I remember sitting there last summer and trying to send a few hundred dollars in USDT to a friend who lived in another country. It was one of those things that happened late at night nothing big, just paying for some of the trip costs. The app said the transaction was still going through, but then it had a problem: gas prices went up because the network was full of some random hype drop or whatever was popular at the time. I had to wait 20 minutes and pay extra to get it done faster. By the time it was confirmed, it felt more like a chore than just a transfer. It was not the money that bothered me; it was not knowing, that nagging feeling that something so simple should not need me to babysit it or question the timing.

That moment stuck with me because it showed me that even stablecoins, which are supposed to be the safe part of crypto, still have all this baggage from the infrastructure that supports them. You know, the kind where you cannot be sure of the speed, the costs change depending on what is going on on the network, and you never know if it will settle without any problems. It is not about making a lot of money or going to the moon; it is the little things that bother you, like waiting too long for confirmations, having reliability drop during busy times, or just the mental stress of checking to see if the chain is working. And what will it cost? They build up slowly, especially if you pay bills by sending or moving money around a lot. This makes something that should be simple into something you have to plan around. Then there is the UX side: wallets that feel clunky when you move money around, or the fear that a transfer will not go through because of slippage or congestion. Those kinds of painful operations add up. That is why a lot of people still use centralized apps, even though they know better: at least they do not feel like they are betting on infrastructure there.

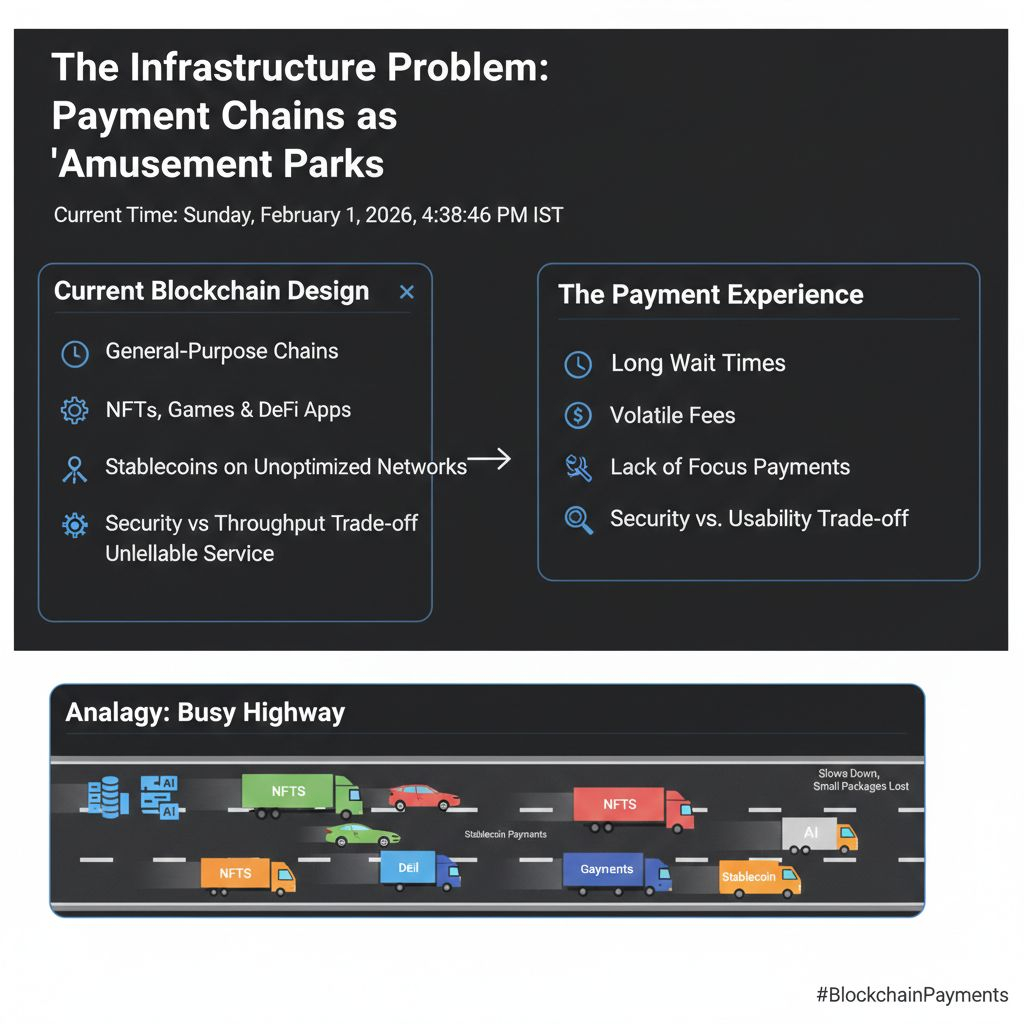

Before I go into the details, think about the bigger issue: blockchain infrastructure does not always think about payments right away. Chains can be used with a wide range of apps, including NFTs, games, and DeFi. This means that they are not the best for any of them. Stablecoins often end up on networks they were never really designed for, which creates problems. Chains either try to do too much and weaken their security, or they sacrifice flexibility just to push more throughput. People can tell that the service is not good because of the long wait times, the fees that change all the time, and the fact that it does not focus on what really matters for moving money: instant finality, low or no cost for basic sends, and reliability that never wavers. It is like trying to run a delivery service on a highway full of people having fun and big trucks. Things move more slowly, and the small packages get lost in the mix.

Think about a subway system where all the lines are full of people going to work, tourists, and people moving things at the same time. The tracks were not built just for passenger flow, so your short trip across town turns into a crawl. They try to handle too many things at once, which slows everything down and makes failures more expensive to fix. The core issue is infrastructure design. Without separate lanes for stablecoin transfers and other high-volume, low-complexity traffic, the entire system ends up congested.

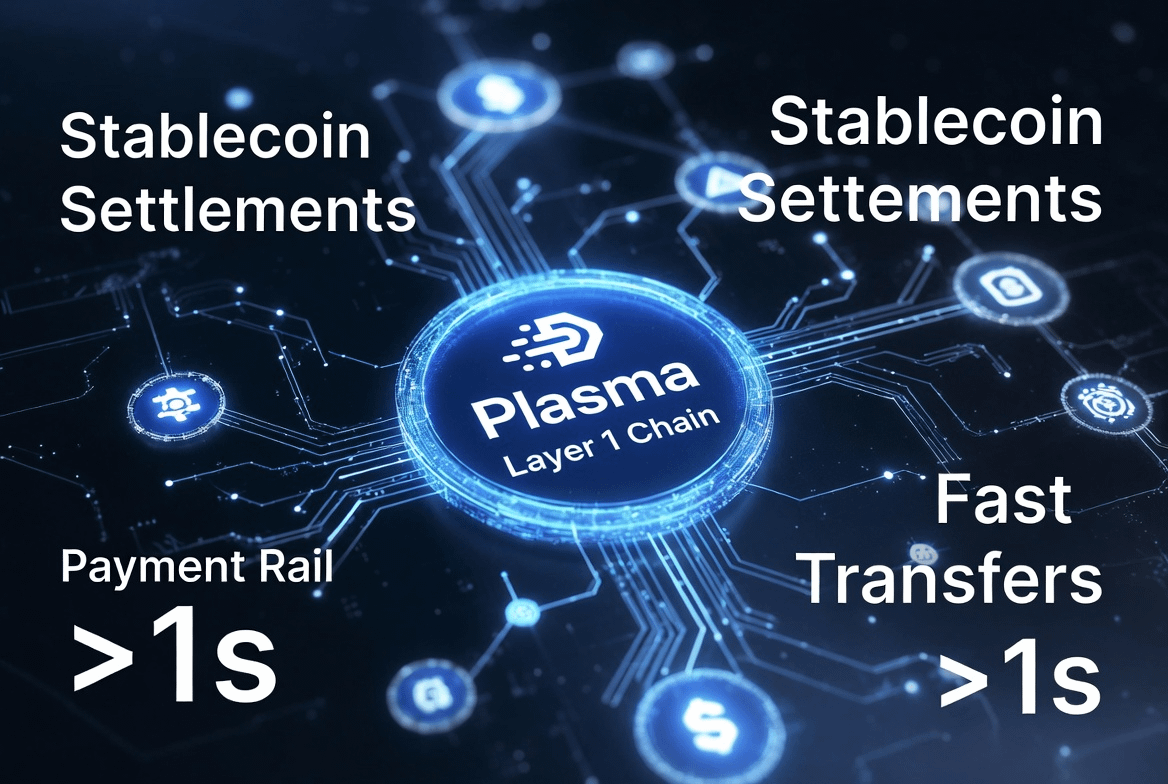

That frustration is what made me realize that Plasma does things differently. Not because it is a magic bullet I have learned not to chase those but because it seems to work on those problems without making big promises. Plasma is a Layer 1 chain that is very good at settling stablecoins. It works more like a payment rail for a certain purpose than a platform that can do anything. It puts transactions first and makes sure they happen in less than a second. This means that there is no more doubt after you send it. It does not add a lot of unrelated features, like NFTs or gaming worlds. This keeps the network from getting too full, which is a problem for bigger chains. That matters for real use because it makes transfers feel predictable: you hit send on USDT, and it arrives without any surprise fees or delays, turning it into a routine instead of an event.

Plasma uses the PlasmaBFT consensus mechanism. In a way, it is a pipelined version of HotStuff. Let us take a closer look at how it works. With this setup, the stages of block production and validation can happen at the same time. This means that blocks can confirm in less than a second without losing their decentralized nature. The way it settles is another thing that makes it unique. It includes a built-in Bitcoin bridge that anchors security to Bitcoin’s main network. Assets like bridged BTC can settle directly within its EVM environment, reducing extra hops and the risks that usually come with cross-chain transfers. It gives up some general-purpose flexibility for this, like how Reth-based EVM compatibility makes execution modular. But it only works with operations that are native to stablecoins, like letting custom tokens pay for gas instead of forcing everything through the native token.

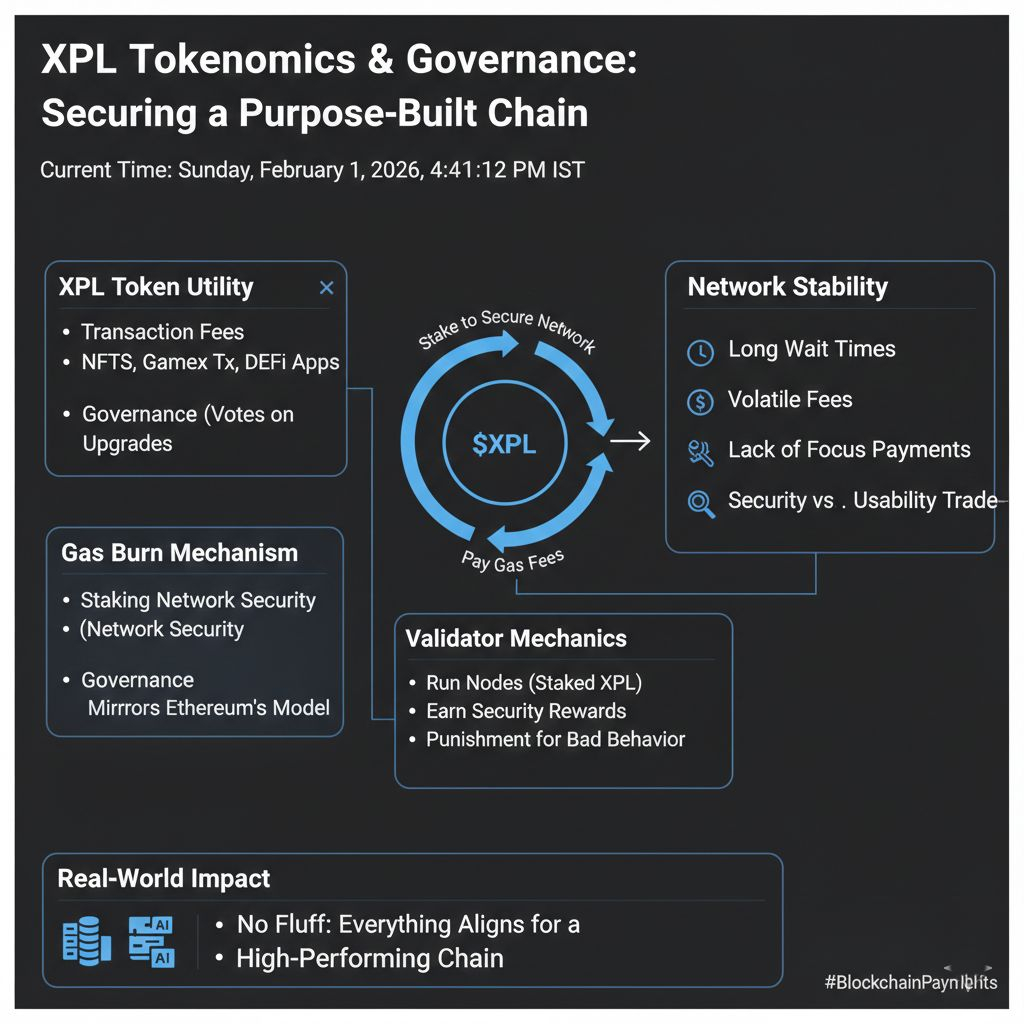

This setup allows XPL to work smoothly alongside other tokens. It covers fees for more complex transactions, such as DeFi interactions, with gas burned in a way that closely mirrors Ethereum’s model. When people stake XPL, they lock it up to keep the proof-of-stake network safe. Inflation starts at 5% a year and goes down to 3%. They get rewards from this. If you do not use custom tokens, this is the last line of defense for fees. Governance comes from votes on upgrades or parameters that are weighted by how much XPL is staked. Validators who run nodes with staked XPL get security rewards and are punished for bad behavior. There is no fluff here; everything is about making sure the chain does its job well.

Plasma's TVL is about $3 billion right now, and every day there are about 40,000 USDT transactions. These figures suggest the platform is handling real activity without much friction. It’s not a sudden surge, but steady usage for a chain that only entered mainnet beta in September 2025.

This makes me think about how investing in infrastructure for the long term is different from trading it for the short term. A lot of people are interested in stories right now, like how prices go up and down when listings come out, how unlocks happen, or how partnerships make people happy. On the day they come out, tokens like XPL can go up a lot, to about $1.50, and then they go back down. People are paying attention right away, which is why. In the end, it comes down to dependability and habit formation. Is the chain the place people trust for moving stablecoins because it stays fast and cheap every time? Infrastructure gains value when users stick around, not for quick flips, but because the friction disappears and transfers become part of everyday behavior. People will always chase the next big thing during fast market shifts, but over time it’s the boring consistency that compounds. Lasting networks are the ones that can absorb heavy traffic without breaking a sweat.

There are, of course, risks. A lot of traffic on the network is one way that things could go wrong. If a lot of DeFi integrations come in at once and slow down the network before it can be made bigger, those sub-second finalities could last longer. This would be a problem for people who expect instant sends but get delays. This would hurt trust in a chain that is based on speed. There is real competition out there. Chains like Tron are the biggest players in the stablecoin market because they have been around for a long time. If Plasma cannot get a lot of people to use it, it might stay niche. There is a lot of uncertainty about how changes in the law might affect the privacy payments feature, especially since it will not be available until 2026. No one knows if stricter rules on private transactions would make them less appealing or if they would have to be redesigned.

In the end, only time will tell if Plasma is something I reach for without thinking about it or if it is just one of many options. It’s the second, third, and hundredth transactions that really prove whether the infrastructure works, because that’s when it fades into the background and becomes easy to forget.

@Plasma