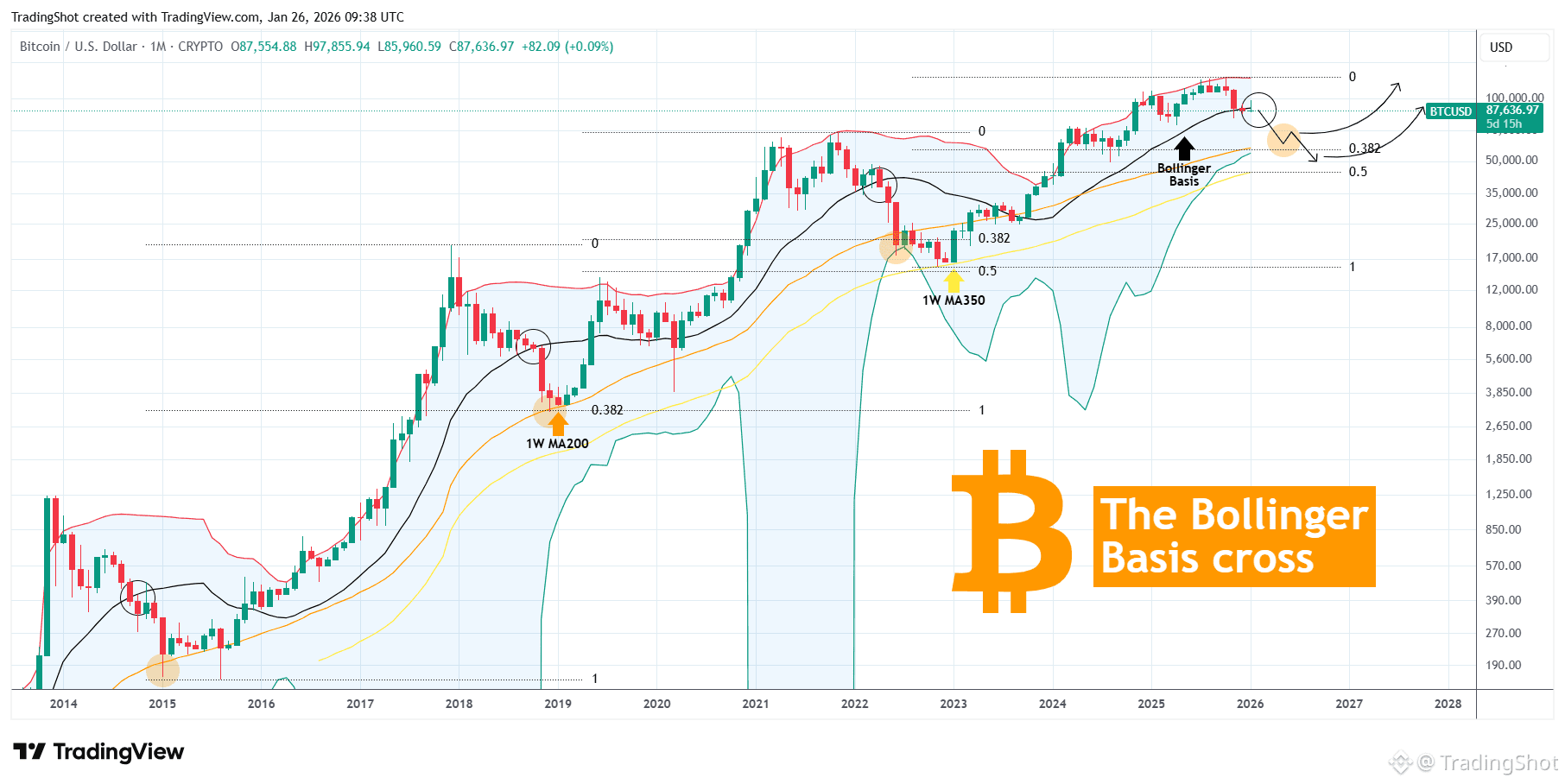

Bitcoin (BTCUSD) is trading for the third straight month on the 1M Bollinger Bands Basis (black trend-line) and with only 5 days left to close the monthly candle, time is running out for a reversal.

That's because every time in the past 12 years that BTC closed a 1M candle below the BB Basis, it initiated Phase 2 of the Bear Cycle, and right now the price is sitting under it.

If it closes this way, Phase 2 should take it to at least the 1W MA200 (orange trend-line), which has always been hit historically during a Bear Cycle and is in fact where the January 2015 and December 2018 bottoms got priced. Based on the last Bear Cycle though, we should even test the 1W MA350 (yellow trend-line), which is where the November 2022 bottom was formed.

If that happens, the Bear Cycle should bottom around $50000, which falls exactly in the middle of the 0.382 - 0.5 Fibonacci retracement zone, again consistent with all previous Cycle bottoms. Notice that only when BTC reclaimed and closed above the 1W MA200 again (March 2023) was the new Bull Cycle confirmed.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!