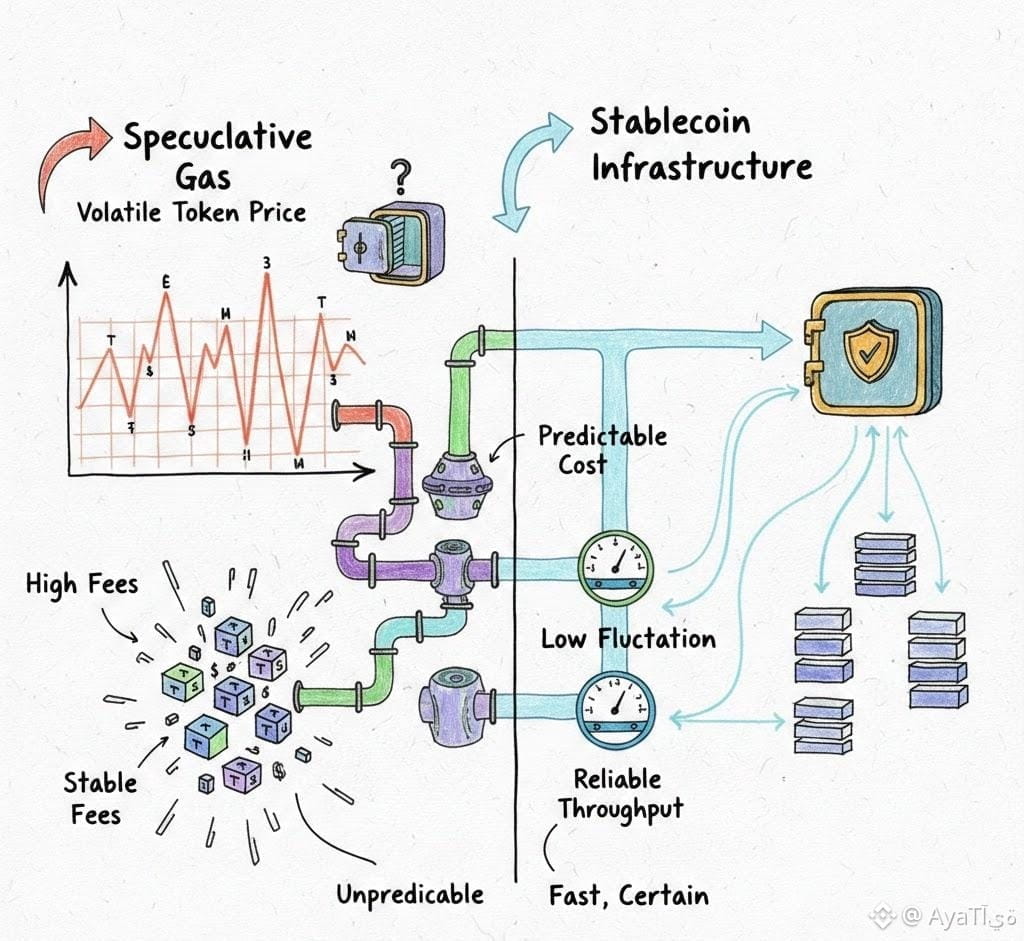

Stablecoin-first gas is not a cosmetic feature; it is a structural intervention into how blockchains price computation. On most networks, gas is denominated in volatile native assets, forcing every transaction—whether a $5 transfer or a $5 million settlement—to inherit speculative risk. @Plasma breaks from this pattern by anchoring execution costs directly to stablecoins, effectively separating economic utility from market noise.

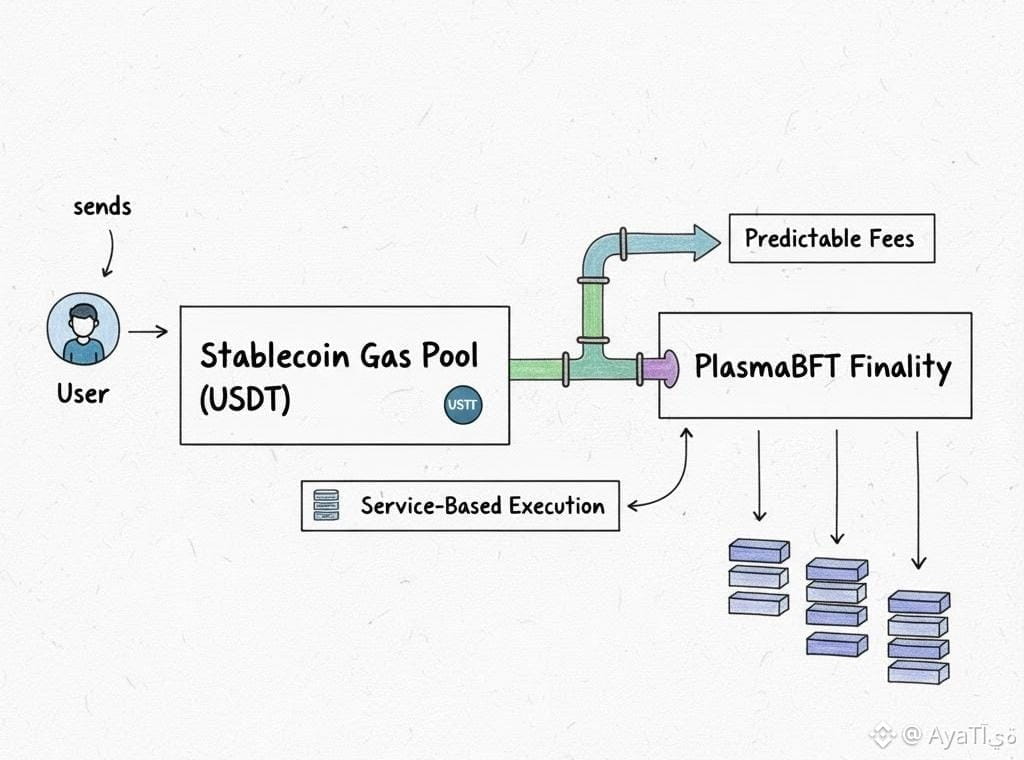

At a technical level, this shifts the gas market from an asset-driven model to a service-driven one. Instead of users implicitly speculating on token price movements just to transact, @Plasma treats execution as a metered utility, closer to bandwidth or electricity than a tradeable commodity. This distinction matters because it realigns incentives across the entire stack: users, applications, and validators all interact with fees as predictable costs rather than fluctuating bets.

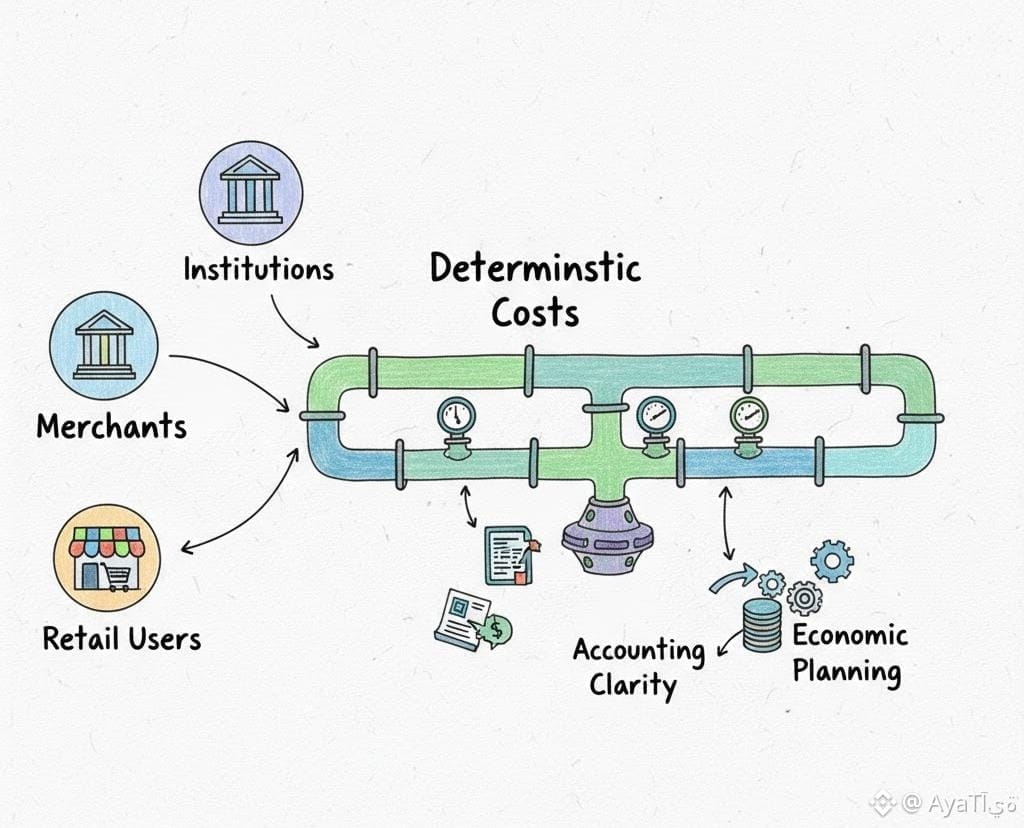

This design choice has second-order effects that are easy to overlook. Stablecoin-denominated gas smooths demand spikes because fee expectations are anchored. Developers can model user behavior more accurately, merchants can price on-chain services without hedging strategies, and institutions can account for blockchain costs without exposing themselves to balance-sheet volatility. In practice, this reduces friction not by lowering fees, but by making them cognitively and financially legible.

The stablecoin-first model also subtly redefines who blockchains are for. Networks optimized around volatile gas tokens tend to privilege traders and technically sophisticated users who understand fee dynamics. Plasma’s approach favors participants who think in cash flows, margins, and settlement certainty—payments firms, remittance corridors, and retail users in high-adoption regions where predictability is not a luxury but a necessity.

Critically, this is not an abstraction layered on top of an unstable base. Plasma couples stablecoin gas with fast finality and Bitcoin-anchored security, meaning predictability does not come at the expense of neutrality or censorship resistance. The result is a system where transaction cost stability is not enforced socially or contractually, but architecturally.

What emerges is a blockchain that behaves less like a market and more like infrastructure. Gas becomes a background constant rather than a foreground risk. And when execution fades into reliability, the economic conversation shifts from “Can I afford to transact right now?” to “What can I build when cost uncertainty disappears?”

That transition—from speculative friction to infrastructural clarity—is Plasma’s quiet but consequential bet.