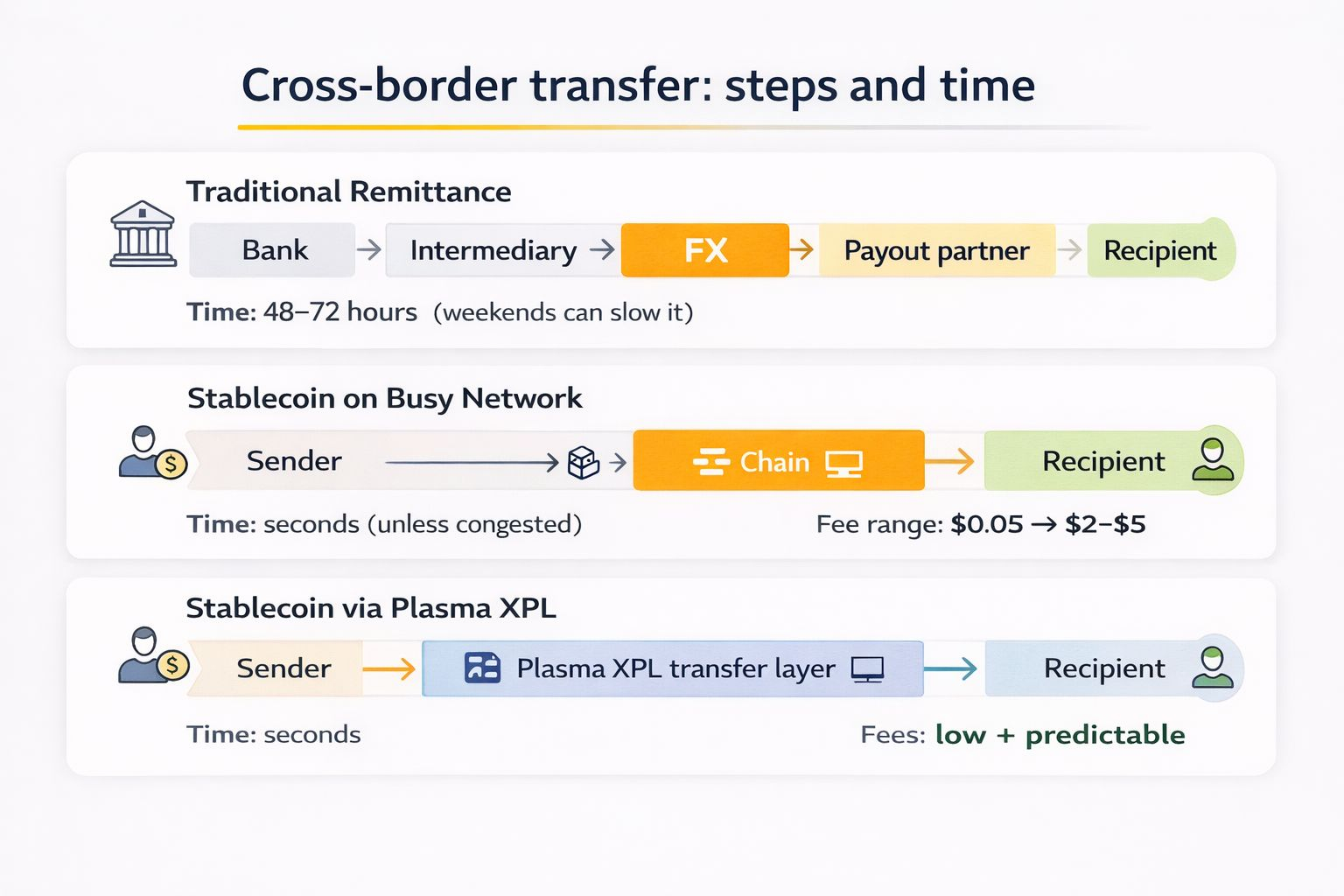

Local bank to payment provider, payment provider to another bank, then an FX step, then another FX step (sometimes), then a payout partner. Each stop is a “small” cut, until it isn’t small anymore.

A pretty normal example looks like this: someone sends $300. A service fee takes $6 to $10. Then the exchange rate isn’t the “real” rate, so another $6 to $12 disappears in spread. The recipient ends up with something like $278 to $288. And if you ask why, you get a shrug and a vague answer about “rates.”

Also, time.

Even when nothing goes wrong, settlement is often 48 to 72 hours. If the send happens Friday night, it can easily slip into the next week. I hate that this feels normal.

Stablecoins fixed one big piece of the puzzle :

The first time I used a stablecoin to move value across borders, I paused for a second like… wait, that’s it?

It moved fast.

The value didn’t bounce around like regular crypto. It didn’t care about weekends. It didn’t ask for permission. You send, they receive.

And in many cases, the cost of the actual on-chain transfer can be tiny. Sometimes under $0.10, sometimes $0.25. Even if it’s $1, it’s still miles better than losing $20 on a $300 send.

So yeah, stablecoins changed the conversation.

But then reality shows up.

Then the network gets busy, and things get ugly :

I’ve watched the same story play out on different chains.

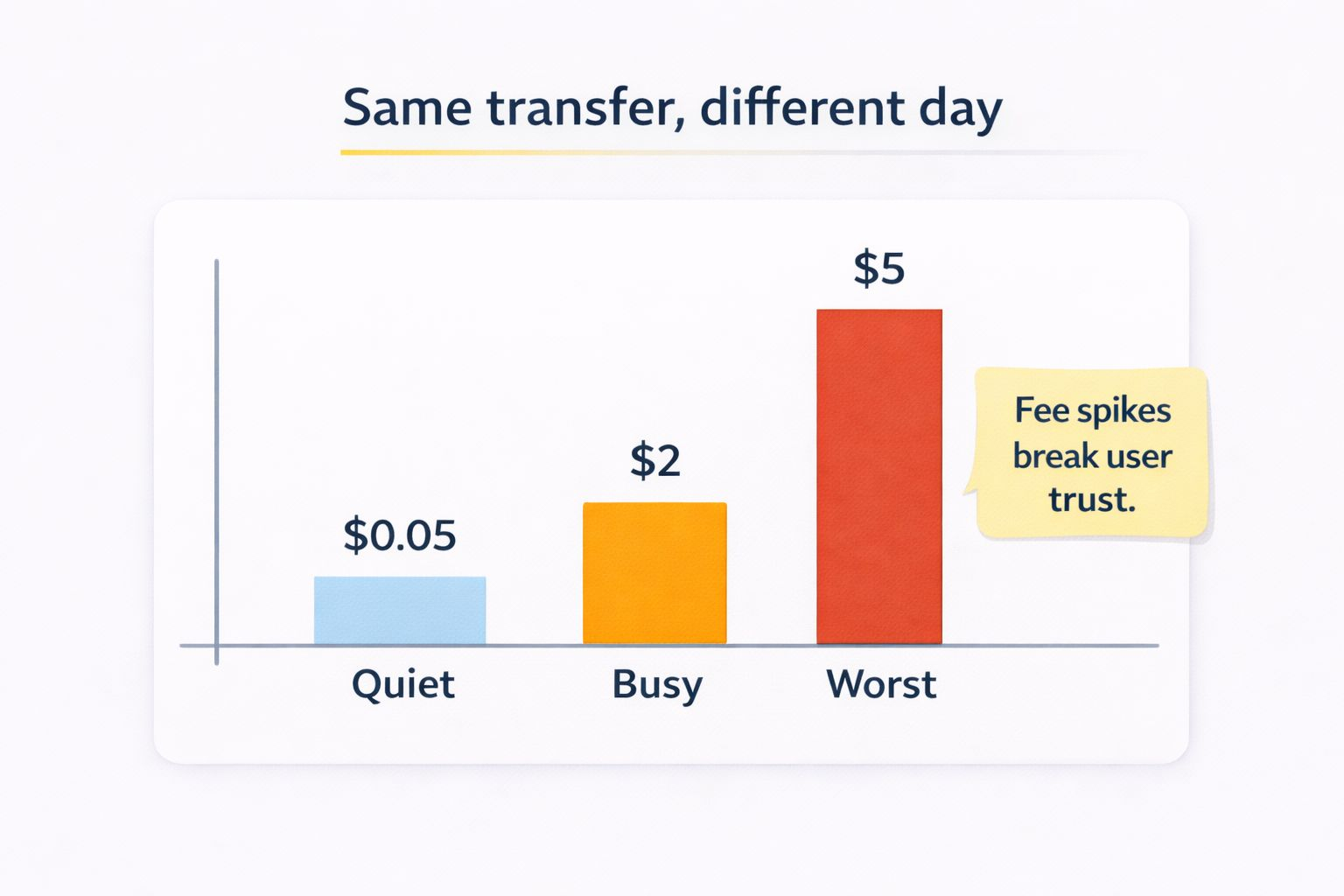

On a quiet day, sending money is cheap and smooth. Then traffic picks up and suddenly fees jump. That $0.05 transfer becomes $2, sometimes $5. If you’re sending $50 or $100, that hurts.

And remittances aren’t one-off transfers. People send again and again. A lot of senders do it once a week, or twice a month. That can easily turn into 24 to 48 transfers a year for one person.

So when fees swing around, people don’t “wait for a better time.” They just go back to the old system, even if it’s overpriced, because at least it’s predictable.

That’s the key word I keep coming back to. Predictable.

Why Plasma’s idea keeps making sense to me

This is where Plasma starts to click.

Plasma, as an approach, is basically about taking frequent transactions off the main chain and settling them later in a secure way.

Less congestion.

Less fee chaos.

More room to breathe.

And when you think about remittances, it fits. Remittances are lots of small transfers. Not one giant transfer once a year. The system has to handle volume without turning into a fee lottery.

I’ve watched networks struggle because they weren’t built for “boring payments.” Plasma was.

So what does Plasma XPL actually change?

Plasma XPL matters here because it leans into that payment-first idea. It’s not trying to be everything for everyone. It’s trying to make transfers feel normal again. Fast. Cheap. Reliable.

If a transfer settles in seconds and fees stay low even when usage rises, that changes behavior. People start trusting the rails.

And the use case is pretty straight forward.

A worker sends stablecoins on Plasma XPL. The recipient gets them quickly. Then a local service converts to cash if needed. Fewer middle steps. Fewer hands taking a slice.

Let me put numbers on it, because numbers make it real. If a $300 remittance usually loses around $18 in fees and spread, and Plasma XPL helps push the all-in loss closer to $3, that’s $15 saved on one send. Over 12 months, that’s $180 kept by a family.

Not abstract “efficiency.” Actual money.

The annoying parts we still have to deal with :

I’m not going to act like this is solved. It’s not.

Off-ramps can still charge 1 to 3 percent. Some regions have weak liquidity. Some users still don’t trust wallets. Regulation varies wildly by country, and that affects how easily people can cash out.

Plus, UX. If someone has to read five guides before sending $100 home, they won’t do it. They’ll choose the familiar option, even if it’s worse.

I’ve watched good tech fail because it ignored these boring friction points.

A calmer way to move money :

Still, I keep coming back to the same feeling.

Plasma XPL sits in the right spot for this problem. Stablecoins handle the “don’t lose value” part. Plasma-style scaling handles the “don’t break under volume” part.

It’s not a miracle. It’s more like… a cleaner road. Fewer toll booths. Less waiting around.

And honestly, that’s what remittance senders want. Not a speech. Not a whitepaper. Just money that arrives, on time, without getting shaved down on the way.

Let money travel like a message, quick, clear, and intact.